Tag Archive: Reuters

Negative Consumer Financing Rates in Germany, Soon More Negative in Switzerland?

Things are increasingly upside down in the brave new centrally planned world: thanks to negative deposit rates central banks have put an explicit cost on saving, while in various instances, such as taking out a mortgage in Denmark and the Netherlands, the bank actually pays the borrower, thus rewarding living beyond one's means.

Read More »

Read More »

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

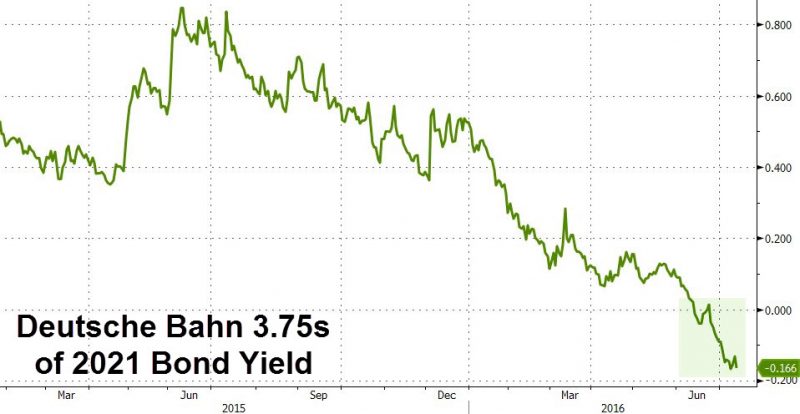

Germany Sells First Ever Negative-Yielding 10Y Treasury, Corporate Bonds

Overnight, we previewed what was about to be a historic for the eurozone bond auction, when this morning Germany sold its first ever 10Y bonds with a zero coupon.

Read More »

Read More »

Stockman Rages: Ben Bernanke Is “The Most Dangerous Man Walking This Planet”

Ben Bernanke is one of the most dangerous men walking the planet. In this age of central bank domination of economic life he is surely the pied piper of monetary ruin. At least since 2002 he has been talking about “helicopter money” as if a notion which is pure economic quackery actually had some legitimate basis.

Read More »

Read More »

