Tag Archive: stocks

Weekly Market Pulse – Real Rates Finally Make A Move

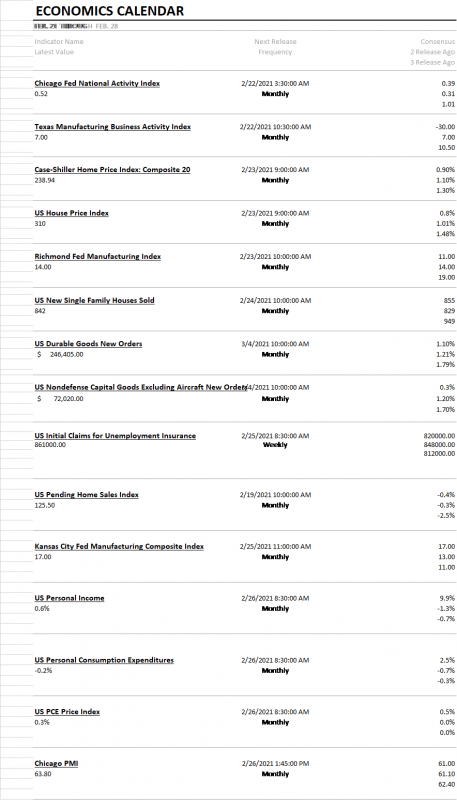

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac.

Read More »

Read More »

Tesla Isn’t A Car Company

We have the luxury, the honor, of speaking to a lot of individual investors here at Alhambra. Whether they are clients or future clients (optimism is my default condition), the most common view of stocks is that they are overvalued and a fall – a large fall – is inevitable. And there is no stock that embodies that view more than Elon Musk’s Tesla Incorporated. It was once known as Tesla Motors but Musk changed the name in early 2017. There may...

Read More »

Read More »

Meanwhile, Outside Today’s DC

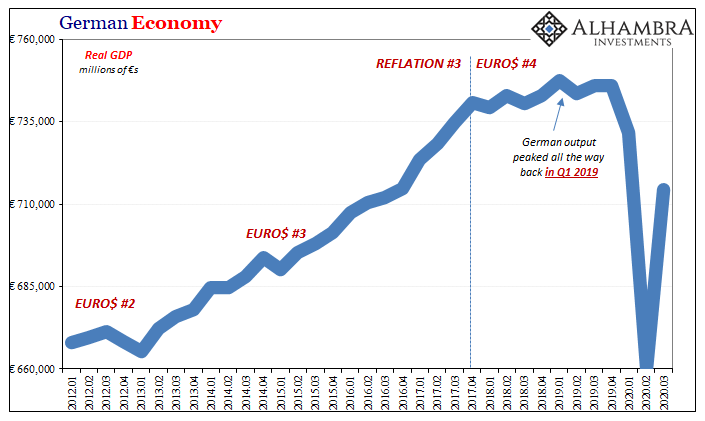

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

What’s Going On, And Why Late August?

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

Read More »

Read More »

Monthly Macro Monitor – September (VIDEO)

Alhambra CEO Joe Calhoun and Alhambra's Bob Williams look at data from the past month and discuss what it means for the economy.

Read More »

Read More »

Monthly Macro Monitor – September 2020

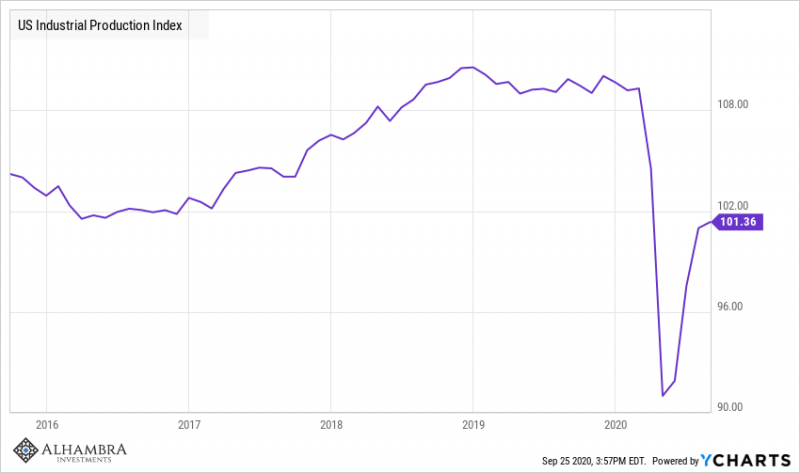

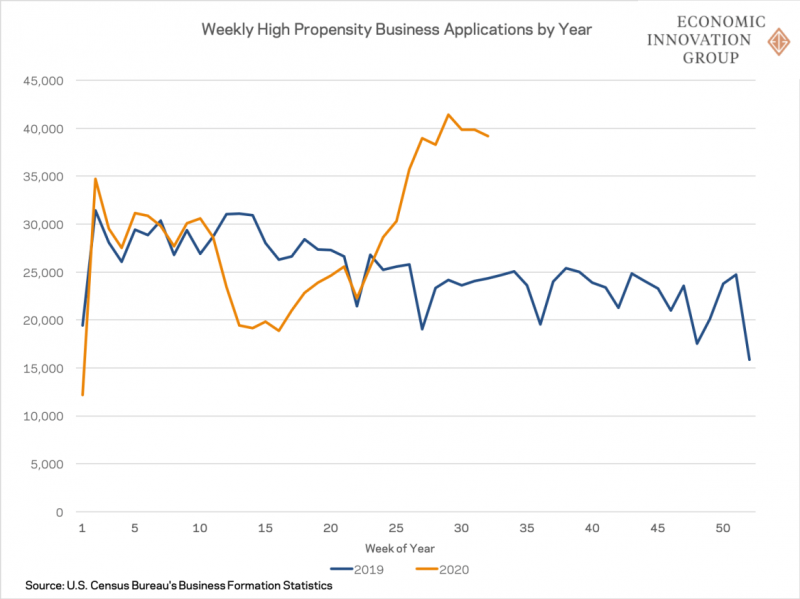

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end.

Read More »

Read More »

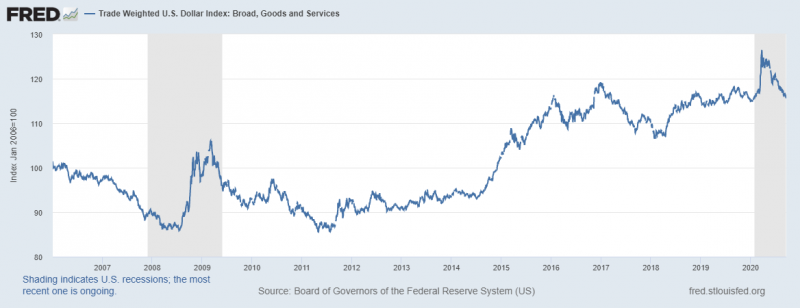

Uh Oh, The Dollar Has Caught A Bid

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008.

Read More »

Read More »

Monthly Market Monitor – August 2020

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again.

Read More »

Read More »

Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE———

AlhambraTube: https://bit.ly/2Xp3roy

Apple: https://apple.co/3czMcWN

iHeart: https://ihr.fm/31jq7cI

Castro: https://bit.ly/30DMYza

TuneIn: http://tun.in/pjT2Z

Google: https://bit.ly/3e2Z48M

Spotify: https://spoti.fi/3arP8mY

Castbox: https://bit.ly/3fJR5xQ

Breaker: https://bit.ly/2CpHAFO

Podbean: https://bit.ly/2QpaDgh

Stitcher: https://bit.ly/2C1M1GB

Overcast: https://bit.ly/2YyDsLa

SoundCloud: https://bit.ly/3l0yFfK...

Read More »

Read More »

Monthly Macro Monitor – August 2020

One of the advantages we enjoy here at Alhambra is the opportunity to interact with a lot of investors. We talk to hundreds of individual investors on a monthly basis, giving us a front-row seat to everyone’s fear and greed. Economic data tells us about the past, which isn’t particularly useful for investors focused on the future.

Read More »

Read More »

Part 2 of June TIC: The Dollar Why

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

Fama 2: No Inflation For Old Central Banks

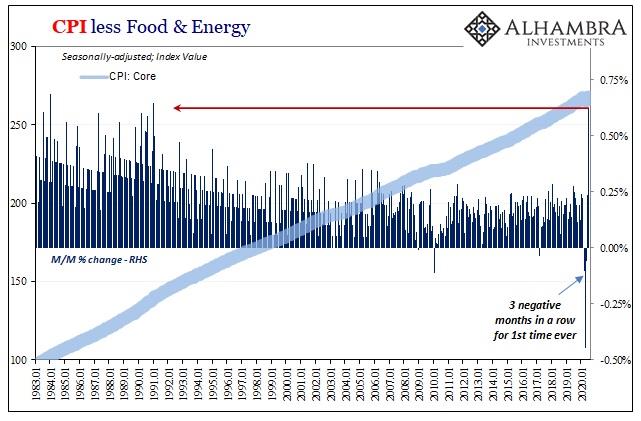

The Bureau of Labor Statistics reported that the core CPI in July 2020 jumped by the most (+0.62%) in almost thirty years. After having dropped month-over-month for three months in a row for the first time in its history, it has posted back to back gains the latest of which pushing the index back above its February level.

Read More »

Read More »

Eugene Fama’s Efficient View of Stimulus Porn

The key word in the whole thing is “bias.” For a very long time, people working in and around the finance industry have sought to gain tremendous advantages. No explanation for the motive is required. Charts, waves, technical (sounding) analysis and so on.

