Tag Archive: SDR

Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

Read More »

Read More »

FX Daily, March 18: Dovish Fed but Yields Rise, Helping the Greenback Recover from Yesterday’s Slide

Overview: Asia Pacific equities mostly advanced after the US benchmarks recovered following the dovish FOMC. Australia, New Zealand, and India did not participate in today's gains. European bourses edged higher, but US shares are struggling, and the NASDAQ futures are off nearly 1%, threatening to end the three-day rally.

Read More »

Read More »

FX Daily, February 26: Fed Hike Ideas Give the Beleaguered Greenback Support

A poor seven-year note auction and ideas that the first Fed hike can come as early as the end of next year spurred a steep sell-off in bonds and equities. Technical factors like the triggering of stops losses, large selling in the futures market, which some also link to hedging of mortgage exposure (convexity hedging), also play a role.

Read More »

Read More »

What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns.

Read More »

Read More »

Inclusion in SDR Does Not Spur Official Demand for the Yuan

China's share of global reserves is in line with expectations prior to its inclusion in the SDR. Three factors influencing allocated reserves - valuation, portfolio decisions, and China's gradual inclusion in allocated reserves. The Swiss franc's as a reserve asset diminished, but the "other" category appeared robust.

Read More »

Read More »

IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

The increase in the yen's share of reserves was flattered by the yen's 9% appreciation. The dollar and euro's share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan's share of reserves.

Read More »

Read More »

Yuan and Why

It is as if Hamlet, the confused prince of Denmark, has taken up residence in Beijing. The famed-prince wrestled with "seeming" and "being". So are Chinese officials. They seem to be relaxing their control over financial markets but are they really? Are they tolerating market forces because they approve what they are doing, such as driving interest rates down or weakening the yuan? If so what happens when the markets do something which they...

Read More »

Read More »

SDR Does Not Stand for Secret Dollar Replacement

At the IMF/World Bank meetings this week, Chinese officials are again pushing for greater use of the IMF's unit of account, Special Drawing Rights. It is China's turn as the rotating host of the G20, which gives it greater influence over its ag...

Read More »

Read More »

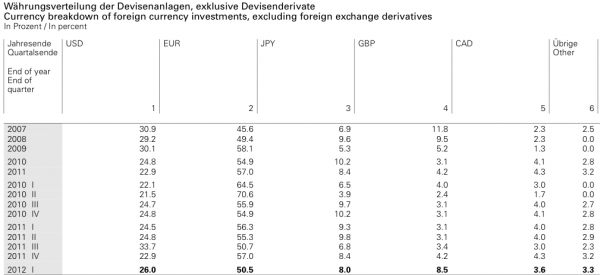

Is the SNB pegging away from the Euro to the SDR currency basket using their FX reserves ?

We reckon that the central bank has introduced an automatic peg mechanism which obliges them to buy euros at exactly 1.2010 and sell euros above this level (reasons and details here). If they sold more euros than they bought, they are happy to have offloaded some items of their overloaded balance sheet. If they bought more euros than they sold, however, there are some "superfluous" euros. Instead putting these euros on their balance sheet, they...

Read More »

Read More »