Tag Archive: Swiss National Bank

“Die Schattenseiten von Schuldenbremsen (The Dark Side of Debt Limits),” ifoSD, 2021

Was Schuldengrenzen aus politökonomischer Sicht besonders attraktiv erscheinen lässt – ihre vermeintliche Einfachheit und Klarheit – birgt also auch Risiken. Es führt dazu, dass Politiker und ihre Wähler die Solidität der Staatsfinanzen über Gebühr an expliziten Bruttoschulden messen.

Read More »

Read More »

“Dirk Niepelt im swissinfo.ch-Gespräch (Interview with Dirk Niepelt),” swissinfo, 2020

Swissinfo, December 14, 2020. HTML, podcast.

We talk about CBDC, the Swiss National Bank, whether CBDC would render it easier to implement helicopter drops, and how central bank profits should be distributed.

Read More »

Read More »

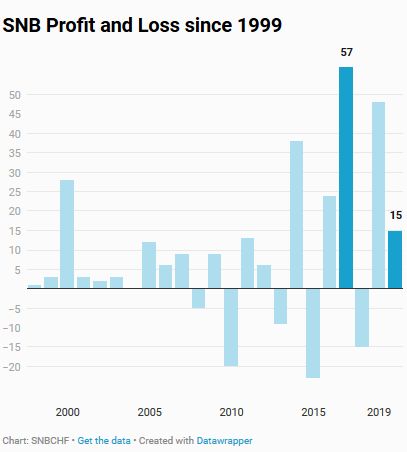

SNB Profit in Q1 to Q3 2020: CHF 15.1 billion Despite Covid19

The Swiss National Bank reports a profit of CHF 15.1 billion for the first three quarters of 2020. We explain why these profits are possible.

Read More »

Read More »

Fed and ECB Money Printing Helps SNB Back into Positive Territory

Fed and ECB money printing and massive fiscal stimulus help the SNB to come back into positive territory for the year.

The renewed asset price inflation compensate for losses on the US dollar.

Read More »

Read More »

“Unabhängigkeit der Nationalbank (Independence of the SNB),” FuW, 2020

Von verschiedenen Seiten werden Ansprüche an den Gewinn der Nationalbank gestellt. Es sollte in der Kompetenz der SNB liegen, zu entscheiden, welchen Teil ihrer Bilanz sie nicht zur Erfüllung ihrer Aufgaben benötigt.

Read More »

Read More »

“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence.

Read More »

Read More »

Willkommen in einer Zukunft ohne Zins

Die SNB, die EZB und andere Zentralbanken erwarten auch langfristig keine Zinswende – und machen Nullzinsen zur Regel. Eine Übersicht der Prognosen. Diese Woche ist die Welt einer Zukunft ohne positive Zinssätze ein Stückchen näher gerückt. Schwedens Notenbank erneuerte ihren Zinspfad.

Read More »

Read More »

“Wenn die Notenbank den Staat finanziert (When the Central Bank Finances the State),” FAS, 2020

Monetary deficit financing is the norm—after all, central banks distribute their profits. Monetary financing occurs in the context of regular open market operations and QE and, hyper charged, with helicopter drops. The question is not whether monetary policy should finance the government, but why it does so, and to what extent. Fiscal and monetary policy are inherently connected; what constitutes monetary policy is defined by objectives.

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

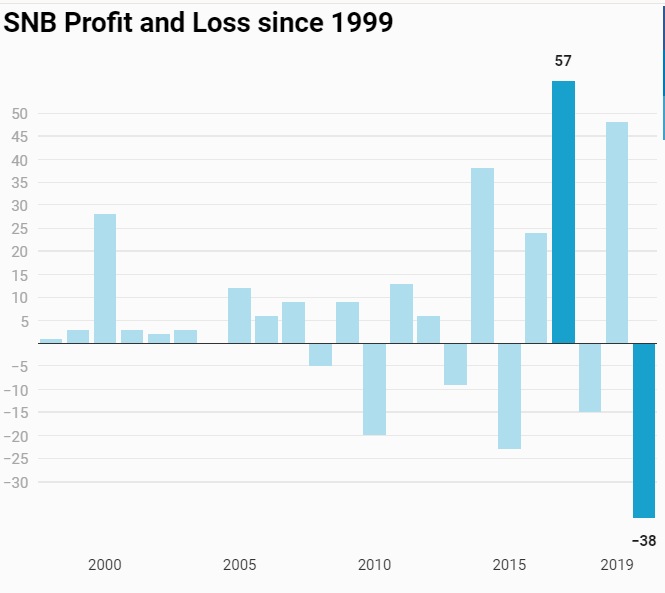

SNB Interim Results: -38 Billion, An Analysis

The Swiss National Bank reports a loss of CHF 38.2 billion for the first quarter of 2020. The loss on foreign currency positions amounted to CHF 41.2 billion.

Read More »

Read More »

Switzerland Peps Up SMEs

How Switzerland peps up SMEs: Banks are encouraged to extend credit (at 0%). The treasury guarantees the loans. The SNB refinances banks and accepts the guaranteed loans as collateral. Fast and efficient. Eventually, some of these loans will turn into grants of course. But that’s ok; the first-best response to a shock with asymmetric effects does involve transfers if markets are incomplete.

Read More »

Read More »

FX Daily, March 10: Markets Stabilize after Body Blow

Overview: It appears after a few days of miscues, US officials struck the right chord, and the global capital markets seemed to stabilize shortly after the US session ended. President Trump's press conference today is expected to spell out in greater detail relief for households and businesses. Asia Pacific equities rallied, led by a 3% surge in Australia.

