Tag Archive: newslettersent

Decrypting the Appointment of John Bolton

So perhaps the dominant wing of the Deep State is finally willing to cut a deal with Trump. To many observers, the appointment of John Bolton as national security advisor is the functional equivalent of appointing the Anti-Christ--or maybe worse. Indeed, these observers would, when comparing the two, find grudging favor with the Anti-Christ.

Read More »

Read More »

What Fed Chair Powell Forgot to Mention

What are the chances of Federal Reserve Chairman Jerome Powell being wrong? The chances he’ll be wrong on the economy’s growth prospects, the direction of the federal funds rate, and inflation itself? Our guess is his chances of being wrong are quite high.

Read More »

Read More »

Imports curdle mood of Swiss cheese producers

Switzerland may be living up to its cliché as a cheese loving nation, but a growing appetite for foreign brands has alarmed local farmers. On average the Swiss consumed 21 kilograms of cheese per person last year, compared to 18 kilograms across Europe, according to figures published by the Swiss Farmers’ Associationexternal link on Wednesday.

Read More »

Read More »

Swiss authorities say Uber drivers should be treated as ‘employees’

For the first time, the Swiss State Secretariat for Economic Affairs (SECO) has clearly indicated that Uber taxi drivers should be classed as employees rather than self-employed. In an internal statement seen by the 10vor10 programme on Swiss public television, SECO gave the legal opinion that according to the conditions that bind drivers to Uber, they should be regarded as employees rather than independent contractors.

Read More »

Read More »

Global Trade War Fears See Precious Metals Gain And Stocks Fall

– Market turmoil as trade war concerns deepen and Trump appoints war hawk Bolton

– Oil, gold and silver jump as ‘Russia China Hawk’ Bolton appointed

– Oil up 4%, gold up 2.2% and silver up 1.6% this week (see table)

– Stocks down sharply – Nikkei down 4.5%, S&P 4.3% & Nasdaq 5.5%

– Bolton scares jittery markets already shell-shocked by US’ tariffs against China

– Currency wars and trade wars tend to proceed actual wars

– Gold now...

Read More »

Read More »

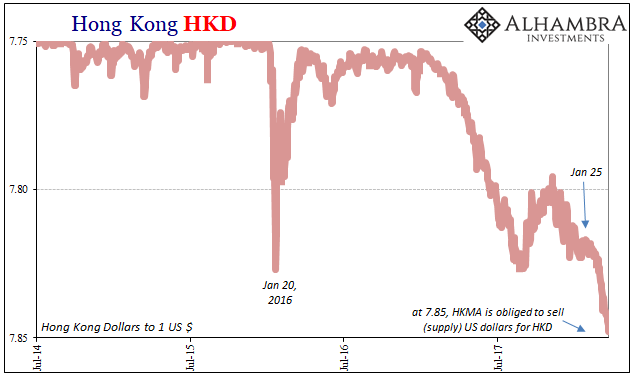

Just A Few More Pips

On Page 1, Chapter 1 of the Central Banker Crisis Handbook it states very clearly, “do not make it worse.” It’s something like the Hippocratic oath where monetary authorities must first assess what their actions might do to an already fragile system. It’s why they take great pains to try and maintain composure, appearing calm and orderly while conflagration rages all around. The last thing you want to do is confirm the run.

Read More »

Read More »

US Stock Market – How Bad Can It Get?

In view of the fact that the stock market action has gotten a bit out of hand again this week, we are providing a brief update of charts we have discussed in these pages over the past few weeks (see e.g. “The Flight to Fantasy”). We are doing this mainly because the probability that a low probability event will actually happen has increased somewhat in recent days.

Read More »

Read More »

