Tag Archive: Too Big To Fail

Banking crisis: The new bailout strategy

Part II of II

To be fair, it is true, this time is different. Indeed, this time the rescue plan for the bust banks is not comparable to what we saw in 2008. In the US, the guarantee for deposits up to $250.000 comes from funds that are maintained by participating banks and not from the taxpayer. The official answer to how they’re going to pay everyone back is also plausible and possible: Some, or even most, of the money can and will be recovered...

Read More »

Read More »

“Dirk Niepelt im swissinfo.ch-Gespräch (Interview with Dirk Niepelt),” swissinfo, 2020

Swissinfo, December 14, 2020. HTML, podcast.

We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed.

Read More »

Read More »

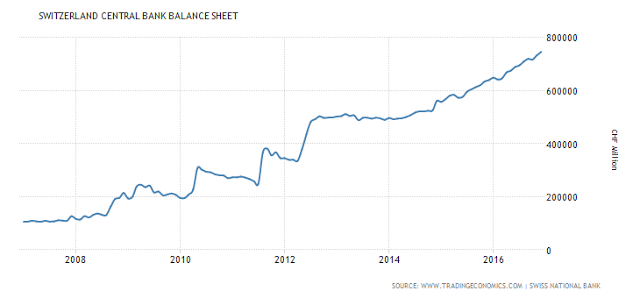

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

The VIX Will Be Over 100 due to Central Bank Created Tail Risk

We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory!

Read More »

Read More »

Spiritus rector des kranken Bonussystems ist Oswald Grübel

97 Franken – das war der Kurs der CS-Aktie im Mai 2007. Vergangene Woche notierte die Aktie noch bei einem Zehntel. Bei einem solch dramatischen Kurszerfall muss die CS sich nicht wundern, wenn kritische Fragen gestellt werden. Weshalb beträgt der aktuelle Wert der CS-Titel nur noch rund die Hälfte des in der Bilanz ausgewiesenen? Besteht die Gefahr eines Konkurses der CS? Wer wird dieses Too Big To Fail-Institut allenfalls retten? Die SNB, der...

Read More »

Read More »

News conference Swiss National Bank 2016, Fritz Zurbrügg

UBS and Credit Suisse: Capital Situation improved further: fully compliant. Domestically focused banks have capitalisation well above regulatory minimum requirements, but mortgage lending and risk exposure increased in 2015. In case of an interest rate shock, this could lead to problems.

Read More »

Read More »

How Unsound Money Fuels Unsound Government Spending

Stefan Gleason shows the major slides that may predict a collapse of the dollar. The Trade Deficit after the abandonment of gold, the explosion of entitlements like social security, Medicare, Obamacare, subsidies and the explosion of the federal deficit to 1 trillion in 2022. The reason: Unsound money.

Read More »

Read More »

Great Graphic: Nonperforming Loans, Another Divergence

Early in the financial crisis, the US forced all large banks to take an infusion of capital. This helped put a floor under the US financial system. Regulators and stakeholders encouraged US banks to address the significant nonperforming loan problem. The eurozone banking woes persist. Before the weekend, the shares of the one the …

Read More »

Read More »

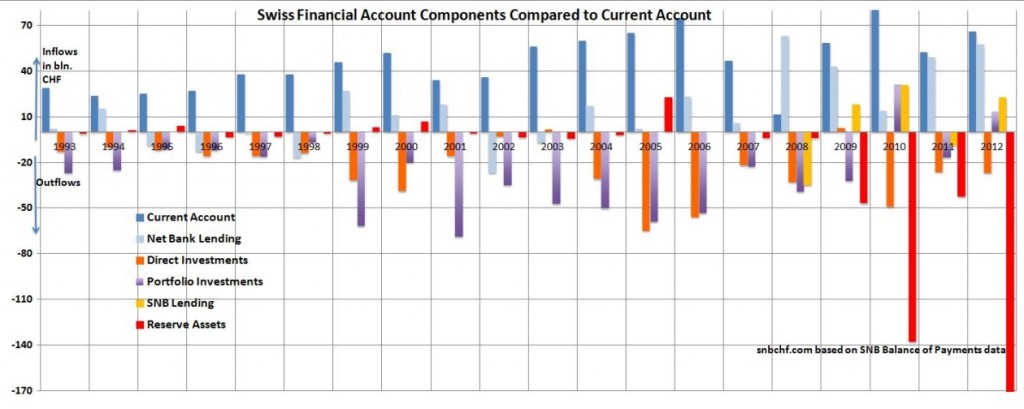

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

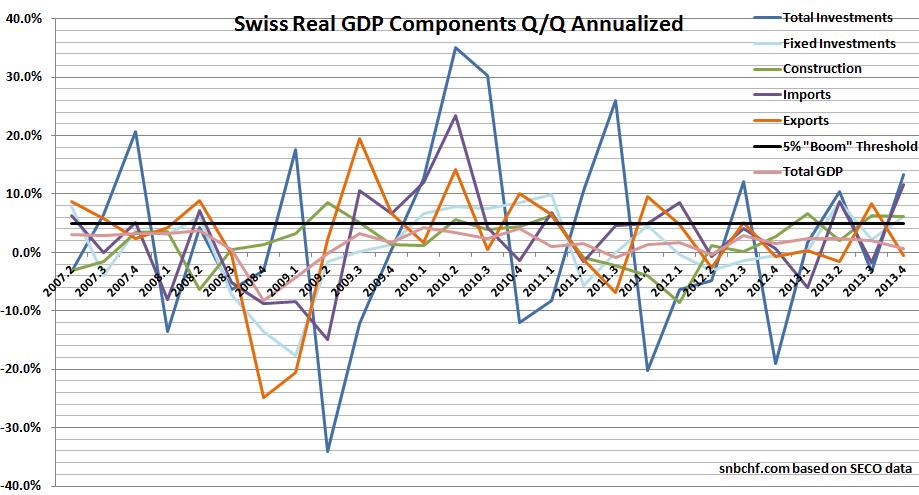

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

Dijsselbloem: The End of the Bankers’ and Bond Holders’ Moral Hazard

We have insisted in several posts that the northern euro zone is very reluctant to continuously bail out the periphery and in particular its banks. The euro group chief Dijsselbloem has confirmed this now.

Read More »

Read More »

History: The Lost 1980s Decade in Latin America

Peripheral Europe is going to follow step and step the Mexican and the resulting Latin American debt crisis of the 1980s.

Read More »

Read More »