Tag Archive: newslettersent

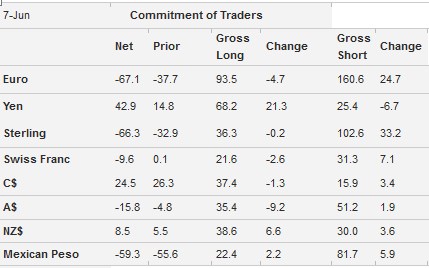

Weekly Speculative Positions after Uneventful ECB and Surprisingly Weak US Jobs

Price action shows a increase of the Swiss franc after the bad US payrolls report. Commitments of traders, however, indicate a move to a short CHF position of 9600 x 100k contracts against the dollar. We must separate speculative CHF positions from inflows into CHF cash, CHF stocks, bonds and real-estate, what we call "real financial flows". These will be revealed on Monday, with the SNB release of sight deposits, the counter-position of real...

Read More »

Read More »

Faber: “Switzerland doing much better than any other country in Europe. So Britain should do the same?”

The European Union is an "empire that is hugely bureaucratic," warns Marc Faber, telling CNBC that he thinks that "a Brexit would be bullish for global economic growth," because "it would give other countries incentive to leave the badly organized EU...

Read More »

Read More »

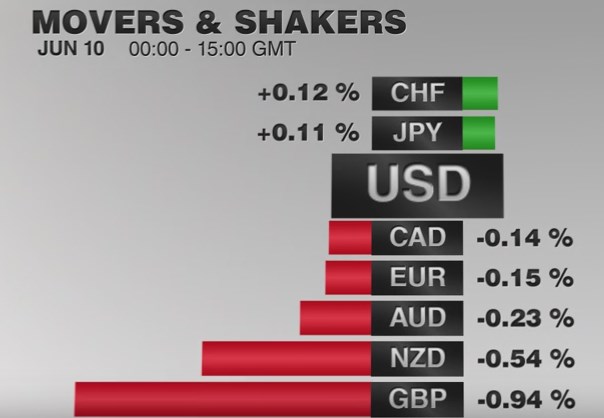

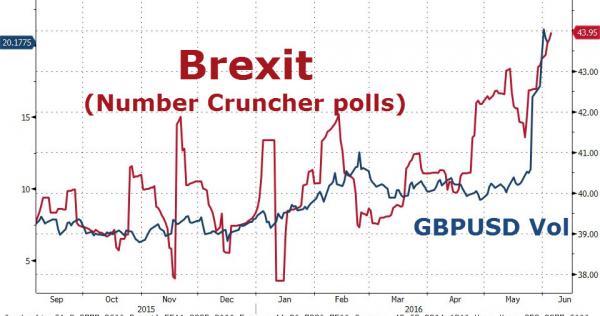

FX Daily, June 10: Yen and Swiss Franc maybe Drawing Support from Brexit Fears

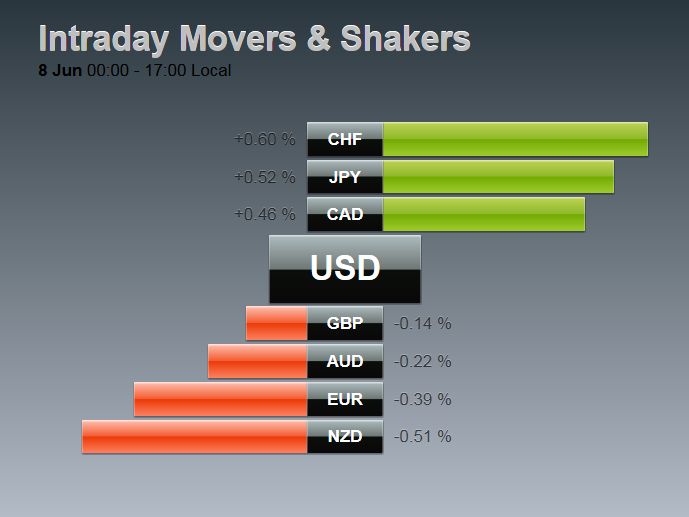

Once again, CHF was one of the strongest performers on the FX market. Next Monday we will report how much the Swiss National Bank had to intervene in our regular "Weekly SNB sight deposits" report. For the week, it is the dollar-bloc and franc that have maintained weekly gains.