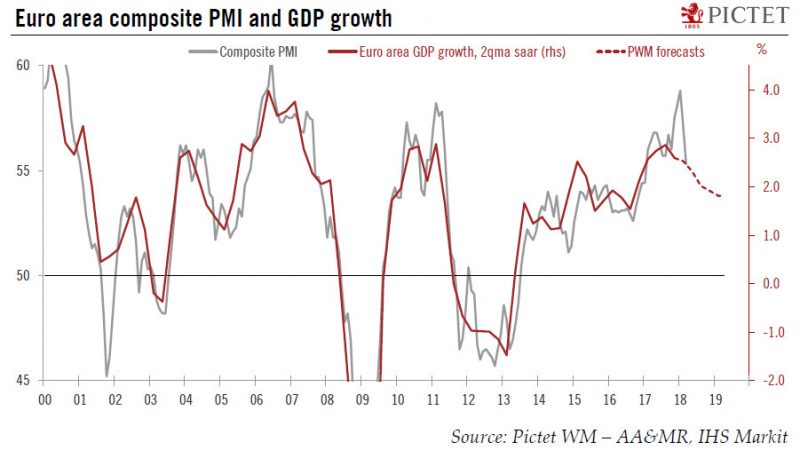

Euro area Flash PMIs: “Growing pains” but no reason to panic

Today’s first batch of euro area March business surveys looks worrying at first sight. The drop in the euro area composite PMI index, from 57.1 to 55.3 in March (consensus: 56.8), was the second one in a row and the largest monthly decline in six years. New orders fell to a 14-month low. The correction in business sentiment was predominantly driven by the manufacturing sector, which could reflect broader concerns of a trade war.

Read More »

Read More »

Freight losses fail to dampen state railway profits

The Swiss Federal Railway’s net profit increased by CHF18 million ($19 million) to CHF399 million ($418 million) last year despite posting a loss in its troubled freight division. The company confirmed a previous decision to cut 800 freight jobs but plans to reduce certain prices for its increasing number of customers, it announced in its annual report on Tuesday.

Read More »

Read More »

Salt set to enter the landline telecoms market

Mobile telephone operator Salt has announced that it will begin offering landline services in Switzerland, in a move set to intensify competition amongst current providers. Salt, which is already an established player in the mobile market, announced on Tuesdayexternal link that it would be proposing “a complete range of telecommunication services in Switzerland, including a ‘triple play’ offer based on high-speed broadband technology”.

Read More »

Read More »

Gold +1.8 percent, Silver +2.5 percent As Fed Increases Rates And Trade War Looms

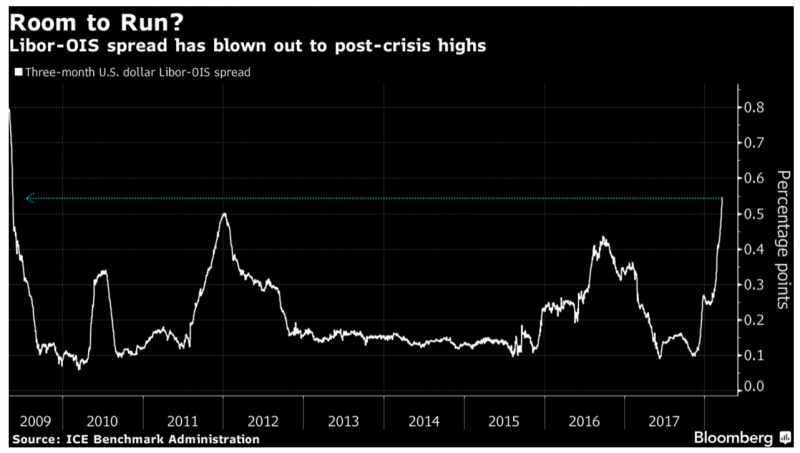

Gold gained 1.8% and silver 2.5% to $1,333/oz and $16.60/oz yesterday. Gold climbs as Fed increases interest rates by 0.25% – now 1.5% to 1.75% range. Dovish Fed Chair Powell plans fewer than expected rate hikes in 2018. Markets disappointed at lack of hawkish comments from new Fed Chair. Dollar LIBOR rises to highest level since November 2008 – $200 trillion worth of dollar-denominated financial products including mortgages based off LIBOR.

Read More »

Read More »

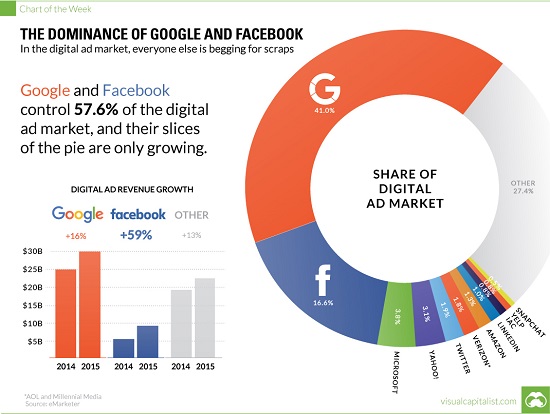

Should Facebook and Google Pay Users When They Sell Data Collected from Users?

