Tag Archive: newsletter

“Weapons of Mass Destruction”: The Last Refuge of the Global Interventionist

The threat of “nuclear proliferation” remains one of the great catch-all reasons—the other being “humanitarian” intervention—given for why the US regime and its allies ought to be given unlimited power to invade foreign states and impose sanctions at any given time.

Read More »

Read More »

What Might Be In *Another* Market-based Yield Curve Twist?

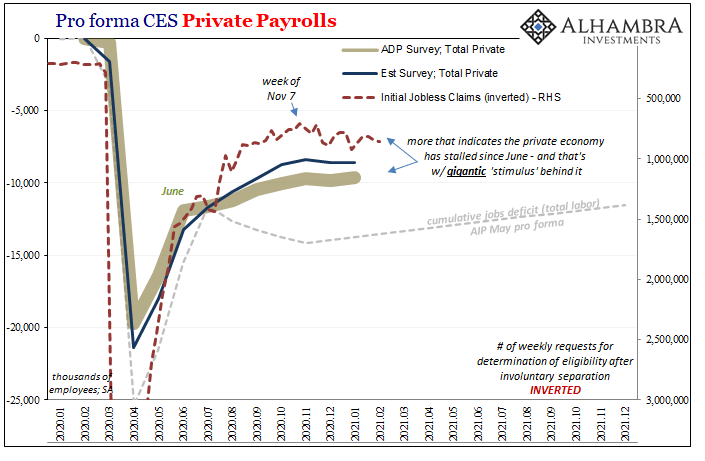

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago.

Read More »

Read More »

Yanis Varoufakis EU ‘WAITING FOR BUBBLE TO BURST’ with states poised for financial CRlSlS

YANIS VAROUFAKIS, Greece's former Finance Minister, said it was only a matter of time before the EU's eurozone bubble "bursts", throwing member states into economic hardship.

Read More »

Read More »

MARKUS KRALL WARNT: DAS WIRD NEUES GELD SEIN! MARKUS KRALL PROGNOSE & ANALYSE DER WIRTSCHAFT

Markus Krall Analyse & Prognose - Markus Krall über die Wirtschaft, das Geldsystem & die Zentralbanken

Read More »

Read More »

Die 7 größten Ausreden beim Geld und die Antworten dazu

Keine Zeit, keine Ahnung, keine Lust: Saidi entlarvt die sieben Todsünden, warum viele Leute sich nicht um Ihre Finanzen kümmern. Und er weiß natürlich auch Rat.

Read More »

Read More »

FX Daily, February 22: Stocks Wilt under Pressure from Rising Yields

Higher interest rates, driven by inflation expectations, is forcing an adjustment to equity markets. The S&P 500 is poised to gap lower today following slides in the Asia Pacific region and Europe. Japanese and Taiwanese indices advanced by steep losses were seen in China, Hong Kong, and India.

Read More »

Read More »

KenFM im Gespräch mit: Thomas Mayer („Die neue Ordnung des Geldes“)

Wer Scheiße baut, muss dafür auch haften! Thomas Mayer ist Volkswirt, Banker und war den größten Teil seines Lebens für die Hochfinanz an den „Märkten“ tätig. Zu seinen Arbeitgebern gehörte neben Goldman Sachs auch der IWF oder die Deutsche Bank Gruppe. Hier war er als Chefvolkswirt und auch für den Bereich Research tätig.

Read More »

Read More »

God, Bitcoin, and Asymmetric Bets

Blaise Pascal was a brilliant mathematician, inventor of the calculating machine, and pioneer of probabilistic theory during the 17th century. His philosophical works were published posthumously under the title of Pensées.

Read More »

Read More »

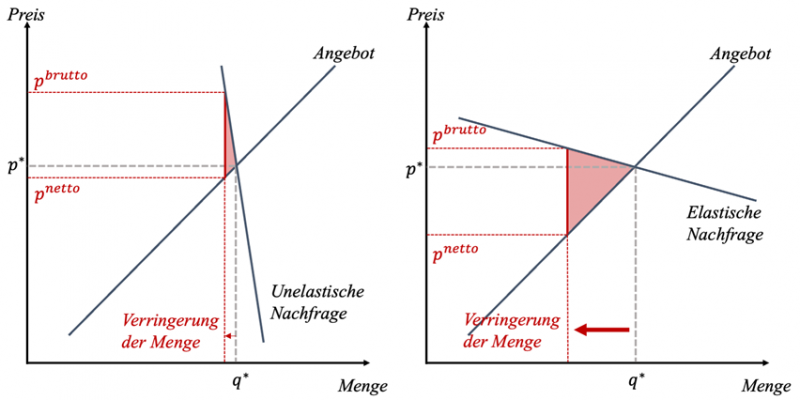

Der Wohlfahrtsverlust durch Besteuerung

Alle Studenten der Wirtschaftswissenschaften werden früher oder später mit der neoklassischen Standardanalyse des Wohlfahrtsverlusts durch Besteuerung konfrontiert. Dabei geht es nicht um die Klärung der Frage, wozu man die Steuereinnahmen des Staates verwenden sollte, sondern vielmehr darum, wie und wo der Staat besteuern sollte, damit es zu möglichst geringen Verzerrungen im Marktgefüge kommt – gewissermaßen so, dass es am wenigsten wehtut.