Read More »

Read More »

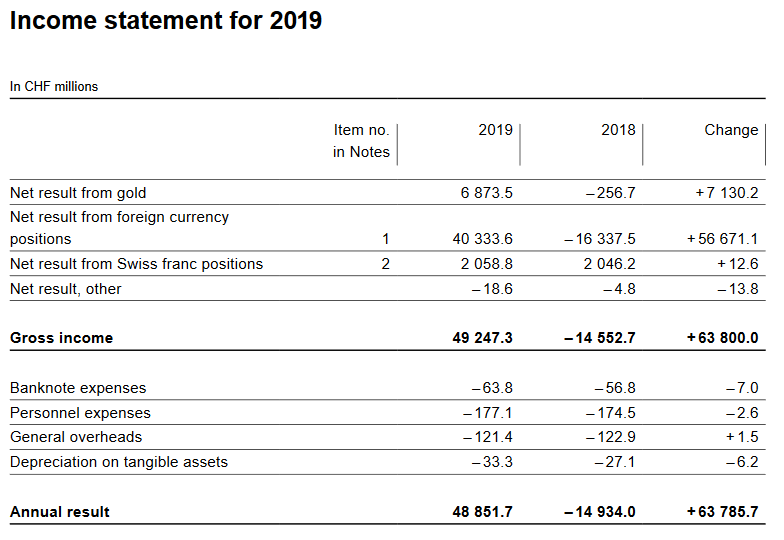

Swiss National Bank to distribute 4 billion francs of profit

In 2019, the Swiss National Bank (SNB) made a profit of around CHF 49 billion. These profits came mainly from the rising value of the assets on the bank’s balance sheet. In 2019, the value of its holdings of foreign currency and gold rose substantially. When combined with interest, dividend income and gains on shares total profits for the year were CHF 49 billion.

Read More »

Read More »

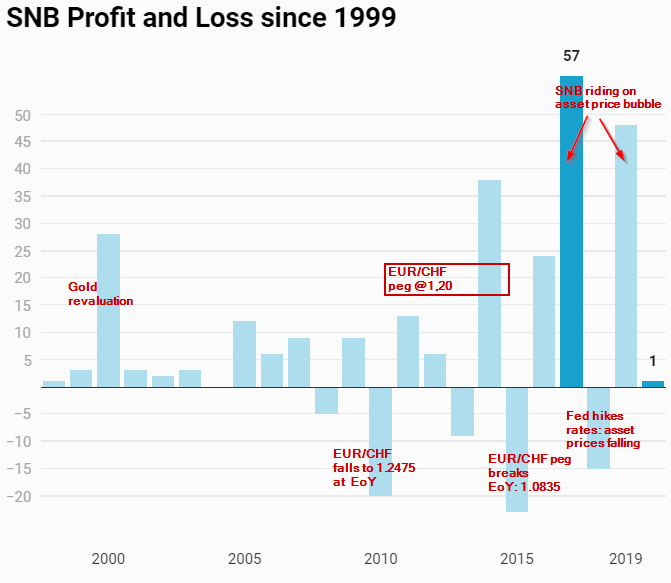

SNB Profit in 2019: 48.9 billion (2018: loss of CHF 14.9 billion, 2020 Does not Look Good)

The increasing volatility of SNB Earnings Annual results are not really definite. Given that the SNB accumulates foreign currencies with interventions, they have huge swings. But the SNB may lose 50 billion in one year and win 60 billion in the next year or vice verse. Good years of the Credit Cycle This trend was … Continue reading »

Read More »

Read More »

Ein rationaler Erklärungsansatz für negative Zinsen

In einem Beitrag auf LinkedIn am 29. Dezember 2019 wirft Prof. Erwin Heri von der Universität Basel in die Runde, dass negative (Real-)Zinsen möglicherweise vernünftig sind. Sie wären das natürliche Ergebnis der Präferenzen der Wirtschaftssubjekte – und nicht primär das Ergebnis einer Manipulation von Zentralbanken.

Read More »

Read More »

Is the SNB In Control of the Amount of Sight Deposits?

The current monetary environment in Switzerland is as far from ordinary as can be imagined: negative interest rates (from -0.75% in the short term to -0.25% for 50Y govt bonds) and oceans of liquidity (M0 has grown to 50% of M3 from pre-crises levels of around 8%).

Read More »

Read More »

Sollen Zentralbanken Klimapolitik betreiben?

Warum die Forderung nach einer klimafreundlichen Anlagepolitik schwierig bis gar nicht umzusetzen ist. Aufgrund ihrer extrem expansiven Geldpolitik sind sowohl die EZB als auch andere wichtige europäische Zentralbanken wie die SNB zu Grossinvestoren auf Anleihenmärkten und teilweise auch an Börsen geworden.

Read More »

Read More »

Central Banks Zoom In on CBDC

According to a BIS press release, several leading central banks collaborate with the BIS on matters relating to the introduction of CBDC: The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency...

Read More »

Read More »

Swiss National Bank expects annual profit of 49 billion francs

According to provisional calculations, the Swiss National Bank (SNB) expects to make a profit of around CHF 49 billion in 2019. Most of this comes from the rising value of the SNB’s foreign currency positions (+CHF 40 billion) and a valuation gain on gold holdings (+CHF 6.9 billion).

Read More »

Read More »

Negativzinsen, unser notwendiges Übel

Warum die Schweizer Negativzinspolitik trotz aller leidigen Nebenwirkungen bis auf weiteres unumgänglich ist. Negativzinsen in der Schweiz sind ein Sonderfall. Denn die Schweiz hat keine Negativzinsen, um das Wirtschaftswachstum anzukurbeln oder um bedrohte Schuldner vor dem Zusammenbruch zu retten. Die Negativzinsen hierzulande haben nur einen einzigen Grund: Ein weiteres Erstarken des Schweizer Frankens soll verhindert werden.

Read More »

Read More »