Tag Archive: Swiss National Bank

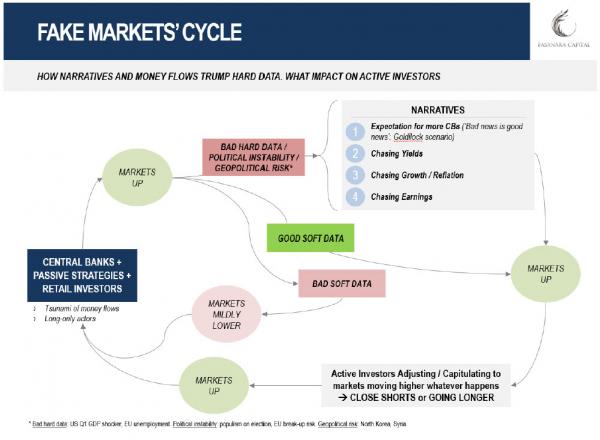

When Do We Know These Are Delusional Markets

Signs of complacency and disconnect from fundamentals abound. So to sanity check, it may still be helpful to periodically remind ourselves of a few recent ones. In no particular order. The Swiss National Bank bought $ 100bn between US and European stocks. It now owns 26 million Microsoft shares (read).

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

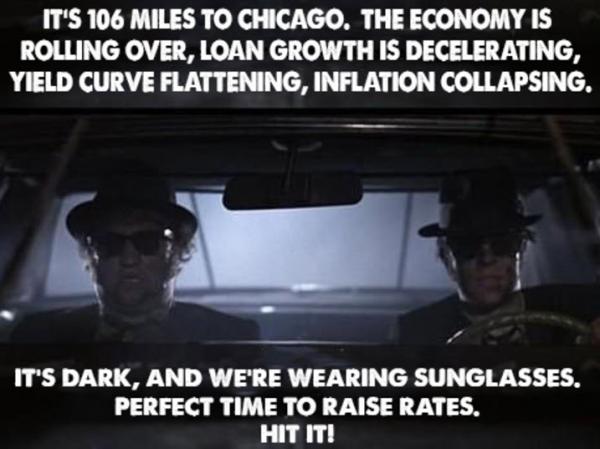

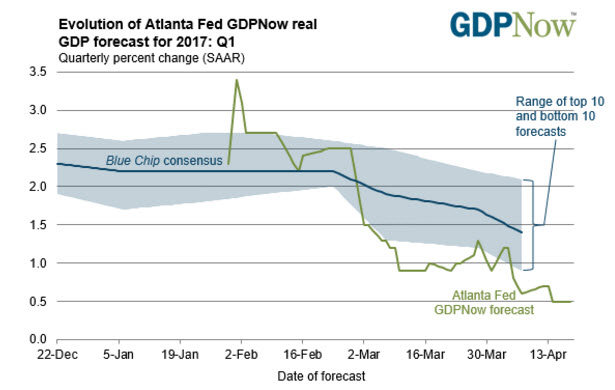

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »

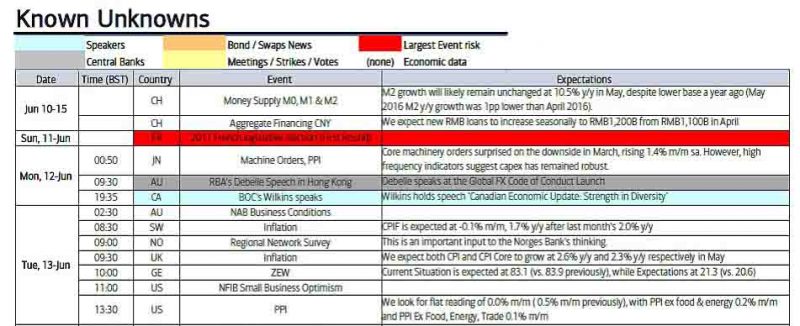

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

The SNB’s Currency Interventions

On the FT’s Alphaville blog, Matthew Klein reviews Swiss monetary policy over the last years and its effect on the real economy. He concludes that - it seems the SNB’s relentless accumulation of foreign assets has been pointless — at best. More likely, the behaviour qualifies as predatory mercantilism at the expense of the rest of the world, especially Switzerland’s hard-hit neighbours.

Read More »

Read More »

Remembering A Still Falling Hero: Small Business

On this holiday weekend known here in the U.S. as Memorial Day, I would like to make a slight turn in the narrative that many give little to no attention too, yet, is one of the most important underlying principles or fundamentals which helped shape, lift, mold, sustain, and create one of the world’s greatest economic powerhouses bar none.

