Tag Archive: Swiss National Bank

Franc-ly we’re delighted, said the SNB

Here’s the Swiss franc at its weakest level against the euro since the Swiss National Bank put its cap into place in September 2011: The euro hit SFr1.2485 on Thursday, up 3.3 per cent since the 10th of January and back to levels not seen since May 2...

Read More »

Read More »

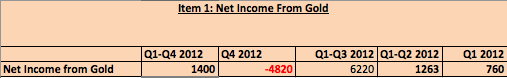

SNB Profit 6 Billion CHF over the Year, 10.9 Billion Loss in Q4/2012

The Swiss National Bank (SNB) obtained a profit of around 6 billion francs for the year 2012 (full statement). The profit was reduced from 16.9 billion francs between Q1 and Q3 2012, which means that in Q4/2012 the bank had a loss of around 10.9 billion francs. The profit in gold fell from 6.2 billion …

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »

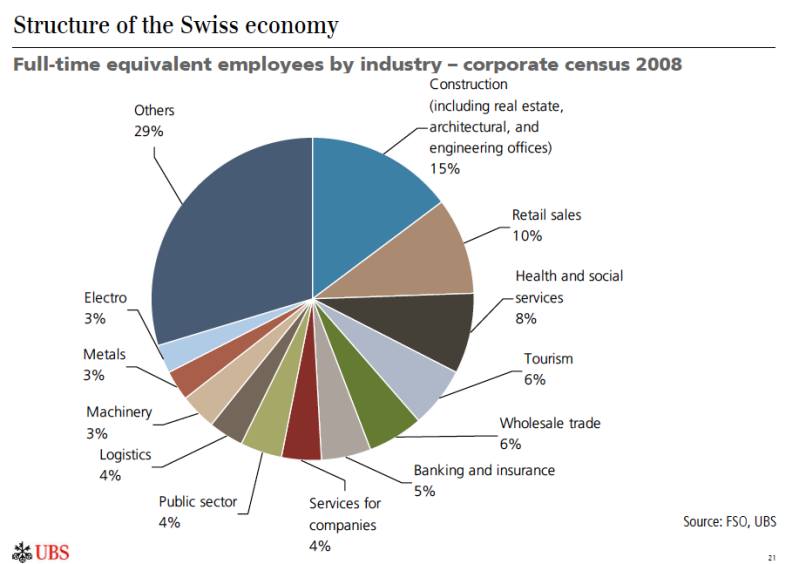

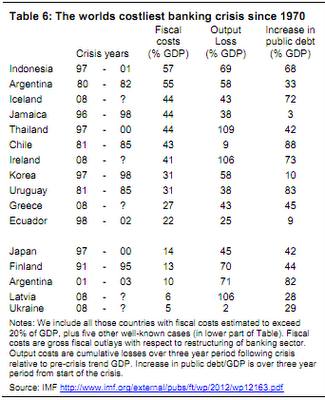

Yearly Swiss Doomsaying and Swissmem’s Control over the Swiss National Bank

The same as every year in December/January: Swiss media and economists are doomsaying. This time they claim that the banking industry and the UBS job losses will bring Switzerland into trouble. Once again they do not understand that the Great Recession was only to a small part a banking crisis, but it was mostly a … Continue reading »

Read More »

Read More »

Nokia investment provides SNB 10 million profit

Recently we reported on SNB losses of 1.85 bil. CHF in just one day and on our estimate of 5 bil. CHF loss in Q4/2012. But now good news: the SNB made a profit of 10 million on Nokia - i.e. 0.2% of the Q4 loss reversed. More on

Read More »

Read More »

Swiss Public Discussion Switched from Floor to Housing Bubble

Why there is no real estate bubble in Switzerland yet and why the SNB will help to create one With the current recovery in the United States the discussion in Switzerland switched from a discussion about the EUR/CHF floor to the Swiss real estate boom, the so-called “housing bubble”. It seems that the Swiss …

Read More »

Read More »

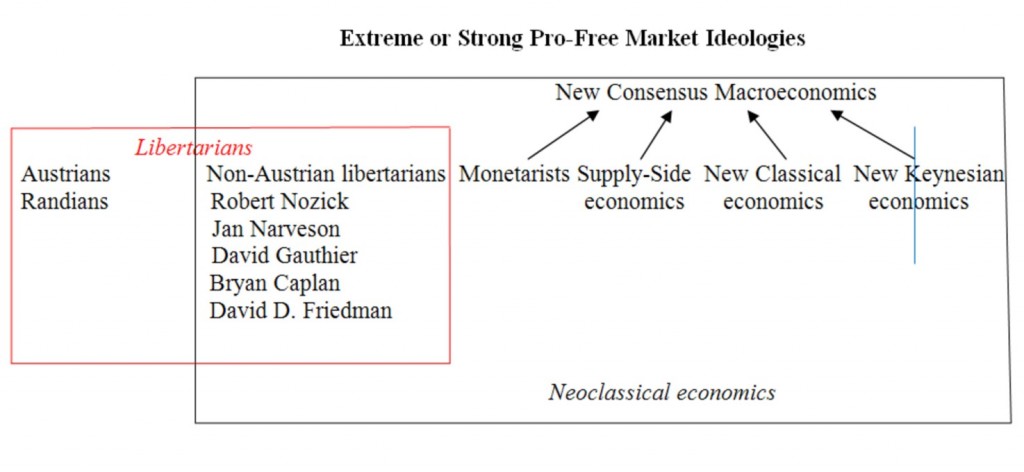

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

Potential losses due to money printing are for the Fed: 1.2% of GDP, Bundesbank: 5% of GDP, SNB: 12% of GDP.