Let's imagine a model in which the marketers of data distribute some of their immense profits to the users who created and thus "own" the data being sold for a premium. It's not exactly news that Facebook, Google and other "free" services reap billions of dollars in profits by selling data mined/collected from their millions of users. As we know, If you're not paying for it, you're not the customer; you're the product being sold, also phrased as if...

Read More »

Read More »

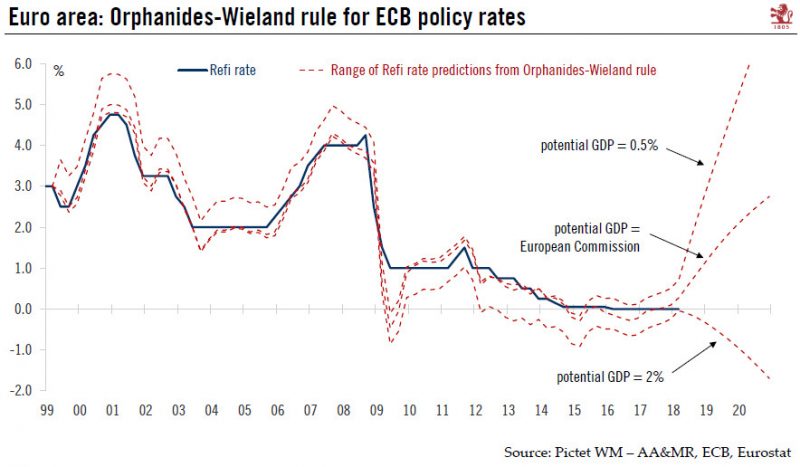

Europe chart of the week – monetary policy

Much of recent ECB dovish rhetoric has been building around the (not-sonew) idea that potential growth might be higher than previously thought, implying a larger output gap and lower inflationary pressure, all else equal. The argument is both market-friendly and politically welcome – what we are seeing is the early effects of those painful structural reforms implemented during the crisis. Inflation would be low for good reasons.

Read More »

Read More »

Cool Video: Let’s Not Declare Trade War Yet

Trade tensions have risen. No doubt about it, but to consider this a trade war is premature. We should not pretend that this is the first time that the US adopted protectionist measures that ensnarled are military allies. We have been to this dance before.

Read More »

Read More »

US trade disputes indirectly threaten Swiss economy

Ongoing global trade disputes involving the United States are casting a potential shadow over Swiss economic growth, along with other international events, such as the Italian elections and Brexit. However, the Swiss economy is forecast to expand 2.4% this year and 2% in 2019.

Read More »

Read More »

Raising Switzerland’s retirement age – like death and taxes

Last week, State Councillor Peter Hegglin (PDC/CVP) withdrew his motion demanding Switzerland’s retirement age automatically rise with life expectancy. He argues that Switzerland urgently needs to find a way to ensure the financial health of its pension system and raising the retirement age is the main way to do this.

Read More »

Read More »

Credit Concerns In U.S. Growing As LIBOR OIS Surges to 2009 High

Key Metric LIBOR OIS Signals Major Credit Concerns. Widening of the spread between LIBOR OIS (overnight index swap) rate raises concerns. Spread jumped to 9 year widest spread, rising to 54.6bps, most since May 2009. Libor recently moved to over 2% for first time since 2008. Wider spread usually associated with heightened credit concerns.

Read More »

Read More »

Incrementum’s New Cryptocurrency Research Report

As we noted on occasion of the release of the first Incrementum Crypto Research Report, the report would become a regular feature. Our friends at Incrementum have just recently released the second edition, which you can download further below (if you missed the first report, see Cryptonite 2; scroll to the end of the article for the download link).

Read More »

Read More »

Swiss central bank records huge profits after franc slide

The Swiss National Bank (SNB) was less active on the foreign exchange markets last year, acquiring CHF48.2 billion ($50.8 billion) in foreign currency to weaken the franc. On Thursday, the central bank nonetheless confirmed massive profits on currency holdings in 2017. In 2017, the SNB purchased CHF48.2 billion in foreign currency to stop the Swiss franc appreciating – down from CHF67.1 billion in 2016.

Read More »

Read More »

FX Daily, March 22: Dollar Trades Off

The US dollar has not recovered from the judgment that yesterday's that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes. Powell is comfortable with the broad policy framework that has been established but seemed to have little time for the summing up of the individual forecasts (dot plot).

Read More »

Read More »