Tag Archive: PMI

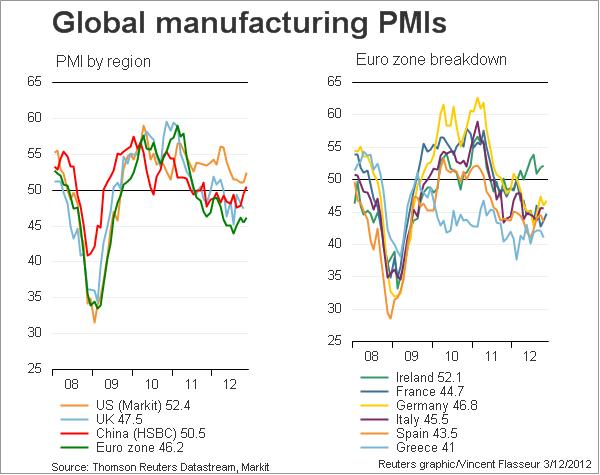

Global Purchasing Manager Indices

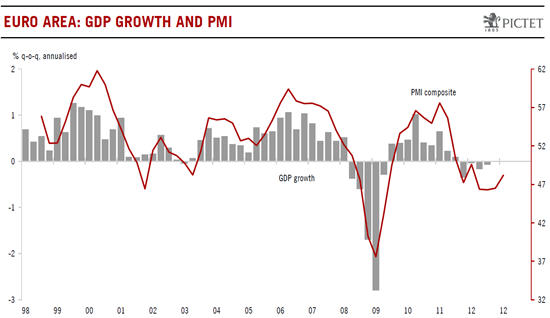

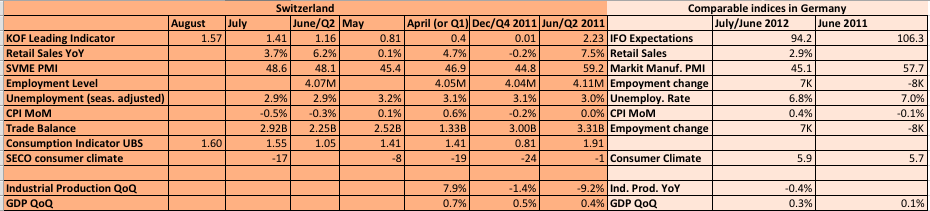

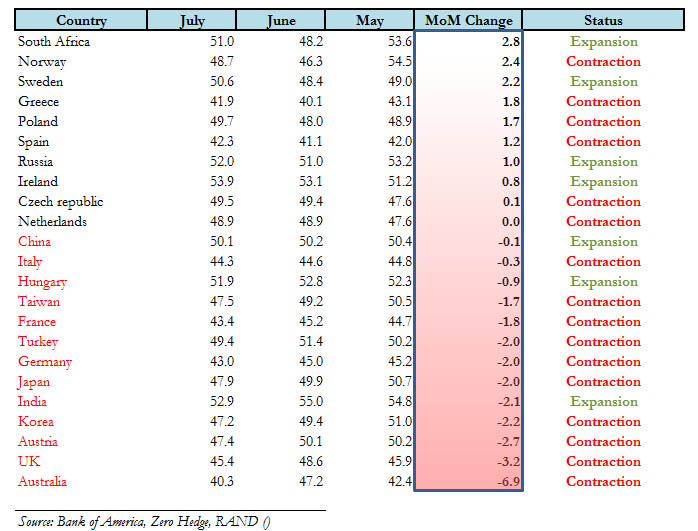

Manufacturing Purchasing Manager Indices (PMIs) are considered to be the leading and most important economic indicators. August 2013 Update Emerging markets: Years of strong increases in wages combined with tapering fears have taken its toll: Higher costs and lower investment capital available. EM Companies have issues in coping with developed economies. Some of them …

Read More »

Read More »

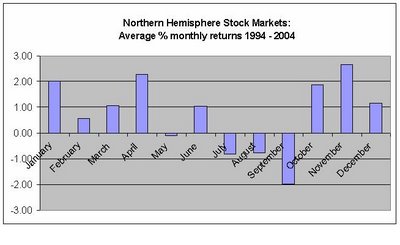

The “Sell in May, Come Back in October” Effect and the 19 Fortune-Tellers of the FOMC

