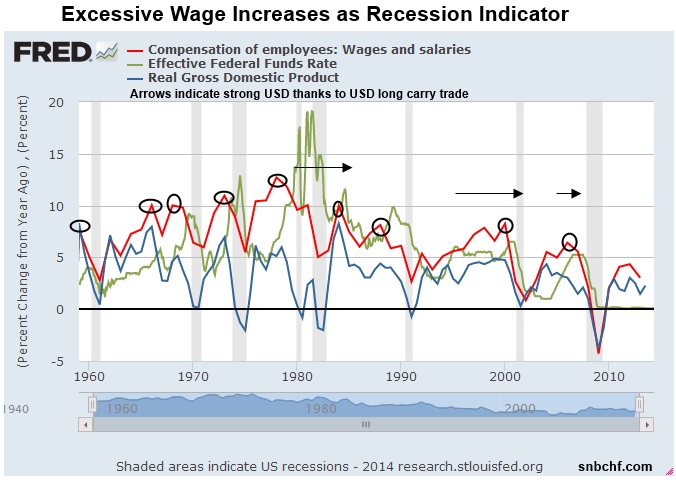

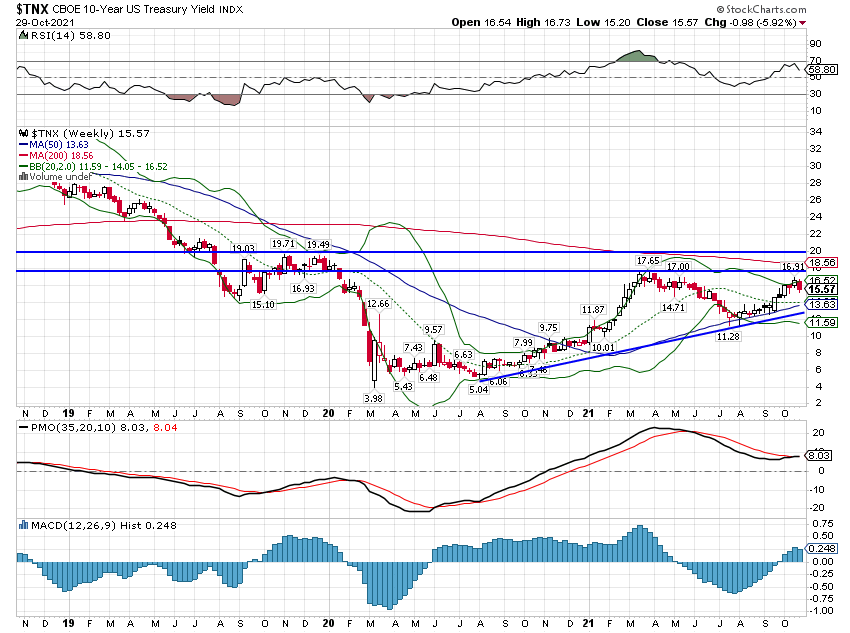

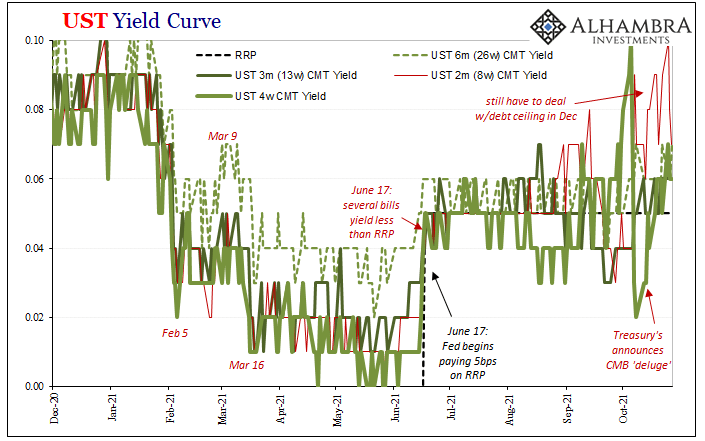

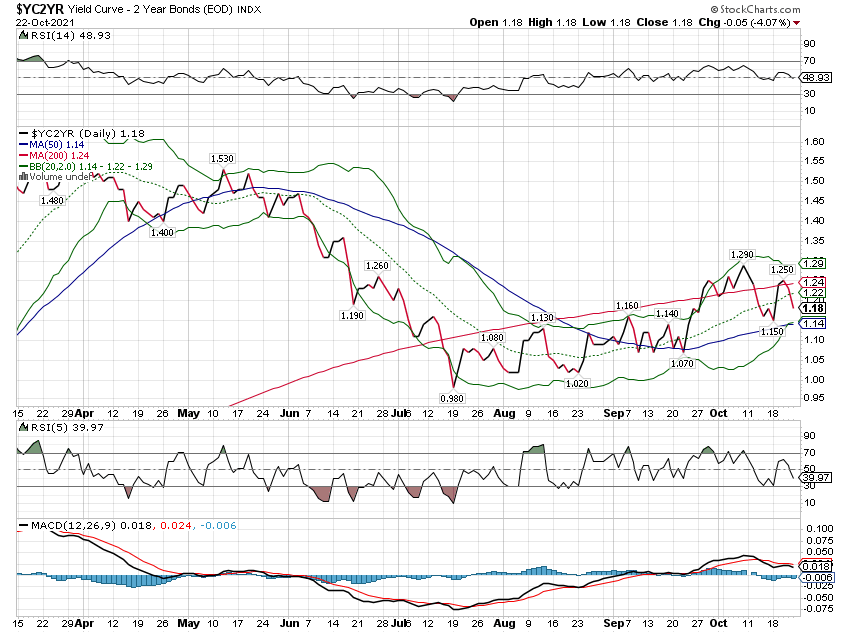

The Federal Reserve is widely expected to raise interest rates again at their meeting next week. They obviously view the recent cyclical upturn as being durable and the inflation data as pointing to the need for higher rates. Our market based indicators agree somewhat but nominal and real interest rates are still below their mid-December peaks so I don’t think a lot has changed.

