Tag Archive: Swiss National Bank

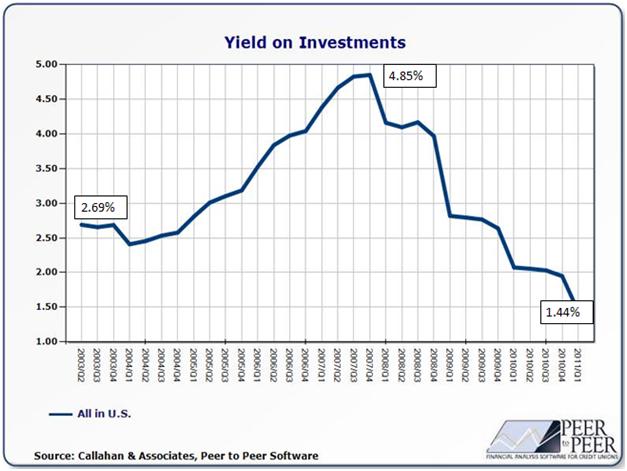

Will SNB FX Investments Yield Enough Until U.S. Inflation Starts?

Will the SNB be able to survive an upturn in inflation: We focus on income and yields for foreign exchange position and gold and find out if the SNB makes enough income to survive a franc appreciation.

Read More »

Read More »

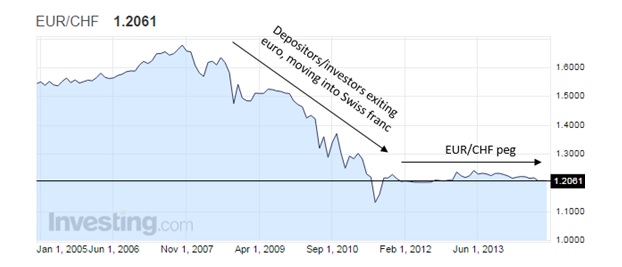

When FX wars become negative interest wars

Beat Siegenthaler, FX strategist at UBS, has been wondering about what the Swiss National Bank may do if the ECB’s measures to weaken the euro begin to test its 1.20 EURCHF floor. He notes, for example, that there has already been a marked divergence...

Read More »

Read More »

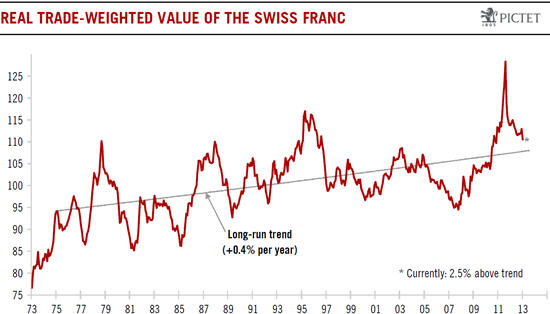

Swiss Franc and Swiss Economy: The Overview Questions

Before the upcoming SNB monetary policy assessment meeting on June 19th, rumors started the SNB could follow the ECB and set negative rates on banks' excess reserves. We would like to deliver the whole background, starting with the question why Swiss inflation has been so low in the past and why CHF always appreciated.

Read More »

Read More »

Gold Referendum, Parliamentary Speech Lukas Reimann

Swiss parliament member Lukas Reimann outlines the importance gold. In a future inflationary environment, prices of SNB holdings, the ones of German Bunds and US Treasuries will drop, while gold will appreciate.

Read More »

Read More »

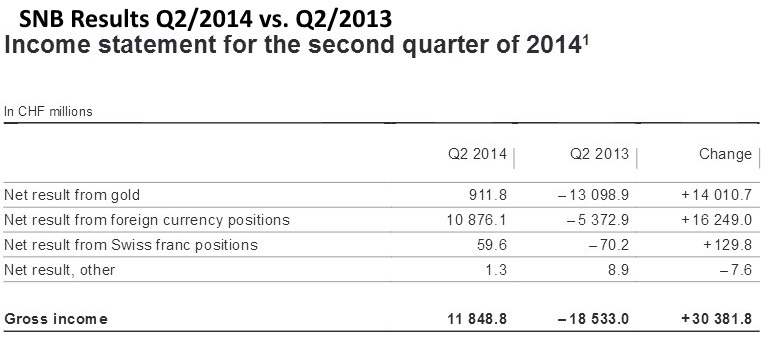

SNB Results Q2/2014: Draghi’s Weak Euro Policy, a Nice Gift for the SNB, for Now

The ECB commitment to a weak euro and the maintenance of ultra-low interest rates, was a nice (temporary) gift for the Swiss National Bank (SNB). The bank earned nearly 12 billion francs in Q2/2014.

