According to the latest polls 38% of voters would support the Swiss gold initiative, 47% are against it. The previous poll, recognized as more reliable, showed 45% pro gold and 38% against. A win of the initiative would most probably imply a breakdown of the EUR/CHF floor.

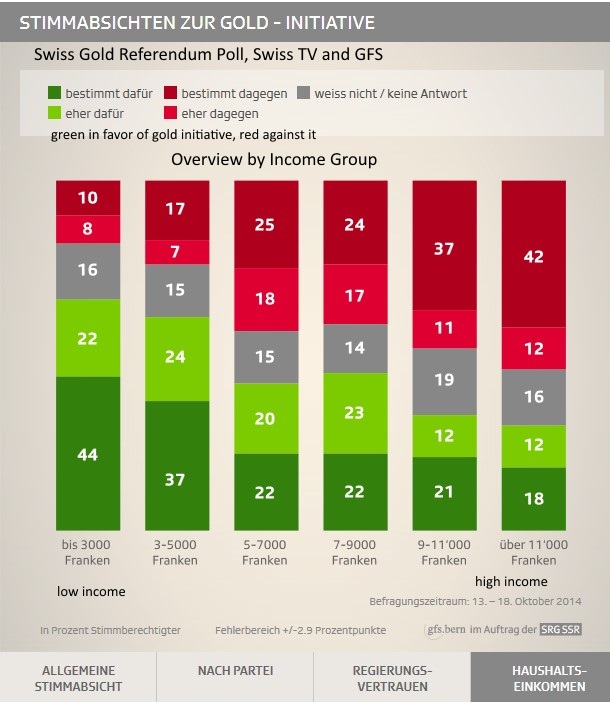

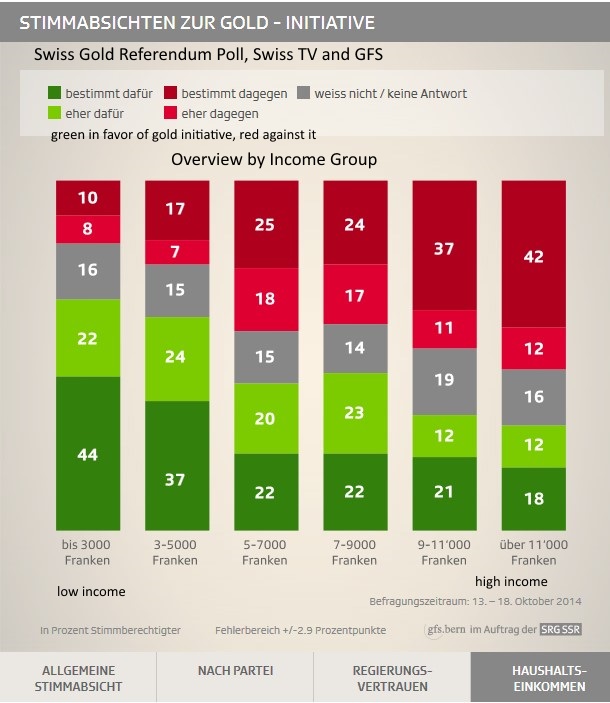

According to the polls, low income groups are in favor. Effectively their purchasing power would increase when the CHF appreciates.

High income earners and stock owners are rather against it. If CHF improves Swiss stocks could collapse; this explains their voting intentions.

Three Swiss referendums on November 30

The Swiss have to cast their ballot for or against:

- Ecopop, a ecological-political movement that wants limit immigration to 0.2% of the population, a number that is far lower than the already approved “vote against mass immigration”. Bloomberg speaks of the biggest risk for Swiss business. The proponents argue that too much wealth makes sick, Switzerland would explode from 9 to 12 million inhabitants (via @WebInfoCH). They explain the initiative in a simple picture:

2. Abolish tax advantages for rich foreigners that currently are taxed on living costs but not based on income/wealth. Some Swiss cantons try to attract such wealthy tax-payers, Michael Schumacher is maybe the most prominent example. The wealthy also creates more demand for high-quality real estate and are accused to drive prices up.

