If it isn’t a Depression, it’s a very close relative of a Depression.

Just for the sake of argument, let’s ask: what if we’re in a Depression but don’t know it? How could we possibly be in a Depression and not know it, you ask? Well, there are several ways we could be in a Depression and not know it:

1. The official statistics for “growth” (GDP), inflation, unemployment, and household income/ wealth have been engineered to mask the reality

2. The top 5% of households that dominate government, Corporate America, finance, the Deep State and the media have been doing extraordinarily well during the past eight years of stock market bubble (oops, I mean boom) and “recovery,” and so they report that the economy is doing splendidly because they’ve done splendidly.

I have explained exactly how official metrics are engineered to reflect a rosy picture that is far from reality.:

I also also asked a series of questions that sought experiential evidence rather than easily gamed statistics for the notion that this “recovery” is more like a recession or Depression than an actual expansion:

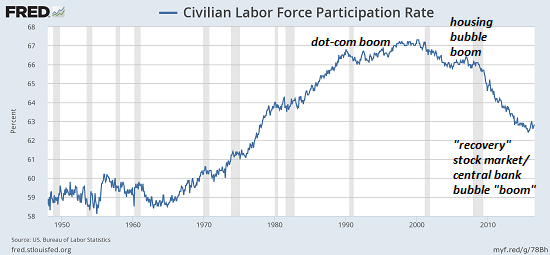

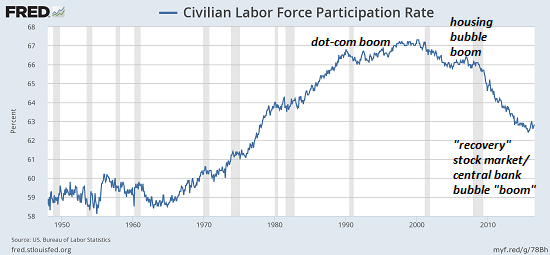

Rather than accept official assurances that we’re in the eighth year of a “recovery,” let’s look at a few charts and reach our own conclusion. Let’s start with the civilian labor force participation rate–the percentage of the civilian work force that is employed (realizing that many of the jobs are low-paying gigs or part-time work).

|

Does the participation rate today look anything like the dot-com boom that actually raised almost everyone’s boat at least a bit? Short answer: No., it doesn’t. Today’s labor force participation rate is a complete catastrophe that can only be described by one word: Depression.

|

Civilian Labor Force Participation Rate Civilian Labor Force Participation Rate - click to enlarge. - Click to enlarge

|

|

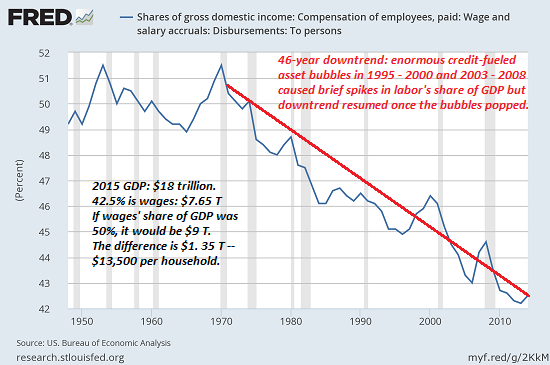

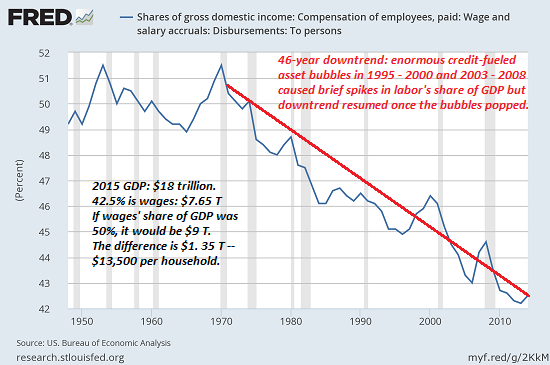

Wages as a percentage of GDP has been in a 45-year freefall that can only be described as Depression for wage earners:

