Tag Archive: newslettersent

Emerging Markets: Week Ahead Preview

EM initially benefitted from the FOMC decision, but softened into the weekend. One culprit was lower oil prices, as reports suggest an output deal is unlikely at the OPEC meeting this week in Algeria. But it wasn’t just EM, as the greenback closed firmer against the majors as well. We still believe that risk and EM should do fine over the next few weeks, as the Fed basically set a two-month window of steady rates.

Read More »

Read More »

Great Causes, a Sea of Debt and the 2017 Recession

NORMANDY, FRANCE – We continue our work with the bomb squad. Myth disposal is dangerous work: People love their myths more than they love life itself. They may kill for money. But they die for their religions, their governments, their clans… and their ideas.

Read More »

Read More »

Juncker eyes Swiss-specific EU immigration deal despite Brexit

European Commission President Jean-Claude Juncker said he was aiming to solve a two-year-old dispute with Switzerland over immigration in a country-specific manner even in the wake of Brexit. The Swiss government has been at pains to implement restrictions on European Union newcomers decided upon in a 2014 referendum without annulling an economically important set of treaties with the 28-country bloc.

Read More »

Read More »

FX Weekly Preview: Politics to Overshadow Economics in the Week Ahead

The major central banks have placed down their markers and have moved to stage left. There are the late-month high frequency data, which pose some headline risks in the week ahead. The main focus for most investors will be on several political developments. The first US Presidential debate is wild card, in the sense that the outcome is unknown. In recent weeks, the polls have drawn close. In early August, Nate Silver’s fivethirtyeight.com, the gold...

Read More »

Read More »

European mobile roaming charges to be axed. Pity the Swiss (who just have a Swiss phone)

On Friday the European Commission announced that EU residents should soon be able to make calls and use data without any additional charges while travelling in another EU country. Countries outside the EU, but within the European Economic Area (EEA), including Norway, Iceland, and Switzerland’s neighbour Liechtenstein, will be included in the deal.

Read More »

Read More »

Don’t Bet on Deflation Lasting Forever

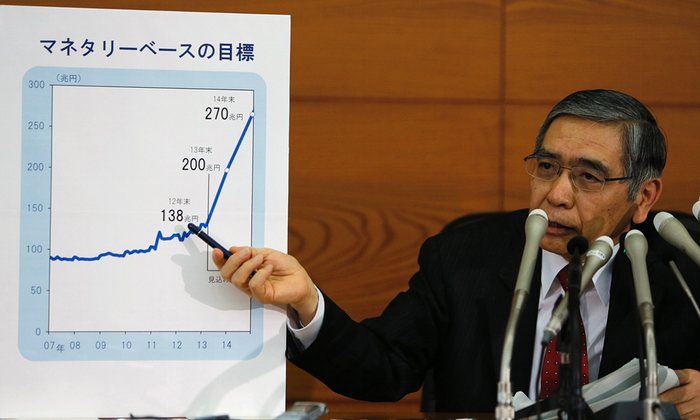

Japan’s stock market crashed in 1989. Since then, the no-luck Japanese have had sluggish growth, recession, and on-again/off-again deflation. For more than a quarter-century, the gears of Japan, Inc. have turned slowly. But will it last forever?

Read More »

Read More »

Emerging Markets: What has Changed

In the EM local currency bond space, Brazil (10-year yield -36 bp), Turkey (-26 bp), and Hungary (-17 bp) have outperformed this week, while Ukraine (10-year yield +9 bp), Mexico (+2 bp), and China (flat) have underperformed.

Read More »

Read More »

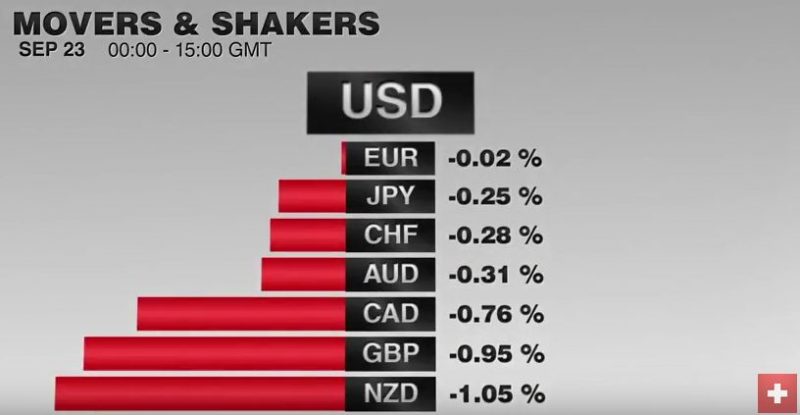

FX Daily, September 23: It is Friday and the Dollar is Firmer Again

As Nassim Taleb instructed, we should not be fooled by randomness. If you see six red results in a row at a roulette table, do not conclude the game is rigged. If you flip a coin, and it is tails six consecutive times, the contest is not necessarily rigged.

Read More »

Read More »

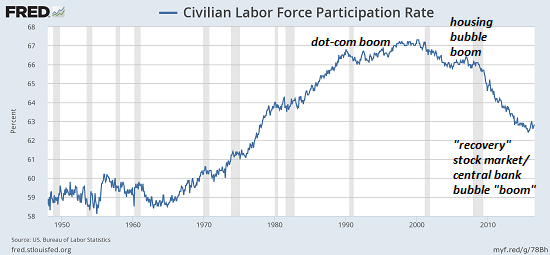

Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed ...

