Tag Archive: Switzerland inflation

SNB Monetary Policy Assessment June 2021

The SNB is maintaining its expansionary monetary policy with a view to ensuring price stability and providing ongoing support to the Swiss economy in its recovery from the impact of the coronavirus pandemic. It is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%, and remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

SNB Monetary Policy Assessment June 2020 and Videos

The coronavirus pandemic and the measures implemented to contain it have led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The SNB’s expansionary monetary policy remains necessary to ensure appropriate monetary conditions in Switzerland.

Read More »

Read More »

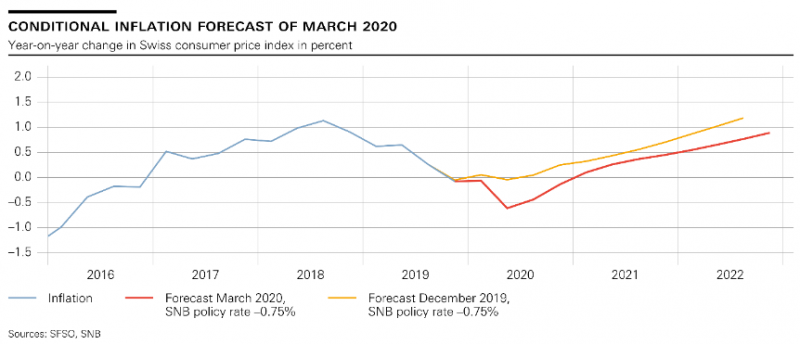

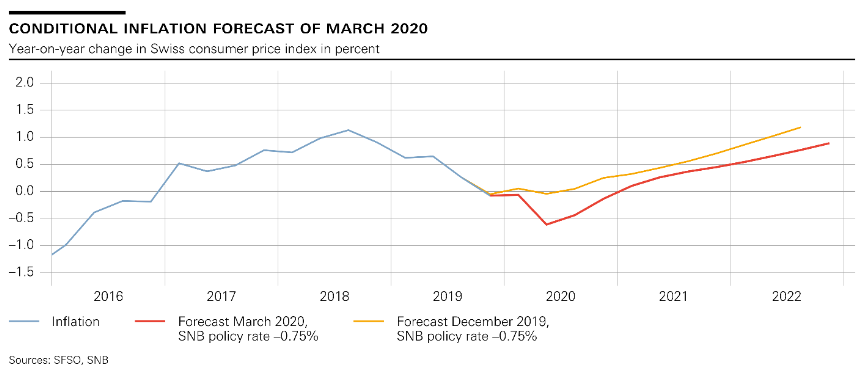

Monetary policy assessment of 19 March 2020

Swiss National Bank maintains expansionary monetary policy, raises negative interest exemption threshold, and is examining additional steps. Coronavirus is posing exceptionally large challenges for Switzerland, both socially and economically. Uncertainty has risen considerably worldwide, and the outlook both for the global economy and for Switzerland has worsened markedly.

Read More »

Read More »

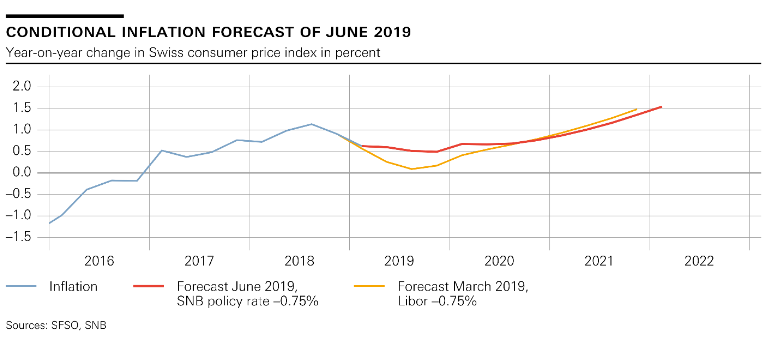

Monetary policy assessment of 13 June 2019

The Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is unchanged at –0.75%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

