Tag Archive: Turkey

Emerging Markets: Preview of the Week Ahead

EM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX.

Read More »

Read More »

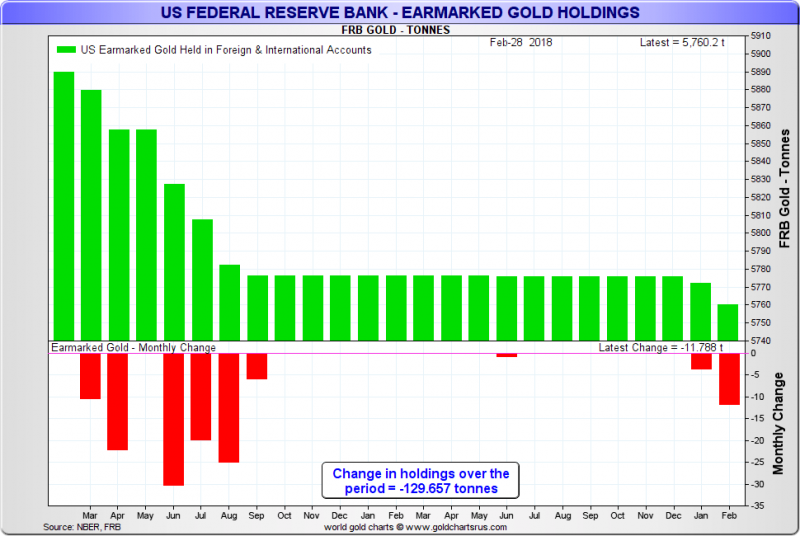

Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey.

Read More »

Read More »

Emerging Markets: What Changed

Reserve Bank of India cut its inflation forecast for the first half of FY2018/19 to 4.7-5.1%. Former South Korean President Park was sentenced to 24 years in prison. Malaysia Prime Minister Razak has called for early elections. Bahrain discovered its biggest oil field since it started producing crude in 1932. Local press reports Turkey’s Deputy Prime Minister Simsek tendered his resignation.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX was mostly stronger last week, despite the dollar’s firm tone against the majors. Best EM performers on the week were MXN, KRW, and COP while the worst were ZAR, INR, and PEN. US jobs data poses the biggest risk to EM this week, as US yields have been falling ahead of the data. Indeed, the current US 10-year yield of 2.74% is the lowest since February 6.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »

Emerging Market Preview: Week Ahead

EM FX was mostly firmer last week, but ended on a mixed note Friday. Best performers on the week for COP, MXN, and BRL while the worst were ARS, PHP, and CNY. We continue to warn investors against blindly buying into this broad-based EM rally, as we believe divergences will once again assert themselves in the coming weeks.

Read More »

Read More »

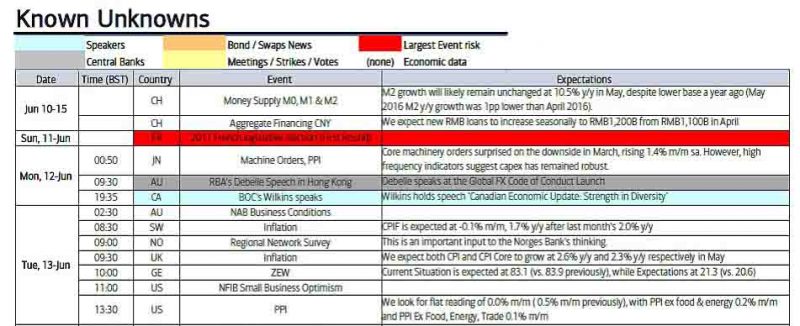

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

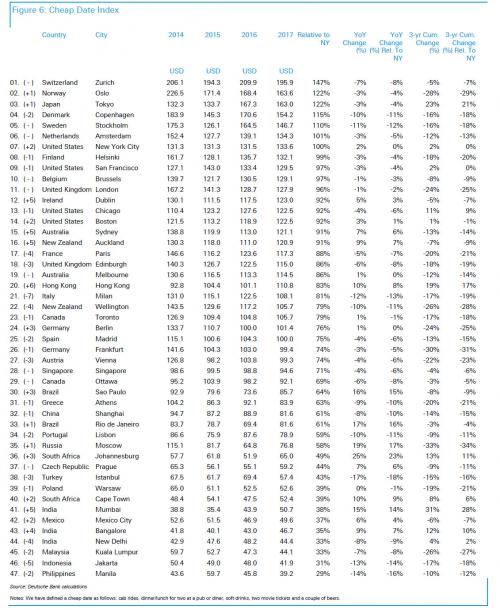

These Are The Most Expensive (And Best) Cities Around The World

Every year Deutsche Bank releases its fascinating index of real-time prices around the world which looks at the cost of goods and services from a purchase-price parity basis, to determine the most expensive - and in this year's edition, best - cities. As have done on several occasions in the past, we traditionally focus on one specific subindex: the cost of & cheap dates in the world's top cities.

