Tag Archive: newslettersent

Weekly Emerging Markets: What has Changed

Bank Indonesia signaled it may pause its easing cycle. Senior Deputy Governor Adityaswara said “We want to see the impact on growth and inflation before we do the next cut.” Elsewhere, Governor Martowardojo said that the central bank must be carefu...

Read More »

Read More »

Great Graphic: WSJ survey of Fed Expectations

This Great Graphic shows the results of the last three Wall Street Journal survey of business and academic economists on the outlook for Fed policy. The key take away is that despite all the talk and ink spilled on the shifting Fed stance and the split within the FOMC, economists views did not change much … Continue...

Read More »

Read More »

Why Janet Yellen Can Never Normalize Interest Rates

Bill Bonner explains why the Fed will normalize interest rates.

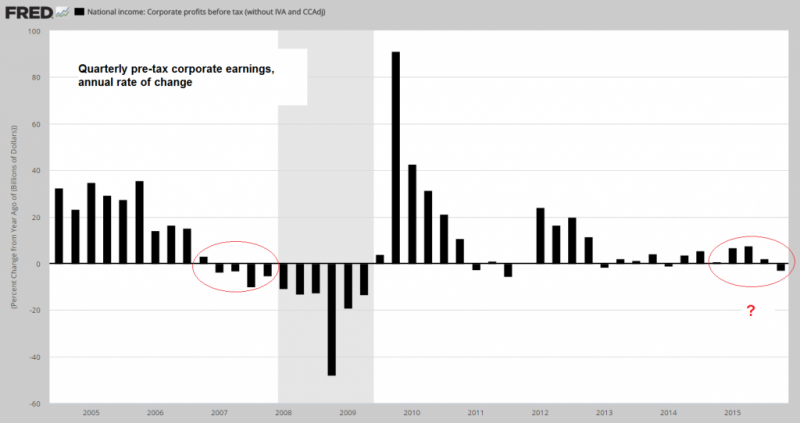

With higher rates, Yellen risks corporate profits and bond defaults.

With higher rates, Yellen risks not only bond defaults, but also bank defaults.

Read More »

Read More »

Great Graphic: Head and Shoulders in Dollar-Yen

The old head and shoulders pattern in the dollar against the yen is back in vogue. We first pointed it out in the first week of January here.

Recall the details. The neckline is drawn around JPY116.30 and measuring objective is near JPY107.00....

Read More »

Read More »

Dutch Referendum: Devil is not in the Details

In what is possibly one of the under-appreciated political events of the year, the Netherlands holds a plebiscite today on an associational agreement with Ukraine that has already been approved by the Dutch parliament, the European Parliament and all other 27 EU members. When stated so baldly, it is difficult to see what is at …

Read More »

Read More »

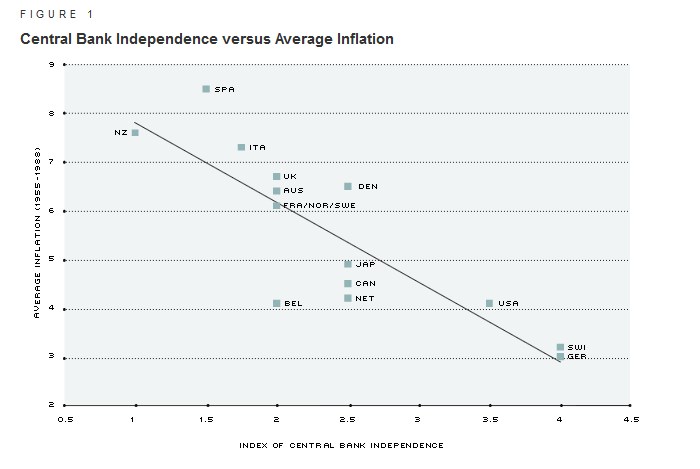

Central Bank Independence in Switzerland: A Farce

articles by Marc Meyer, one of the most critical voices against the SNB.

This post explains

--- That the SNB does not understand what assets and liabilities are - and therefore - it speculates with massive leverage.

--- The difference between good and bad deflation

--- Both the SNB and the Swiss government do what some Swiss exporters want. Therefore, the formerly admired central bank independence in Switzerland has become a farce.

Read More »

Read More »

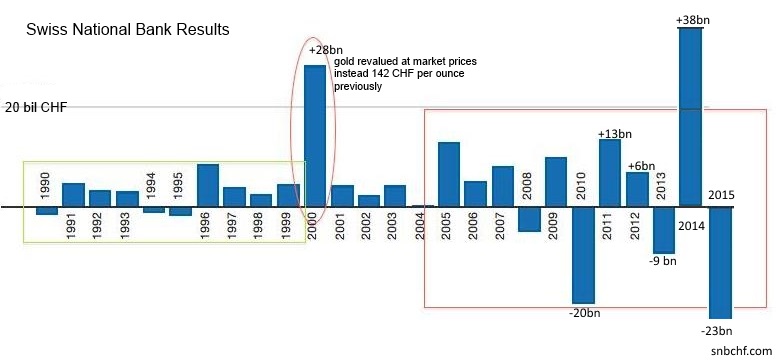

Swiss National Bank Results 2015 and Comments

The Swiss National Bank (SNB) is reporting a loss of CHF 23.3 billion for the year 2015 (2014: profit of CHF 38.3 billion). The loss on foreign currency positions amounted to CHF 19.9 billion. A valuation loss of CHF 4.2 billion was recorded on gold holdings. The profit on Swiss franc positions was CHF 1.2 billion.

Read More »

Read More »