Read More »

Read More »

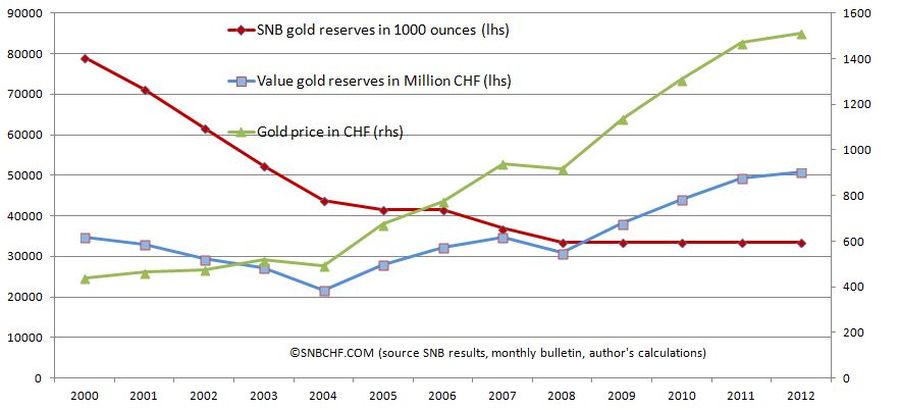

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

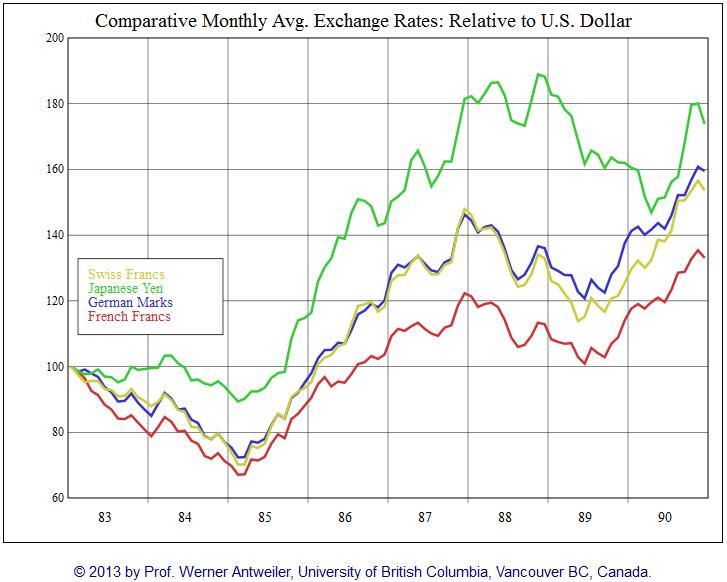

Swiss Franc History 1986-1996: Swiss real estate Boom and Bust

A critical Swiss franc history: This chapter describes the most controversial episode in the Swiss monetary history: How the Swiss National Bank helped to wreck the Swiss real estate market in the 1990s.

Read More »

Read More »

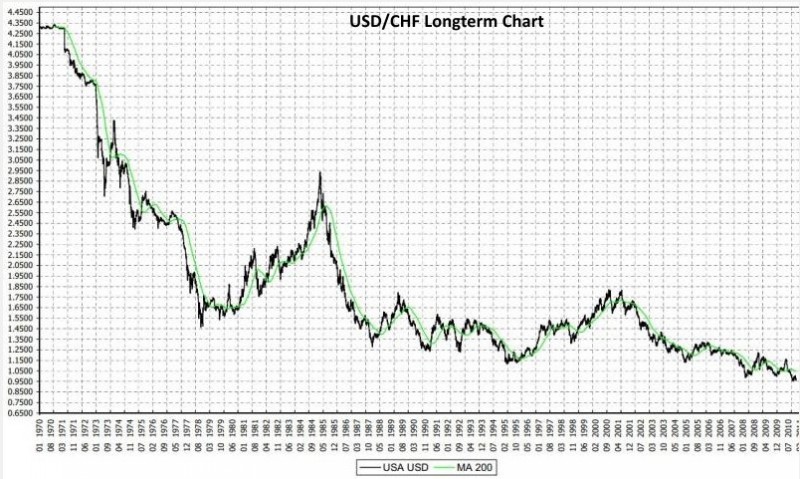

Swiss Franc History: The long-term view and the comparison with gold

We establish a long-term view and history of the Swiss franc. We compare the franc with gold.

Read More »

Read More »

Private markets, public investors: The march of the sovereigns

SOVEREIGN wealth funds, typically set up by oil-exporting nations, have been around for decades, in the case of Kuwait since 1953. But their influence has increased in recent years, as China has adopted a similar strategy for investing some of its vast foreign-exchange reserves while existing funds have been fuelled by gains from high oil prices.

