Tag Archive: Speculative Positions

Weekly Speculative Positions (as of August 29): Speculators Make Minor Position Adjustments, but Like that Aussie

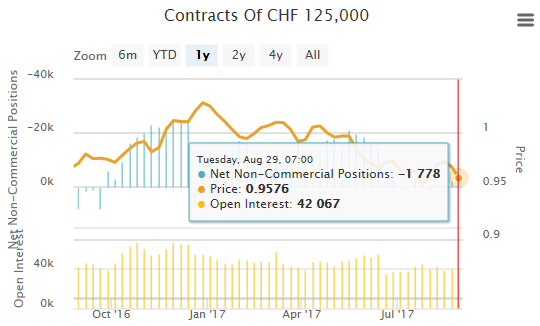

The net speculative CHF position has fallen from 2K short to 1.8K contracts short (against USD). Speculators did not make any significant adjustment to gross positions, which we define as 10k or more contracts in the currency futures, during the CFTC reporting week ending August 29.

Read More »

Read More »

Weekly Speculative Positions (as of August 22): Sterling Bears Press, but Too Much?

The net speculative CHF position has risen from 1.2K short to 2K contracts short (against USD). Speculators continued to amass a significant short sterling position in the futures market. In the CFTC reporting week ending August 22, speculators added 11.7k contracts to the gross short position, lifting it to 107.4k contracts.

Read More »

Read More »

Weekly Speculative Positions (as of August 15): Speculators Add to Sterling and Peso Shorts, While Cutting Euro and Canadian Dollar Longs

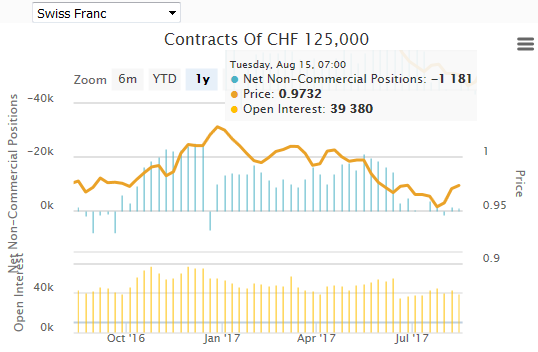

The net speculative CHF position has fallen from -1.4K short to -1.2K contracts short (against USD). Speculators made several significant position adjustment in the CFTC reporting week ending August 15, that included an escalation of aggressive rhetoric by the US and North Korea.

Read More »

Read More »

Weekly Speculative Positions (as of August 01): Speculators Press Ahead with Dollar-Bloc Currencies, but Hesitate with Euro and Yen

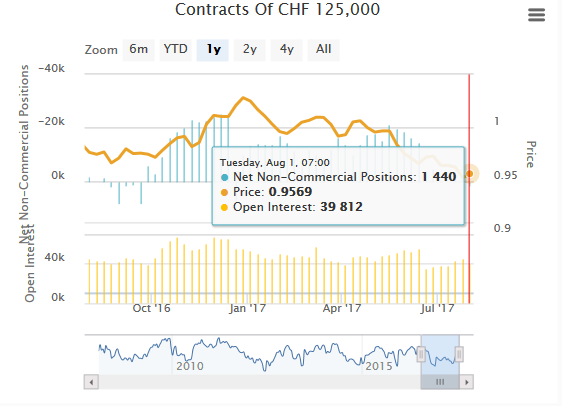

The net speculative CHF position has risen from -1.5K short to 1.4K contracts long (against USD). In the CFTC reporting week ending August 1, speculators in the futures market continued to build long exposure in the dollar-bloc currencies. In the three sessions after the reporting period closed, the dollar-bloc currencies have traded heavily.

Read More »

Read More »

Weekly Speculative Positions (as of July 25): Speculators Continue to Pour into Australian and Canadian Dollar Futures

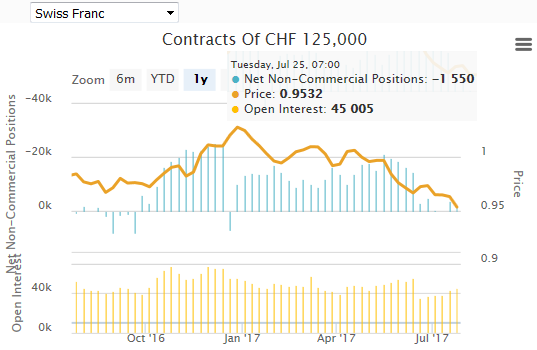

The net speculative CHF position has risen from -3.7K short to -1.5K contracts short (against USD). Speculators were active in the currency futures in the CFTC reporting week ending July 25. In particular, speculative sentiment continues to be drawn to the Canadian and Australian dollars.

