Tag Archive: U.S. ADP Nonfarm Employment Change

The ADP National Employment Report is a measure of the monthly change in non-farm, private employment, based on the payroll data of approximately 400,000 U.S. business clients. The release, two days ahead of government data, is a good predictor of the government's non-farm payroll report. The change in this indicator can be very volatile.

FX Daily, June 3: Dollar is Sold and ROW is bought

Overview: Two recent trends continue. Equities are moving higher, and the dollar remains heavy. Equity markets in the Asia Pacific region rose at least one percent, and South Korea, Singapore, and Malaysia rallied 2-3%. Europe's Dow Jones Stoxx 600 is up more than 1% for the third consecutive session. US shares are trading higher and are poised to extend their recent run.

Read More »

Read More »

FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher.

Read More »

Read More »

FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday's lows. While the political situation in Italy is worrisome, many observers suspect that the new banking rules exacerbated the illiquidity that explains outsized moves.

Read More »

Read More »

FX Daily, December 06: Equity Slump Continues, Lifts Bonds, Bolsters Yen

The swoon in equities, perhaps sparked by a rotation spurred by potential US tax changes, is continuing today. It is providing a risk-off mood, which is expressed in the foreign exchange market as a stronger yen. The most compelling answer of yen strength is not that investors are buying yen as a haven.

Read More »

Read More »

FX Daily, October 04: Consolidative Tone in FX Continues

The US dollar has a softer tone today, and it was that way even for the European PMI. The greenback eased further after the upside momentum faded yesterday. The heavier tone in Asia seemed spurred by a hedge fund manager's call that Minneapolis Fed President, and among the most dovish members of the FOMC, Kashkari would be the next Fed chair.

Read More »

Read More »

FX Daily, August 30: US Dollar Recovery Extended

The US dollar recovery that began in North American yesterday continued to in Asia and Europe. The geopolitical anxiety sparked by North Korea's missile over Japan subsided. The US response was seen as measured and tempered.

Read More »

Read More »

FX Daily, August 02: Euro Climbs Relentlessly, While Greenback is Mixed

The euro's strength is surely partly a reflection of US dollar weakness, but it is also a reflection of the improved sentiment among investors. The initial dollar losses at the start of the year was largely a correction that is common after a Fed hike. This is more or less what happened at the start of 2016 as well, following the Fed hike in December 2015.

Read More »

Read More »

FX Daily, July 06: Stocks and Bonds Mostly Heavier, while Dollar Hovers Little Changed

The US dollar is narrowly mixed against the major currencies after being confined to tight ranges through the Asian session and European morning. Equities are nursing small losses, and interest rates are pushing higher. The yield on the 10-year German Bund reached 50 bp for the first time since early 2016. Oil prices have steadied after yesterday's slide.

Read More »

Read More »

FX Daily, June 01: Greenback Steadies at Lower Levels, Sterling Struggles

The US dollar is mostly firmer against the major currencies. It is consolidating yesterday's losses more than staging much of a recovery. Even sterling, where a YouGov poll has the Tory lead at three percentage points, down from seven previously, is above yesterday's lows. On the other hand, even strong data from Japan did not drive the yen higher.

Read More »

Read More »

FX Daily, May 03: Marking Time

The global capital markets are relatively calm. Japan, South Korea, and Hong Kong markets are closed for national holidays. Investors await the FOMC statement, though expectations could not be much lower. The disappointing US auto sales, and poor Apple sales figures reported yesterday have had little impact on the broader investment climate.

Read More »

Read More »

FX Daily, March 08: Dollar Bid as Rates Firm

The US dollar is moving higher against nearly all the other major foreign currencies today. As far as we can tell, the driving force remains interested rate considerations. US rates are rising in absolute terms and about Europe and Japan. The US 10-year yield is moving above the downtrend that has been in place since the day after the Fed hiked rates last December.

Read More »

Read More »

FX Daily, 01 February: Markets Stabilize, Investors Await Signals from US data and FOMC, and POTUS

(commentary will be sporadic for the next couple of weeks during a European business trip) The US dollar is consolidating yesterday's losses that were spurred speculation that the US was abandoning the more than 20-year old strong dollar policy. The meaning of that policy was clear to global investors even if it was often parodied.

Read More »

Read More »

A Few Thoughts Ahead of the US Jobs Report

ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation's average weekly earnings will likely be too small to detect.

Read More »

Read More »

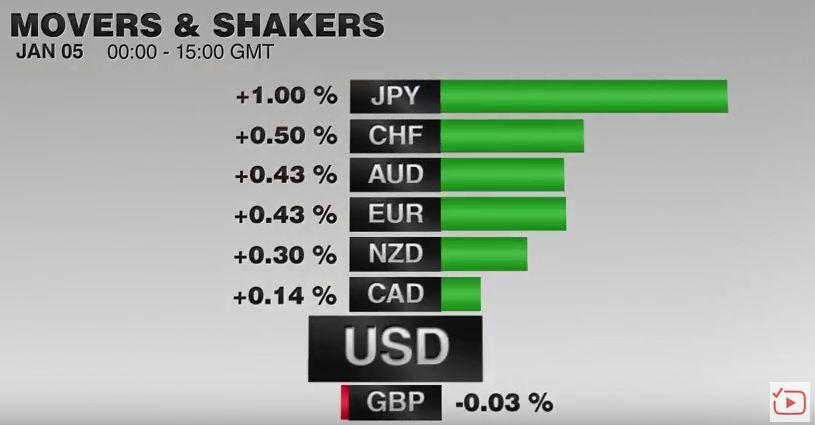

FX Daily, January 05: Dollar Slide but Resilience Demonstrated while Yuan Squeezed Higher

There are two main developments. First, the high degree of uncertainty expressed in the FOMC minutes and the repeated references to the strong dollar spurred a wave of dollar selling. The dollar retreated in Asia, but European participants saw the pullback as a new buying opportunity.

Read More »

Read More »