Read More »

Read More »

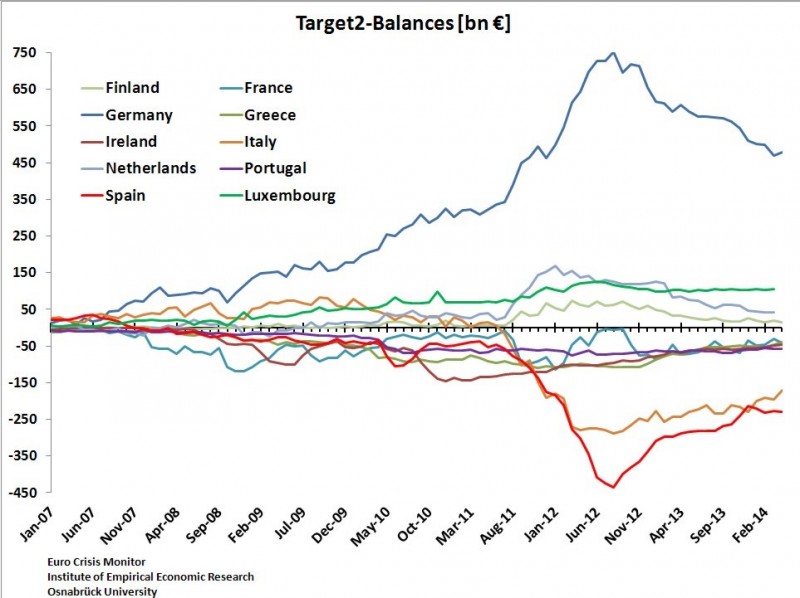

Negative Rates for Bundesbank TARGET2 Surplus?

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

Read More »

Read More »

SNB verlängert Goldabkommen, aber wozu?

Die SNB schreibt heute in einer Medienmitteilung: Um ihre Absichten in Bezug auf ihre Bestände an Gold darzulegen, geben die Beteiligten am Goldabkommen folgende Erklärung ab: Gold bleibt ein wichtiges Element der globalen Währungsreserven.

Read More »

Read More »

Is the SNB Intervening Again?

Update March 21, 2014: Total SNB sight deposits increased to 367.8 bln. CHF, but flows reverted a bit. Foreign banks and “non-banks” reduced their CHF exposure at the SNB to 50.8 bln, possibly converting a part of the difference into USD. Dollars are more useful when sanctions will hurt both Russian and German firms. On … Continue...

