Tag Archive: newsletter

Cronyism and Historical Revisionism

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

The Fed’s Two-Percent Inflation Target Is Meaningless

What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property...

Read More »

Read More »

Can American Federalism Survive Global De-Dollarization?

“Money does not grow on trees” is an old expression of wisdom that seems to have been disregarded by 21st century American policymakers. People all over the world and throughout time base their decisions primarily through lived experience. The US dollar became the world’s reserve currency in the aftermath of World War II, which is now almost eighty years ago. There is virtually no one in power at the American government or in leading institutions...

Read More »

Read More »

Mexico Is Still Blaming Americans for Mexico’s Gang Violence

This week, the US Supreme court announced that it will consider throwing out the Mexican government’s suit in the case of Smith & Wesson Brands v. Estados Unidos Mexicanos. The Mexican government alleges that Smith & Wesson and wholesaler Witmer Public Safety Group Inc. are intentionally conspiring with middle-men to supply Mexican cartels with guns. The Mexican plaintiffs have never actually proven any of this, of course, and this is all...

Read More »

Read More »

Swiss watchmaking sector faces rise in unemployment

Seco: "rise in unemployment not surprising, will rise again"

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

Can America Survive Global De-Dollarization?

“Money does not grow on trees” is an old expression of wisdom that seems to have been disregarded by 21st century American policymakers. People all over the world and throughout time base their decisions primarily through lived experience. The US dollar became the world’s reserve currency in the aftermath of World War II, which is now almost eighty years ago. There is virtually no one in power at the American government or in leading institutions...

Read More »

Read More »

USD/CHF Price Prediction: Surges in bullish breakout from multi-week range

USD/CHF breaks out of the range it has been straight-jacketed in for weeks.

The pair has probably started a new uptrend with odds now favoring the acquisition of bullish targets.

USD/CHF decisively breaks out of the top of its multi-week range, probably ending its protracted sideways market trend. A close clearly above 0.8540 and the range ceiling would cement bullish expectations.

The move means the pair has probably changed its short-term...

Read More »

Read More »

10-4-24 The Importance of Trusts in Financial Planning

Market preview & Fed possiblities as jobs numbers are releasaed today; anecdotal evidence that small businesses are making more credit inquiries to banks: A prelude to more growth? The Longshoreman's strike is suspended with a proposed 65% pay increase; raises the question of value in the cost of a college degree. The marriage of blue collar jobss to AI will present new opportunities with rewarding pay. Jon & Matt discuss aspects of...

Read More »

Read More »

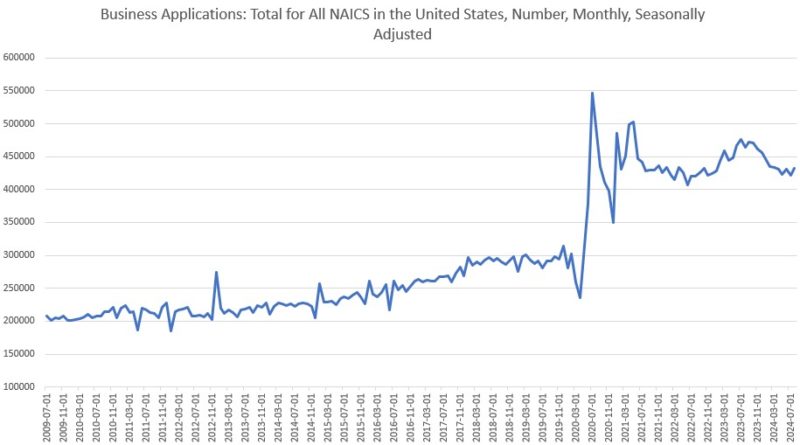

The Imaginary “Boom” in the Small-Business Economy

For more than four years now, the Biden Administration has been insisting that the state of small business in America is better than it has ever been. This claim, however, is based on a single government statistic: the business applications metric published by the Census Bureau, which is a record of applications for an employer identification number (EIN).The Administration has repeatedly and enthusiastically promoted the surge in these new...

Read More »

Read More »

The arc of war: a bloody week in Lebanon

In a matter of weeks the conflict between Israel and Hizbullah has transformed life in Lebanon (https://www.economist.com/leaders/2024/10/03/the-year-that-shattered-the-middle-east?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners). Our correspondent reports from the streets of Beirut. After a pandemic-sized hiccup in the...

Read More »

Read More »

P. Diddy Skandal wird zur Politbombe!

Der P.Diddy Skandal wird die gesamte Unterhaltungs-Branche und Politik in den USA in Schockstarre versetzen!

Mein Depot: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Langfristige Sparpläne mit Zinssätzen bis zu 8,76 %!

- Rendite von 3,86 % in Euro und 5,31 % in Dollar bei täglicher Gutschrift der Zinsen!

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen:...

Read More »

Read More »

How to Utilize Work Benefits for Financial Security and Growth

Exploring the benefits at work - Roth vs. pre-tax for 401ks, disability insurance, and more! Building a secure future goes beyond expectations. ? #FinancialTips #Insurance

Watch the entire show here: https://cstu.io/6c03ff

YouTube channel = @ TheRealInvestmentShow

Read More »

Read More »

NEU! Finanzfluss Copilot App für iOS & Android! Vermögen Tracken & Finanzen visualisieren

Zur Finanzfluss Copilot App ►► https://link.finanzfluss.de/r/copilot-app-yt ?

ℹ️ Weitere Infos zum Video:

Endlich ist die Finanzfluss Copilot App fertig! Mit der App könnt ihr nun auch ganz bequem an eurem Handy euer Vermögen tracken. In diesem Video stellen wir euch die Features vor, die es zum Start bereits in der Finanzfluss Copilot App gibt.

Zur Copilot App: ►► https://link.finanzfluss.de/r/copilot-app-yt

Direktlink zum Apple App Store:...

Read More »

Read More »

A Major Contribution to Libertarian Social Thinking

Common Law Liberalism: A New Theory of the Libertarian Society by John Hasnas. Oxford University Press 2024. 328pp.John Hasnas, who teaches law and philosophy at Georgetown University, has written one of the most valuable books about libertarian theory that has appeared in several decades. Its principal value is that, although Hasnas has not been influenced very much by Ludwig von Mises and Murray Rothbard, he arrives at many of their insights in...

Read More »

Read More »

Swiss hotels on course for a record summer

Swiss hotels on course for a record summer after a good August

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

Today’s Employment Report is Important, but Fed Sees Another Before the Next FOMC Meeting

Overview: The stronger than expected ISM services, which the market has seemed particularly sensitive this year lifted the two-year yield to about 3.71%, its highest level since the last employment report. The 10-year yield, which had been toying with 3.80%, finally settled above it for the first time in a month. The Dollar Index extended its advance to four sessions, matching the longest in six months. The focus is on the US employment report....

Read More »

Read More »

“Guns and Butter” Is Back

Sabrina Carpenter has been a star since she was 12, staring on Disney’s Girl Meets World. Now she’s a singer and, I’ve heard, she has broken records set by the Beatles. She’s recorded a catchy cover of Nancy Sinatra‘s 1965 hit “These Boots Are Made For Walking.” ”I want to feel as confident as humanly possible so I can be up there and not worry about what I’m doing,” Carpenter says. “It helps me perform better.” She ended up donning custom...

Read More »

Read More »