Tag Archive: Swiss National Bank

SNB sollte Bund bis 60 Milliarden ausschütten – nur so ist der Steuerzahler sicher

Letzte Woche gab die Schweizerische Nationalbank (SNB) bekannt, dass sie für dieses Geschäftsjahr eine Milliarde Franken an Bund und Kantone ausschütten wird. Von der Presse wird dies unterschiedlich interpretiert. Einerseits nimmt man mit Genugtuung zur Kenntnis, dass die SNB überhaupt eine Milliarde ausschütten kann. Andererseits wird mit Blick auf drohendes negatives Eigenkapital der SNB gewarnt, diese müsse dringend Reserven bilden.

Read More »

Read More »

Did President-Elect Trump Just Inadvertently Kill The Golden Goose?

President-Elect Trump may have just unwittingly sowed the seed of an equity market draw-down which will send even more protesters into the streets of America. Donald Trump’s stated economic policies are clearly pro-growth and if he manages to implement his pro-business, anti-regulation agenda, in the longer term they have the potential to surpass the bold and successful initiatives of Ronald Reagan.

Read More »

Read More »

European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List.

The European Central Bank (ECB), creator of the Euro, currently claims to hold 504.8 tonnes of gold reserves. These gold holdings are reflected on the ECB balance sheet and arose from transfers made to the ECB by Euro member national central banks, mainly in January 1999 at the birth of the Euro. As of the end of December 2015, these ECB gold reserves were valued on the ECB balance sheet at market prices and amounted to €15.79 billion.

Read More »

Read More »

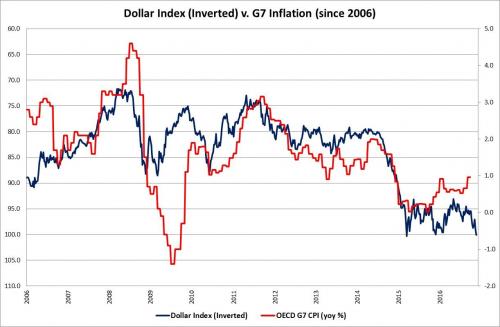

Dollar Illiquidity Getting Critical: A $10 Trillion Short Which The Fed Does Not Understand

In the latest report from ADM ISI’s strategy team, “Dollar Liquidity Threat is Getting Critical and Fed is M.I.A.”, Paul Mylchreest argues that mainstream economic luminaries (like Carmen Reinhart) are finally acknowledging the evolving crisis due to the dollar shortage outside the US, a topic which even the head researcher at the BIS shone a spotlight on yesterday suggesting that the strength of the dollar, not the VIX is the new "fear...

Read More »

Read More »

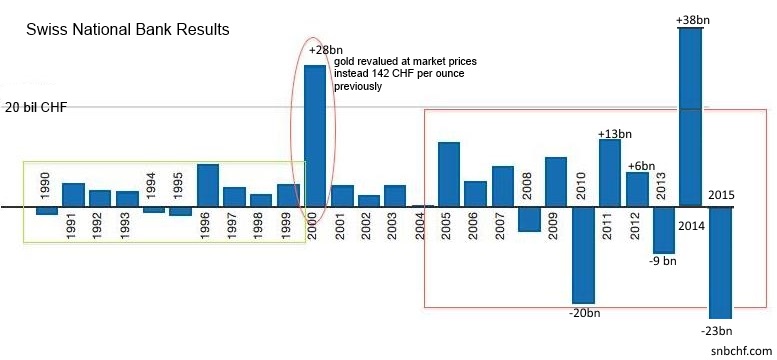

Federal Department of Finance and SNB enter new distribution agreement

The Federal Department of Finance (FDF) and the Swiss National Bank (SNB) have signed a new agreement regarding the SNB’s profit distribution for 2016 to 2020. Subject to a positive distribution reserve, the SNB will in future pay CHF 1 billion p.a. to the Confederation and cantons, as was previously the case. In future, however, omitted distributions will be compensated for in subsequent years if the distribution reserve allows this.

Read More »

Read More »

We’re All Hedge Funds Now – Central Banks Become World’s Biggest Stock Speculators

At first, the idea of central banks intervening in the equity markets was probably seen even by its fans as a temporary measure. But that’s not how government power grabs work. Control once acquired is hard for politicians and their bureaucrats to give up. Which means recent events are completely predictable.

Read More »

Read More »

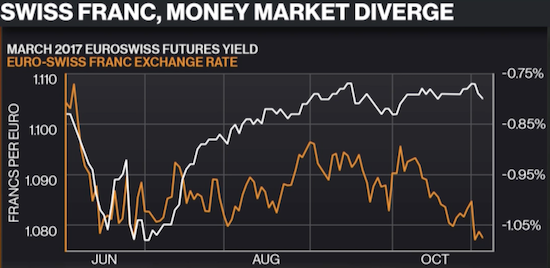

THIS Time A Swiss Franc Hedge Makes More Sense

Money markets and the Swiss franc have diverged despite a presumed increase in event risk from the U.S. Presidential election. Moreover, shorts against the Swiss franc have risen. This surprising divergence opens up a presumed opportunity use the franc as a hedge against a surprise outcome from the election. This time I agree with the strategy even as I suspect that, once again, any subsequent incremental strength in the Swiss franc will be...