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

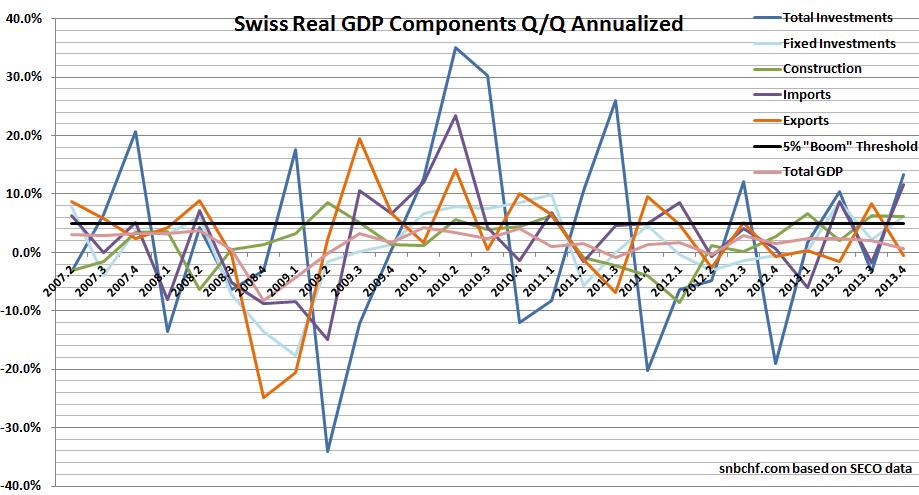

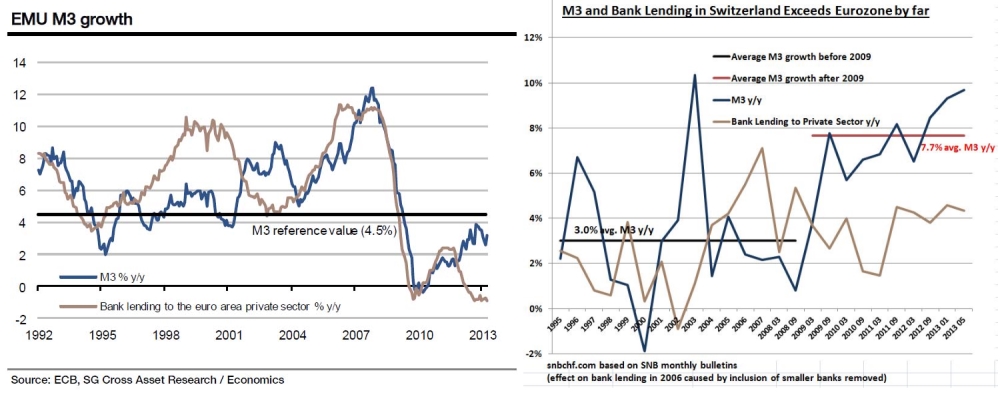

GDP: Switzerland Enters Boom and.. incredibly.. SNB is Still Printing Money

According to the latest data from the SECO,Swiss GDP rose by 0.2% in Q4/2013. Despite the relatively weak headline, the detailed data showed a couple of characteristics that speak for an upcoming boom. At the same time, the Swiss National Bank is printing money again: both the monetary base and money supply are increasing.

Read More »

Read More »

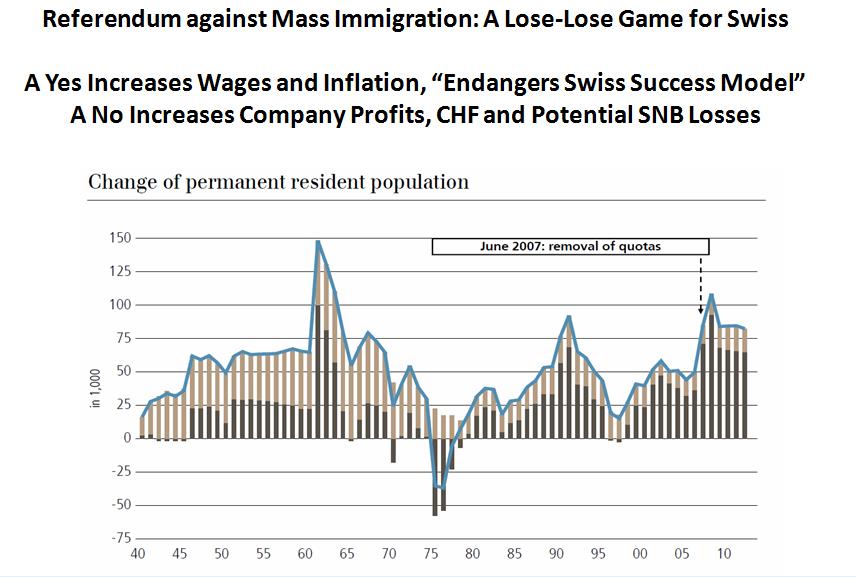

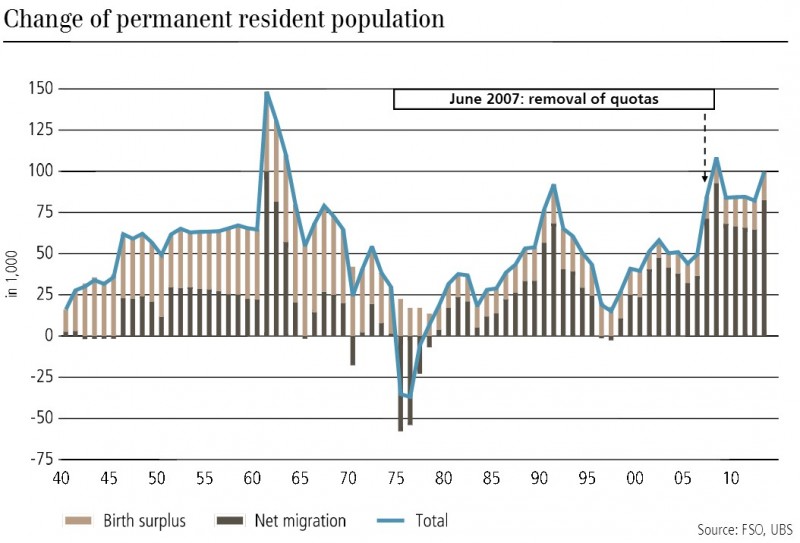

Swiss Yes To Referendum Against Mass Immigration Is A Yes To Higher Salaries And Higher Inflation

In the referendum on Mass Immigration on Sunday, the Swiss opted for less competition, which implies that with the upcoming Swiss boom, salaries and inflation will rise.

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »