Tag Archive: Swiss National Bank

End of Peg Buiter Critique

In a Citi research note, Willem Buiter discusses the SNB’s decision to discontinue the exchange rate floor of the Swiss Franc vis-a-vis the Euro. His main points are: Buiter refers to his earlier work on removing the lower bound on nominal interest r...

Read More »

Read More »

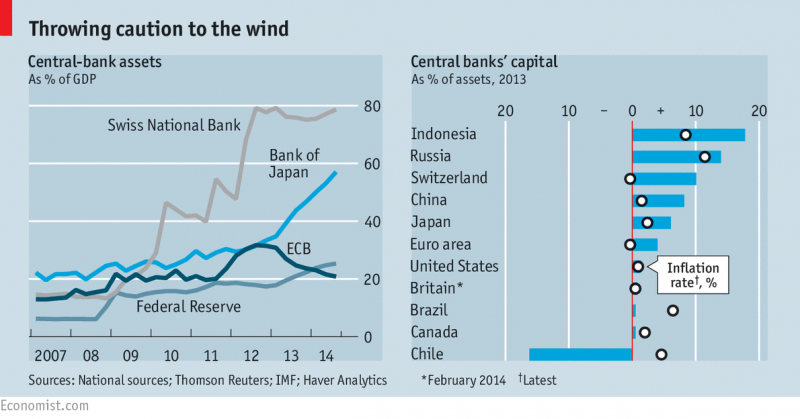

Free exchange: Broke but never bust

CONTEMPORARY central banking is a strongbox of oddities. Deposits, which normally pay interest, can now incur a charge. Investments in government debt, which normally offer a return, give a negative yield. Faced with this weirdness central banks are trying to respect some cardinal rules of finance, with the Swiss National Bank (SNB) and the European Central Bank (ECB) taking steps to protect themselves from losses and ensure that their...

Read More »

Read More »

Switzerland’s currency: Shaken, not stirred

SWISS voters used to hold their central bank in high esteem: one survey in 2013 found the Swiss National Bank (SNB) to be their most respected national institution. That may change after its shock decision on January 15th to abandon the Swiss franc’s cap against the euro. The franc instantly shot up by 30%, provoking howls of anguish from Swiss firms.

Read More »

Read More »

Foreign exchange: Swiss miss

WHEN the Swiss National Bank (SNB) intervened to weaken its currency in 2011, analysts called the subsequent abrupt drop in the franc’s value a “20-standard-deviation move”. Assuming the franc’s ups and downs follow a normal distribution, such a big shift should not have occurred again for many squillions of years.

Read More »

Read More »

Switzerland’s monetary policy: The three big misconceptions about the Swiss franc

ON THURSDAY January 15th Switzerland’s central bank, the Swiss National Bank (SNB), removed the cap on its currency, which it had imposed over three years ago and reaffirmed only three days before its repeal. The doffing of the cap surprised and upset the foreign-exchange markets, hobbling several currency brokers, including Alpari (which happens to sponsor the London football team I support).

Read More »

Read More »

The Economist explains: Why the Swiss unpegged the franc

IN THE world of central banking, slow and predictable decisions are the aim. So on January 15th, when the Swiss National Bank (SNB) suddenly announced that it would no longer hold the Swiss franc at a fixed exchange rate with the euro, there was panic. The franc soared. On Wednesday one euro was worth 1.2 Swiss francs; at one point on Thursday its value had fallen to just 0.85 francs.

Read More »

Read More »

The liquidity monster and FXCM

As we have already pointed out about Thursday’s unprecedented Swiss franc move following the SNB’s announcement about removing its 1.20 euro level floor and introducing a -0.75 per cent interest rate regime, the real story to pay attention to is what...

Read More »

Read More »

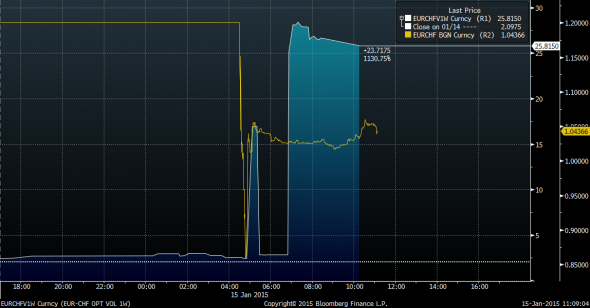

What did the SNB do to EURCHF options markets?

The Swiss National Bank made G10 FX a lot more fun to watch today. One interesting thing is how the options markets responded. Via Jared Woodard of BGC, here’s a chart comparing the move in one-week implied volatility in the exchange rate between the...