|

Shares of GDP; Compensation of Employees, paid; Wage and Salary Accruals; Disbursements: To Persons Shares of GDP; Compensation of Employees, paid; Wage and Salary Accruals; Disbursements: To Persons - click to enlarge. - Click to enlarge

|

|

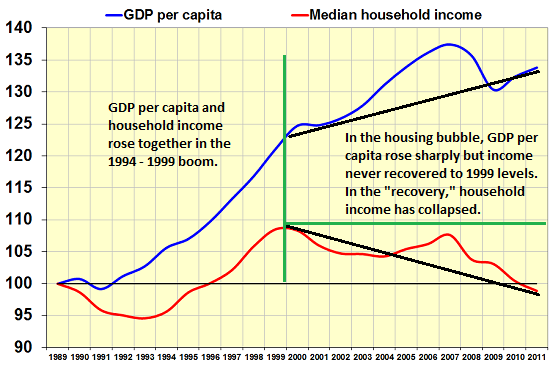

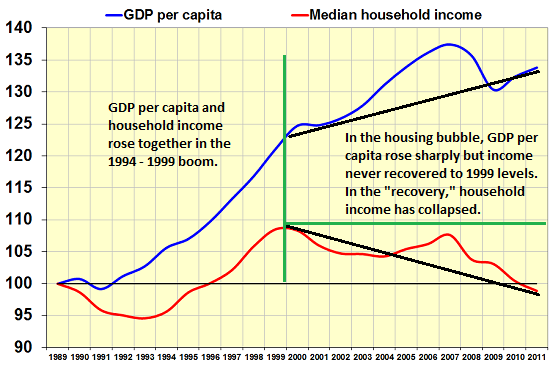

Notice what happened when the Federal Reserve started blowing serial asset bubbles in 2000: GDP went up but wages went down. Is this a recession or depression? It’s your call, but if you’re the recipient of the stagnating wages, it’s depressing.

|

GDP per Capita; Median Household Income GDP per Capita; Median Household Income - click to enlarge. - Click to enlarge

