Tag Archive: newsletter

Die RENTE in DEUTSCHLAND ist eine ZEITBOMBE! Ökonom Dr. Daniel Stelter im Interview

Hier könnt ihr den Podcast/Blog von Dr. Daniel Stelter anschauen https://think-beyondtheobvious.com/

Audible 30-Tage kostenlos testen ► ► https://shorturl.at/eqtAR *

Audible 60-Tage kostenlos testen (für Prime-Kunden) ► ► https://cutt.ly/YBveIxP *

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

? Meine Shirts & Hoodies ►► http://kapitalisten.shop

Du willst mehr über...

Read More »

Read More »

The USD is seeing some downside. Looking to break 4 day of gains.

The USD is seeing a modest move to the downside. There is some reactionary moves off of high USD levels in some of major currencies.

EURUSD: For the EURUSD the pair found support buyers against a swing area low going back to 2002 between 0.9662. The low got within 6-7 pips of that level

USDJPY: The USDJPY got within 6-7 pips of the BOJ intervention high at 145.90 reachedon September 22 and moved to the downside GBPUSD: The

GBPUSD reached a...

Read More »

Read More »

Is Inflation Cooling? | 3:00 on Markets & Money

(10/11/22) Oil prices were over sold and due for a rally, which came to fruition, and we took off some energy exposure on Monday. OPEC cuts and tapping the SPR is creating a forecast for higher oil prices, yet. If oil prices stabilize at $85-87/bbl and work off their overboughtedness, we could then see another rally up to $100/bbl by the end of the year. However, oil prices have declined over all from their peak earlier this year. We're looking for...

Read More »

Read More »

Alasdair Macleod: The Crash Has Begun! You Need More Gold & Silver

▶︎1000x – Enter your Email ▶︎ https://bit.ly/3RT4WVc

▶︎ Subscribe to this YouTube channel ▶︎ https://bit.ly/CompactSilverNews_subscribe

▶︎ Join the official 1000x Telegram channel! Join us on the road to 1000x: https://t.me/official1000x

Alasdair has been a celebrated stockbroker and Member of the London Stock Exchange for over four decades. His experience encompasses equity and bond markets, fund management, corporate finance and investment...

Read More »

Read More »

This is not the 1970’s Inflation

(10/11/22) Is Jamie Dimon correct in predicting a recession by 2023? 263k jobs number is great, but part of a declining trend. The Paradox of Savings makes for a weaker economy; earnings season is coming with estimates still too high. CEO confidence is at record lows, anticipating layoffs, starting with work-at-home employees. Employment growth is trending negatively. The Fed WILL make a policy mistake, and there is clear evidence Recession will...

Read More »

Read More »

Inflation, High Inflation, Hyperinflation

The word “inflation” is heard and read everywhere these days. However, since different people sometimes have very different understandings of inflation, here is a definition: Inflation is the sustained rise in the prices of goods across the board.

Read More »

Read More »

Die 5 wichtigsten Punkte für soliden Vermögensaufbau mit Aktien – Leben von Dividenden

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Bank of England Steps in to Buy Inflation-Linked Bonds for the First Time

Overview: The dollar continues to ride high. It reached its highest level against the yen since the recent intervention. The Canadian dollar has fallen to its lowest level in two-and-a-half years and the New Zealand dollar is approaching the 2020 extreme.

Read More »

Read More »

Switzerland shares bank details with Nigeria for first time

Five additional countries, including Nigeria, now benefit from an automatic exchange of banking information with Switzerland, taking the total to over 100 for the first time.

Read More »

Read More »

Live-Trading mit Rüdiger Born 25.10.22

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter. Kostenlose Anmeldung: https://de.xtb.com/born-live

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/Taegliche-Marktanalysen

??? Trading Wissen:

https://www.xtb.com/de/Ausbildung

? Unsere BESTE mobile Trading App:

https://www.xtb.com/de/mobile-app

? Aktien ohne Provision: https://www.xtb.com/de/aktien

?...

Read More »

Read More »

Live-Trading mit Rüdiger Born 18.10.22

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter. Kostenlose Anmeldung: https://de.xtb.com/born-live

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/Taegliche-Marktanalysen

??? Trading Wissen:

https://www.xtb.com/de/Ausbildung

? Unsere BESTE mobile Trading App:

https://www.xtb.com/de/mobile-app

? Aktien ohne Provision: https://www.xtb.com/de/aktien

?...