Read More »

Read More »

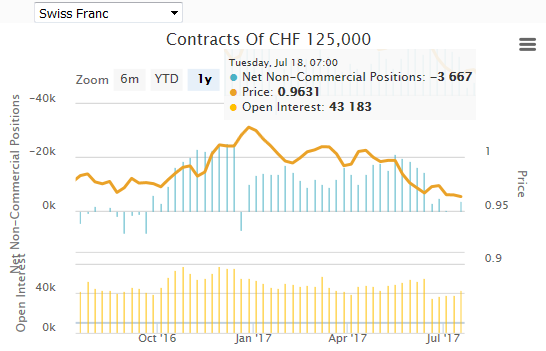

Weekly Speculative Positions (as of July 18): Speculators short CHF against USD again

The net speculative CHF position has changed from -0.2K long to 3.7K contracts short (against USD). Since the beginning of May the Canadian dollar has been the strongest of the major currencies. However, until the most recent CFTC reporting week ending July 18, speculators in the futures market were net short.

Read More »

Read More »

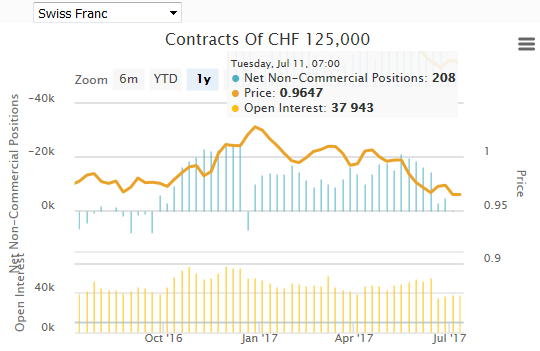

Weekly Speculative Positions (as of July 11): Speculators Switch to CHF Long against USD

The net long CHF position has risen from 0.1K short to 0.2K contracts short (against USD). Speculators are long EUR against both USD and CHF. We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward.

Read More »

Read More »

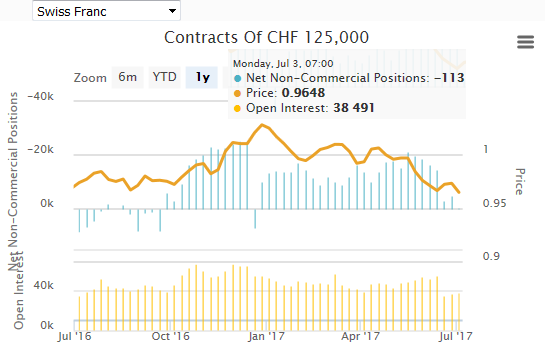

Weekly Speculative Positions (as of July 04): Speculators Still Dollar Negative

The net short CHF position has fallen from 4.7k short to 0.1k contracts short (against USD). Speculators in the futures market made several significant position adjustments in the CFTC reporting week ending July 4, despite it being a holiday-shortened week.

Read More »

Read More »

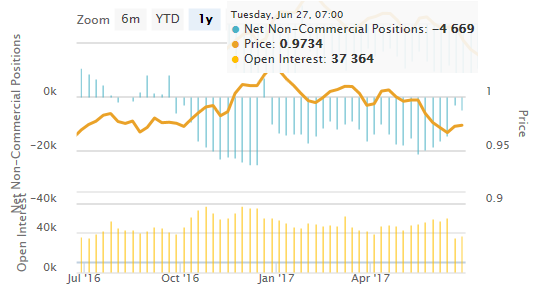

Weekly Speculative Positions (as of June 27): Speculators Scramble to Cover Short Canadian Dollar and Mexican Peso Futures

The net short CHF position has risen from 3k short to 4.7k contracts short (against USD). Speculators bought back previously sold Canadian dollar and Mexican peso futures positions in dramatic fashion in the CFTC reporting week ending June 27.