3. The gold initiative.

The Swiss People’s Party wants to “Save Swiss Gold” to give more credibility to the SNB’s monetary policy and the Swiss Franc. The initiative would require that the SNB;

- Does not sell anymore of it’s gold reserves

- Must not let gold reserves fall below 20%

- Must hold all gold reserves in Switzerland

After the government voted against the original initiative the SVP collected the 100k signatures needed to hold a referendum.

If the vote is “yes” the SNB has;

- 2 years to repatriate it’s gold reserves

- 5 years to reach the 20% reserve level

This would mean that Switzerland would have to buy around 1500 tons of gold over 5 years. (via ForexLive)

Polls expect three no votes, the closest initiative to a win is vote number 2. Some intellectuals like university professor Geiger say three times Yes.

In our article “SNB Concerned: Does a Yes to the Swiss Gold Referendum Imply an End of the CHF Cap?” we explain that if the widely discussed Swiss gold initiative wins, then the Swiss National Bank would need to buy large amounts of gold. A second possibility would be to sell about half of its currency reserves, which would imply a breakdown of the EUR/CHF floor.

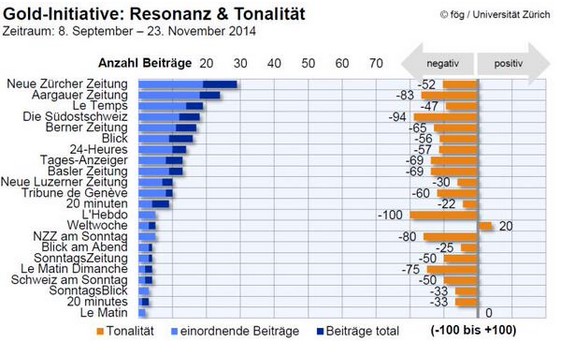

We explain more Swiss background, polls below. The gold initiative has far higher visibility in the streets and in the social media, this might help to attract low-income voters. However, both political parties and newspapers are against it. Newspapers may strongly influence the votings of mid-income voters.

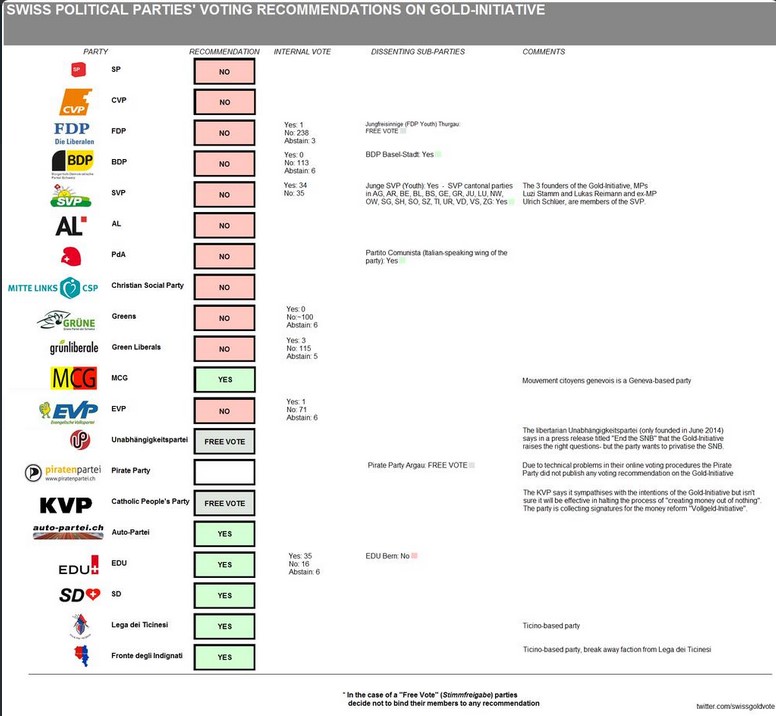

Recommendations by political parties is negative

Unfortunately for the proponents even their own party , the People’s Party (in German “SVP”) recommended a no. It is the biggest Swiss party and typically obtains 25%-30% in political elections. At national level, however, they recommended a No with 35 against 34 votes some time ago. This contradicts voting intentions by political party.

