Tag Archive: newslettersent

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony

Hungary’s Gold Repatriation Adds To Growing Protest Against US Dollar Hegemony. Hungarian National Bank (MNB) to repatriate 100,000 ounces gold from Bank of England. Follows trend of Netherlands, Germany, Austria and Belgium each looking to bring gold back to home soil. Hungary one of the smallest gold owners amongst central banks, with just 5 tonnes. Central bank gold purchases continue to be major drivers of gold market.

Read More »

Read More »

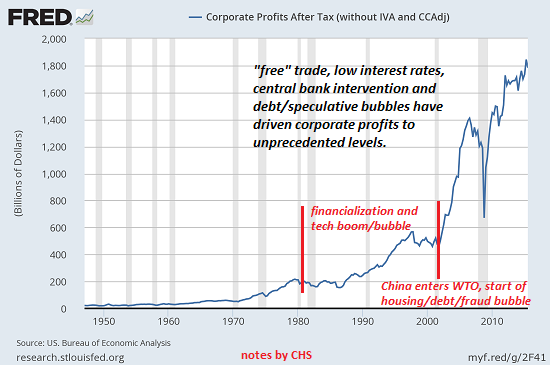

There is No “Free Trade”–There Is Only the Darwinian Game of Trade

Rising income and wealth inequality is causally linked to globalization and the expansion of Darwinian trade and capital flows. Stripped of lofty-sounding abstractions such as comparative advantage, trade boils down to four Darwinian goals: 1. Find foreign markets to absorb excess production, i.e. where excess production can be dumped. 2. Extract foreign resources at low prices. 3. Deny geopolitical rivals access to these resources.

Read More »

Read More »

Great Graphic: Potential Topping Pattern for Euro

The euro appears to be potentially carving out a topping pattern. Recall that after correcting lower last September and October, the euro rallied for three months through January before weakening 1.75% in February. That was its biggest decline since February 2017. The euro's high print was actually on February 16 near $1.2555, when it posted a key reversal, which is when it makes a new high for the move and then closes below the previous day's low.

Read More »

Read More »

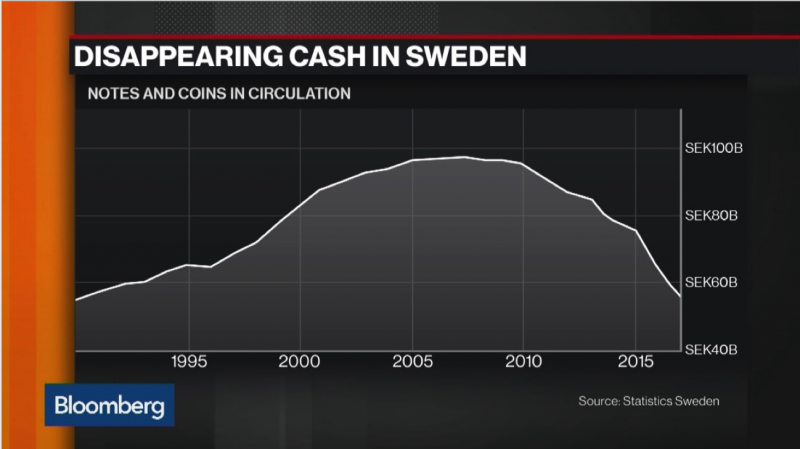

Gold Protects As Cashless Society Threatens Vulnerable

Gold Protects As Cashless Society Threatens Vulnerable. Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’. Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash. Cash usage in Sweden falling both as share of GDP and in nominal terms. Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona. Cashless is not a disincentive for illegal drug...

Read More »

Read More »

Switzerland – a definition of middle class

A recent survey calculates 60.1% of Switzerland’s population was middle class in 2015, a figure that has remained broadly stable since 1998, reaching its highest in 2009 (61.3%) and lowest in 2013 (56.8%). But what is middle class in Switzerland? According to Switzerland’s Federal Statistical Office, it is anyone living in a household with a gross income between 70% and 150% of the gross median income.

Read More »

Read More »

Raiffeisen chair resigns over scandal-tainted former CEO

Johannes Rüegg-Stürm, the chairman of the board of directors of Switzerland’s third-largest bank has resigned from his position with immediate effect. The bank hopes turn a new page following the arrest and criminal proceedings against former CEO Pierin Vincenz. A statementexternal link released by the bank on Thursday, said the move was intended to “preserve the long-term credibility of the bank”.