Read More »

Read More »

Der SNB-Milliardengewinn täuscht Stärke vor. Tatsächlich ist die SNB so schwach wie nie.

Voller Stolz präsentiert die SNB ihr Zwischenergebnis für die ersten 9 Monate dieses Jahres: 28.7 Milliarden Franken Gewinn. Und die Medien kolportieren diese Zahlen unbedarft. Die Devisenreserven der SNB seien erneut gestiegen wird da behauptet; und zwar allein in diesen neun Monaten um 73 Milliarden auf sage und schreibe 666 Milliarden Franken. Solche Schlagzeilen sind oberflächlich und lenken von der grossen Gefahr ab, in welcher sich die SNB...

Read More »

Read More »

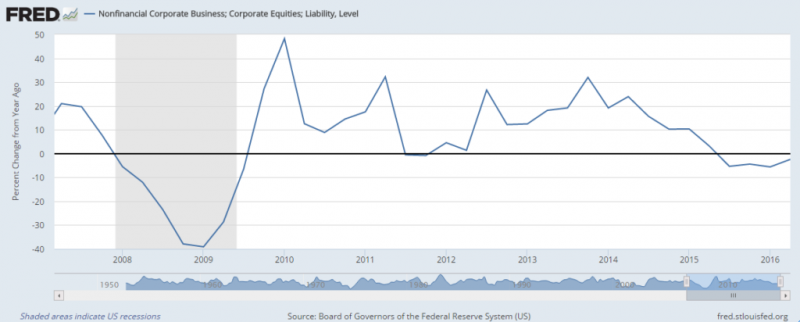

Swiss National Bank Results Q3 / 2016: Volatility of Results is Increasing

Interim results of the Swiss National Bank as at 30 September 2016 The Swiss National Bank (SNB) reports a profit of CHF 28.7 billion for the first three quarters of 2016. But the volatility is rising: The SNB may lose 50 billion in one year and win 60 billion in the next year or the opposite.

Read More »

Read More »

Und nun kommt der Nobelpreisträger daher und will uns weismachen, wir müssten den Mindestkurs wieder einführen

„Es kostet fast nichts, Franken im richtigen Umfang zu drucken.“ Das sagte der Wirtschaftsnobelpreisträger Joseph Stiglitz am World Economic Forum (WEF) in Davos anlässlich eines Interviews mit dem Tages-Anzeiger.

Read More »

Read More »

Risk Happens Fast

As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn't for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast.

Read More »

Read More »

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »

Global stocks at lowest levels since July

The Swiss Market Index is set to finish the week lower, but outperforming global stocks, thanks to a strong week of luxury good stocks. Global stocks fell to their lowest levels since July on Thursday as investors rushed to the safety of government bonds, yen and gold after renewed concerns over weakness in the Chinese economy and as the Federal Reserve considers raising interest rates.

Read More »

Read More »

Switzerland’s central bank offers a glimpse behind the curtain

The Swiss National Bank is offering a rare look into how it sets monetary policy. A video of SNB President Thomas Jordan and fellow members of the governing board shows them beginning their quarterly policy assessment discussing the state of the economy with about 30 people.

Read More »

Read More »

Algos, Barriers, Rumors: Some Theories On What Caused The Pound Flash Crash

As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up.

Read More »

Read More »

Is Someone Trying To Buy The Swiss National Bank?

By now it is well-known that as we profiled previously, one of the most ravenous buyers of US stocks in recent years, has been a central bank: the Swiss National Bank... However, it is far less known that not only is the Swiss National Bank also a publicly traded stock, but is also one of the best performing stocks in the world this year.

Read More »

Read More »

Janet Yellen’s Shame

n honest capitalism, you do what you can to get other people to voluntarily give you money. This usually involves providing goods or services they think are worth the price. You may get a little wild and crazy from time to time, but you are always called to order by your customers.

Read More »

Read More »

Seven years of inaction on SNB rates day won’t end this week

Anyone feeling let down that the European Central Bank didn’t do much last week might just want to skip the Swiss rate decision on Thursday to avoid more disappointment. While the Swiss National Bank may be infamous for some seismic policy changes in the last few years, those bombshells weren’t dropped at scheduled meetings. In fact, the last time the institution altered interest rates at a decision in its public calendar was more than seven years...

Read More »

Read More »

Strong Swiss growth lessens chance SNB will act

Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.

Read More »

Read More »