Newspaper coverage is negative

As usual journalists recognize only currently low price inflation and the weak gold price. They often help inexperienced investors (e.g. the SNB ??) to buy high and sell low. It is very possible that journalists were more in favor of gold when the price was high in 2011/2012.  The initiative was started in Summer 2011 when the gold price was at its highs. SNB sales at prices under 500$ until 2007, compared to the price of gold of around 1800$ in 2011 was certainly a reason.

The initiative was started in Summer 2011 when the gold price was at its highs. SNB sales at prices under 500$ until 2007, compared to the price of gold of around 1800$ in 2011 was certainly a reason.

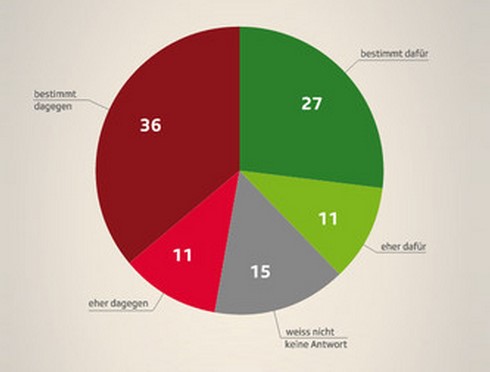

Poll published November 19

Swiss television and the recognized GFS institute, Red is against, Green in favor, darker colours indicate stronger opinion  Also in this poll the tendencies shown further below are repeated:

Also in this poll the tendencies shown further below are repeated:

- Low incomes are in favor of gold; they possibly want a stronger franc to fight against rising rents and food

- High incomes are anxious about their stocks and are receptive to SNB’s arguments

- middle incomes: no clear tendencies

The Italian-speaking Switzerland is in favor of the initiative, the French-speakers are as usual on the side of the central banks and monetary expansion.

.@gfsbern poll suggests #goldinitiative most popular in Italian-speaking parts of #Switzerland http://t.co/nwtK2OxmmW pic.twitter.com/EDzHYWqUx6 — Swiss Gold Vote (@swissgoldvote) November 19, 2014

With the Italian inflation tradition, they prefer the inflation hedge gold. The Ecopop initiative, which would radically limit immigration to Switzerland, seems to get rejected: 56% of respondents were against the measure and 39% in favor of it.

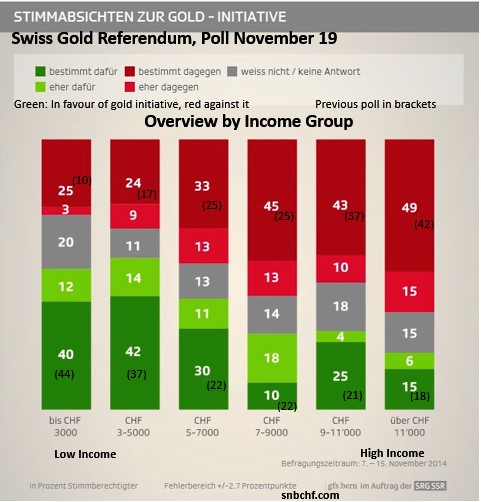

Changes in voting intentions by income groups in the latest poll

The changes in voting intentions by income group reflect the following tendencies:

- The opponents have managed to mobilize a big part of mid-income households, in particular from 7000 to 9000 CHF.

- No big change in high income, solely the entrepreneurs/stock owners above 11K income intensified the opposition against the initiative.

- Some mobilization against the initiative among low-income voters, mostly concentrated on the lowest income (< 3K).

