Tag Archive: newsletter

FX Daily, February 17: Follow-Through Dollar Buying after Yesterday’s Reversal Tests the Bears

Overview: After reversing higher yesterday, the US dollar sees follow-through gains today, leaving the euro around a cent lower from yesterday's highs. Sterling's surge is also being tempered. Most emerging market currencies are lower as well.

Read More »

Read More »

Swiss competition watchdog to investigate Mastercard

The competition authority suspects the global credit card firm of using its position to prevent the rollout of a new, more uniform, ATM system across Switzerland.

Read More »

Read More »

Julian Hosp Live

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

Read More »

Read More »

Austrian Economics is the Science of Business Success

For any size and any type of business, the generation of value requires more than strategy, planning, and executional excellence. It calls for the establishment, communication, and internalization of value-generation principles, solidly founded and consistently applied.

Read More »

Read More »

Was viele über Konsum und Frugalismus denken (aber nicht stimmt)!

Mittlerweile betreibe ich einige Projekte und es macht mir ungemein Spass, an diesen zu arbeiten. Ich gebe mir viel Mühe, alle Projekte wie z.B. den Sparkojoten, das Finanzrudel oder den Amazing Online-Shop auf Kurs zu halten. Falls ihr euch für eines der Projekte interessiert, checkt sie gerne ab.

Read More »

Read More »

Noch 50 Punkte bis zum Allzeithoch – “DAX Long oder Short?” mit Marcus Klebe – 16.02.2021

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler Anbieter von Multi-Asset-Trading- und Investmentlösungen.

Read More »

Read More »

“Self-control and self-respect have become undervalued”

After a year of lockdowns, social isolation, financial uncertainty and extreme political polarization, a lot of people are finding it very difficult to remain optimistic and to see a way back to some kind of normalcy. While the economic, social and political impact of the covid crisis can be easily identified and frequently discussed, the unseen, psychological pressures that millions of people are struggling with often go undiscussed.

Read More »

Read More »

Down with the Presidency

The modern institution of the presidency is the primary political evil Americans face, and the cause of nearly all our woes. It squanders the national wealth and starts unjust wars against foreign peoples that have never done us any harm. It wrecks our families, tramples on our rights, invades our communities, and spies on our bank accounts. It skews the culture toward decadence and trash. It tells lie after lie. Teachers used to tell school kids...

Read More »

Read More »

Quick Takes: Not Allowing Deflation *is* the Inflation (w/Jeff Snider Criticism)

Two sides of the same coin here, where preventing deflation is the inflation. #JeffSnider #EmilKalinowski #AlhambraInvestments #InflationVsDeflation #LukeGromen #LynAlden

Read More »

Read More »

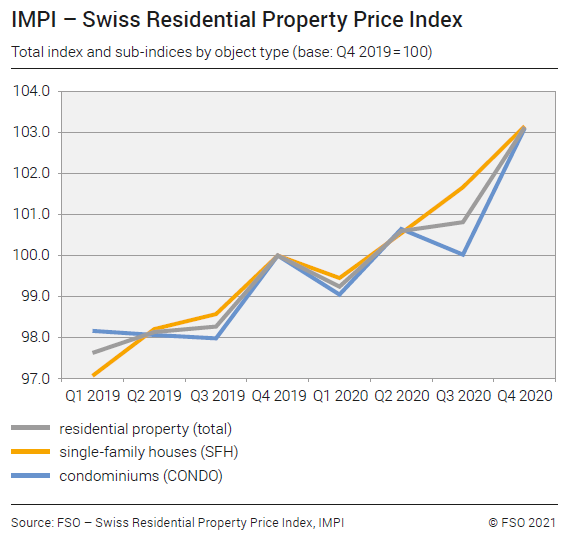

Residential property prices continue to rise

Residential property prices in Switzerland rose sharply in the final quarter of 2020, and by an average 2.5% for the year as a whole, according to the Federal Statistics Office.

Read More »

Read More »

FX Daily, February 16: Greenback Remains Heavy

The equity rally appears undeterred by the rise in interest rates or the surge in oil prices. Led by Tokyo and Hong Kong, Asia Pacific equities advanced. China, Taiwan, and Vietnam markets remain closed. After gapping higher yesterday and extended the gains in early turnover today, the Dow Jones Stoxx 600 is consolidating.

Read More »

Read More »

ACHTUNG VERMÖGENSSTEUER!!! BITCOIN CRASH JA ODER NEIN??

ACHTUNG VERMÖGENSSTEUER!!! BITCOIN CRASH JA ODER NEIN?? Was du genau wissen solltest und wie du darauf reagieren kannst, erfährst du in diesem Video.

► Hier kannst du bitcoins kaufen und bekommst auch gleich bis zu 10% pro Jahr Zinsen: https://cakedefi.com/

——————

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr...

Read More »

Read More »

Hear Swiss stories for the world on The Swiss Connection podcast

What’s it like to move back to – or away from – Switzerland during a pandemic? What does gold mined in Peru have to do with Switzerland? Did you know that “nostalgia” is a Swiss invention?

Read More »

Read More »

Unhappy Endings: Deception Has Gone Global

Looking Behind the LabelsRegardless of one’s politics, most would agree that extremely complex issues are typically given extremely misleading titles.Not all those of the extreme left, for example, are all that “woke” and not everyone on the far right, to be fair, is a “domestic terrorist.

Read More »

Read More »

Average annual inflation rate for residential property in 2020 was 2.5 percent

16.02.2021 - The Swiss residential property price index (IMPI) increased in the 4th quarter 2020 compared with the previous quarter by 2.3% and reached 103.1 points (4th quarter 2019 = 100). Compared with the same quarter of the previous year, inflation was 3.1%. The average annual inflation rate for residential property in 2020 was 2.5%.

Read More »

Read More »

2021 Marktvorschau mit Special Gast

► Hier kannst du bitcoins kaufen und bekommst auch gleich bis zu 10% pro Jahr Zinsen: https://cakedefi.com/

——————

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr verpassen? ABONNIERE meinen Kanal: https://www.youtube.com/channel/UCseNUrq7mUUWqTspr4QJ9eg?sub_confirmation=1 UND klicke die GLOCKE ? - WICHTIG!

⏰...

Read More »

Read More »

The Green Market – Episode 1: Charles Hugh Smith, Julian Morris and Martí Jiménez-Mausbach

This weeks host, Richard Bonugli, CEO of Cedargold, talks with Charles Hugh Smith (OfTwoMinds.com), Julian Morris (Senior Fellow at Reason Foundation), and Martí Jiménez-Mausbach (Head of Research at the Ostrom Institute) on the works of Hayek, Elinor Ostrom and whether local and decentralised economies can promote Market Environmentalism to the masses, who are looking to find a sustainable solution to the problems of climate change, without...

Read More »

Read More »

The Fight over Economics Is a Fight over Culture

The Left long ago figured out how to get ordinary people interested in economic policy. The strategy is two pronged. The first part is to frame the problem as a moral problem. The second part is to make the fight over economic policy into a fight over something much bigger than economics: it's a fight between views of what it means to be a good person. The Left knows how to make the war over economics into a war over culture.

Read More »

Read More »