Tag Archive: Swiss National Bank

SNB meeting on March 15th, 2012: Pure Speculation that SNB raises floor, How to Trade it ?

Between November 2011 and January 2012 mostly left-wing politicians and trade unions wanted the EUR/CHF floor to be risen to 1.30 or 1.40 and uttered their wishes regularly in the Swiss newspapers, triggering many FX traders to speculate on this hike. Recently these demands have become more silent even if some UBS analysts still see the floor to …

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

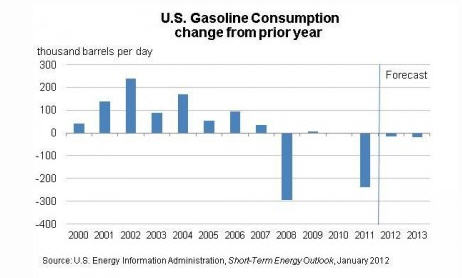

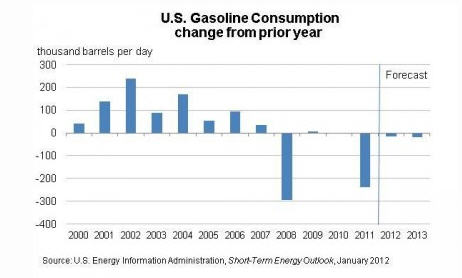

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »

Keynesians vs. Anti-Keynesians: How price deflation has kick started the US growth

In recent posts Keynesians were criticized that hikes in the monetary base like Quantitative Easing (QE2) failed to lift the US economy, but it was the debt ceiling that helped to restore confidence in the US and that austerity can lead to GDP growth. Paul Krugman angrily replied that “even a huge rise in the …

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: February 2012

EUR/CHF Busy Doing Jack; Jordan Gobbing Off Later EUR/CHF sits at 1.2048, some 7 pips easier from when I started out. Barrier option interest sits at 1.2025 and ofcourse 1.2000. SNB interim head honcho Jordan speaks later this evening (18:30 GMT) in Zurich. Might be giving instructions on how to make his favourite alpine muesli … Continue reading...

Read More »

Read More »

The new European Save-Havens: Trade SEK/CHF and NOK/CHF

After the announcement of the floor in the EUR/CHF pair, many predicted the Swedish and the Norwegian Krone to take the place of the Swiss Franc as European save-haven against the Euro turmoil (http://on.ft.com/pKSJ1V). Both countries possess a low level of debt, positive trade balance and very competitive economies.

Read More »

Read More »

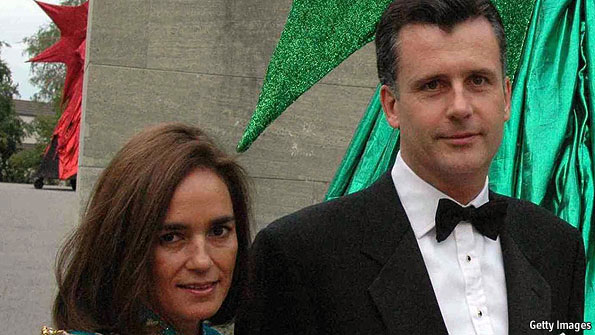

A Swiss central-banking scandal: Called to account

IT IS starting to look like a sustained attack. On January 4th an article in Die Weltwoche, a Swiss weekly magazine, accused Philipp Hildebrand, president of the Swiss National Bank (SNB), of personal currency speculation while the SNB was intervening to stabilise the Swiss franc/US dollar rate.

Read More »

Read More »

EUR/CHF, Market betting on Floor Hike, December 2011

Four Trades For 2012: #2 Sell The Swiss Franc I bought EUR/CHF shortly after the 1.20 peg was introduced and have held it ever since. My only regret has not been trading the range more aggressively. At this point everyone has an opinion of the SNB so I won’t try to convince the bears. Personally, … Continue reading »

Read More »

Read More »