Explanation: The opponents have successfully placed the argument that the SNB would not be able to act when the gold portion must be at least 20% and would lose its fire power to sustain the peg. In particular mid incomes were receptive for this argument, while higher incomes were potentially already aware of this issue before. As we reported, the gold initiative has already started to fight actively against the SNB and the euro floor. In the Swiss television “Arena” discussion, the proponent Luzi Stamm clearly stated that the euro floor was only a temporary measure and the floor could be abolished. This would mean: The main measure to achieve 20% gold could be to sell euros and dollars and NOT only to buy gold. Moreover, if one day the gold share gets too high in the SNB balance sheet, then a future generation could decide to sell gold, certainly again in a referendum (source Luzi Stamm). This element was thrown into the discussion more actively only during the week when the poll took place. It might change the opinions again. Critique against the poll: The latest poll did not confront voters with the arguments for the gold initiative, but arguments were fully presented for the other two votes.

Explanation: The opponents have successfully placed the argument that the SNB would not be able to act when the gold portion must be at least 20% and would lose its fire power to sustain the peg. In particular mid incomes were receptive for this argument, while higher incomes were potentially already aware of this issue before. As we reported, the gold initiative has already started to fight actively against the SNB and the euro floor. In the Swiss television “Arena” discussion, the proponent Luzi Stamm clearly stated that the euro floor was only a temporary measure and the floor could be abolished. This would mean: The main measure to achieve 20% gold could be to sell euros and dollars and NOT only to buy gold. Moreover, if one day the gold share gets too high in the SNB balance sheet, then a future generation could decide to sell gold, certainly again in a referendum (source Luzi Stamm). This element was thrown into the discussion more actively only during the week when the poll took place. It might change the opinions again. Critique against the poll: The latest poll did not confront voters with the arguments for the gold initiative, but arguments were fully presented for the other two votes.

Why did SRG Swiss TV tell pollster @gfsbern not to test pro/anti #goldinitiative arguments on voters? #schade #abst14 pic.twitter.com/3fofHyeLXp — Swiss Gold Vote (@swissgoldvote) November 23, 2014

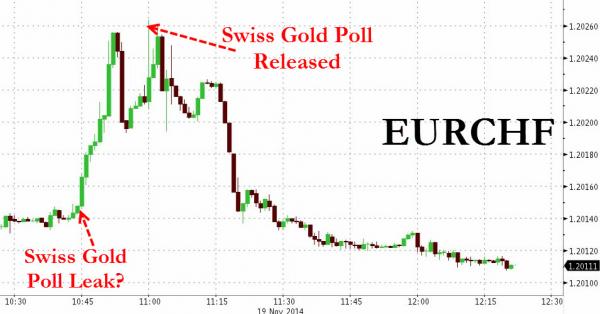

Poll seems to have no influence on fundamentals for CHF

Traders thought that recent CHF strength was caused by the gold referendum, because mainstream news published such misinformation.

Some traded based on the leak of the poll results. Once the global macro algos from the big US banks and hedge funds started running, EUR/CHF fell again to the level it belongs to based on fundamentals: Namely to levels close to 1.20

According to the latest polls 38% of voters would support the Swiss gold initiative, 47% are against it. The previous poll, recognized as more reliable, showed 45% pro gold and 38% against. A win of the initiative would most probably imply a breakdown of the EUR/CHF floor. According to the polls, low income groups are in favor. Effectively their purchasing power would increase when the CHF appreciates. High income earners and stock owners are rather against it. If CHF improves Swiss stocks could collapse; this explains their voting intentions. - Click to enlarge

Poll on the gold initiative, Oct. 27 (Online vote): 38% in favor, 47% against

The following are some detailed results from the latest poll this week, which saw gold initiative support fall from 45% to 38%:

The poll showed 38 percent of respondents were in favour of the initiative, down from support of 45 percent in a poll in the paper last week. Some 47 percent of those survey opposed the proposals, while 15 percent remained undecided.