Read More »

Read More »

What If We’re in a Depression But Don’t Know It?

Stick it to the Establishment by becoming a $1/month patron of this wild and crazy site via patreon.com.

Read More »

Read More »

World markets rally as cheap money policy continues

The Swiss Market Index is set to finish the week notably higher, although under-performing global stocks amid optimism that central banks will continue to support equities by keeping interest rates at historic lows and providing markets with additional liquidity.

Read More »

Read More »

FX Daily, September 22: Swiss Franc Strongest Currency Again

Once again the Swiss Franc was the strongest. The EUR/CHF depreciated to 1.0875. As said yesterday, the reasons: the Fed and the strong Swiss trade balance.

Read More »

Read More »

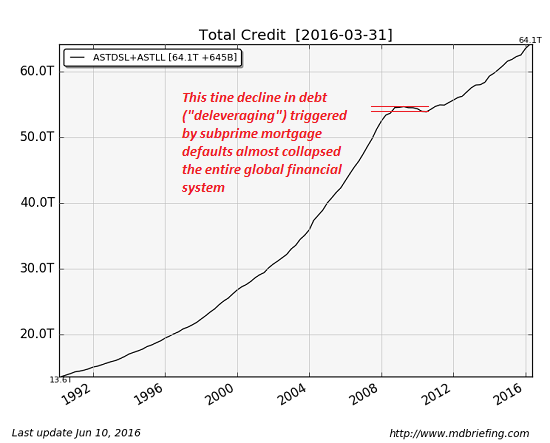

Why the Coming Wave of Defaults Will Be Devastating

In an economy based on borrowing, i.e. credit a.k.a. debt, loan defaults and deleveraging (reducing leverage and debt loads) matter. Consider this chart of total credit in the U.S. Note that the relatively tiny decline in total credit in 2008 caused by subprime mortgage defaults (a.k.a. deleveraging) very nearly collapsed not just the U.S. financial system but the entire global financial system.

Read More »

Read More »

Julius Baer CEO says Asia revenue may excede Europe’s in 5 years

Julius Baer Group Ltd. said Asia may overtake Europe as its biggest revenue-generating region, as the Swiss wealth manager steps up hiring in Hong Kong and Singapore. “In the next five years, Asia could be the biggest region for us if we grow at double-digit” rates, Chief Executive Officer Boris Collardi said Wednesday in an interview in Singapore. More than half of about 200 new bankers that Julius Baer plans to hire this year will be based in...

Read More »

Read More »

Swiss still the world’s wealthiest, says report

Largely due to a flood of central bank liquidity, global private financial assets have grown by 61% over the seven years since the financial crisis, almost twice the growth rate of economic output, says a report from the German Insurance giant Allianz. This has boosted the wealth of those who own shares.

Read More »

Read More »

FX Daily, September 21: BOJ Can’t Weaken Yen, Fed keeps Rates Unchanged, CHF Stronger

The EUR/CHF accelerated its decline since yesterday's strong Swiss trade balance data. The second reason was certainly the Fed decided to keep rates unchanged.

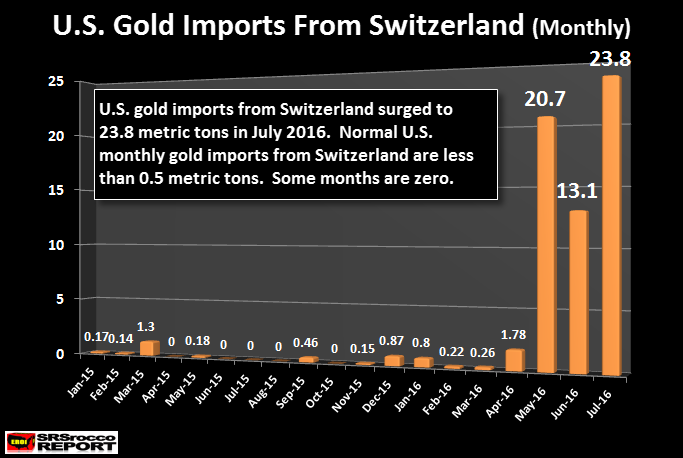

We know that the Swiss Franc has similar "counter-dollar" status as gold.

Read More »

Read More »

Swiss economy slowly gains momentum but risks remain

In a report published by SECO, a group of economy experts working for Switzerland’s federal government, says it anticipates an acceleration in economic growth in Switzerland from 0.8% in 2015 to 1.5% in 2016 and 1.9% in 2017. Along side this they expect unemployment to rise from 3.3% in 2015, to an annual average of 3.6% in 2016, before falling again to 3.4% in 2017. However, they also see risks.

Read More »

Read More »

Why should you Buy Government Bonds with Negative Yields?

A question worth asking considering the rather large amount of them knocking about at the moment. According to JPM, the total universe of government bonds traded with a negative yield was $3.6tr last week or 16 per cent of the JPM Global Government Bond Index. It’s an answer in itself, really.

Read More »

Read More »

Swiss watch exports fall for fourteenth straight month

The Swiss watch industry is strongly correlated with the growth in Asia. While the chemical and pharmaceutical industry (the "Basel companies") export a lot into the United States. The firmer is currently weakening, while the latter profits on the stronger dollar and "Obamacare demand". As usual, the Swiss press only speaks about the weak industries, while the latter has new export records.

Read More »

Read More »