Read More »

Read More »

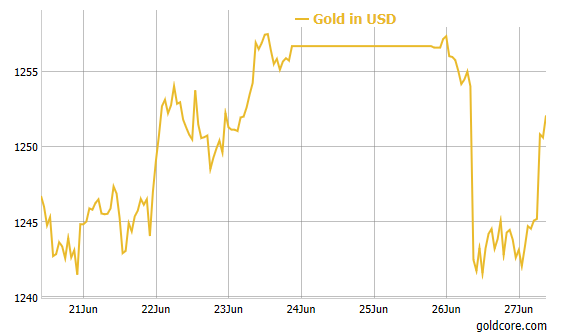

FX Daily, April 17: Markets Trying to Stabilize in Holiday-Thin Activity

Financial centers in Europe are closed for the extended Easter holiday. Australian and New Zealand markets were also closed. The drop in US 10-year Treasury yields in early Asia, with a brief push below 2.20%, appears to have kept the dollar under pressure. As the North American market prepares to open, the dollar is softer against the all major currencies and many emerging market currencies.

Read More »

Read More »

100 Years Ago, Russian Stocks Had A Very Bad Day

In recent months, Ray Dalio seems to be undergoing a deep midlife and identity crisis, which has not only led to dramatic recent management changes at the world's largest hedge fund, Bridgewater, but also resulted in some fairly spectacular cognitive dissonance, as Dalio first praised, then slammed, president Trump.

Read More »

Read More »

Switzerland: Chocolate, Watches, And Jihad

Swiss authorities are currently investigating 480 suspected jihadists in the country. "Radical imams always preached in the An-Nur Mosque... Those responsible are fanatics. It is no coincidence that so many young people from Winterthur wanted to do jihad." — Saïda Keller-Messahli, president of Forum for a Progressive Islam.

Read More »

Read More »

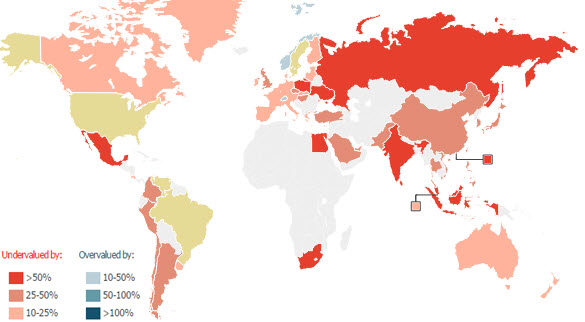

The US Dollar Is Now Overvalued Against Almost Every Currency In The World

In September 1986, The Economist weekly newspaper published its first-ever “Big Mac Index”. It was a light-hearted way for the paper to gauge whether foreign currencies are over- or under-valued by comparing the prices of Big Macs around the world. In theory, the price of a Big Mac in Rio de Janeiro should be the same as a Big Mac in Cairo or Toronto.

Read More »

Read More »

First ZeroHedge Symposium and Live Fight Club

For over four decades, many of the planet's biggest trouble makers and assholes have met each year in Davos, Switzerland, for the World Economic Forum with the humble mission of, "Improving the state of the world."

Read More »

Read More »

European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

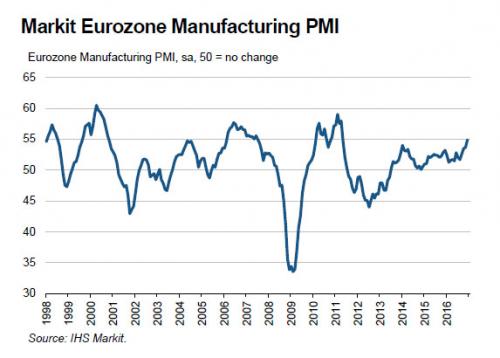

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia's major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April 2011.

Read More »

Read More »

Short Summary on US Thanksgiving

Euro fell to new 20-month lows before steadying. The dollar extended its recovery against the yen. Emerging markets remained under pressure, and Turkey's central bank surprised with a 50 bp hike in the repo rate.

Read More »

Read More »