Read More »

Read More »

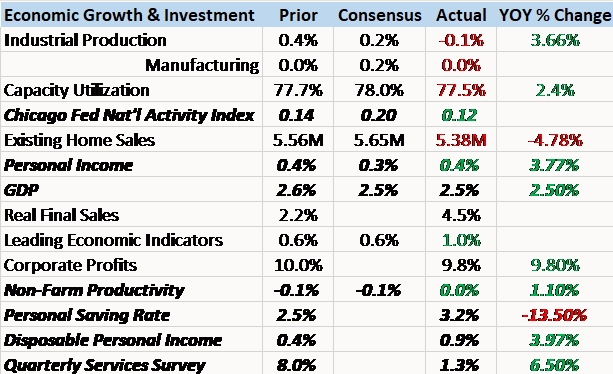

Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing.

Read More »

Read More »

FX Daily, March 13: Non-Economic Developments Dominate Ahead of US CPI

Many see the eruption of the scandal that threatens senior government officials as yen positive because it weakens those that ostensibly want to depreciate the yen through monetary policy. The scandal involves falsifying documents to conceal a sweetheart deal. The government sold of state-owned land to a school-operator, reportedly with connections to Prime Minister Abe's wife at an incredibly low price.

Read More »

Read More »

Weekly Technical Analysis: 12/03/2018 – USDJPY, EURUSD, GBPUSD, Gold

The USDCHF pair traded negatively yesterday to break 0.9488 and settles below it, which stops the positive effect of the recently mentioned bullish pattern and push the price to decline again, targeting heading towards 0.9373 initially.

Read More »

Read More »

How hot politics in the Balkans slowed the clock on your oven

Switzerland’s power grid is part of a large pool of ebbing and flowing electricity spanning 25 countries, known as the Continental European (EC) power grid. Enough electricity must be fed into it to keep it at a stable frequency. The EC’s magic number is 50 Hz. Maintaining this requires a carefully coordinated trans-national balancing act. When electricity consumption rises, power stations across the network must work harder.

Read More »

Read More »

Swiss politicians with links to health sector can still fully participate in health commissions

Lukas Reimann, a parliamentarian and member of the Swiss Peoples Party (UDC/SVP), fought to have parliamentarians paid by health companies partially excluded from government commissions dealing with health issues. He thinks vested interests are behind high health premiums and that cartels must be broken.

Read More »

Read More »

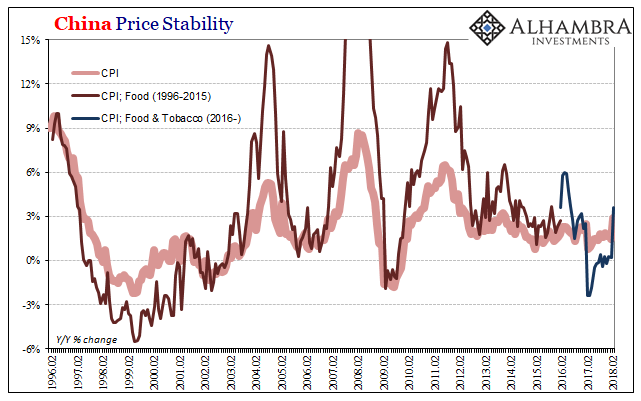

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »

Stock and Bond Markets – The Augustine of Hippo Plea

Most fund managers are in an unenviable situation nowadays (particularly if they have a long only mandate). On the one hand, they would love to get an opportunity to buy assets at reasonable prices. On the other hand, should asset prices actually return to levels that could be remotely termed “reasonable”, they would be saddled with staggering losses from their existing exposure. Or more precisely: their investors would be saddled with staggering...

Read More »

Read More »

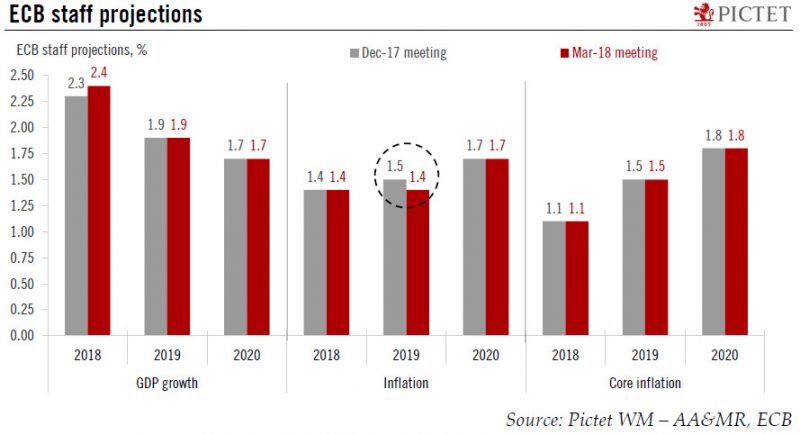

ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway.