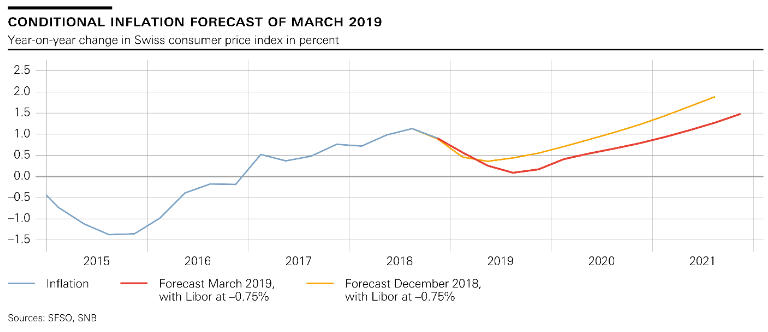

Monetary policy assessment of 21 March 2019

The Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

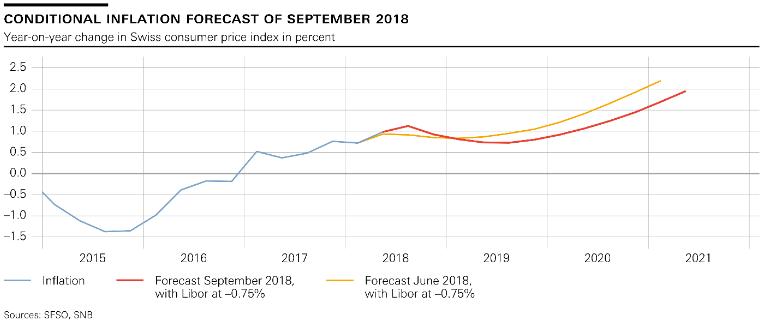

Monetary Policy Assessment of 20 September 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB remains at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

Food consumes far less of Swiss budgets than it did 25 years ago

Comparing the most recent statistics on Swiss consumer inflation to those in 1993 reveals a steep drop in the percentage of spending allocated to food. When statisticians calculate consumer price rises they look at the prices of a standard basket of goods. In 1993, food and non-alcoholic beverages made up 14.3% of the value of this standard basket. By 2018, the percentage had fallen to 10.4%, a 27% drop.

Read More »

Read More »