The US dollar weakened in the first half of the week as

participants continued to react to the shockingly poor jobs report and shift in Fed...

Read More »

Read More »

Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly...All-time highs within reach... everything is awesome...wait what...

Quite a week:

Gold +5.25% in last 2 weeks - best run in 4 months

Silver +5.65% this week - best week since May 2015

Copper -4% this week to lowest week...

Read More »

Read More »

Emerging Markets: What has Changed

China granted US asset managers a CNY250 bln ($38 bln) quota under the existing QFII system

Bank of Korea surprised the market by delivering a 25 bp rate cut to 1.25%

Oman issued its first global ...

Read More »

Read More »

A Darwin Award for Capital Allocation

Beyond Human Capacity Distilling down and projecting out the economy’s limitless spectrum of interrelationships is near impossible to do with any regular accuracy. The inputs are too vast. The relationships are too erratic. The economy – comple...

Read More »

Read More »

Politics and Economics

Many people understand politics and economics to be two different disciplines. I remember in graduate school more than two decades ago, many colleagues and professors operationally defined political economy as how politics, by which they meant the state, screws up economics. I spoke at the Fixed Income Leaders Summit earlier this week and teased that many seemed …

Read More »

Read More »

With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates.

Read More »

Read More »

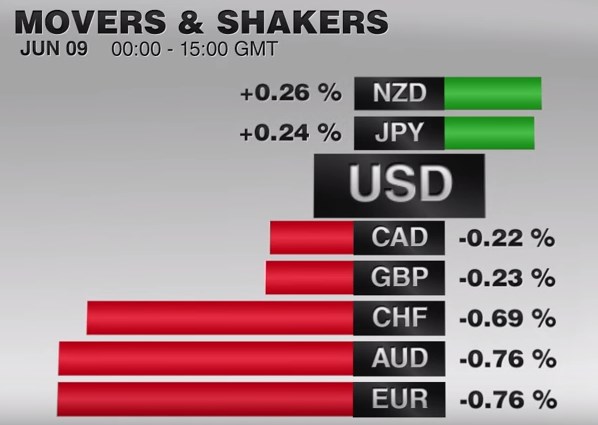

FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD.

The US dollar is posting modest upticks against most of the

European currencies and the Canadian and Australian dollars. However, it has fallen against the yen and taken out the

recent low, leaving little between it and the May 3 l...

Read More »

Read More »

Wealth Management Products: What Could Possibly Go Wrong?

Wealh Management Products issuance equaled $1.1 trillion in 2015, a nearly 75% jump on the prior year and equaling 40% of the total growth in credit. Almost one-third of the WMP were bought by credit institutions for inclusion in other WMP – WMP Squared!

Read More »

Read More »

The Trump Risk: Will President Trump Trigger a Recession?

“The economic consequences of a Trump win would be severe,” claims Mr. Summers in the headline. But he has no way of knowing what the consequences would be, let alone if they would be severe. Would they be worse than if Ms. Clinton were elected? No one knows.

Read More »

Read More »

Need Safe havens: CHF or Gold?

In times of negative interest rates and falling earnings per share, gold is the ultimate safe haven. Due to negative rates, it is not the Swiss Franc.

Read More »

Read More »

Global Peace Index: Only 10 countries not at war (among them Switzerland)

The world is becoming a more dangerous place and there are now just 10 countries which can be considered completely free from conflict, according to authors of the 10th annual Global Peace Index, among them Switzerland.

Read More »

Read More »

FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

Once again the Swiss Franc appreciates both against EUR and USD.

The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596.

The foreign exchange market is quiet. The euro remains confined to the

narrow range seen on Monday between $1.1325 and $1.1395. We continue to

look for higher levels near-term as the

drop from May 3 (~$1.1615) to May 30 (just be...