Read More »

Read More »

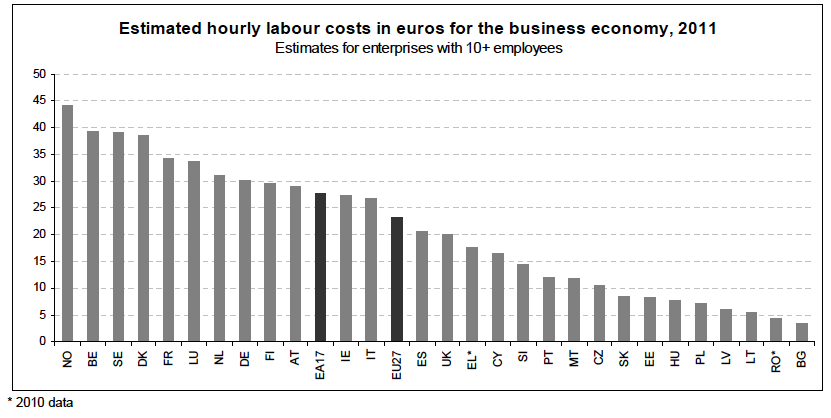

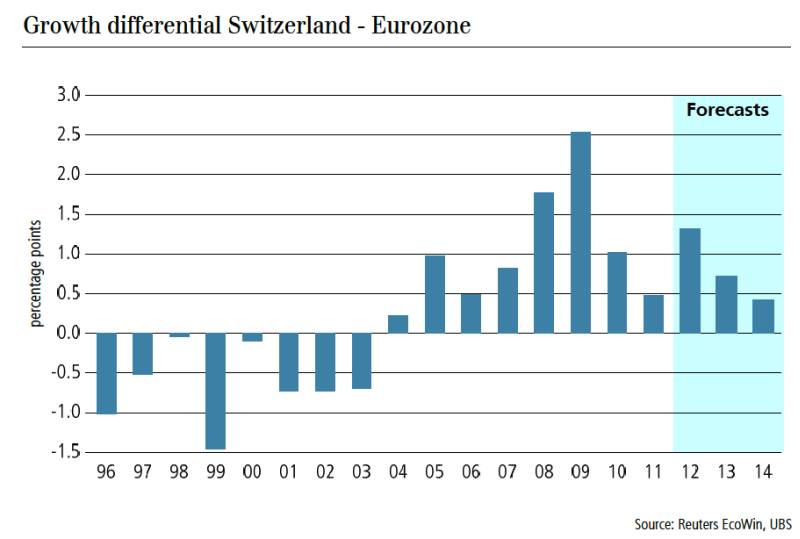

Why the SNB will not Imitate Hong Kong, but Potentially Singapore

The SNB will not be able to realize a fixed currency peg over the long-term. The consequence would be that Switzerland loses its competitive advantage, lower Swiss rates, if it follow euro inflation.

Read More »

Read More »

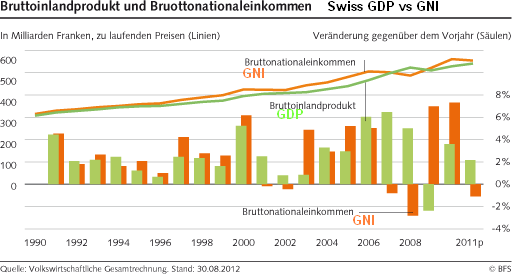

History of SNB monetary policy assessments vs. economic data

History of SNB monetary policy assessments vs. the Swiss gross national product (GDP) and gross national income (GNI).

Read More »

Read More »

Ways to the Northern Euro

Two ways for building the Northern euro, exit of Southern members or slow creation of Northern euro with currency interventions of central banks.

Read More »

Read More »

Because They Knew What They Were Doing: The Parallels between European and SNB Leaders

Similarly as European leaders knew what they were doing with the euro, namely introducing a not feasible currency, Swiss National Bank did between 2005 and 2008, namely the absolutely wrong thing.

Read More »

Read More »

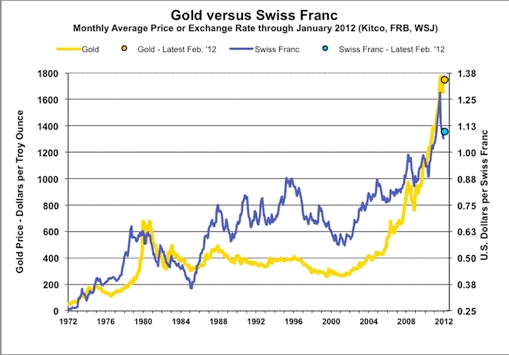

Correlations Between the Swiss Franc, Gold and the German Economy

In yesterday’s post we focused on several economic events that weakened the position of the Swiss National Bank (SNB). In this extended replacement post, we give several reasons for recent movements in the gold price and explain the correlation between German economic data, gold and the Swiss franc. IFO data shows that Germany will not …

Read More »

Read More »

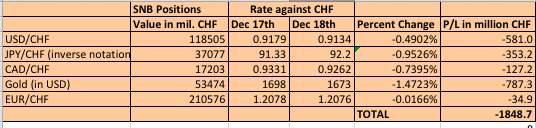

SNB Losses: 1.85 Billion Francs in Just One Day, 231 Francs, 250$ per Inhabitant

After the disappointing US current account data, traders have realized which countries have strong trade balances, namely Germany and Switzerland (see here for our details on the ever rising Swiss trade surplus), additionally fueled the good German IFO data. Both the euro and the Swissie strongly rose against the dollar. Due to Abe’s pressure on the …

Read More »

Read More »

SNB Monetary Policy Assessment December 2012: (Nearly) Full Text

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% …

Read More »

Read More »

SNB Monetary Policy Assessment Outlook

On Thursday, December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to …

Read More »

Read More »