Tag Archive: newsletter

USDCHF making new lows for 2025, but working toward key support including 100 day MA

Seller in control, but the 100 day MA at 0.9000 and swing area between 0.8914 to 0.8923 is a key target area

Read More »

Read More »

Bitcoin breaks lower and below a floor area between $90,742 to $92,092

Also trades below $90,000 and to new 2025 lows. Sellers make a play but find support buyers near key retracement level

Read More »

Read More »

Flipping Secrets: How This Investor Made 540 Deals in One Year – Brent Daniels, Scott Pennebaker

? Join the #1 real estate investing community: https://www.richdadpro.com

Want to know the secret to flipping and wholesaling 540+ real estate deals in just one year? In this episode of the Rich Dad Radio Show, Brent Daniels sits down with Scott Pennebaker, a real estate investor who has mastered the art of getting paid multiple times on every deal. From direct mail marketing strategies to leveraging hedge fund buyers, Scott reveals the exact...

Read More »

Read More »

The EURUSD & GBPUSD are stretching to new highs to start the US session. USDJPY is up/down

The key technical levels in play for the three major currency pairs to kickstart the NA session

Read More »

Read More »

2-25-25 Estimates By Analysts Have Gone Parabolic

The Chicago Fed's National Activity Index falls to -4.3: Looks like the data is catching up ith reality. Excess Savings Metric: Most are in no better financial shape than before the pandemic; implications to companies' earnings that the bottom 90% are beginning to struggle. Markets challenged the 50-DMA and failed on Monday; likely to be in a corrective phase for a hile. "If I ere President, the first thing I ould do..." Lance and...

Read More »

Read More »

“Elon muss jetzt NOCH aggressiver vorgehen!”

Elon Musk wird in Zukunft noch aggressiver mit der DOGE Commission vorgehen!

Meine Depotempfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR...

Read More »

Read More »

Can We Still Rely on Cash As A Currency?

Is cash trash? It all depends on the debt markets which are the big topic of the U.S. today. I’ve explained how inflation and debt cycles in my new study, How Countries Go Broke. You can read the first parts of my free study here: https://economicprinciples.org/how-countries-go-broke

#raydalio #howcountriesgobroke

Read More »

Read More »

Emmanuel dexterity: Trump and Macron chat

The meeting between France’s and America’s presidents had a familiarly chummy feel. We ask whether Emmanuel Macron’s charm offensive (https://www.economist.com/europe/2025/02/25/has-emmanuel-macron-managed-to-reason-with-donald-trump?utm_campaign=a.io&utm_medium=audio.podcast.np&utm_source=theintelligence&utm_content=discovery.content.anonymous.tr_shownotes_na-na_article&utm_term=sa.listeners) might have changed Donald Trump’s mind...

Read More »

Read More »

US 10-year Yield Falls to New Low for the Year, while Dollar has Muted Reaction to Trump’s Affirmation of Tariffs on Canada and Mexico

Overview: The US 10-year yield has fallen to a new two-month low near 4.33% today, ahead of the $70 bln sale of five-year notes, following strong demand at the two-year floating note sale yesterday. The 200-day moving average is near 4.25%. The 10-year yield peaked in mid-January near 4.80%. The dollar initially rallied on President Trump's acknowledgement that tariffs on Mexico and Canada were still on track, though another official was quoted on...

Read More »

Read More »

Ein auffälliger Lifestyle ist doppelt teuer! ? #doppelwumms #shorts

Ein auffälliger Lifestyle ist doppelt teuer! ? #doppelwumms

?.Warum “arm" aussehen die BESTE Entscheidung sein kann!:

&t=55s

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine...

Read More »

Read More »

How MMT Advocates View Money and the State

According to the Modern Monetary Theory (MMT), money is something decided by the state. The MMT regards money as a token. For instance, when an individual places a coat in the cloakroom of a theater, he receives a tin disc or a paper receipt. This receipt or a disc is a proof that the individual is entitled to demand the return of his coat.According to the MMT, the material used to manufacture the tokens is irrelevant—it can be gold, silver, or any...

Read More »

Read More »

Eilmeldung: Hier platzt gerade die CDU auseinander!

Die CDU bricht die Wahlversprechen, noch bevor sie in der Koalition ist! Das muss man auch erstmal schaffen!

Meine Depotempfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen: https://link.aktienmitkopf.de/Depot *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT *

?JETZT auch als Hörbuch bei...