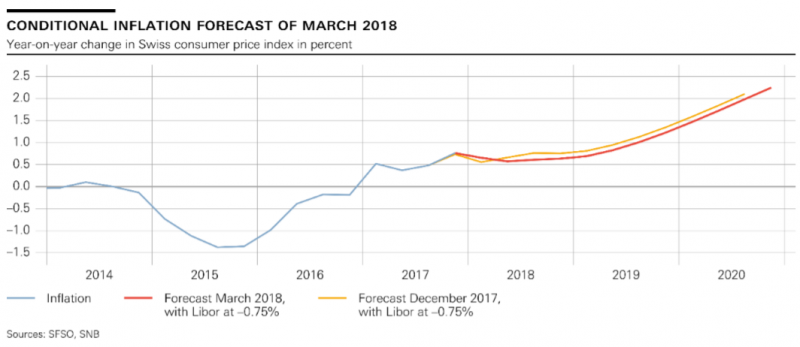

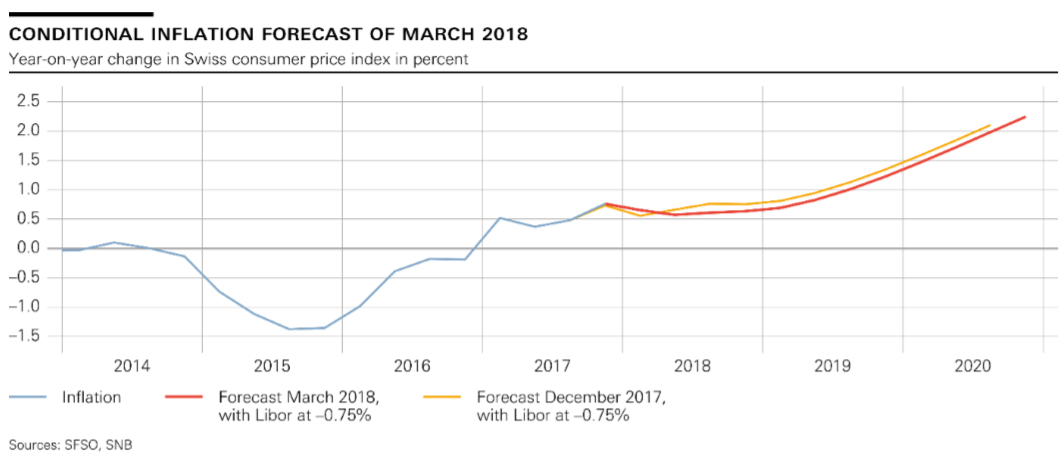

SNB Monetary policy assessment of 15 March 2018

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

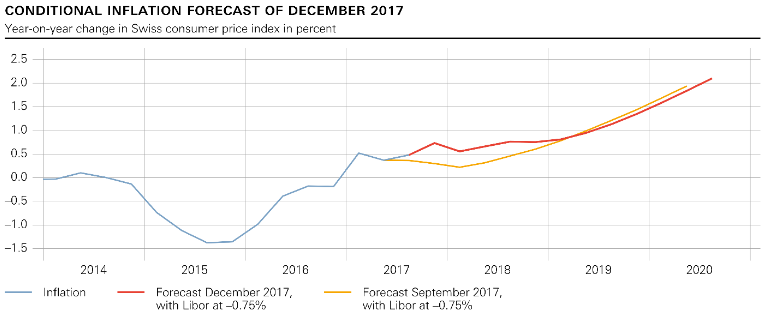

SNB Monetary policy assessment of 14 December 2017

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

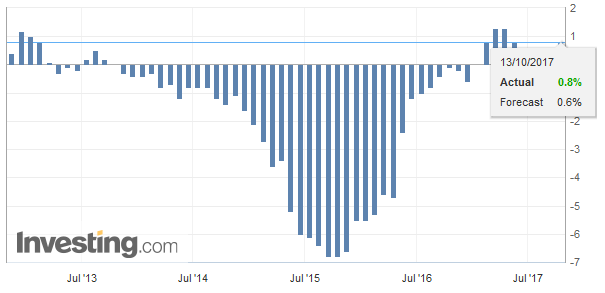

Swiss Producer and Import Price Index in September 2017: +0.8 YoY, +0.5 MoM

The Producer and Import Price Index rose in September 2017 by 0.5% compared with the previous month, reaching 100.5 points (base December 2015 = 100). The rise is due in particular to higher prices for petroleum products, basic metals, semi-finished products of metal, and scrap. Compared with September 2016, the price level of the whole range of domestic and imported products rose by 0.8%.

Read More »

Read More »

