IT IS starting to look like a sustained attack. On January 4th an article in Die Weltwoche, a Swiss weekly magazine, accused Philipp Hildebrand, president of the Swiss National Bank (SNB), of personal currency speculation while the SNB was intervening to stabilise the Swiss franc/US dollar rate. That reignited a controversy that seemed to have died down after the SNB’s own pre-Christmas investigations—conducted by PwC, an accountancy firm—exonerated Mr Hildebrand of any infringement of the bank’s rules on personal-account dealing. That report was hurriedly published by the SNB on January 4th, along with the central bank’s code of ethics.

The controversy began in December when the Swiss Federal Council reportedly confronted Mr Hildebrand with allegations of suspicious trading, which had been brought to them by Christoph Blocher, a right-wing politician. Mr Hildebrand immediately told the SNB board, and an investigation started.

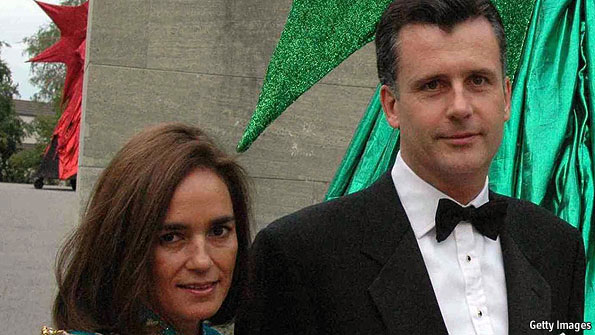

The allegations centre on a currency trade made in August that switched SwFr400,000 ($512,000) into dollars just two days before the SNB started intervening to weaken the franc and three weeks before the bank imposed a ceiling on the currency’s value. The trade was reversed in October at a 16% better rate against the franc. The PwC report says this trade was “awkward” but did notinfringe the central bank’s own guidelines. The report says the August trade was made by Mr Hildebrand’s wife, Kashya. When Mr Hildebrand learned of it a day later he reported it to the SNB’s head of compliance and instructed Bank Sarasin, his private bank, that in future only he would handle foreign-exchange trades. That seemed to let him off the hook.

But Die Weltwoche, which is identified with Mr Blocher, says it has evidence that the August trade was done by Mr Hildebrand himself. That, and a TV interview by Mrs Hildebrand, refanned the flames. More light is expected to come from a press conference with Mr Hildebrand later today (see update below).

There are grounds to be sceptical about the attack on Mr Hildebrand. He is a controversial figure, respected by some, annoying to others, for spearheading an attack two years ago against the big Swiss banks and their adventures into investment banking. According to Bank Sarasin, one of its employees, since sacked, leaked the trade information to a lawyer with links to the right-wing Schweizerische Volkspartei (SVP), breaching hallowed Swiss banking secrecy. The lawyer then relayed the information to Mr Blocher. But even if the Hildebrands are victims of a campaign to undermine him, they remain open to the charge of remarkable naivety.

Update: Mr Hildebrand admitted at a press conference on January 5th that he had made mistakes, but not infringed the bank’s code of ethics. He looked uncomfortable when asked why, on learning of his wife’s foreign exchange deal, he had not immediately reversed it. Otherwise he came out of his corner fighting, saying that the bank was resolved to make its code of ethics more transparent. All personal transactions of more than SwFr20,000 should be declared, he said.

Mr Hildebrand also threatened legal action against those who had breached banking secrecy and taken screen shots of his bank transactions. The perpetrator thought he had seen a smoking gun, but gave those details to the wrong people, which he later regretted, Mr Hildebrand said. The “wrong people” would include Mr Blocher who also broke his silence on January 5th, in a television interview. He had heard from various quarters that central bankers were able to do personal foreign exchange deals “and I found it monstrous”. That had prompted him to take the evidence to Micheline Calmy Rey, the Swiss federal president.

Even if no heads roll, the SNB is likely to change its code of ethics. One Swiss private banker is scandalised by the whole affair. According to his own code of ethics “I haven’t bought or sold a security in the past 10 years because I know one day there will be a conflict.” Why not apply that to central bankers and foreign exchange dealing?

Full story here Are you the author? Previous post See more for Next postTags: Philipp Hildebrand,Swiss National Bank