|

|

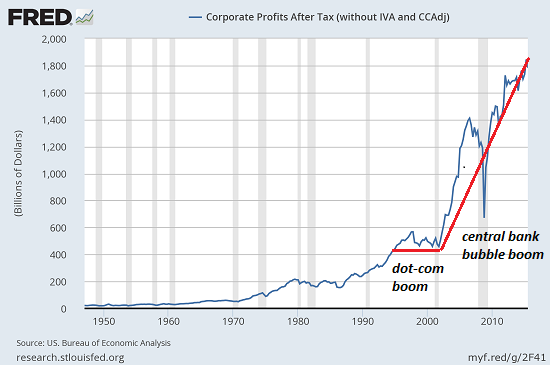

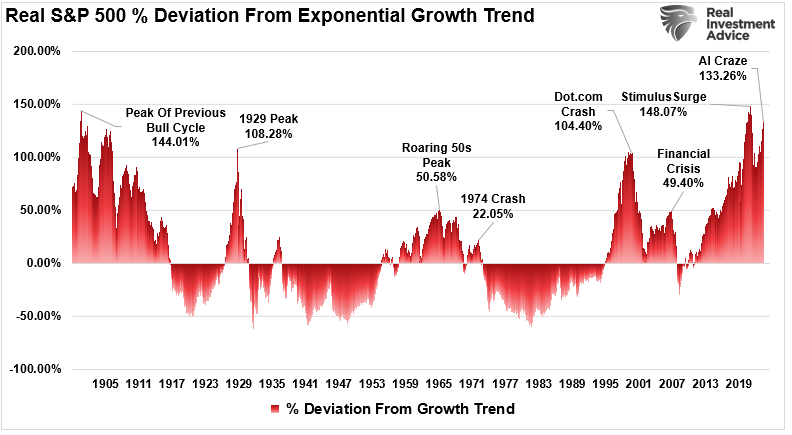

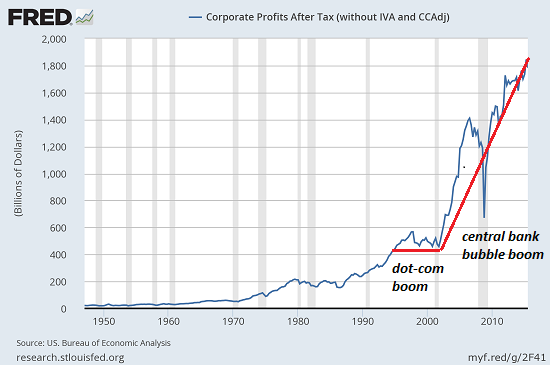

Meanwhile, the top 5% who own most of the assets that have been bubbling higher have been doing great. The Depression is only a phenomenon of the bottom 95%:

|

Growing Change Since 1973 to Wages Among Men at the Top and Middle of the Earnings Distribution Growing Change Since 1973 to Wages Among Men at the Top and Middle of the Earnings Distribution - click to enlarge. - Click to enlarge

|

|

Look at the rocket ship of corporate profits. What happened around 2001 to send corporate profits on a rocket ride higher? The Fed happened, that’s what:

|

Corporate Profits After Tax Corporate Profits After Tax - click to enlarge. - Click to enlarge

|

|

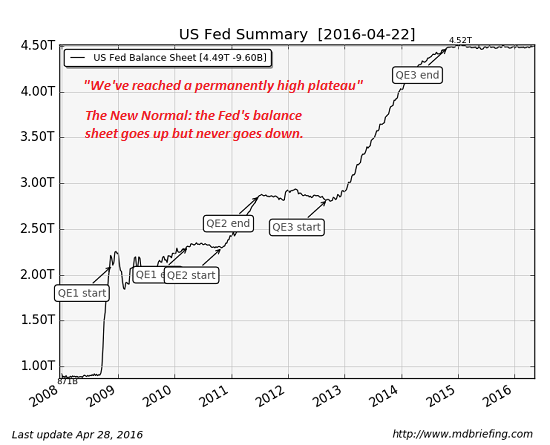

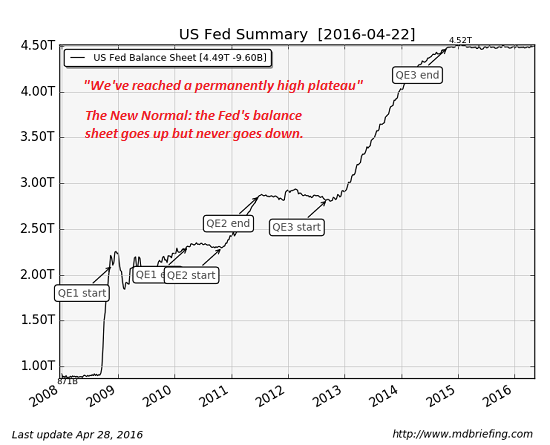

Here’s the Fed balance sheet: to the moon!