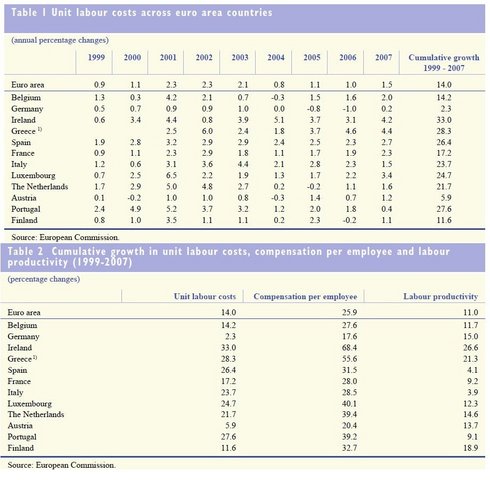

Jürgen Stark’s resignation and the ECB 2005 warning about labor cost divergence in the Euro-zone

The Wirtschaftswoche reports about the real reasons of ECB Chief economist Jürgen Stark’s resignation. The reasons are rather political, namely a protest against European governments:

Read More »

Read More »

SNB: Lift EUR/CHF floor or not ?

Many participants in the FX markets seem to be sure that the SNB will lift the EUR/CHF flow to 1.25 Here the pros and the cons:

Read More »

Read More »

Expectations: Jedi monetary policy

On Tuesday, the Swiss National Bank (SNB) adopted a bold policy of pledging to sell Swiss Francs in an unlimited amount to ensure that the exchange rate viz-a-viz the euro is at least 1.2 Swiss Francs per euro. The exchange rate promptly jumped over 8 percent to a bit more than 1.2 Swiss Francs per euro. The SNB can clearly weaken its currency in this way, so long as its commitment is unwavering.

Read More »

Read More »

Exchange-rate targets: Francly wrong

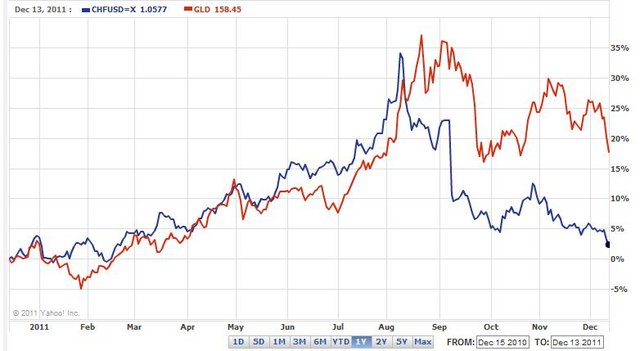

WHEN the going gets tough, the tough buy Swiss francs. That was true in the 1970s, when the Swiss were forced to impose negative interest rates on foreign depositors. And it has been true in recent years, with Switzerland's currency rising by 43% against the euro between the start of 2010 and mid-August this year.

Read More »

Read More »

Currency interventions: Francs for nothing

CENTRAL banks have historically been regarded as the guardians of a currency's value, but occasionally they want to drive their exchange rates down. Rarely have they acted as aggressively as the Swiss National Bank (SNB) did on September 6th.

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): May 2011

May 2011 ForexLive Asian Market Open: Analysis With Fries Just brilliant Jamie Australian GDP this morning and the market is now gearing itself for a poor number after yesterday’s data and weekend comments from the Treasurer. China is selling rallies in AUD/USD and Middle East Sovereigns are buying big dips; sounds like a recipe for medium … Continue reading »

Read More »

Read More »

Swiss Franc at record highs (May 2011)

May. 27th 2011 Extracts from the history of the Swiss franc (May 2011) This month, the Swiss Franc touched a record high against not one, but two currencies: the US dollar and the Euro. Having risen by more than 30% against the former and 20% against the latter, the franc might just be the world’s … Continue reading »

Read More »

Read More »

Has the Swiss Franc Reached its Limit? (February 2011)

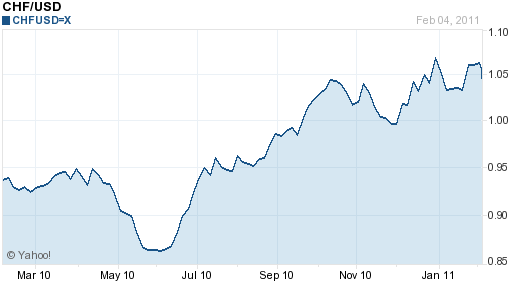

Feb. 6th 2011 Extracts from the history of the Swiss franc (February 2011) The second half of 2010 witnessed a 20% rise in the Swiss Franc (against the US Dollar), which experienced an upswing more closely associated with equities than with currencies. It has managed to entrench itself well above parity with the Dollar, and …

Read More »

Read More »