Read More »

Read More »

Cool Video: Bloomberg Television–All about the Periphery

I am in Boston to attend the Fixed Income Leaders Summit and was invited to join Alix Steel, Joe Weisenthal, and Scarlet Fu on Bloomberg TV. We talked about the peripheral in Europe, especially Portugal, Italy and Spain. Each has a pressing issue. In Portugal, yields have not fallen as much as in other … Continue reading »

Read More »

Read More »

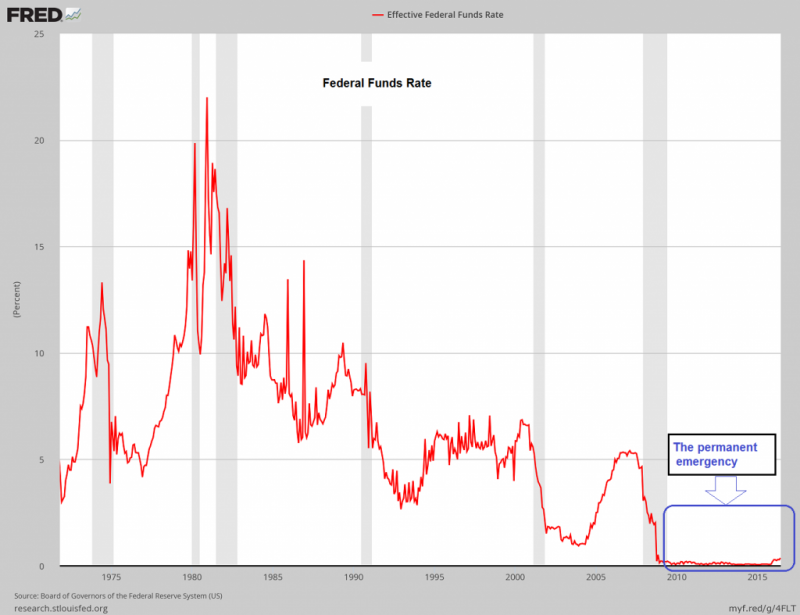

Presidential Elections and Fed Policy: How Close is Close?

The most important element in next week’s FOMC meeting may come from the dot plot and whether Fed officials back away from the two hikes thought appropriate in March. When looking the schedule of FOMC meetings, and understanding that when the Fed says “gradual” to describe the normalization process, it does not mean hiking at …

Read More »

Read More »

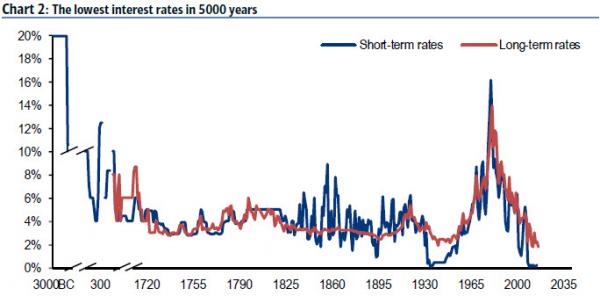

Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financi...

Read More »

Read More »

Free Speech Under Attack

Offending People Left and Right Bill Bonner, whose Diaries we republish here, is well-known for being an equal opportunity offender – meaning that political affiliation, gender, age, or any other defining characteristics won’t save worthy targets ...

Read More »

Read More »

Janet Yellen – Backtracking Again

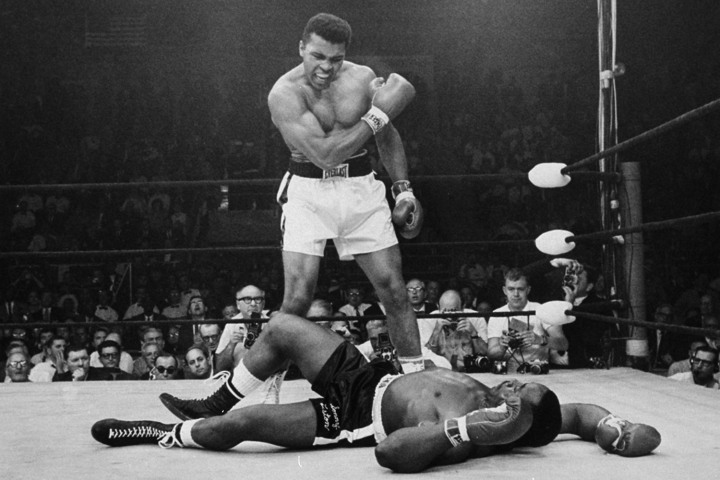

Muhammad Ali Could Take a Punch BALTIMORE – You had to admit. Muhammad Ali could take a punch. Unlike Donald Trump, Dick Cheney, George W. Bush, and Bill Clinton, he was a real war hero. He stood up and faced his enemies on the draft board, rather ...

Read More »

Read More »