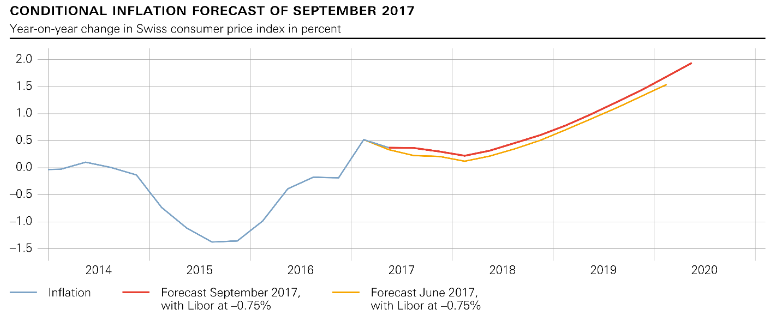

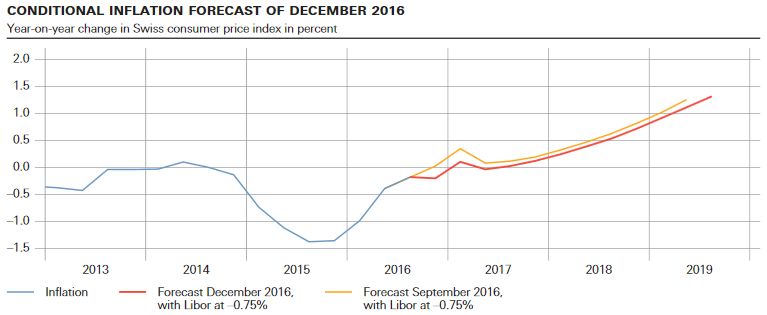

SNB Monetary Policy Assessment September 2017 and Comments

The SNB projects that she will reach her inflation target, shortly under 2% in the medium term, i.e. in 2019/2020. One reason might be the weakening of the Swiss Franc. But she does not prepare for a normalization of her policy: From the history we know that - once the franc is weakening - inflation may rise very quickly.

Read More »

Read More »

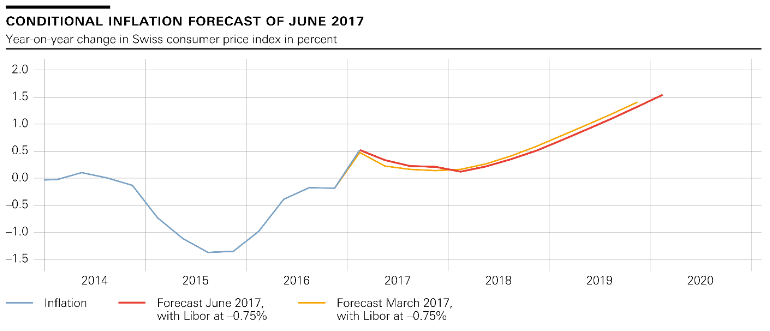

SNB Monetary Policy Assessment June 2017 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy, with the aim of stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is to remain at –0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%.

Read More »

Read More »

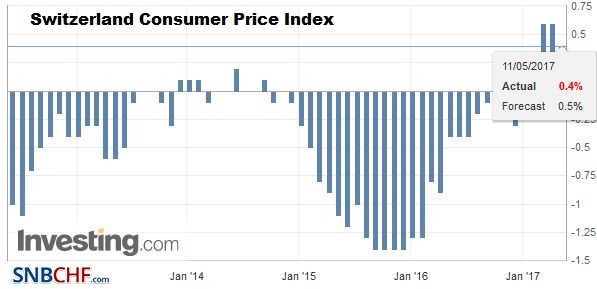

Swiss Consumer Price Index in April 2017: Up +0.4 percent against 2016, +0.2 percent against last month

The consumer price index (IPC) increased by 0.2% in April 2017 compared with the previous month, reaching 100.9 points (December 2015=100). Inflation was 0.4% compared with the same month the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

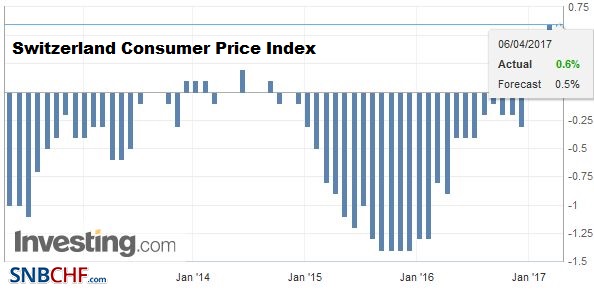

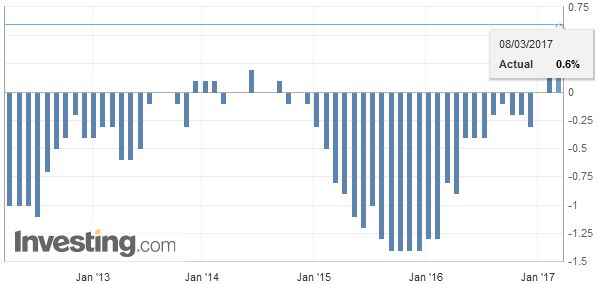

Swiss Consumer Price Index in March 2017: Up +0.6 percent against 2016, +0.2 percent against last month

The consumer price index (IPC) increased by 0.2% in March 2017 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.6% compared with the same month the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Swiss Consumer Price Index in February 2017: Up +0.6 percent against 2016, +0.5 percent against last month

The Swiss National Bank will have difficulties to weaken the Swiss Franc, because she is obliged to maintain her mandate, the avoidance of inflation. Already in January 2015, she gave up, because continuing interventions - at the excessively high euro rate of 1.20 - could have endangered her inflation mandate.