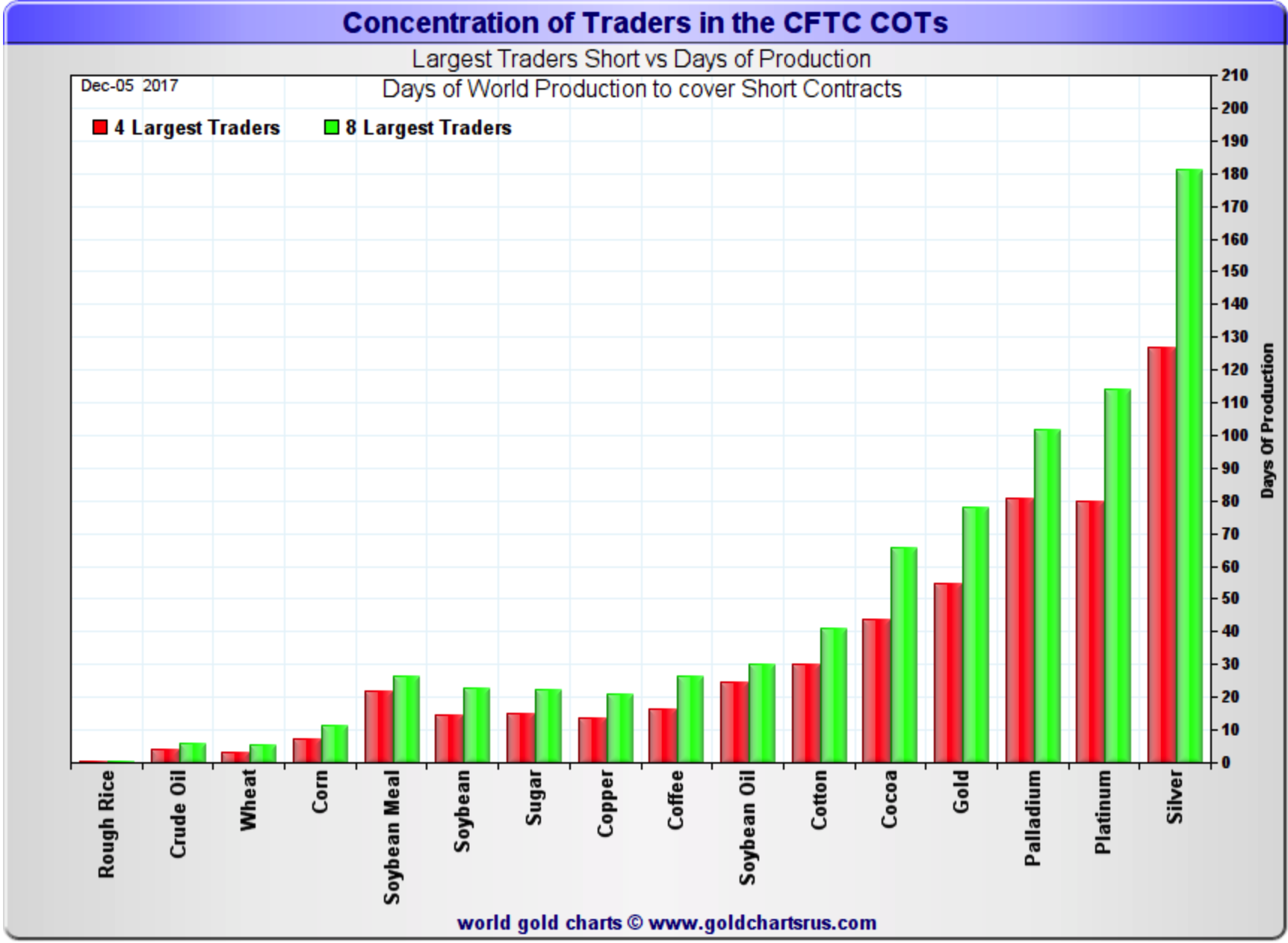

SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full.

Read More »

Read More »

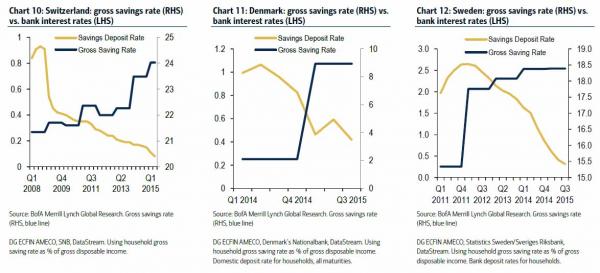

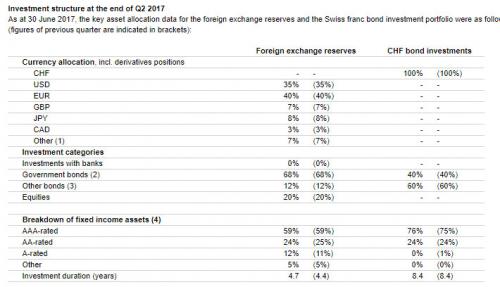

In Surprising Development NIRP Starts To Work, Pushing Rich Swiss Savers Out Of Cash Into Stocks

One of the rising laments against NIRP is that far from forcing savers to shift from cash and buy risky (or less risky) assets, it has done the opposite. Intuitively this makes sense: savers expecting a return on the cash they have saved over the years are forced to save even more in a world of ZIRP or NIRP, as instead of living off the interest, they have to build up even more prinicpal.

Read More »

Read More »

Faber: “Switzerland doing much better than any other country in Europe. So Britain should do the same?”

The European Union is an "empire that is hugely bureaucratic," warns Marc Faber, telling CNBC that he thinks that "a Brexit would be bullish for global economic growth," because "it would give other countries incentive to leave the badly organized EU...

Read More »

Read More »

Here Comes The Turkish Flood: EU Commission Backs Visa-Free Travel For 80 Million Turks

Earlier this week we observed that in what may be Europe's latest mistake, the European Union is about to grant visa-gree travel to 80 million Turks: a key concession that Erdogan obtained as a result of the ongoing negotiations over Europe's refugee...

Read More »

Read More »