Read More »

Read More »

Central Europe and the Swiss franc: Currency risk

ANXIETY at the Swiss National Bank’s surprise decision today to drop its peg against the euro was nowhere more evident than in central Europe. The Swiss franc soared against all the region's currencies, including the euro, the Hungarian forint and especially the Polish zloty, and stock exchanges in Poland (pictured) and Hungary dropped sharply.

Read More »

Read More »

The SNB and the Russia/oil connection

A quick post to collate a few side theories on the reasons, justifications and consequences of the SNB move. Simon Derrick at BNY Mellon is first to point out that the euro floor/chf celing was leaving an open door to safe haven flows from Russia by ...

Read More »

Read More »

Currencies: Going cuckoo for the Swiss

CURRENCIES don't normally move that far on a daily basis—2 to 3% is a big shift. The exception is when a country on a fixed exchange rate suffers a devaluation; then a 20-30% fall is a possibility. But a 20-30% plus upward move is almost unprecedented. That, however, is what happened to the Swiss franc on January 15th, as Switzerland's central bank abandoned its policy (instituted back in 2011) of capping the currency at Sfr1.20 to the euro.

Read More »

Read More »

Vieles wird teurer doch das Deflationsgespenst bleibt am Leben

Die SNB wird nicht müde, uns vor der bösen Deflation zu warnen und die Inflationserwartungen tief zu halten: SNB: «Deflationsrisiken nochmals zugenommen» – Handelszeitung, 11.12.14 Mittelfristige Inflationserwartungen weiterhin tief und stabil – SNB,...

Read More »

Read More »

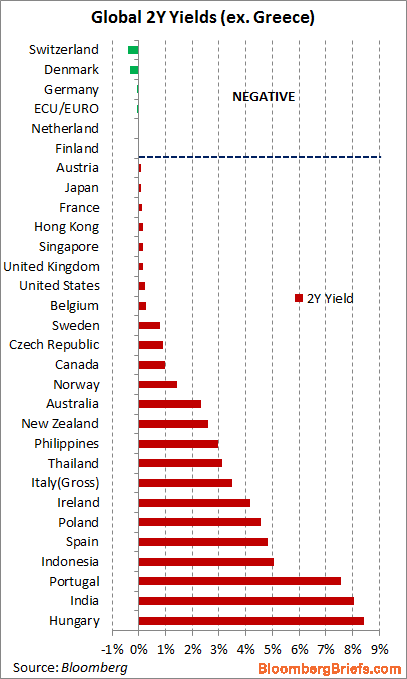

Negative and Close to Zero Yields of Government Bonds and the Reasons

We judge that negative or close to zero yielding government bonds reflect three points: Risk off environment, long-run currency gains on currency with low inflation, insufficient supply of government bonds for bank refinancing purposes.

Read More »

Read More »

Setting monetary policy by popular vote: Full of holes

THE Swiss franc is a volatile currency that is fast becoming worthless. That, at least, is what some members of Switzerland’s right-wing People’s Party (SVP) would have you believe. Thanks to the SVP, Switzerland will vote on November 30th on a radical proposal to boost the central bank’s gold reserves. Bigger reserves, activists argue, will make the Swiss economy more stable and prosperous. In fact the opposite is true.

Read More »

Read More »

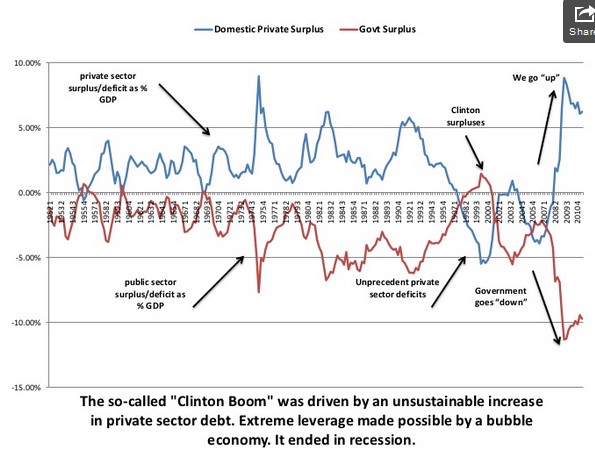

Why was the gold price so low in 1999/2000?

To find further explanations as to why the gold price was weak in the late 1990s we analyze sector balances. Effectively private spending and private debt went in two different directions: a heavy increase in private spending and debt in the US against less growth in private spending and less debt in the rest of world. This combination fostered GDP growth in the US and weakened it in other countries. Real interest rates were positive. Markets...