Read More »

Read More »

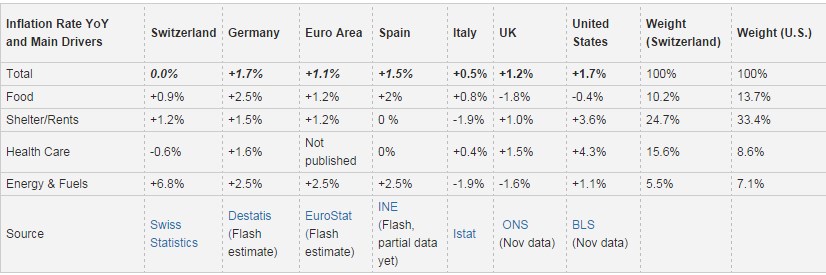

Switzerland Consumer Price Index in December 2016: 0.0 percent against 2016, -0.1 percent against last month

Energy prices in Switzerland turned around from a minus 2.4% in November to a +6.8% in December. Oil prices had seen its trough exactly one year ago.

Especially in Germany and Spain, this translated into inflation rates, that are close to the ECB target rate of 2%.

Read More »

Read More »

SNB Monetary policy assessment December 2016 and Comments

The Swiss National Bank (SNB) is maintaining its expansionary monetary policy. Interest on sight deposits at the SNB is to remain at–0.75% and the target range for the three-month Libor is unchanged at between –1.25% and –0.25%. At the same time, the SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation into consideration.

Read More »

Read More »

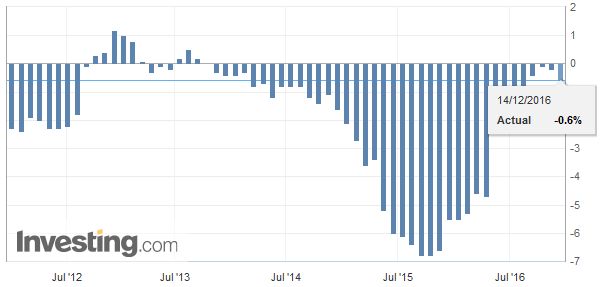

Swiss Producer and Import Price Index, November 2016: +0.1 percent MoM, -0.6 percent YoY

The Producer and Import Price Index rose in November 2016 by 0.1% compared with the previous month, reaching 99.9 points (base December 2015 = 100). The slight rise is due in particular to higher prices for scrap and petroleum products. Compared with November 2015, the price level of the whole range of domestic and imported products fell by 0.6%. These are the findings from the Federal Statistical Office (FSO).

Read More »

Read More »

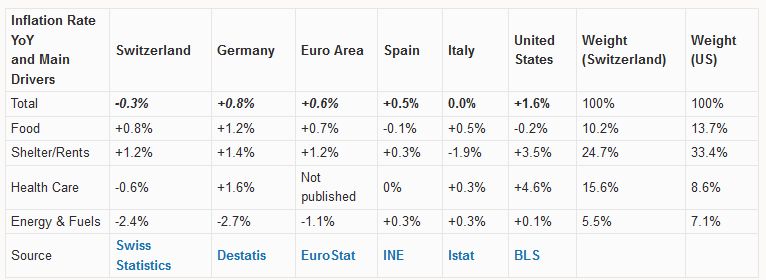

Switzerland Consumer Price Index in November 2016: -0.3 percent against 2015, -0.2 percent against last month

Swiss consumer price inflation remain the lowest in comparison with different countries in the euro zone and the United States. Consumer prices in the U.S. are driven by rising health care costs and asset price inflation in shelter. In Europe, we see the opposite phenomenon: Rents in Italy or Spain are steady or falling. In Germany and Switzerland rent control prevents that asset price inflation moves into consumer prices. In Switzerland, more and...

Read More »

Read More »