Tag Archive: newsletter

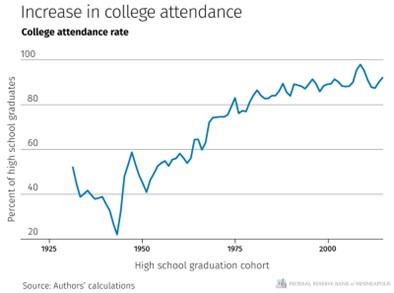

Seeing the Student Loan Crisis as a Form of Boom and Bust

In a market economy, prices are determined by supply and demand: how much of a quantity is being offered and how much value people place on that good relative to other goods. However, with great government power comes potential for great government irresponsibility: artificially lowering prices for some either through outright money printing or by taxing some to subsidize others.

Read More »

Read More »

US Opening Bell mit Marcus Klebe – 27.09.22

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler Anbieter von Multi-Asset-Trading- und Investmentlösungen.

Read More »

Read More »

Zurich to enshrine the circular economy in constitution

Voters in Switzerland’s biggest canton have overwhelmingly approved a new article to promote a cleaner and more efficient use of resources.

Read More »

Read More »

Nasdaq technical analysis: Trading this swing Long potential

Trading this Nasdaq rebound potential with a stop below the 11k round number and scaling out in 3 'take profit' parts.

See the video for details and follow possible updates within the post or comment of this page on ForexLive.com

https://www.forexlive.com/technical-analysis/nasdaq-technical-analysis-trading-this-swing-long-potential/

Trade the Nasdaq at your risk only.

Read More »

Read More »

Question the path you’re taking #shorts

Best known as the author of Rich Dad Poor Dad—the #1 personal finance book of all time—Robert Kiyosaki has challenged and changed the way tens of millions of people around the world think about money.

Read More »

Read More »

IMPUESTO A LOS RICOS. OTRO ENGAÑO

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Warren Buffett & Charlie Munger Margin Calls and The Complexity of Financial Institutions

Warren Buffett and Charlie Munger speaking at the 2004 Berkshire Hathaway annual meeting.

Read More »

Read More »

Jana Misar Wie dir das richtige Money Mindset zu mehr Sichtbarkeit verhilft

Vom 6. – 14.10.2022 coachen dich 34 Top-Expertinnen und UnternehmerInnen auf deinem ganz persönlichen Weg in die Sichtbarkeit!

Erhalte 30+ Strategien & sofort anwendbare Tipps, um als Expertin in die Sichtbarkeit zu kommen und zum unwiderstehlichen Kundenmagneten zu werden!

Read More »

Read More »

Katastrophale Daten: Schlimmer war es noch nie!

Ich halte wirklich rein gar nichts von Panikmache, zumal langfristige Investoren in der Krise häufig den besten Zeitpunkt zum Kauf erwischen. Dabei ist es auch gar nicht notwendig, dass sie am Tief kaufen.

Read More »

Read More »

Vorarlberg LIVE mit Schifteh Hashemi, Jasmin Auer, Thomas Mayer und Alois Vahrner

Moderation: Marc Springer

01:15 Beginn

01:41 Jasmin Auer und Thomas Mayer, Landeszentrum für Hörgeschädigte

Am Sonntag feierte die ganze Welt den internationalen Tag der Gehörlosen.

Read More »

Read More »

Jetzt auf RÜCKSETZER WARTEN? Anleger REDUZIERT seinen SPARPLAN WTF?!

? bis zu 2 Gratisaktien bei Depotempfehlung für ETFs & Aktien ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ► https://link.aktienmitkopf.de/Bison *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts & Hoodies...

Read More »

Read More »

LIVE: 3. WELTKRIEG UND NEUE GELDORDNUNG

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

Read More »

Read More »

It’s Game Over For Fiat Currencies Invest In Real Assets!! – Alasdair Macleod | BUY SILVER

It’s Game Over For Fiat Currencies Invest In Real Assets!! - Alasdair Macleod | BUY SILVER

In this video Alasdair Macleod talks about why we should invest in real assets like Silver.

Enjoyed the video? Comment below! ?

? Subscribe to The Financial Brief here ?? https://watch.thefinancialbrief.com/1i1mr

❤️ Enjoyed? Hit the like button! ?

⬇ Inspired By: ⬇

URGENT: I’m Buying All the Silver - Robert Kiyosaki

SILVER: Return of the Short Squeeze -...

Read More »

Read More »

Will We Re-challenge June’s Lows?| 3:00 on Markets & Money

(9/26/22) Markets sold off on Friday, re-testing June's lows. The question now is, is the market set to go lower, or do we get a reflexive rally to sell-into? June's lows will be re-challenged once again this morning, and with markets at three standard deviations off the 50-DMA, a reflexive-rally back up to 3,900 would not be surprising, and a great area from which to lift exposure.

Bearish sentiment is now at record levels, and a record number of...

Read More »

Read More »

The Fed has Gone Too Far

(9/26/22) Markets on Friday held onto June bottoms and are expected to rally back to 3,900; there were a record number of put-options placed on Friday, as well, indicating investors are hedging against a market crash. Could Italian national elections installing a fiscal conservative by an overwhelming majority be a precursor to US Mid-terms? Current challenges in the auto market: Few used cars available, prices at a premium; long term result of...

Read More »

Read More »

„Guter Ökonom, böser Ökonom“ | Prof. Dr. Max Otte im Gespräch

#shorts

Man kann es in fast allen Wissenschaften sehen. Meinungsmacher und Gefälligkeits-Experten, die aufgrund Ihres Halbwissens, besonders gut als Sprachrohr genutzt werden.

Read More »

Read More »

Wie ist eine Weltsystemkrise zu verstehen? | Prof. Dr. Max Otte im Gespräch

Systemkrise bedeutet nicht gleich Finanzkrise! Eine Systemkrise kann u. a. durch intensive staatliche Eingriffe, Regulierungen und Kontrollen gekennzeichnet sein.

Read More »

Read More »

Chance auf kurzfristige Gewinne | Blick auf die Woche | KW 39

Im DAX hat die Unterstützungszone rund um den Jahrestiefstand, oder sagen wir vielmehr um den ehemaligen Jahrestiefstand ? bei 12.367 Punkten, nicht gehalten. Freitag ging es mit insgesamt fast 3 % doch recht massiv bergab.

Read More »

Read More »