|

US Fed Summary US Fed Summary - click to enlarge. - Click to enlarge

|

|

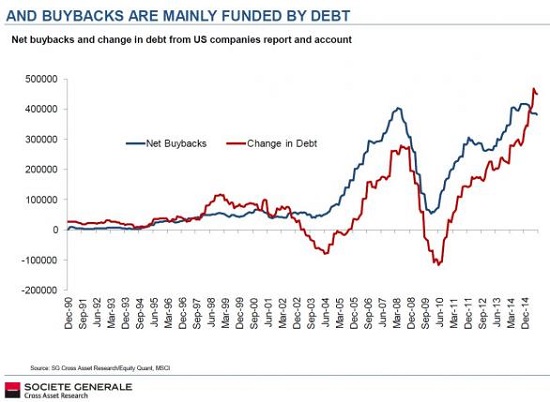

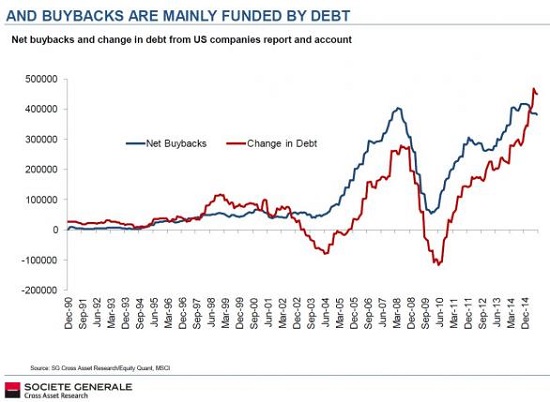

Free money for financiers and corporations fueled the stock market buyback boom:

|

Net Buybacks and Change in debt from US Companies Report and Account Net Buybacks and Change in debt from US Companies Report and Account - click to enlarge. - Click to enlarge