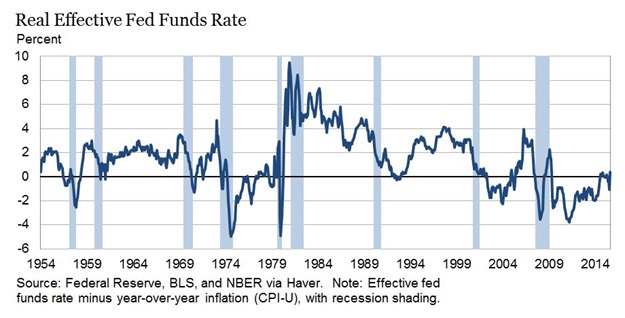

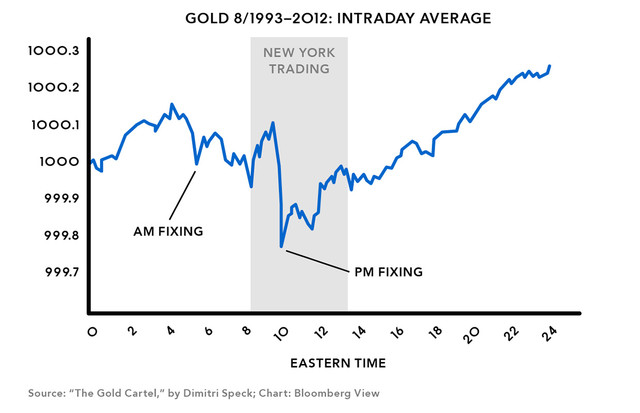

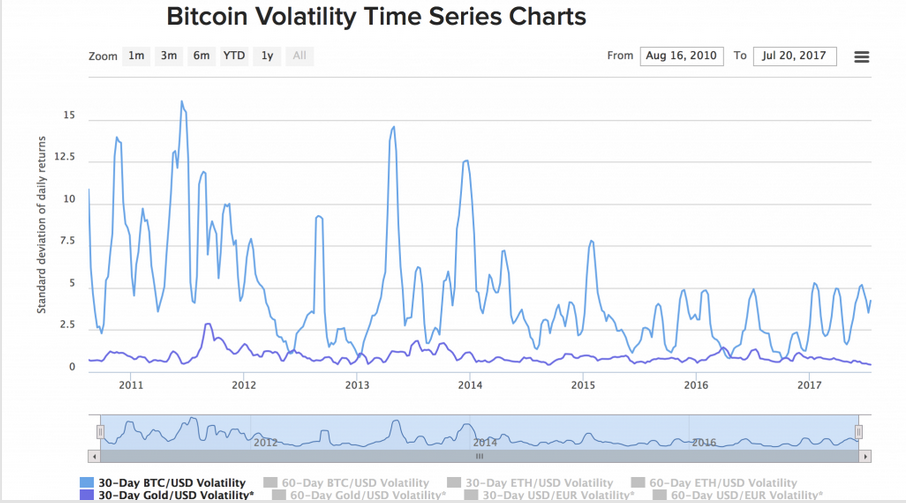

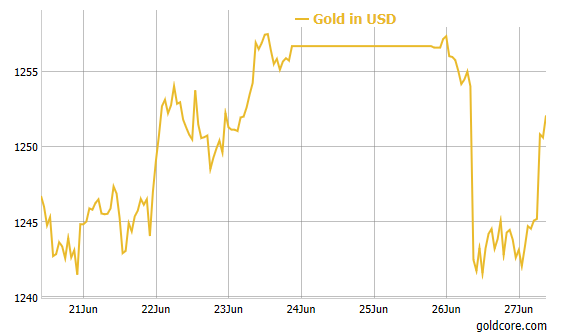

Gold And Negative Interest Rates

Submitted by Dan Popescu via Acting-Man.com,

The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed h...

Read More »

Read More »

With Tech Tanking, Can Anything Save The System?

Submitted by John Rubino via DollarCollapse.com,

First it was the banks reporting horrendous numbers — largely, we were told, because of their exposure to recently-cratered energy companies. Now it’s Big Tech, which is a much harder thing t...

Read More »

Read More »

How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8

Submitted by Ronan Manly of Bullionstar Blogs

Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exporte...

Read More »

Read More »

