News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital.

Read More »

Tag Archive: Swiss gold

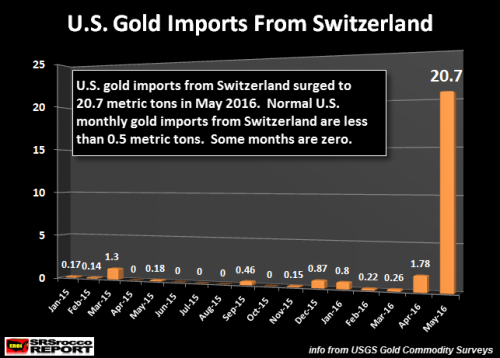

Record Swiss Gold Flow Into The United States

Record Swiss Gold Flow Into The United States. There was a huge trend change in U.S. gold investment in May. Something quite extraordinary took place which hasn’t happened for several decades. While Switzerland has been a major source of U.S. gold exports for many years, the tables turned in May as the Swiss exported a record amount of gold to the United States.

Read More »

Read More »

Venezuela’s Gold Reserves Plunge To Lowest Ever As Maduro Repays Debt With Gold

Several months ago, as Venezuela's hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in "Scenes From The Venezuela Apocalypse: "Countless Wounded" After 5,000 ...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

New Swiss Gold Initiative Getting Attention When Parallel Currencies Might Challenge Swiss Franc

In Switzerland the ordinary people have started several initiatives to protect their savings against the establishment. After the first gold referendum failed in November 2014, a new gold initiative is trying to introduce a gold-backed Swiss currency, as parallel currency or investment vehicle.

With the end of the EUR/CHF peg and the apparent risks caused by the SNB, the importance of the Gold Franc initiative has increased. Different groups want...

Read More »

Read More »

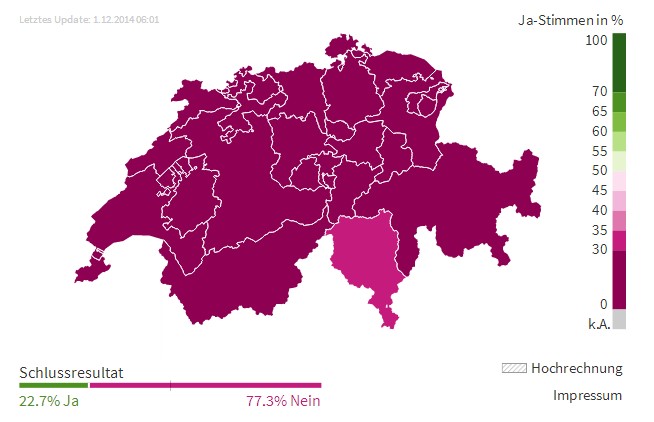

Swiss Gold Referendum: Results and Analysis

In a referendum, the Swiss had to decide about:

1) Ecopop, an ecological-political movement that wants to limit immigration to 0.2% of the population.

2) Abolishment of tax advantages for rich foreigners.

3) A gold initiative.

All three initiatives were rejected, the gold initiative by 78%.

George Dorgan summarizes the outcome. He explains what it means for gold, CHF and the SNB. He argues that the next economic cycle will be driven by...

Read More »

Read More »

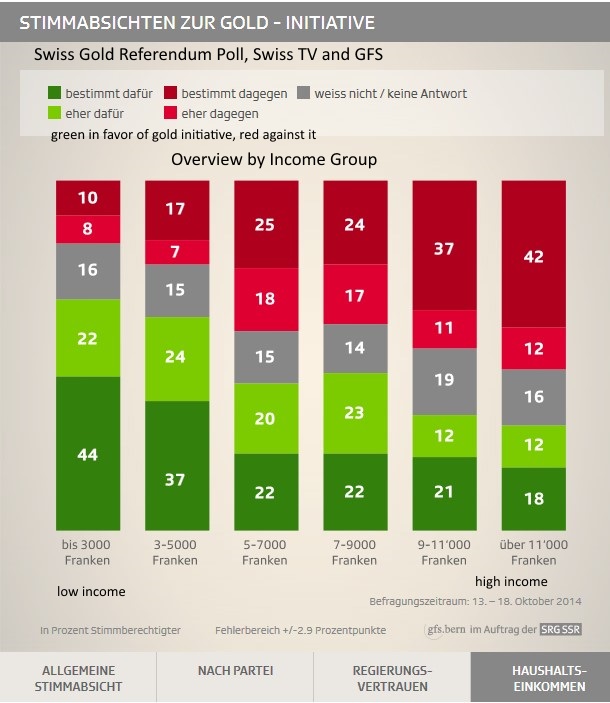

Swiss Gold Referendum: Opinion Polls

According to the latest polls 38% of voters would support the Swiss gold initiative, 47% are against it. The previous poll, recognized as more reliable, showed 45% pro gold and 38% against.