Read More »

Read More »

Yanis Varoufakis says EU ‘waiting for bubble to burst’ with states poised for financial crisis

Yanis Varoufakis says EU 'waiting for bubble to burst' with states poised for financial crisis. YANIS VAROUFAKIS, Greece's former Finance Minister, said it was only a matter of time before the EU's eurozone bubble "bursts", throwing member states into economic hardship. The coronavirus pandemic has forced countries around the world to take unprecedented economic measures.

Read More »

Read More »

Weekly Market Pulse – Real Rates Finally Make A Move

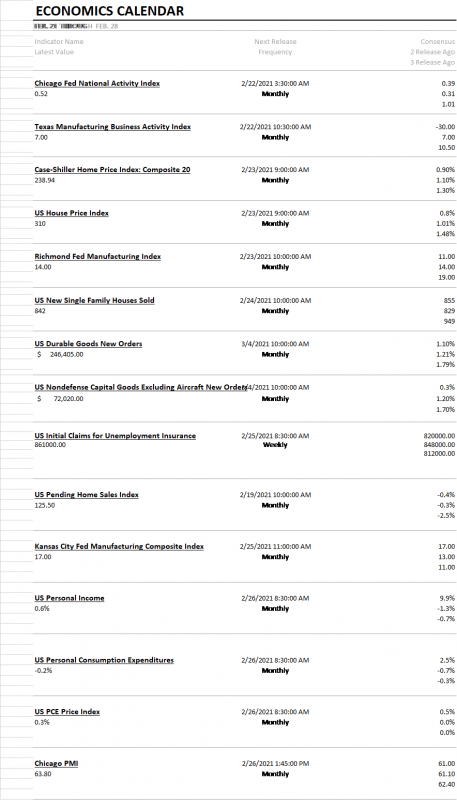

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery.

Read More »

Read More »

Aktuelle Geldpolitik im Fintool Talk: Geldschwemme, Börsenboom, Modern Money Theory!

Wir besprechen die Modern Money Theory (MMT) und die aktuelle Geldpolitik, wie sie von den Zentralbanken betrieben wird. Ob die MMT zielführend ist und ob sie überhaupt praxistauglich ist klären wir im Fintool Talk.

Read More »

Read More »

Es geschieht vor unseren Augen

Max Otte (* 7. Oktober 1964 als Matthias Otte in Plettenberg) ist ein deutsch-US-amerikanischer Ökonom. Er ist Leiter des von ihm im Jahr 2003 gegründeten Instituts für Vermögensentwicklung (IFVE) und als Fondsmanager tätig. Otte ist langjähriges CDU-Mitglied. Seit Juni 2018 ist der Vorsitzender des Kuratoriums der AfD-nahen Desiderius-Erasmus-Stiftung.

Read More »

Read More »

Warum ich in BITCOIN drin bin? – FOMO kickt hart … | Sparkojote Tea Time Talk

Mittlerweile betreibe ich einige Projekte und es macht mir ungemein Spass, an diesen zu arbeiten. Ich gebe mir viel Mühe, alle Projekte wie z.B. den Sparkojoten, das Finanzrudel oder den Amazing Online-Shop auf Kurs zu halten. Falls ihr euch für eines der Projekte interessiert, checkt sie gerne ab.

Read More »

Read More »

Politikkrise: Staatsmedien und Mainstreammedien haben sich freiwillig aufgegeben – Dr. Markus Krall

Politikkrise: Staatsmedien und Mainstreammedien haben sich freiwillig aufgegeben - Dr. Markus Krall

Read More »

Read More »

Unsere Buchempfehlungen — Gerd Kommer Invest Team Edition #1

Das Team von Gerd Kommer Invest stellt dir heute seine Buchfavoriten vor!

? Du möchtest nach dem Weltportfolio-Konzept von Gerd Kommer investieren? Erfahre mehr über den neuen Robo Advisor Gerd Kommer Capital: http://gerd-kommer-capital.de/youtube-promo/ *

ℹ️ Infos zum Video:

Nachdem Gerd Kommer im vergangenen Video auf Wunsch der Community hin ein in seinen Augen besonders lesenswertes Buch vorgestellt hat, ist nun das Team von Gerd Kommer...

Read More »

Read More »

Some Swiss cantons call for earlier restaurant re-openings

Several cantons have called for restaurants to be re-opened a month earlier than the official nationwide plan presented by the government earlier this week.

Read More »

Read More »

Rüdiger Born: Interessantes Chartbild im Nasdaq

Im Nasdaq zeigt sich aktuell ein interessantes Chartbild. Was im Trading möglich ist, schaue ich mir im folgenden Video genauer an.

Read More »

Read More »

Prof. THORSTEN POLLEIT: Der Euro wird bald crashen!

Thorsten Polleit (4. Dezember 1967 in Münster) ist ein deutscher Ökonom. Er ist Chefökonom der Degussa Sonne/Mond Goldhandel, Partner der Polleit & Riechert Investment Management LLP, Präsident und Gründer der deutschen Abteilung des libertären Ludwig von Mises Institute (Ludwig von Mises Institut Deutschland) und Honorarprofessor an der Universität Bayreuth.

Read More »

Read More »

Switzerland’s record breaking deficit in 2020

Switzerland’s federal accounts ended 2020 with a record-breaking deficit of CHF 15.8 billion. The deficit was caused by the pandemic.

Read More »

Read More »