Tag Archive: newslettersent

Great Graphic: CAD Takes out Trendline

CAD BGN Curncy It has been painful trying to pick a bottom of the US dollar against the Canadian dollar. But now a 4-5 point downtrend from the secondary high in late-January is being violated today. It is found near CAD1.2785 today. Intraday penetration is one thing, but some models may take the signal on … Continue reading...

Read More »

Read More »

Great Graphic: Odds of President Trump Rise (Predictit)

TRUMP . USPREZ16 This Great Graphic is a 90-day history of the “betting” at PredictIt that Trump becomes the new US President. With Cruz suspending his campaign, the odds of Trump have risen just above 40%. The US national interests and challenges to those interests do not change much from year-to-year, and this may help …

Read More »

Read More »

Greenback Firmer, but has it Turned?

There is one question many investors are asking after noting that with Cruz dropping out of the Republican primary, Trump has secured the nomination, and that is whether the dollar has turned. The greenback has extended yesterday’s reversal higher. The euro had briefly poked through $1.16 and closed on its lows a little below $1.15. …

Read More »

Read More »

May Day Mayhem – Discontent on the Continent

Europe’s Political Class Under Fire All over Europe not only religious and national holidays are observed, but also a socialist holiday, which we always thought was a bit strange – and in a way quite telling (as far as we know, there is no holiday ...

Read More »

Read More »

Commodities – Will the Rally Continue?

Pros and Cons The recent rally in commodity prices has surprised many market participants and has greatly supported the stock market’s rebound. It has also made bulls out of a number of former stock market bears, as one of its side effects was to c...

Read More »

Read More »

Two Decisions from Europe

It might not be on investors' calendars, but European officials will take steps toward addressing two issues tomorrow. First, the EC will make a preliminary recommendation of visa-free travel in the Schengen area for Turkish passport holders. S...

Read More »

Read More »

Dollar Continues to Push Lower

The US dollar’s downtrend is extending. The euro traded above $1.16 for the first time since last August. With Japanese markets closed for the second half of the Golden Week holidays, perhaps participants felt less hampered by the risk of intervention and pushed the dollar to almost JPY105.50. Despite an unexpectedly large fall in the …

Read More »

Read More »

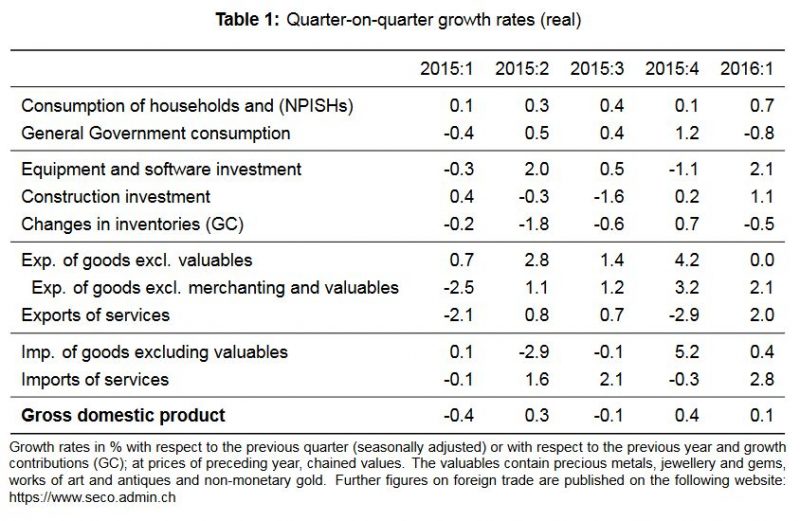

Gross domestic product in the 1st quarter 2016

Switzerland’s real gross domestic product (GDP) grew by 0.1% in the 1st quarter of 2016.* GDP was underpinned by consumption expenditure from private households and investments in construction and equipment but curbed slightly by government consumption. On the production side, the picture was mixed: whilst financial services and the hotel and catering industry saw a decline, value added in manufacturing,

Read More »

Read More »