Read More »

Read More »

Monthly Market Monitor – July 2020

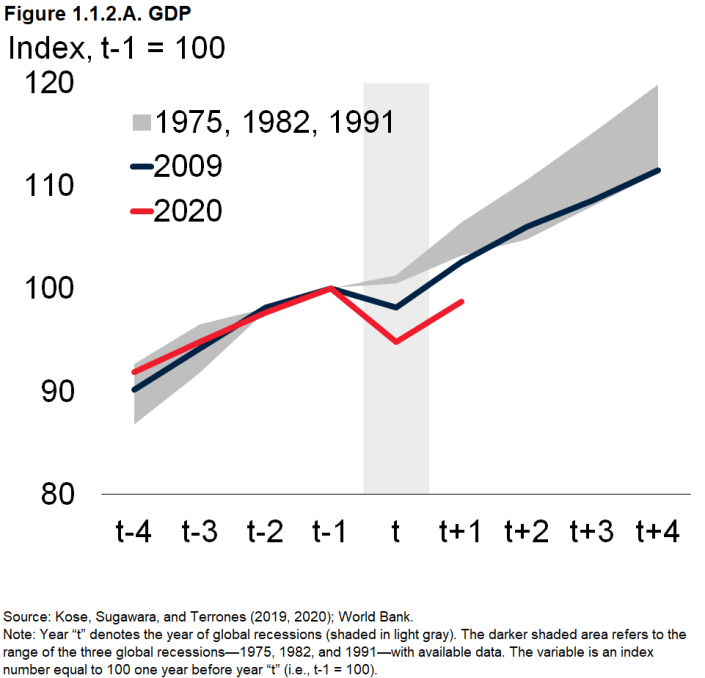

Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime.

Read More »

Read More »

Monthly Macro Monitor – June 2020

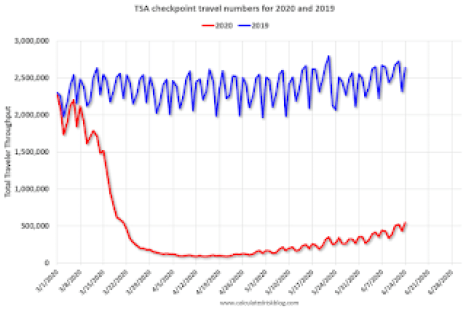

The stock market has recovered most of its losses from the March COVID-19 induced sell-off and the enthusiasm with which stocks are being bought – and sold but mostly bought – could lead one to believe that the crisis is over, that the economy has completely or nearly completely recovered. Unfortunately, other markets do not support that notion nor does the available economic data.

Read More »

Read More »

Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

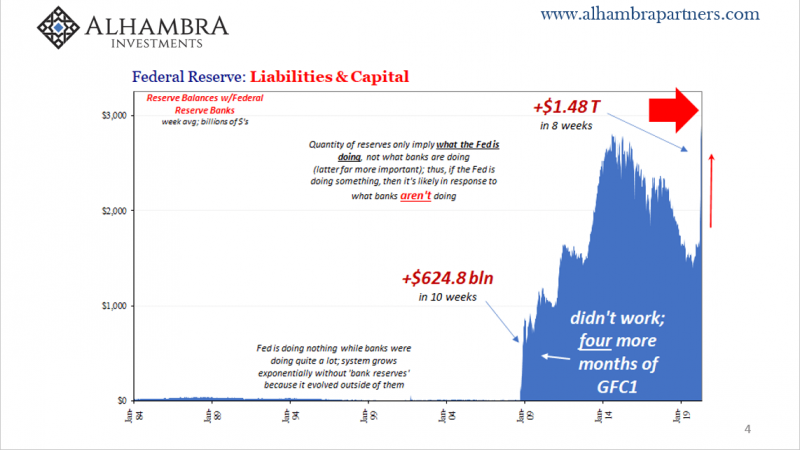

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t).

Read More »

Read More »

We Have Reached The Silly Phase of the Bull Market

Have we entered a new bull market? Was the 35% pullback in the S&P 500 in March the fastest bear market in history? Or is this just a continuation of the bull market that started in 2009, interrupted by a rather large correction? Bull markets and bear markets are about behavior, about the human emotions of fear and greed. While we got a brief bout of fear in March, greed has since overwhelmed all sense, common and otherwise.

Read More »

Read More »

COT Black: No Love For Super-Secret Models

As I’ve said, it is a threefold failure of statistical models. The first being those which showed the economy was in good to great shape at the start of this thing. Widely used and even more widely cited, thanks to Jay Powell and his 2019 rate cuts plus “repo” operations the calculations suggested the system was robust.

Read More »

Read More »