Tag Archive: Switzerland

The other risk for the SNB: Will German Bund yields double ?

In the latest post we started discussing the implications of a German euro exit for the Swiss National Bank, this time we will look on another risk: The rising German Bund yields.

Read More »

Read More »

Steen Jakobsen, Chief Economist Saxo Bank is buying in our arguments

Steen Jakobsen sees 25% percent chance that the floor breaks and if it does it breaks to parity. Last week Thomas Jordan removed any hopes on a hike of the EUR/CHF and invited smart money and hedge funds to a no-risk, high return game on the Swiss franc, which these gratefully accepted. After Morgan Stanley …

Read More »

Read More »

Another week, another 14 bln. francs printed

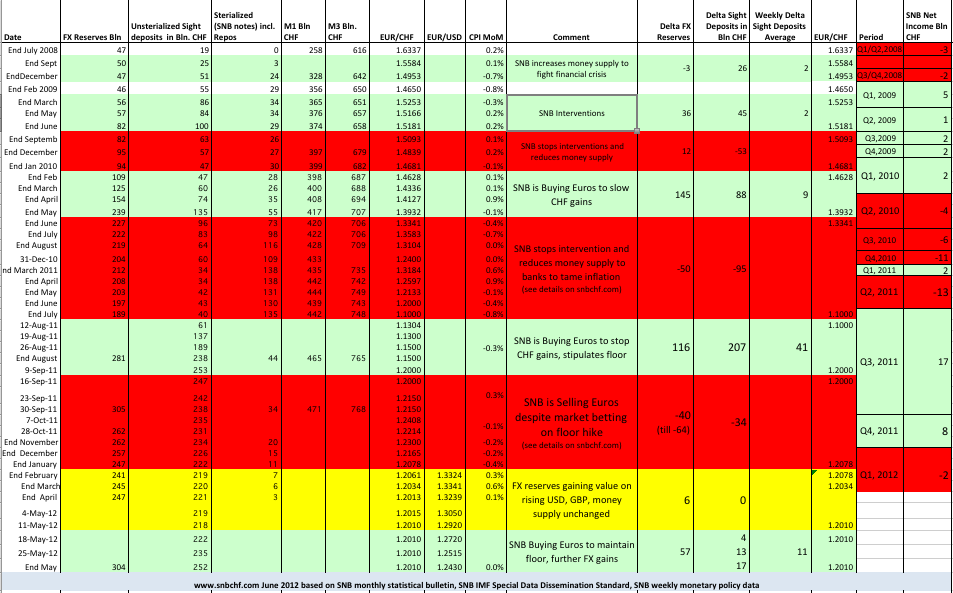

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »

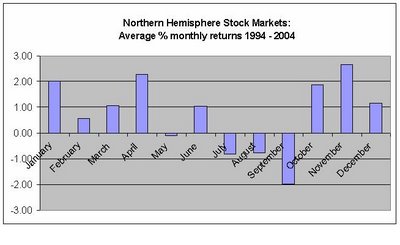

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

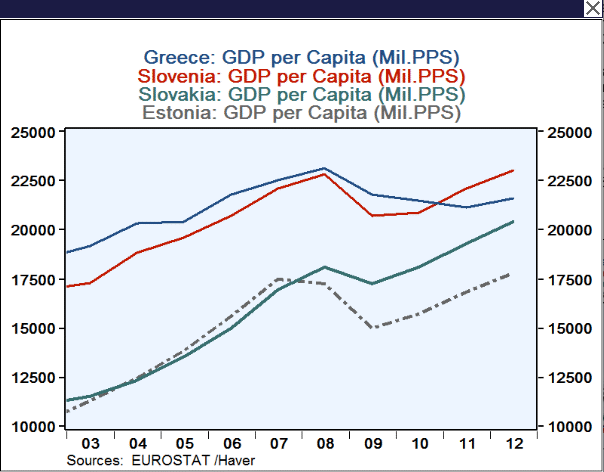

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »

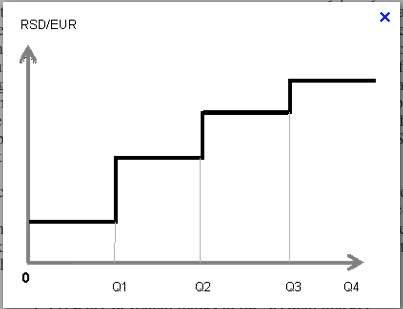

CNBC rumors: Different peg methods for the SNB

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

Huge rise in Currency Reserves: The SNB has restarted the printing press

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in …

Read More »

Read More »

SNB’s Jordan admits that EUR/CHF floor will not be raised

For the first time the chairman of the Swiss National Bank Jordan has admitted that the EUR/CHF floor of 1.20 will not be raised. In an interview with the Swiss Sonntagszeitung, here also cited by Bloomberg, he said:

Read More »

Read More »

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

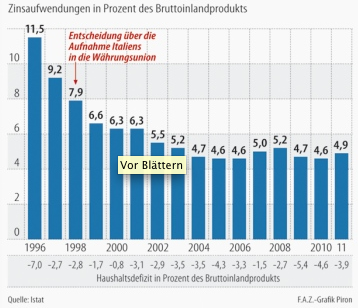

Italy: About the Hypocrisy of Politicians and the Blindness of the English-Speaking Financial Papers

Just a little wrap-up of two tweets read in 5 minutes, to which I finally added a bit more out of my recent Tweets. One Tweet: The British finance minister Osborne has emphasized that the euro zone needs to protect its peripheral economies. “The whole of Europe needs to become more competitive and productive. That …

Read More »

Read More »

EUR/CHF, A History, The Game Changes: April 2012

EUR/GBP: If You Want To Know Why Its Falling, Have A Look At The SNB Thanks Goose for the reminder that the SNB released figures on its FX reserves holdings and these showed a marked increase in GBP holdings. This has been a constant theme over the last few weeks/months, the SNB buys EUR/CHF in the marketplace … Continue reading »

Read More »

Read More »

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor: March 2012

Nomura Touts EUR/CHF Longs Strategists there advise going long around the current levels, they say the floor will not break. They target 1.24. I have to agree. To me, it’s a question of buying low or buying a bit lower. By Adam Button || March 30, 2012 at 14:50 GMT EUR/CHF Touches One-Month Low Bounced off … Continue reading »

Read More »

Read More »