Read More »

Read More »

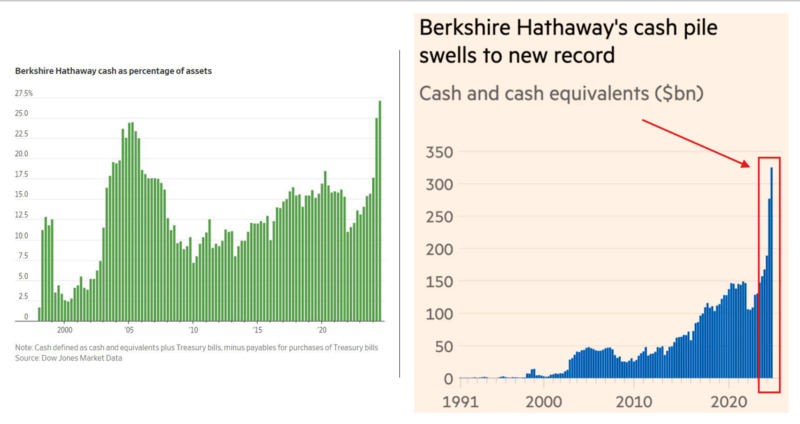

Cash At Buffett’s Berkshire Continues To Grow

In its annual letter to shareholders this past weekend, Warren Buffett's Berkshire Hathaway announced that it had increased its cash holdings to $334 billion. As the Financial Times chart on the right shows, Berkshire's cash balances have more than doubled over the last few quarters to its highest level. Additionally, cash as a percentage of …

Read More »

Read More »

Swiss Säntis mountain cable car set for gust resistant refit

Säntis cable car will be completely renovated

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

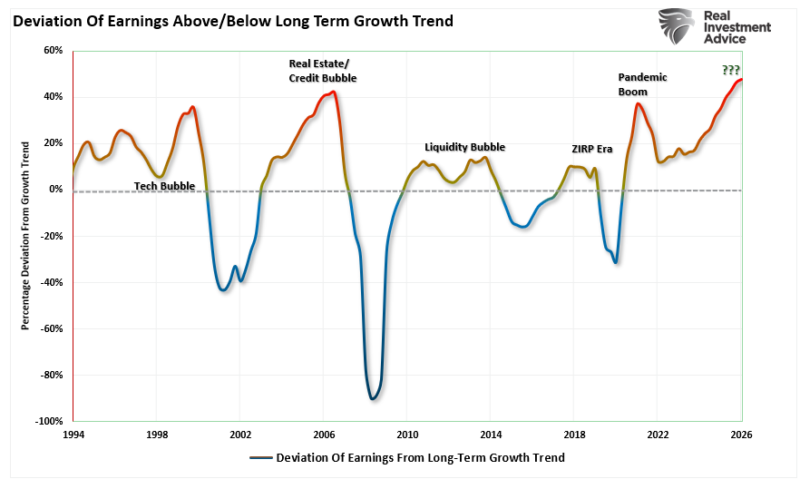

Estimates By Analysts Have Gone Parabolic

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing exuberance on Wall Street. As noted last week, correlations between all asset classes, whether international or emerging markets, gold or bitcoin, have all gone to one. Unsurprisingly, rationalizations …

Read More »

Read More »

Audit slams Swiss military contractor for suspected fraud

Fraud or mistrust: Ruag is once again under fire for its management

Keystone-SDA

Listen to the article

Listening the article

Toggle language selector...

Read More »

Read More »

Top 12 Fintech Courses and Certifications in Switzerland in 2025

Fintech is one of the fastest growing industries in the world. The Boston Consulting Group (BCG) estimates that the market will reach a size of US$1.5 trillion in revenue 2030, representing a roughly fivefold increase from 2024.

This growth has driven a surge in demand for fintech professionals, leading to the launch of a wide range of educational programs, courses, and certifications tailored to both young students and experienced professionals...

Read More »

Read More »

Larry McDonald: Last Democrat Who Wanted to Audit Fort Knox

An issue which not long ago had only the support of Ron Paul has now become a priority for the Trump Administration: the auditing of Fort Knox. At CPAC last week, Donald Trump took time out of speech to boast that he and Elon Musk were soon to be traveling to America’s largest gold depository “to see if the gold is there. Because maybe somebody stole the gold. Tons of gold.”The topic of Fort Knox is interesting itself for a number of other reasons....

Read More »

Read More »

USDJPY Technical Analysis – the JPY remains supported amid risk-off sentiment

#usdjpy #forex #technicalanalysis

In this video you will learn about the latest fundamental developments for the USDJPY pair. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

1:09 Technical Analysis with Optimal Entries.

2:14 Upcoming Catalysts...

Read More »

Read More »

Hart aber fair: Bürgermeisterin sprengt die komplette Sendung!

Hart aber fair: Eine Bürgermeisterin einer kleinen Stadt in Thüringen sprengt die Sendung!

Bildrechte: By Sandro Halank, Wikimedia Commons, CC BY-SA 3.0, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=68883149

Meine Depotempfehlung: https://link.aktienmitkopf.de/Depot *

Auf der Freedom 24-Plattform findest Du:

- Bis zu 1.000.000 Aktien, ETFs, Aktienoptionen und andere Finanzinstrumente!

- Depot kostenlos eröffnen:...

Read More »

Read More »