|

|

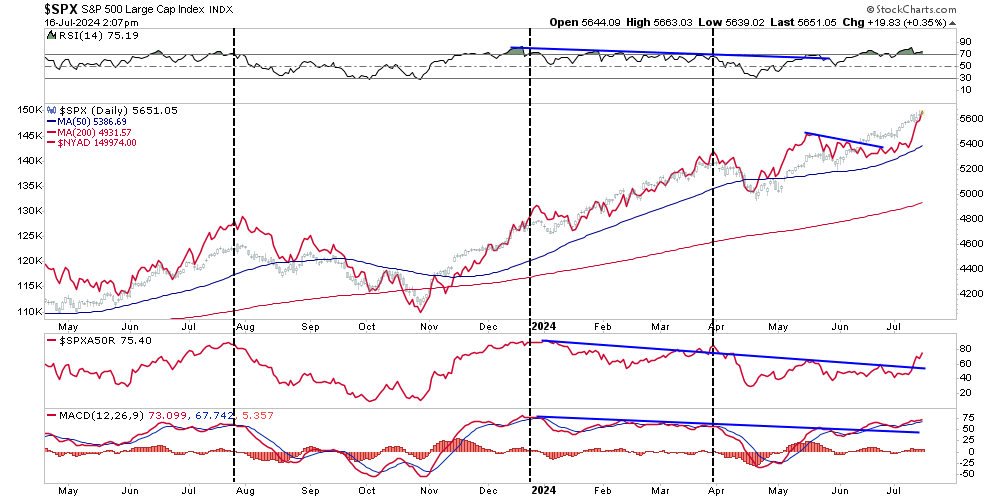

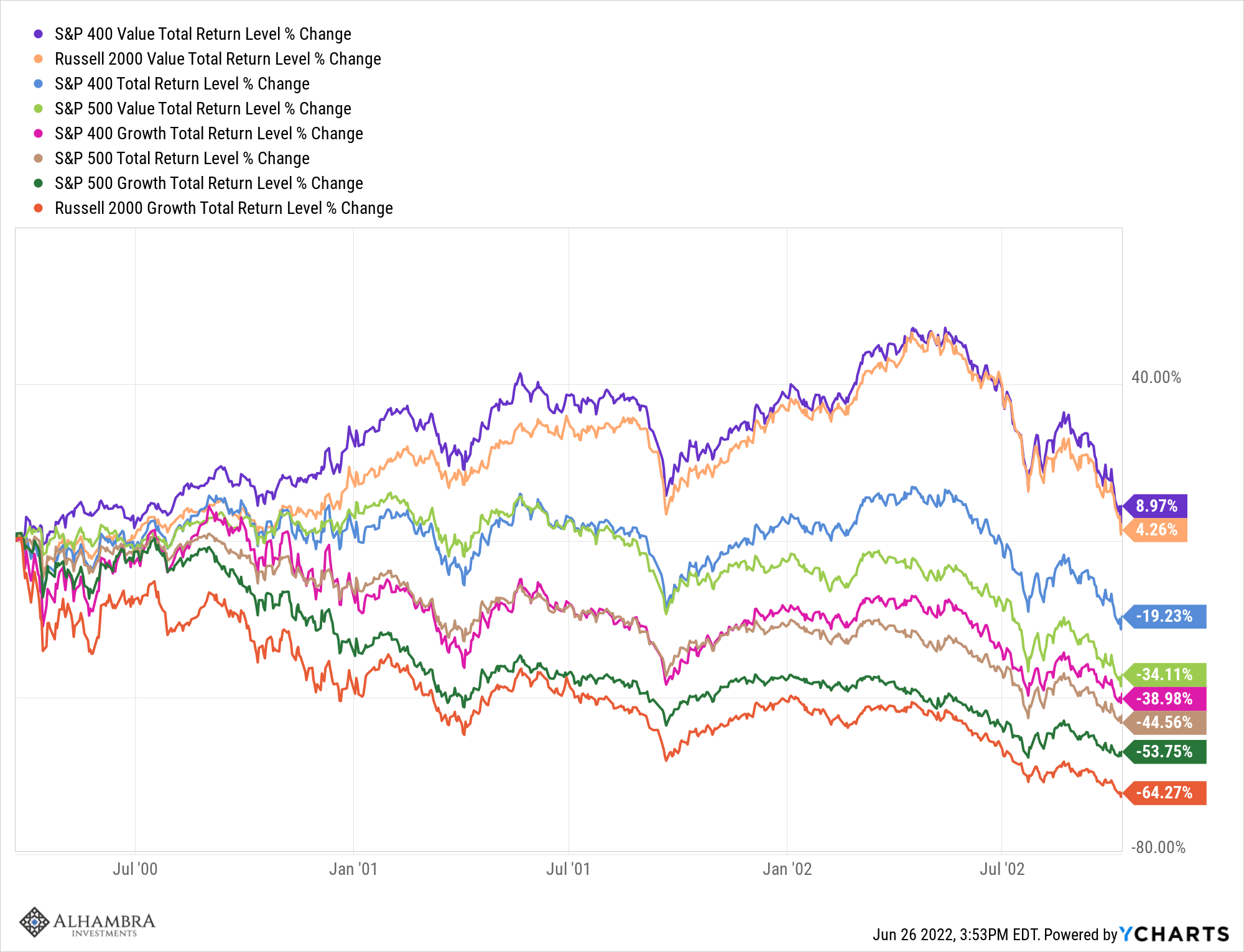

Which fueled the stock market bubble:

|

Stock Buybacks Have Been Propping Up the S&P 500(see more posts on S&P 500, )  Stock Buybacks Have Been Propping Up the S&P 500 - click to enlarge. - Click to enlarge

|

Is the economy in a Depression? Not if you’re a corporate bigwig skimming vast gains from corporate buybacks funded by the Fed’s free money for financiers.

But if you’re a wage earner who’s seen your pay, hours and benefits cut while your healthcare costs have skyrocketed–well, if it isn’t a Depression, it’s a very close relative of a Depression.

Recent interviews:

My new book is The Adventures of the Consulting Philosopher: The Disappearance of Drake. For more, please visit the

book's website.

Full story here

Are you the author?

At readers' request, I've prepared a biography. I am not confident this is the right length or has the desired information; the whole project veers uncomfortably close to PR. On the other hand, who wants to read a boring bio? I am reminded of the "Peanuts" comic character Lucy, who once issued this terse biographical summary: "A man was born, he lived, he died." All undoubtedly true, but somewhat lacking in narrative.

Previous post

See more for 5.) Charles Hugh Smith

Next post

Tags:

newslettersent,

S&P 500