The U.S. economy regularly improves between October and April, this year additionally fueled by "unlimited" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies. Update 2013: The Case-Shiller index continued to climb in April 2013; it became clear that this year the "Sell in May" …

Read More »

Read More »

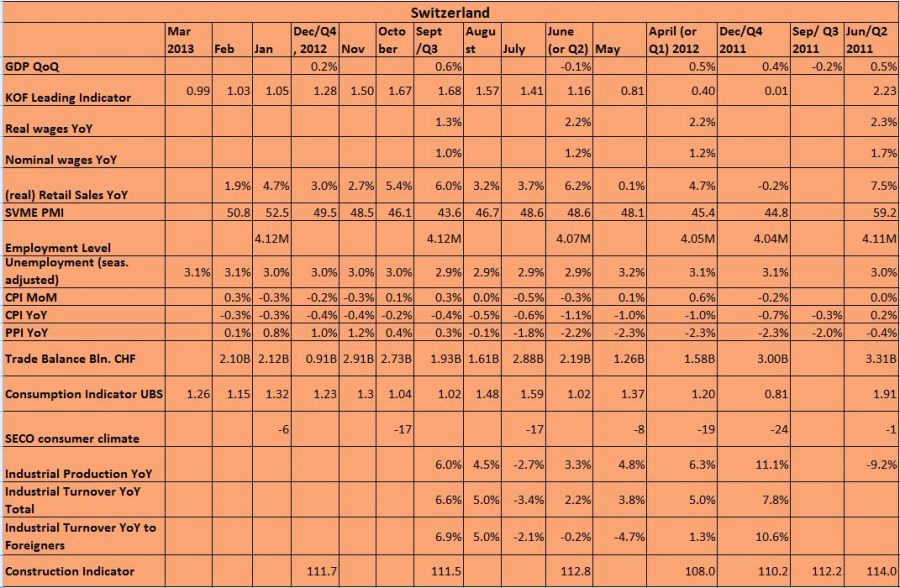

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

Global Purchasing Manager Indices, Update January 25

Manufacturing PMIs are considered to be the leading and most important economic indicators. After a strong slowing in summer 2012 and the Fed’s QE3, this is the fourth month of improvements in global PMIs January 25th Expansion-contraction ratio: There are 15 countries that show values above 50 and 14 with values under 50. Positive-negative-change ratio: …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 17

Manufacturing PMIs are considered to be the leading and most important economic indicators. Since the Fed’s QE3, this is the third month of improvements in global PMIs after a strong slowing in summer 2012. January 25th Expansion-contraction ratio: There are as many countries that show values above 50 as under 50. Positive-negative-change ratio: 18 countries …

Read More »

Read More »

Global Purchasing Manager Indices, Update December 10

Manufacturing PMIs are considered to be the most leading and important economic indicators. Jim O’Neill, Chairman of Goldman Sachs Asset Management, believes the PMI numbers are among the most reliable economic indicators in the world. BlackRock’s Russ Koesterich thinks it’s one of the most underrated indicators. Global Purchasing Manager Indices for the manufacturing industry December 3, 2012 …

Read More »

Read More »