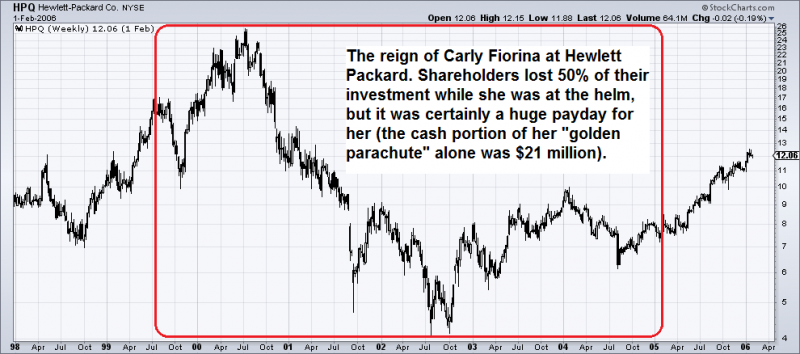

Carly Fiorina: Running Mate Turns Into Fall Girl

Ted Cruz picked Carly Fiorina as “vice-presidential running mate”. Shareholders lost 50% when Fiorina was leading HP. Will Fiorina help Cruz losing?

Read More »

Read More »

Great Graphic:US Rents and Core Inflation

Shelter inflation in the U.S. is at 3.2% per year, but only 1% in Europe. It is 33% of the US CPI basket, but only 6.4% of the euro zone. This leads to massive distortions in CPI inflation, and to wrong bets of investors and FX traders.

Read More »

Read More »

China: Services Companies Benefit on Lower Tax with VAT introduction

Yesterday, China announced one of the most important tax reforms of the past twenty years. It is replacing a business tax on gross revenue for non-manufacturing companies with a VAT. Manufacturing companies have been subject to a VAT approach subject

Read More »

Read More »

Emerging Market Preview for the Week Ahead

EM ended the week on a firm note, which should carry over into this week. The biggest near-term risk to EM is the US jobs data on Friday, as the weekly claims data points to another strong gain. Otherwise, the global liquidity backdrop remains EM-supportive. Thailand reported April CPI earlier today. It rose 0.07% year-over-year. …

Read More »

Read More »

FX Daily, May 02: New Month, Same Heavy Dollar

In quiet turnover, with China, Hong Kong, Singapore and London markets closed, the US dollar is trading with a heavier bias against all the major currencies. Lower commodity prices, including oil and copper, appears to be taking a toll on some emerging market currencies, including the South African rand. Japanese markets were closed last Friday …

Read More »

Read More »

How Unsound Money Fuels Unsound Government Spending

Stefan Gleason shows the major slides that may predict a collapse of the dollar. The Trade Deficit after the abandonment of gold, the explosion of entitlements like social security, Medicare, Obamacare, subsidies and the explosion of the federal deficit to 1 trillion in 2022. The reason: Unsound money.

Read More »

Read More »

Bank of Japan: The Limits of Monetary Tinkering

After waking up on Thursday, we quickly glanced at the overnight market action in Asia and noticed that the Nikkei had tanked rather noticeably. Our first thought upon seeing this was “must be the yen” – and so it was. The BoJ cannot manipulate the yen anymore.

Read More »

Read More »

Another Strong Jobs Report may Not be Sufficient to Reignite Dollar Rally

The die is cast. The Federal Reserve is on an extended pause after the rate hike last December. The market remains convinced that the risk of a June hike are negligible (~ less than 12% chance). The ECB has yet to implement the TLTRO and cor...

Read More »

Read More »

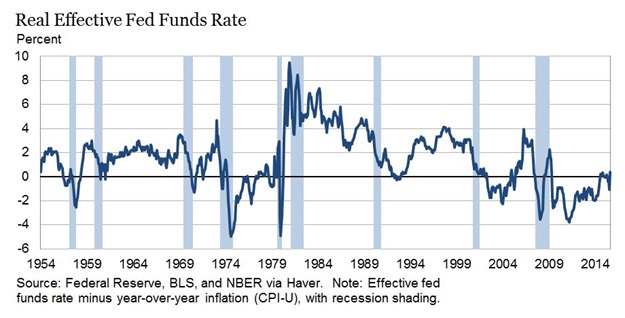

Gold And Negative Interest Rates

Submitted by Dan Popescu via Acting-Man.com,

The Inflation Illusion

We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed h...

Read More »

Read More »

Weekly Speculative Postions: Euro and Yen Exposure Trimmed ahead of FOMC and BOJ

Speculators in the futures market made mostly small position adjustments in the sessions leading up to the FOMC and BOJ meetings. During the Commitment of Traders reporting week ending April 26, the largest adjustment of speculative position in the currency futures was the 12.5 k build of gross long Australian dollar contracts. The accumulation …

Read More »

Read More »