Tag Archive: Swiss National Bank

Merkel: ‘No Eurobonds as Long as I Live’, Hollande: ‘Eurobonds will take up to 10 years’

German chancellor Angela Merkel today confirmed the content of our article that Eurobonds are pure utopia. She vows "No Eurobonds as Long as I Live".

Read More »

Read More »

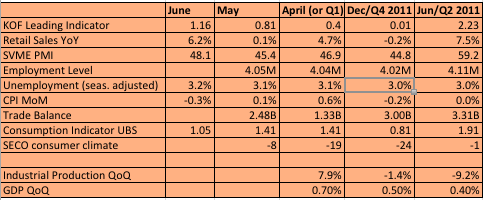

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

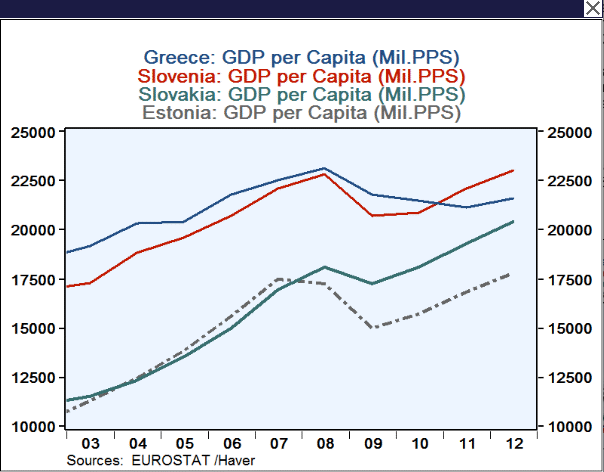

Eurobonds, fiscal union or banking union are all pure utopia

Eurobonds are light years away.Germany wants the following order: 1) Euro Plus Pact 2) Fiscal Compact 3) ESM 4) Political union 5) Fiscal union 6) Eurobonds

Read More »

Read More »

The other risk for the SNB: Will German Bund yields double ?

In the latest post we started discussing the implications of a German euro exit for the Swiss National Bank, this time we will look on another risk: The rising German Bund yields.

Read More »

Read More »

Is the SNB prepared for the black swan ?

Will the SNB printing policy lead to inflation and a housing bust when Germany leaves the Euro ? Recently the voices for a German euro exit have become louder and louder. The most recent voice comes from Biderman , the FT says that the rise of German Bunds holds the secret how the eurozone crisis will … Continue reading...

Read More »

Read More »

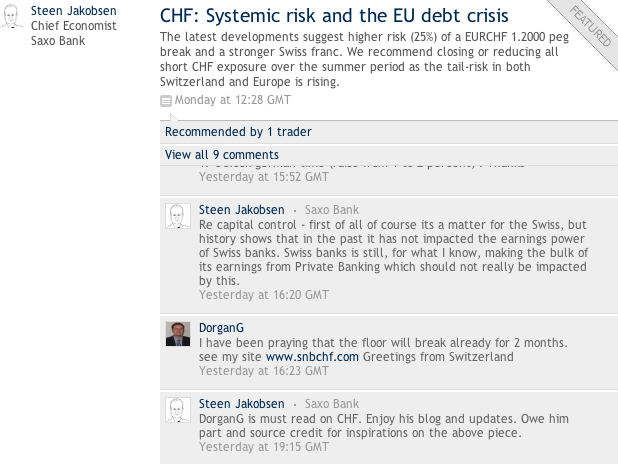

Steen Jakobsen, Chief Economist Saxo Bank is buying in our arguments

Steen Jakobsen sees 25% percent chance that the floor breaks and if it does it breaks to parity. Last week Thomas Jordan removed any hopes on a hike of the EUR/CHF and invited smart money and hedge funds to a no-risk, high return game on the Swiss franc, which these gratefully accepted. After Morgan Stanley …

Read More »

Read More »