Read More »

Read More »

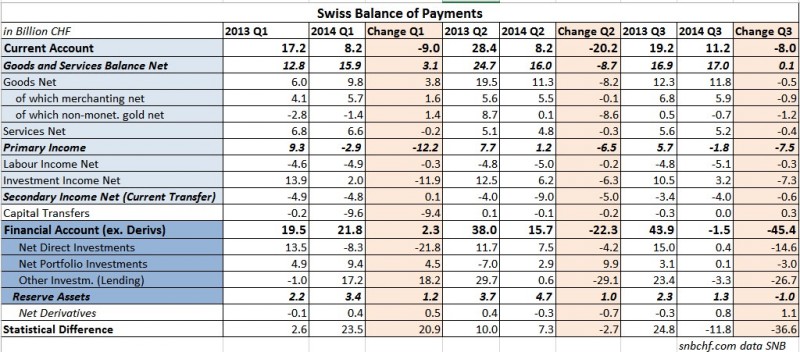

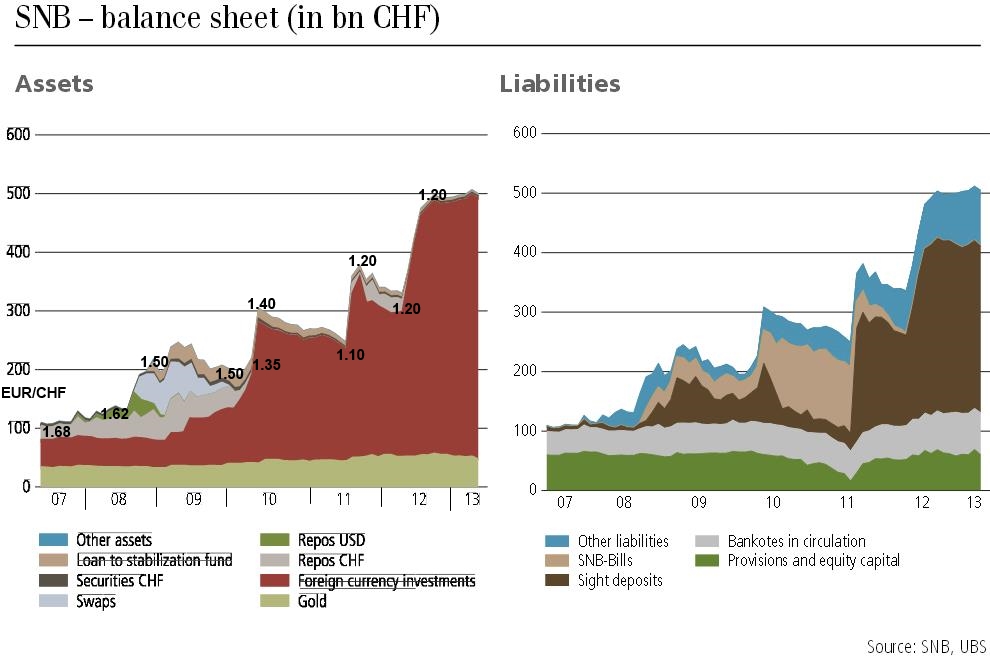

History of SNB Interventions

High inflows of around 400 billion francs between 2009 and 2012 in the Swiss balance of payments could only be countered with an increase in reserve assets and interventions by the Swiss National Bank. This number is far higher than the one seen during the collapse of the Bretton Woods system, when the ten times bigger Germany had to buy reserves for 71 billion German Marks (at the time around 56 billion CHF). We look at the detailed history of...

Read More »

Read More »

Weltwoche nimmt Blogbeitrag zu Gold von unbequemefragen.ch auf

Da habe ich nicht schlecht gestaunt, als sich Markus Schär von der Weltwoche vorgestern Abend bei mir über Twitter gemeldet und verkündet hat, dass er bei seinem Artikel über die Goldverkäufe der SNB sehr prominent meinen Blogbeitag zitiert. Nochmals...

Read More »

Read More »

Swiss Gold Referendum and SNB’s Opinion: An Exchange of Arguments

Already in 2013, the Swiss National Bank (SNB) spoke out against the gold initiative and revealed that the Swiss gold is stored mostly in Switzerland and 20% in the UK and 10% in Canada. There is no Swiss gold in the United States according to SNB chairman Jordan. In this post we provide an exchange of Jordan's arguments against the ones of the gold initiative. We also state our view that is not as strict as the one of the referendum proponents.

Read More »

Read More »

Bewiesen: Die SNB verkaufte Gold, welches bei der Fed gelagert war

Endlich kommt der Beweis für meine Vermutung! Die SNB hat heute – parallel zur Propaganda des Bundesrats – ein Dokument “Goldinitiative – häufig gestellte Fragen” (PDF) ins Netz gestellt und dabei sogar interessante Fakten preisgegeben. Konkret geht ...

Read More »

Read More »