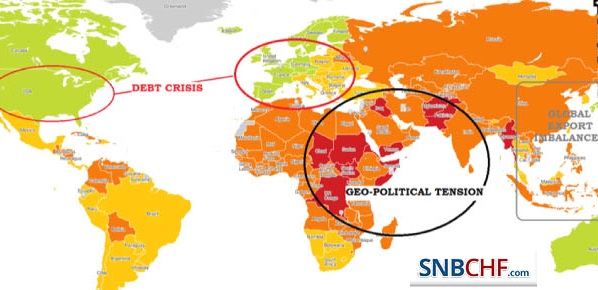

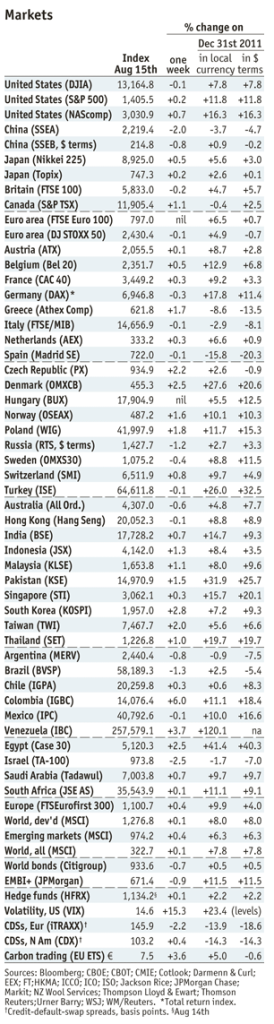

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 10

Submitted by Mark Chandler, from marctomarkets.com Key policy makers are preparing new efforts to address the deterioration of financial and economic conditions. This is seen reducing tail risks, which allowed the rally in risk assets to be extended, and undermined the dollar. China is providing new fiscal support. The ECB announced its new Outright Market …

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

The End of ECB Rate Cuts or Draghi against Weidmann to be Continued..

Even in the unlikely case of a fiscal union, the conflict “Draghi against Weidmann”, between the ECB and the Bundesbank will continue for years. The ECB mandate and european inflation figures do not allow for excessive ECB rate cuts or for state financing via the printing press, but Draghi wants to help his struggling …

Read More »

Read More »

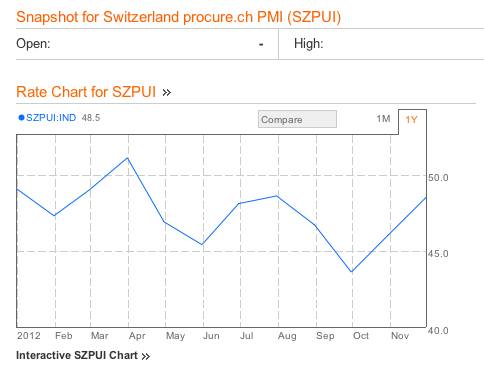

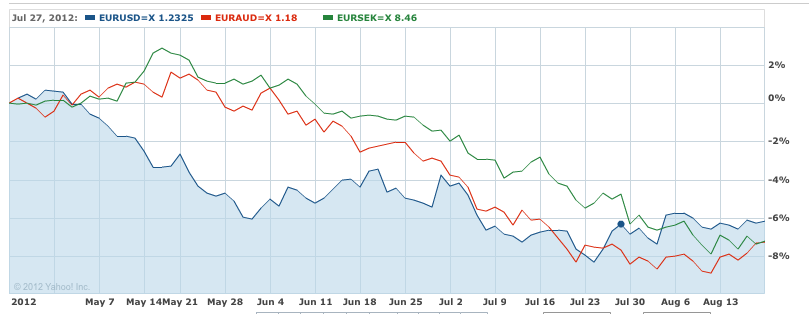

Why the euro has recovered? or are Markit PMI really reliable?

Here a follow-up of our contribution on Seeking Alpha written on August 15th, with the title “Are Markit PMIs really reliable?“. We recommended to go long the euro and the Swiss franc against the US dollar and sterling, because the Markit PMIs were not in line with trade balance data. Previously we suggested in … Continue...

Read More »

Read More »

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

Global PMIs Contracting More – Are Stocks Overvalued?

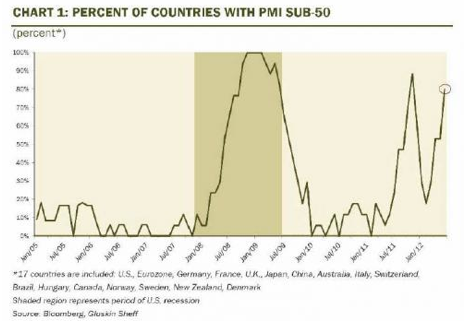

updated August 05,2012 We publish a detailed analysis of global PMIs and compare them with the main risk indicators S&P500, Copper, Brent and AUD/USD some days after most PMIs came out. Abstract: Thanks to positive US consumer confidence, stock markets are highly valued, whereas the Purchasing Manager Indices (PMIs) for the manufacturing industry are contracting …

Read More »

Read More »

Global Macro with all Global PMIs July 4th

updated July 4,2012 This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out. JP Morgan’s Global PMI: Click for details inside the table, History of composite PMI

Read More »

Read More »