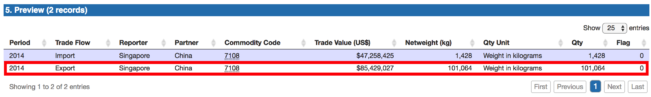

Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future. Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking China’s progress of imports –...

Read More »

Tag Archive: Singapore

Emerging Markets: Preview of the Week Ahead

EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally.

Read More »

Read More »

Emerging Markets: The Week Ahead, February 12

EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM.

Read More »

Read More »

Why the SNB will not Imitate Hong Kong, but Potentially Singapore

The SNB will not be able to realize a fixed currency peg over the long-term. The consequence would be that Switzerland loses its competitive advantage, lower Swiss rates, if it follow euro inflation.

Read More »

Read More »