The authors of Friday’s poll said the survey was conducted online on Oct. 27 with 12,491 voters. Results were then weighted by voter demographics, geography and other political variables in order to better represent the Swiss voting population.

Still, the method of polling is seen as less reliable than that of Berne–based research and polling institute gfs.bern, which published a survey last Friday showing the gold initiative had the support of 44 percent of the public. (via DailyMail)

Previous poll, October 15 (recognized institute GFS): 45% in favor, 38% against

We know that news reporting is always biased, and so it was for the first poll results for the referendum two weeks ago. The “gold-friendly” Forbes wrote:

A slim majority of Swiss citizens said they would vote yes to force the Swiss National Bank to increase and hold on to their gold reserves, according to the country’s first opinion poll.

On Tuesday, 20 Minuten, Switzerland’s biggest daily newspaper, released the results of its online survey. According to the poll, which was conducted on Oct. 15 and had more than 13,000 respondents, 45% to 39% said they would support the “Save Our Gold” initiative. (Forbes)

Reuters, a part of the financial establishment, noted:

A proposal to prohibit the Swiss National Bank from selling any of its gold reserves has the support of 44 percent of the public, a closely watched survey showed on Friday, though that result falls short of the backing it needs to pass into law.

The group behind the opinion poll also said support was likely to diminish as a Nov. 30 vote on the measure approaches. (Reuters)

This previous poll came from the recognized GFS bern institute and was published in the widely read “20 Minuten“. The full detail arrived some days later via Swiss television SRF.

The “20 Minuten” article actually concentrates on the Ecopop initiative, a second referendum that takes place at the same time. The left-wing Ecopop initiative wants to radically reduce immigration into Switzerland. In the GFS poll, Ecopop obtain 53% of the vote, while in the online poll 46%.

Similar to Mauldin Economics, we judge that Switzerland is a business, not a country. For us, as people who live in Switzerland, the Ecopop referendum is more important than the gold referendum. It has the potential to destroy the Swiss franc and the Swiss business model that is based on immigration of highly-qualified personnel.

The gold initiative, however, represents only an income switch inside Switzerland. Namely from Swiss exporters and banks (that profit on the already relatively weak franc) to Swiss households, wage earners and low incomes. In particular, the latter groups would see their purchasing power increase when CHF appreciates. The Swiss seem to understand perfectly. According to the detailed results of the poll, low income groups are rather in favor of the initiative, while high income earners are against it. In particular, the household income groups under 5000 francs are in favor of the gold initiative.

Switzerland imports a large part of its food and basic necessities from its neighbours, the German discounters Aldi and Lidl have a strong presence in Switzerland. A 10% stronger franc would imply far lower living costs for the low income groups. Low income groups are also particularly hit hard by the Swiss real estate bubble and rising rents, as rents now account for a higher part of their consumption basket.

On the other side, entrepreneurs and high wage earners would have losses on Swiss stocks, as the SNB would no longer be able to manipulate the FX rate. Logically, the latter group is against the gold initiative.

Overview of voting intentions by income group (Poll October 27)

The financial press (see Reuters above) emphasizes that discussions around the two initiatives have not really started yet and that often initially undecided or uninformed people vote according to the mainstream. The mainstream, the Swiss government and parliament, is against both Ecopop and the gold initiative.

This time, however, things may be different. Often low-income earners are less interested in politics and may rather belong to the currently still undecided voters.

Background:

Older Polls: October 27 and October 15.

In favor of a no: SNB chairman Jordan, his speech in PDF format.

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

The full details, Swiss Franc History: the SNB sells a big part of the Swiss gold reserves at cheap prices.

Latest Referendum in February 2014: Swiss Yes to Referendum Against Mass Immigration is a Yes to Higher Salaries and Higher Inflation

Already in the year 2000, Swiss television SRF anticipated the high gold demand by China and India. Video in German.

Are you the author? Previous post See more for Next post

Tags: Swiss gold