Read More »

Read More »

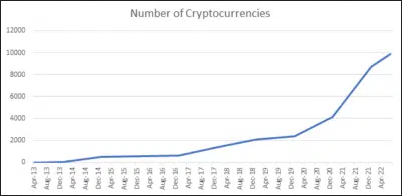

Crypto and the Environment

An intrusive intervention into the crypto market similar to what the EU has recently provided is not a sure promise of a Pareto efficient result.

Read More »

Read More »

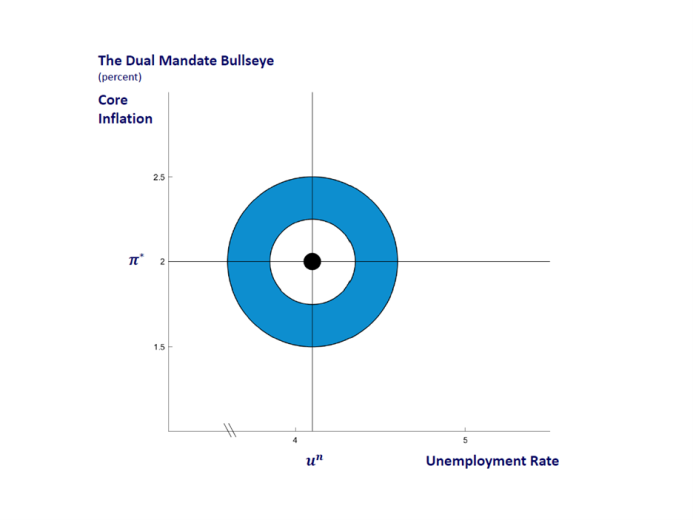

The Fed’s Real Mandate

The Federal Reserve has a legal dual mandate to minimize unemployment and price inflation. The current “dual” between the two mandates is to reduce price inflation by increasing interest rates to increase unemployment and kill businesses to choke off aggregate demand.

Read More »

Read More »

Weekly Market Pulse: The Real Reason The Fed Should Pause

The Federal Reserve has been on a mission lately to make sure everyone knows they are serious about killing the inflation they created. Over the last two weeks, Federal Reserve officials delivered 37 speeches, all of the speakers competing to see who could be the most hawkish.

Read More »

Read More »

Krisensicher Anlegen als Privatanleger mit @Thomas der Sparkojote

Ein besonderes Highlight auf dem diesjährigen Börsentag Zürich war die BX Swiss Blogger-Lounge. Bekannte YouTuber und Finanz-Influencer standen für Gespräche und Diskussionen bereit und vermittelten Ihr Wissen und Ihre Erfahrungen in Vorträgen.

Hier steht @Thomas der Sparkojote auf der Bühne .... ??

☛ Kapitel ☚

00:08 Intro Börsentag Zürich & @Thomas der Sparkojote

00:56 Krisensicher Anlegen als Privatanleger

01:16 Gesamte Asset-Allokation...

Read More »

Read More »

USDCAD moves higher and away from 200 hour MA. What next?

The USDCAD moved above the 200 hour MA last Friday and after a test, bounced against the MA level. That MA is now close support. Stay above is more bullish.

The highs from September and early October loom above between 1.3807 to 1.3836. Above that and the 1.38548 will be the next target before moving into the 2020 extreme levels.

Read More »

Read More »

AUDUSD trades to news lows for the year/low going back to April 2020. What now?

The AUDUSD fell to the lowest level since April 2020 today and outside an up and down swing area that had confined the pair over the last two or so weeks of trading. What now?

Sellers are in control. The pair is in a channel on the hourly chart that if broken to the upside might give some dip buyers more hope. However, it will still take a move above the 0.6363 low from September 28 and the 38.2% of the move down from the last high last week at...

Read More »

Read More »

Ende des Geldes, wie wir es kennen? [Fiat Meltdown]

? Brandneues Krypto Rendite Training

? https://kryptorendite.com/yt/updates

? Jetzt eintragen & alle Updates erhalten!

------------------------------------

#Eurokollaps 2022? Nach dem Einbruch des britischen #Pfund stellen sich Investoren und Kleinanleger die Frage, kann das auch mit dem #Euro passieren? Kann der Euro kollabieren? Was genau in UK passiert ist, wie es zum Wertverlust des britischen Pfund kam und ob Euro, japanische Yen & Co...

Read More »

Read More »