Read More »

Read More »

FX Weekly Preview: Another Goldilocks Moment

Spring is around the corner in the Northern Hemisphere, and with it, a sense of a Goldilocks moment. Growth is sufficiently strong to see employment grow and absorb the economic slack. In the US, the participation rate of the key 25-54 aged demographic group has risen and now stands at 89.3%, the highest since 2010.

Read More »

Read More »

Drive for women in top jobs suffers setback

The percentage of women in top executive positions dropped slightly in Switzerland last year, a report has found. The annual survey by the Schilling human resource consultancyexternal link shows a 1% drop to 7% in 2017 compared with the previous year. In 2016, the share of women in company executive positions had risen by 2%, raising hopes of a strong increase over the years to come.

Read More »

Read More »

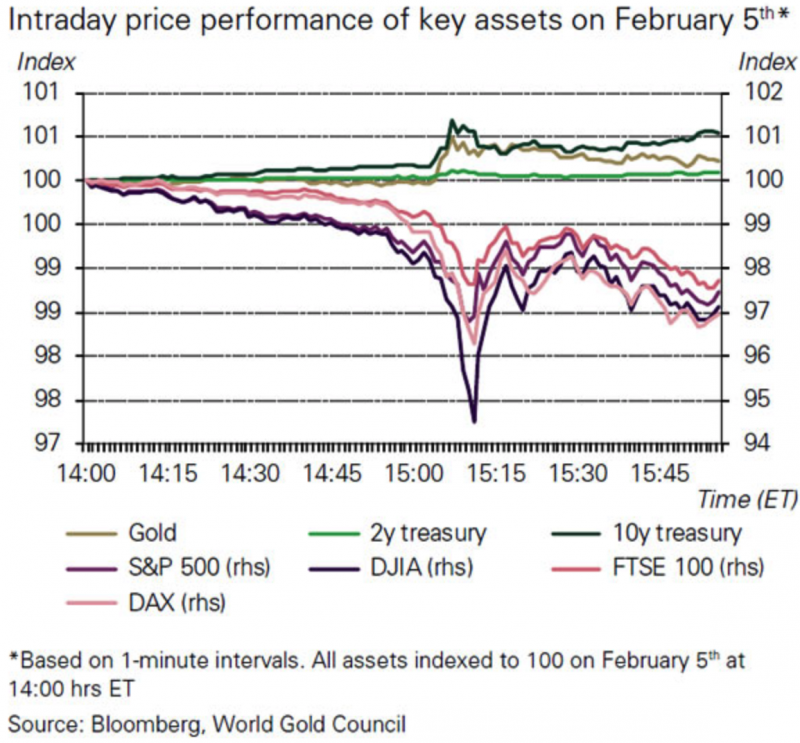

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk. Recent stock market selloff showed gold can deliver returns and reduce portfolio risk. Gold’s performance during stock market selloff was consistent with historical behaviour. Gold up nearly 10% in last year but performance during recent selloff was short-lived. The stronger the market pullback, the stronger gold’s rally. WGC: ‘a good time for investors to consider including or adding gold...

Read More »

Read More »

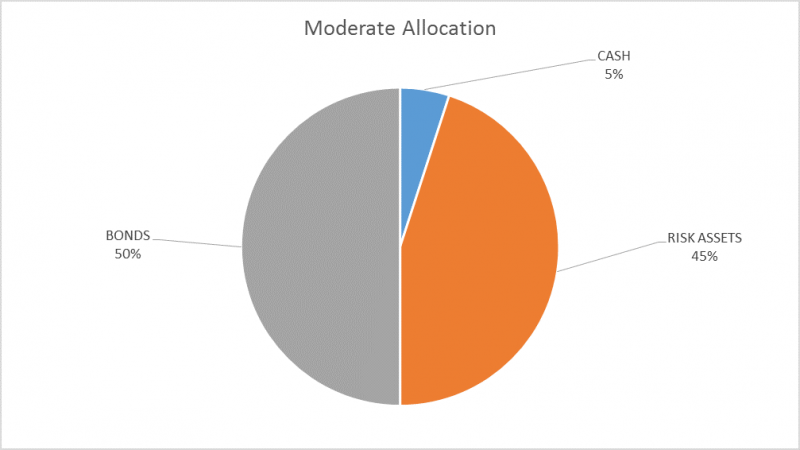

Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

Women’s Pension Crisis Highlights Dangers To Savers

Women’s Pension Crisis Highlights Dangers To Savers.

– International Women’s Day highlights the underreported UK Women’s pension crisis.

– 2.66 million affected by UK government’s change to state pension act.

– Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees.

– Changes by government highlights the counterparty risks pensions are exposed to.

– Global problem as pensions gap of developed...

Read More »

Read More »