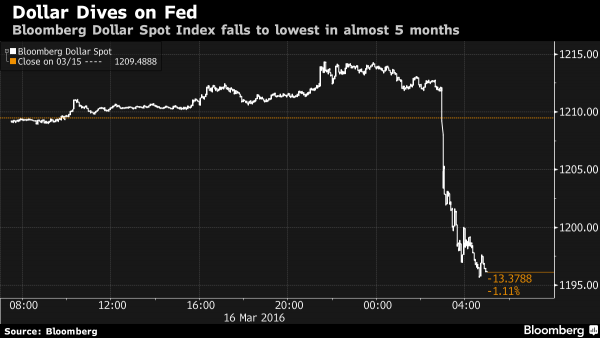

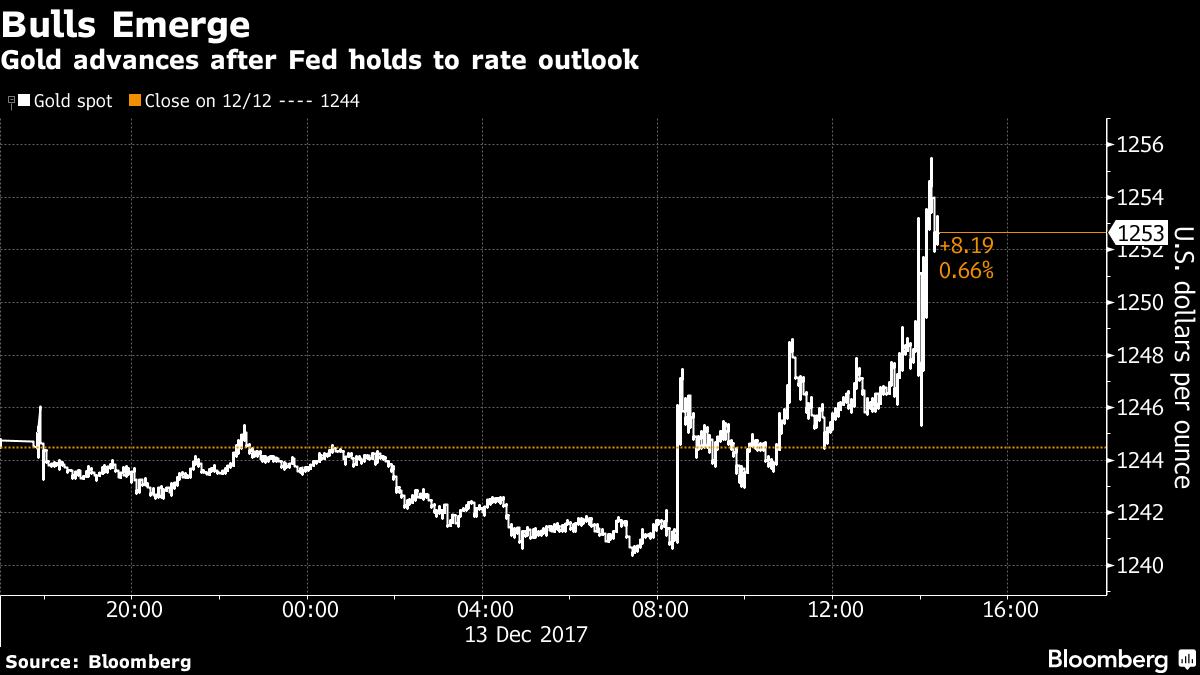

Another Fed “Policy Error”? Dollar And Yields Tumble, Stocks Slide, Gold Jumps

Yesterday when summarizing the Fed's action we said that in its latest dovish announcement which has sent the USD to a five month low, the Fed clearly sided with China which desperately wants a weaker dollar to which it is pegged (reflected promptly ...

Read More »

Read More »

“Time To Panic”? Nigeria Begs World Bank For Massive Loan As Dollar Reserves Dry Up

Having urged "don't panic" just 4 short months ago, it appears Nigeria just did just that as the global dollar short squeeze forces the eight-month-old government of President Muhammadu Buhari to beg The World Bank and African Development Bank for $3...

Read More »

Read More »

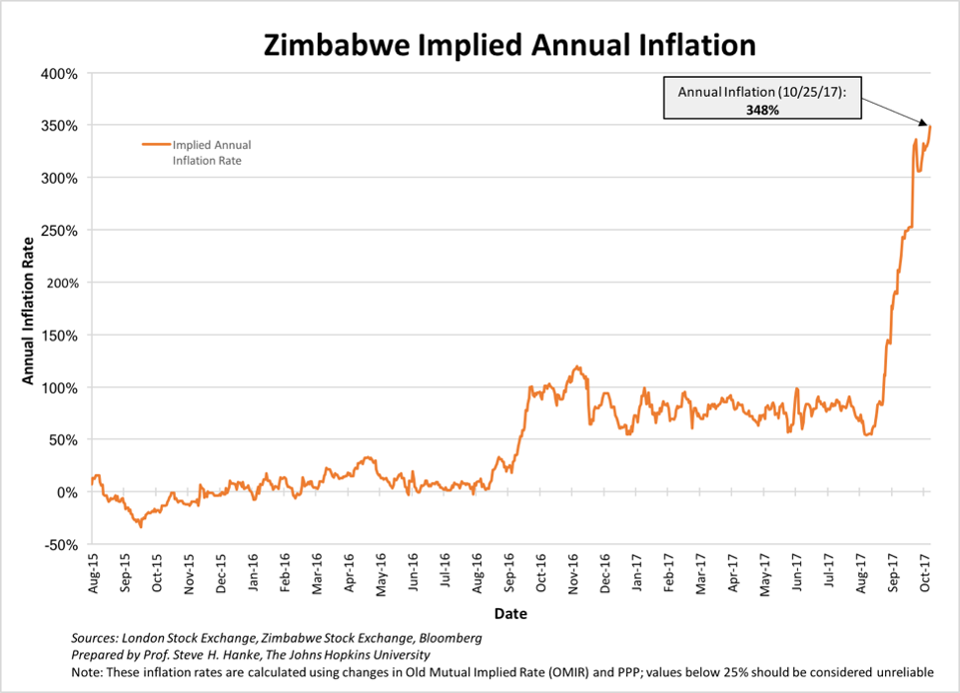

Nigerian Currency Collapses After Central Bank Halts Dollar Sales To Stall “Hyperinflation Monster”

Having told banks and investors "don't panic" in September, amid spiking interbank lending rates and surging default/devaluation risks, it appears the massive shortage of dollars that we warned about in December has washed tsunami-like ashore in oil-...

Read More »

Read More »