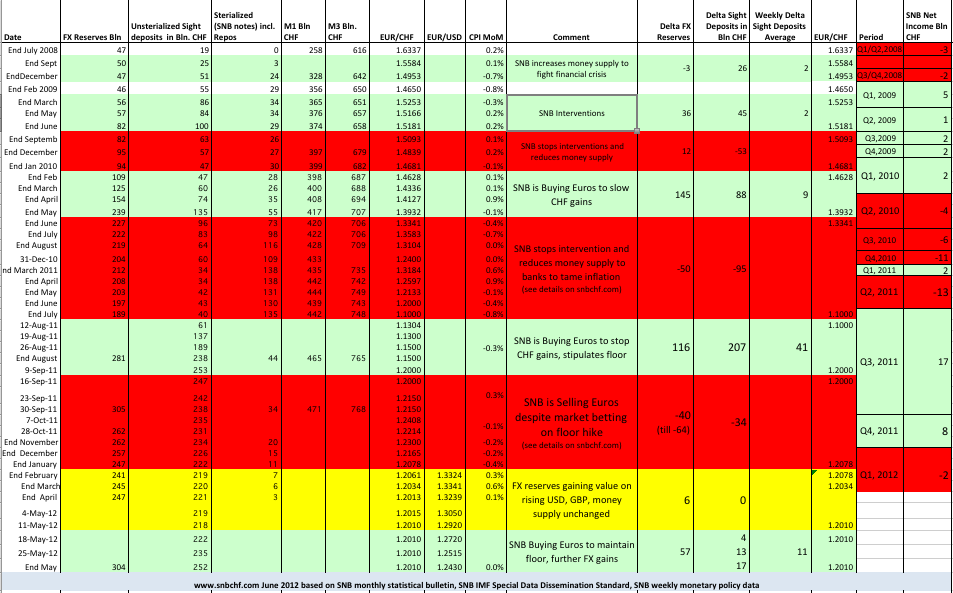

Another week, another 14 bln. francs printed

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »

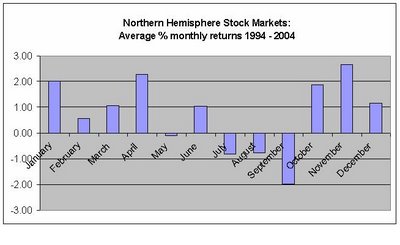

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

The German supply-side reforms or will German companies take over the PIIGS ?

Words heart on German street in 2010 during the first Greek bailouts were that Germany should obtain the Greek islands as collateral if Greece is not able to pay back the debt to Germany. But even today German n-tv is reporting about many Greek real estate brokers that are currently delling islands. If it is not that type … Continue...

Read More »

Read More »

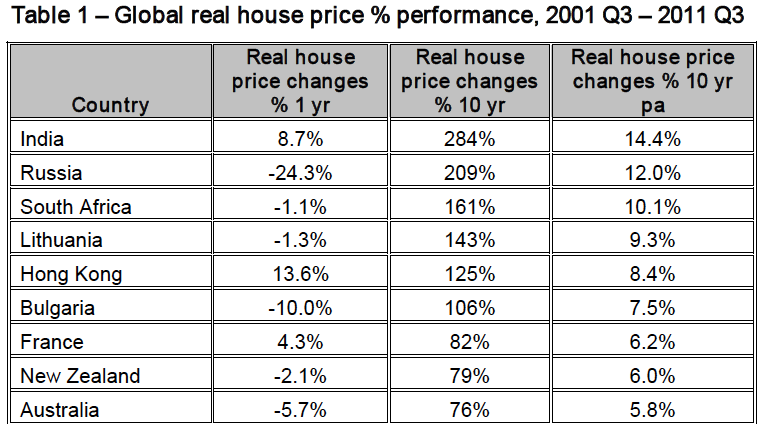

The latest bubble: Real estate in Russia

Still a draft, From Barnaul, Siberia, Russia Inna, 28, is a high-school teacher, she has one child. Her monthly salary is 8’500 Russian Rubel, about 257 USD. Similarly as many state employees her salary is very low. Recently the state doubled the salary of policemen and soldiers from 20’000 RUB to 40’000 RUB. A main …

Read More »

Read More »

CNBC rumors: Different peg methods for the SNB

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

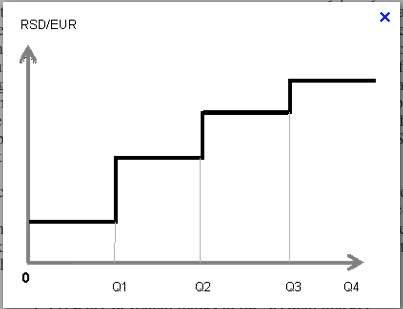

SNB switched from selling euros to buying euros, might sell GBP

As explained in our previous post, at least till May 4th the Swiss National Bank could have been a net buyer of GBP, USD and JPY selling Euros off their balance sheet. In the week of May 11, QE3 talk came up together with a bad Phily Fed reading. From then the SNB had to acquire … Continue reading »

Read More »

Read More »