Read More »

Tag Archive: TIPS

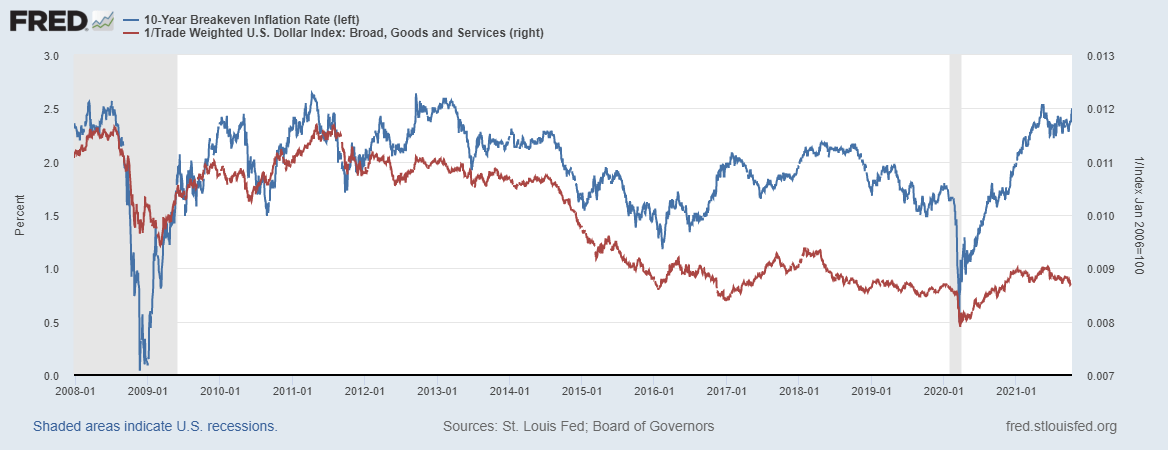

Inflation Expectations = Real GDP Growth = Ten-Year Treasury Yields – 0.5%?

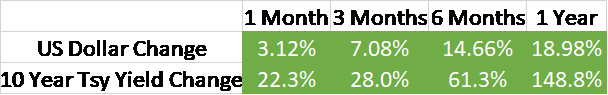

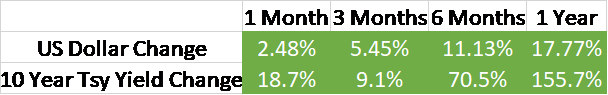

Inflation expectations drive the Fed's and markets behaviour. Bond yields adjust, often but not always, with an inflation premium against short-term rates.

Read More »

Read More »