Read More »

Read More »

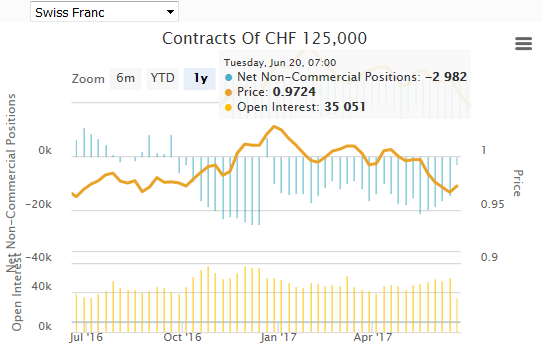

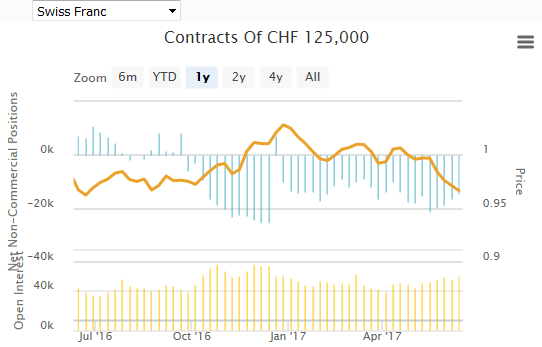

Weekly Speculative Positions (as of June 20): Surge in Positioning amid Currency Contract Roll

The net short CHF position has fallen from 14.5 short to 3K contracts short (against USD). The expiration of the June contracts and the roll into September positions appears to have boosted activity in the currency futures, and may obscure the signaling effect. Of the 16 gross positions we track, speculators add to exposure in all but four positions. There speculators covered gross short Swiss franc, Canadian, Australian, and New Zealand dollar...

Read More »

Read More »

Weekly Speculative Positions (as of June 13): Specs Cut Euro, Yen, and Aussie Exposure and Do Little Else

The net short CHF position has fallen from 16.5 short to 14.5K contracts short (against USD). We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward.

Read More »

Read More »

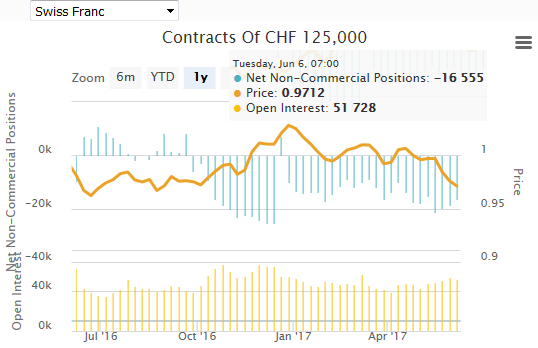

Weekly Speculative Positions (as of June 06): Speculators Trimmed Exposure Ahead of Super Thursday

The net short CHF position has fallen from 18.5 short to 16.5K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the CFTC reporting week that covered the US employment data and the run-up to Super Thursday that featured an ECB meeting, former FBI Director Comey's testimony before the Senate Intelligence...

Read More »

Read More »

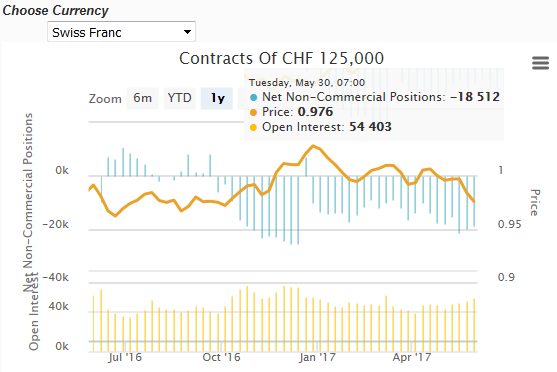

Weekly Speculative Positions (as of May 30): Speculators make Small Adjustments, but Like that Peso

The net short CHF position has fallen from 19.8 short to 18.5K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. Speculators in the future market made mostly minor adjustment in the gross positioning in the currencies.

Read More »

Read More »

Weekly Speculative Positions (as of May 23): Speculators Remain Bearish the Dollar and Bullish Bonds

The net short CHF position has fallen from 21.1 short to 19.8K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the CFTC reporting week ending May 23 speculators in the futures market continued to largely position themselves for further dollar weakness.