A win of the initiative would most probably imply a breakdown of the EUR/CHF floor.

According to the polls, low income groups are in favor. Effectively their purchasing power would increase when the CHF appreciates.

High income earners and stock owners are...

Read More »

Read More »

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

Already in 2013, the Swiss National Bank (SNB) spoke out against the gold initiative and revealed that the Swiss gold is stored mostly in Switzerland and 20% in the UK and 10% in Canada. There is no Swiss gold in the United States according to SNB chairman Jordan. In this post we provide an exchange of Jordan's arguments against the ones of the gold initiative. We also state our view that is not as strict as the one of the referendum proponents.

Read More »

Read More »

Gold Referendum, Parliamentary Speech Lukas Reimann

Swiss parliament member Lukas Reimann outlines the importance gold. In a future inflationary environment, prices of SNB holdings, the ones of German Bunds and US Treasuries will drop, while gold will appreciate.

Read More »

Read More »

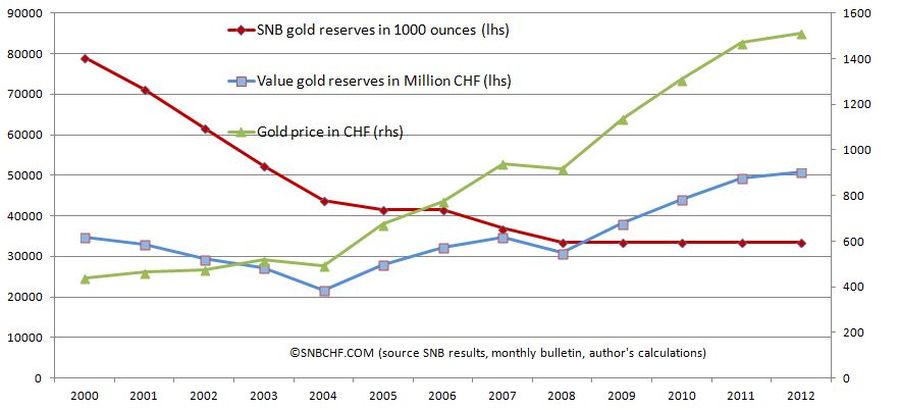

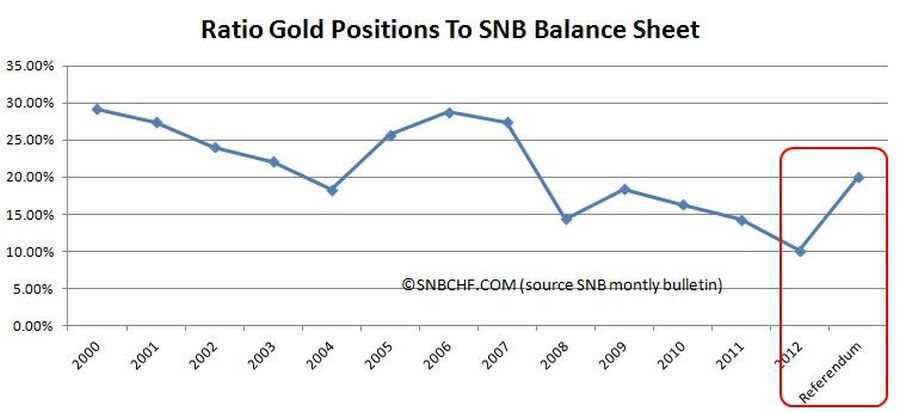

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

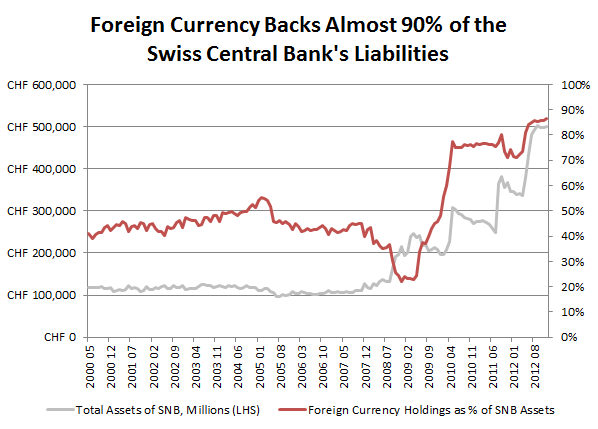

How Modern Monetary Policy Changed CHF from Gold-Backed to a USD and Euro-Backed Currency

we slowly move into an inflationary environment and prices of German Bunds and US Treasuries are falling.... ECB and Fed interest rates seem to be nailed to zero for years.

Read More »

Read More »

“SNB Concerned”: Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap?

If the upcoming referendum "Save our Swiss gold" wins, the SNB must increase gold holdings from 10% to 20% of its balance sheet. Gold purchases and/or sales of fiat money implies an end of CHF cap.

Read More »

Read More »