Tag Archive: newsletter

Prof. Thorsten Polleit sehr ernst – Dieser GEHEIME PLAN läuft vor unseren Augen! SIEHST DU ES NICHT?

Videoinhalte: Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen, Silber, Edelmetalle, Bitcoin, Kryptowährung, Währungskrise, Währungsreform, Finanzcommunity, Finanzpolitik, Finanzmarkt, Banken, Finanzcrash,

Read More »

Read More »

Prohibition’s Repeal: What Made FDR Popular

For seventy-plus years, the case of Franklin Delano Roosevelt has vexed people of a libertarian bent. His policies, extending war socialism based on Mussolini's economic structure, expanded the American state to an unthinkable extent and prolonged the Great Depression through the horrific World War II.

Read More »

Read More »

Märkte in der Berichtssaison | Live-Trading mit Rüdiger Born | 27.10.2020 | XTB

CFD sind komplexe Instrumente und beinhalten wegen der Hebelwirkung ein hohes Risiko, schnell Geld zu verlieren. 77% der Kleinanlegerkonten verlieren Geld beim CFD-Handel mit diesem Anbieter. Sie sollten überlegen, ob Sie verstehen, wie CFD funktionieren und ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren.

Read More »

Read More »

Is The Mississippi Bubble Scenario Unfolding On The Dollar? – Alasdair Macleod | Fiat Money

Is The Mississippi Bubble Scenario Unfolding On The Dollar? - Alasdair Macleod | Fiat Money |Stock Market Crash| Fiat currency

Read More »

Read More »

Der große Crash steht unmittelbar bevor. Bereiten Sie sich vor!

Markus Krall spricht darüber, dass wir heute schon die massivste Bankenrettung im Umfang von tausenden von Milliarden haben. Die Kernfrage lautet also nicht waren die Bilanzen der Banken ausgehöhlt, sondern die Kernfrage lautet, wann es sichtbar wird.

Read More »

Read More »

GAMING YOUTUBER MIT 1.000.000 EURO IN CRYPTO: DIE DISKUSSION

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

Read More »

Read More »

Swiss Trade Balance January 2021: foreign trade starts the year on a positive note

After declining in December 2020, Swiss foreign trade again showed a strong increase at the start of 2021. In January and in seasonally adjusted terms, exports rose 5.4% to 18.9 billion francs and imports by 3.3% to 15.3 billion. In both directions of trafficking, the boom relied heavily on chemicals and pharmaceuticals. The trade balance closed with a surplus of 3.6 billion francs.

Read More »

Read More »

FX Daily, February 18: Markets Chill

The bout of profit-taking in equities continued today, and most markets in Asia Pacific and Europe are lower. China's markets re-opened but struggled to sustain early gains. However, the Shanghai Composite rose by about 0.5%, and a smaller increase was recorded in Taiwan and an even smaller gain in Australia.

Read More »

Read More »

Switzerland tops global e-commerce index

Switzerland is the best equipped country for online shopping, according to a United Nations comparison of more than 150 states.

Read More »

Read More »

The United Nations in Geneva – before and during the pandemic

With the exception of a few organisations and institutions that continue to operate in person, such as the UN Human Rights Council, which is currently conducting its Universal Periodic Review process, the Office of the UN High Commissioner for Human Rights, the WHO and some permanent missions to the United Nations, most day-to-day business and multilateral activities are conducted online.

Read More »

Read More »

Trading Wochenanalyse für KW07/2021 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

Read More »

Read More »

If America Splits Up, What Happens to the Nukes?

Opposition to American secession movements often hinges on the idea that foreign policy concerns trump any notions that the United States ought to be broken up into smaller pieces. It almost goes without saying that those who subscribe to neoconservative ideology or other highly interventionist foreign policy views treat the idea of political division with alarm or contempt. Or both.

Read More »

Read More »

Rüdiger Born: Charttechnik aktuell bei Dax und Dow

Dax und Dow schaue ich mir in diesem schwächelnden Marktumfeld genauer am Chart an. Im Dow sehen wir sogar den Rutsch unter einen Trendkanal. Was bedeutet das für Trader?

Read More »

Read More »

Fiat Geld und Kollektive Korruption. Eine hintergründige Analyse

Ein Vortrag von Thorsten Polleit, aufgenommen am 29. Januar 2021 in Frankfurt a. M. von Manuel Teubert.

Read More »

Read More »

Money, Interest, and the Business Cycle

The banks very often expand credit for political reasons. There is an old saying that if prices are rising, if business is booming, the party in power has a better chance to succeed in an election campaign than it would otherwise. Thus the decision to expand credit is very often influenced by the government that wants to have “prosperity.” Therefore, governments all over the world are in favor of such a credit-expansion policy.

Read More »

Read More »

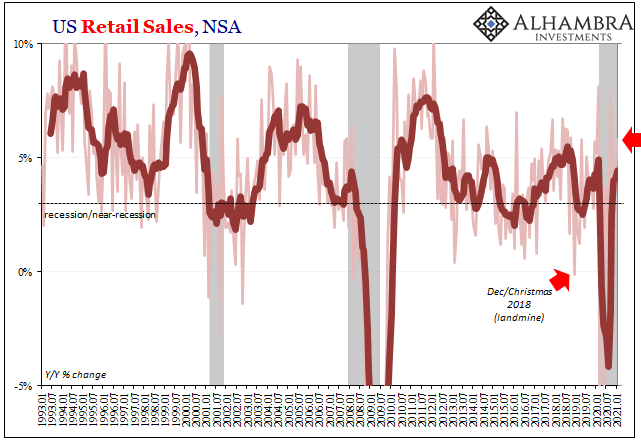

Uncle Sam Was Back Having Consumers’ Backs

American consumers were back in action in January 2021. The “unemployment cliff” along with the slowdown and contraction in the labor market during the last quarter of 2020 had left retail sales falling backward with employment. Seasonally-adjusted, total retail spending had declined for three straight months to end last year.

Read More »

Read More »

2021-02-14 Retirement Lifestyle Advocates Radio w/ Alasdair MacLeod

We have two global problems. The potential bankruptcy, in fact, almost certain bankruptcy of the Eurozone and the ending of the Euro. And at the same time, in America with dollars being printed to create a wealth effect, when that bubble pops the dollar will similarly have virtually no future and probably wipe it out. And, I'm talking about the very near future, because I don't think it's going to take very long for this to go wrong.

Read More »

Read More »

Stiftung in Liechtenstein: Errichtung und Aufbau von Verwaltungsstrukturen im Sinne des Stifters

Neben Steuervorteilen sind Stiftungen in Liechtenstein auch aus vielen anderen Gründen attraktiv. Im Dialog mit Prof. Dr. Dr. Gierhake erörtert Christoph Juhn die Details zur Errichtung einer Stiftung in Liechtenstein und den steuerlichen Implikationen bei der Übertragung des Stiftungsvermögens. Vor allem aber liegt der Fokus des Gesprächs auf den Aufbau von unabhängigen Organen, die den Vorstellungen des Stifters zum Zweck der Stiftung Gestalt...

Read More »

Read More »

Rüdiger Born: Indizes schwach – was für uns Trader machbar ist

Im folgenden Video schaue ich mir die US-Indizes an. Die zeigen aktuell eine fallende Tendenz. Was ist für uns Trader möglich? Wollen Sie meine täglichen Analysen im “Trade des Tages” erhalten? Dieses Angebot ist für Sie völlig kostenfrei! Melden Sie sich dafür einfach hier an. Trade des Tages von Rüdiger Born und seinem Analystenteam BORN-4-Trading … Continue reading »

Read More »

Read More »