Read More »

Read More »

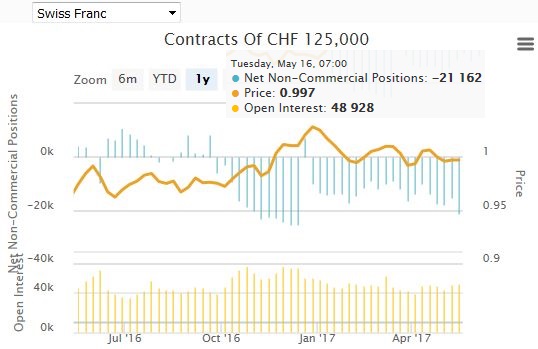

Weekly Speculative Positions (as of May 16): Yen and Aussie Bears Push Forward, while Sterling Bears Continue to Run for Cover

The net short CHF position has risen from 15.2 short to 21.1K contracts short (against USD). But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF. In the Commitment of Traders reporting week ending May 16, speculators in the futures market made three significant adjustments in the currency futures.

Read More »

Read More »

Weekly Speculative Positions (as of May 09): Significant Position Adjustment in the Currency Futures

The net short CHF position has fallen from 17.7 short to 15,2K contracts short (against USD).

But the major movement was that speculators are net long the euro now and not the dollar any more. This implies that they are also long Euro against CHF.

Read More »

Read More »

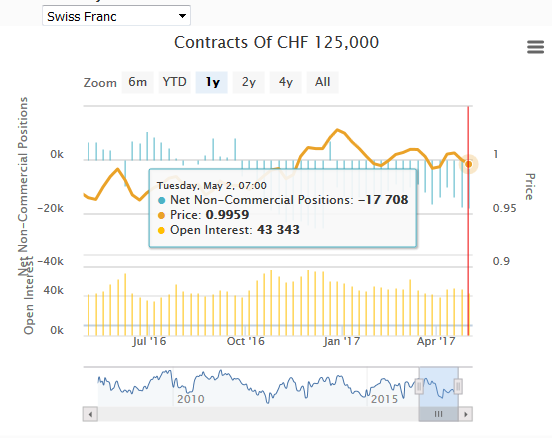

Weekly Speculative Positions (as of May 02): Euro Shorts Covered, Yen Longs Liquidated

The net short CHF position has risen to 17K contracts (against USD). It was feast or famine in the adjustment of speculative positions in the currency futures market during the CFTC reporting period ending May 2. Speculators either made large adjustments or very small adjustments, and little in between.

Read More »

Read More »

Weekly Speculative Positions (as of April 25): Bulls Take Charge of 10-year Note Futures, while Sterling Bears Hang On

The net short CHF position has risen to 17K contracts (against USD). The striking development among speculators in the futures market is the reversal of the record gross (and net) short Treasury note position two months ago.

Read More »

Read More »

Weekly Speculative Positions (as April 18): CHF Position Stands at same Level

The net short CHF position stands at 13K contracts (against USD). In the CFTC reporting period ending April 21, speculators to significant positions in the euro, sterling and the Mexican peso. Bulls and bears were took more exposure in the euro and sterling, while in the peso the former added on while later sought cover.

Read More »

Read More »

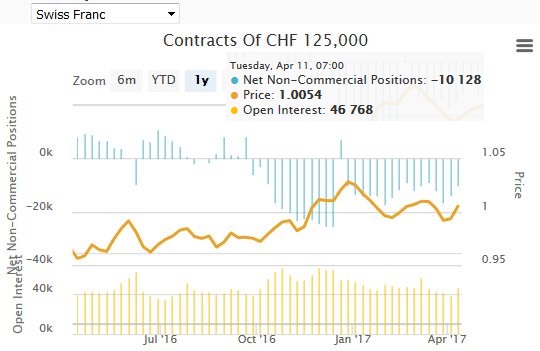

Weekly Speculative Positions (as of April 11): Adding To Foreign Currency Exposure Before Trump’s Talk

The net short CHF position has fallen to 10K contracts (against USD). In the days before US President Trump expressed concern about the dollar's exchange value, speculators in the futures market mostly added to the gross long foreign currency positions.

Read More »

Read More »