Read More »

Read More »

New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

Read More »

Read More »

SocGen: Beware The Ghost Of 1993

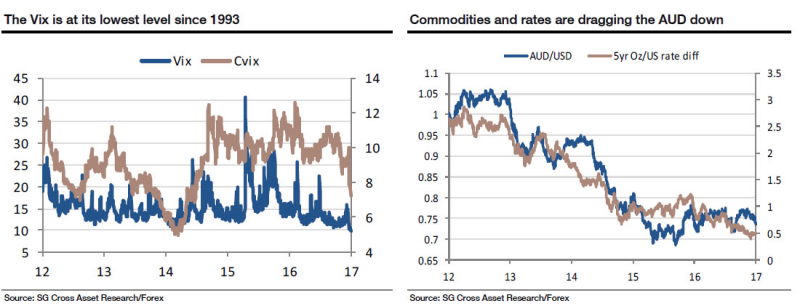

With Monday's financial media blasting reports about the VIX collapse to levels not seen in 24 years, going all the way back to 1993, it is worth remembering that the near record low volatility collapse of 1993 did not end well either for stocks, or for bonds, with the great 1994 bond tantrum. Reminding us of that, and of broader implications for the cross-asset space, is SocGen's Kit Juckes with his overnight note, "The ghost of 1993"

Read More »

Read More »

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

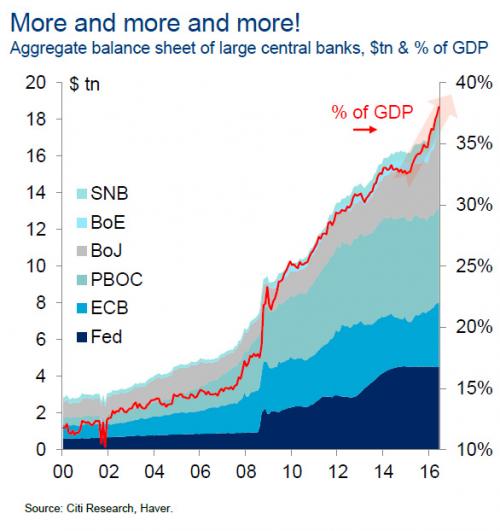

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »

“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a "mystery" central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank's interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the "the BoJ comes in big, the...

Read More »

Read More »

Digital Swiss Francs

The Swiss National Bank held its annual general meeting of shareholders (web TV). In response to one of the questions posed by shareholders Thomas Jordan suggested (2:58–2:59) that possibly a digital Swiss Franc might be introduced sometime in the future.

Read More »

Read More »

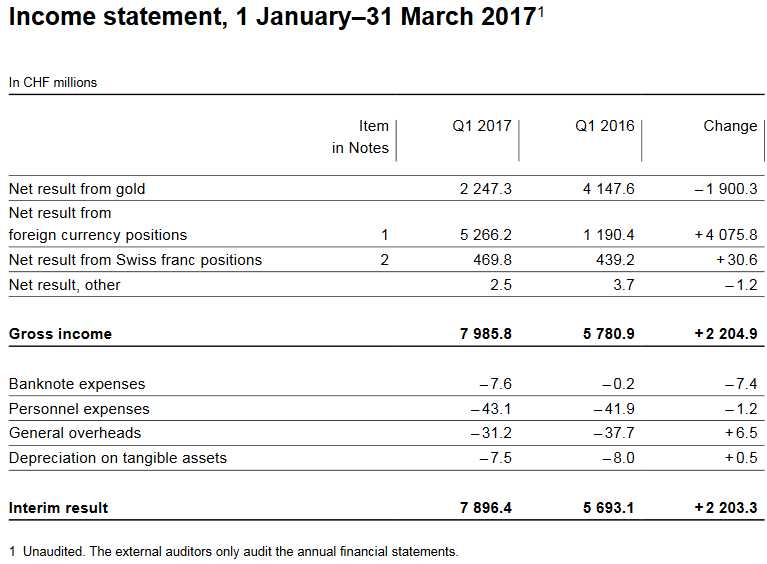

SNB posts 7.9 billion CHF Profit in Q1

The SNB reports a profit of 7.9 bn CHF, of which 2.2 bn come from the gold holdings. Given that the bank has introduced a "minimum euro rate" around 1.06-1.07, this is not very difficult. It comes at the price of continuing interventions.

Read More »

Read More »

Where There’s Smoke…

Central banks around the world have colluded, if not conspired, to elevate and prop up financial asset prices. Here we'll present the data and evidence that they've not only done so, but gone too far. When we discuss elevated financial asset prices we really are talking about everything; we're talking not just about the sky-high prices of stocks and bonds, but also of the trillions of dollars’ worth of derivatives that are linked to them, as well...

Read More »

Read More »

Switzerland at IMF and World Bank 2017 Spring Meetings in Washington, D.C.

Federal Councillor Ueli Maurer as Head of the Swiss delegation, Federal Councillor Johann N. Schneider-Ammann and Thomas Jordan, Chairman of the Governing Board of the Swiss National Bank, will take part in the joint Spring Meetings of the International Monetary Fund (IMF) and the World Bank Group in Washington, D.C., from 21 to 23 April 2017. Prior to these meetings, Federal Councillor Ueli Maurer will represent Switzerland at the meeting of G20...

Read More »

Read More »

Swiss Franc Exchange Rate Index

The Swiss National Bank has updated its exchange rate indices. In an SNB Economic Studies paper, Robert Müller describes how. The upshot is that the SNB considers the Swiss Franc slightly less overvalued than before.

Read More »

Read More »