Tag Archive: newsletter

“Global Economy Is Already Damaged And We Are In Severe Recession” | Says Marc Faber

"Global Economy Is Already Damaged And We Are In Severe Recession" | Says Marc Faber

Dr. Marc Faber argues we may be transitioning into a time period where returns are no longer easily generated and there might be an extended environment of financial assets losing value.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

RESOURCES :

? Trade Safely and Anonymously with AtlasVPN:

83% OFF with this link

https://partner.vpnatlas.com/SHLK

(These are Affiliate Links)...

Read More »

Read More »

Why hate is fuelling politics

Hate is fuelling politics in America and Britain, as arguments over racial justice, transgender rights and other issues become more polarised. These tribal "culture wars” spell bad news for democracy. Film supported by @Mishcon de Reya LLP

00:00 - Are we becoming more divided?

01:16 - Critical race theory

06:48 - What are culture wars?

11:32 - Transgender rights

17:14 - The effects of social media

19:42 - Policing vs democracy

23:46 - The...

Read More »

Read More »

Sprott Money Ask The Expert September 2022 – Dr. Ron Paul

Former Congressman and sound money advocate, Dr. Ron Paul, joins us to answer your questions regarding the economy, gold and the current state of U.S. politics.

Subscribe to our weekly newsletter www.sprottmoney.com/news-letter.

Have questions for us? Send them to [email protected] or simply leave a comment here.

Read More »

Read More »

Higher Rates are Here to Stay Until 2023 | 3:00 on Markets & Money

(9/22/22) The Fed jacked rates up 75-basis points, as expected, and held out the possibility of at least two more rate hikes this year. The thing that shocked markets was the implication by Jerome Powell that higher rates would be here to stay throughout 2023, barring a recession or credit-related event that might cause the Fed to reverse policy. Markets in response sold off, taking out lows established back in May, an important support level we've...

Read More »

Read More »

The BOJ intervenes sending the USDJPY lower. The SNB raises rates by 50 BPS. CBs go wild

Lots of central bank action as they go wild with policy signal. The action sends currency rates around.

- The Federal Reserve raised rates by 75 basis points yesterday

- The Bank of Japan kept rates unchanged but intervene in the currency markets

- The Swiss National Bank raise rates by 75 basis points and the threaten to intervene in the currency market

- The Bank of England raise rates by 50 basis points with some dissenters looking for a higher...

Read More »

Read More »

Did the Fed Just Break the Economy?

(9/22/22) It's a Trifecta Thursday with the onset of Autumn and the Death of the Roberts' Duber; the Fed raises rates 75-basis points, as expected, but shocks markets by saying higher rates are here to stay through 2023...unless something occurs to cause a change in stance. The Fed's "good intentions" vs reality; markets are now on the same page. The impact of higher rates on Bonds: TINA, FOMO, & YOLO in the Bond market; the...

Read More »

Read More »

Gerd Kommer: #Aktien bringen 2x soviel wie #Immobilien!

Warum Aktien alles schlagen und im Vergleich zu anderen Anlageklassen die beste Wahl sind bringt Dr. Gerd Kommer, Vermögensverwalter & Autor in diesem Video auf den Punkt.

Diese Video ist ein Ausschnitt aus der Diskussion zwischen Gerd Kommern und Wiener Börse-Chef Christoph Boschan zum Thema "Drohender Wohlstandsverlust – Zeit zu handeln für Staat & Bürger" vom 13.9.2022. Die beiden Börsen-Profis erörtern, wie mehr Menschen von...

Read More »

Read More »

Cryptomarkt verliert zwei Drittel seiner Marktkapitalisierung

Im November 2021 hatte der Markt fast die Marke von drei Billionen erreicht. Seitdem ging es jedoch steil bergab. In den letzten Tagen ging es sogar unter eine Billionen US-Dollar, so dass der Markt in weniger als einem Jahr zwei Drittel seines Gesamtwertes verloren hat. Crypto News: Cryptomarkt verliert zwei Drittel seiner MarktkapitalisierungFür Bitcoin ging es im selben Zeitraum sogar etwas mehr als zwei Drittel nach unten. Dies zeigt wieder...

Read More »

Read More »

Schrödinger’s US-Dollar | Tavi Costa & Ronald Stöferle

Tavi Costa of Crescat Capital interviews Ronald Stöferle at this year’s Precious Metals Summit Conference located in Beaver Creek, CO. Together they discussed the current market setup. They discuss an interesting point, that the US-Dollar currently seems to be strong and weak at the same time.

The current setup

All around the western world we are looking at some sort of recession. Especially in Europe and the USA. Europe right now seems to be much...

Read More »

Read More »

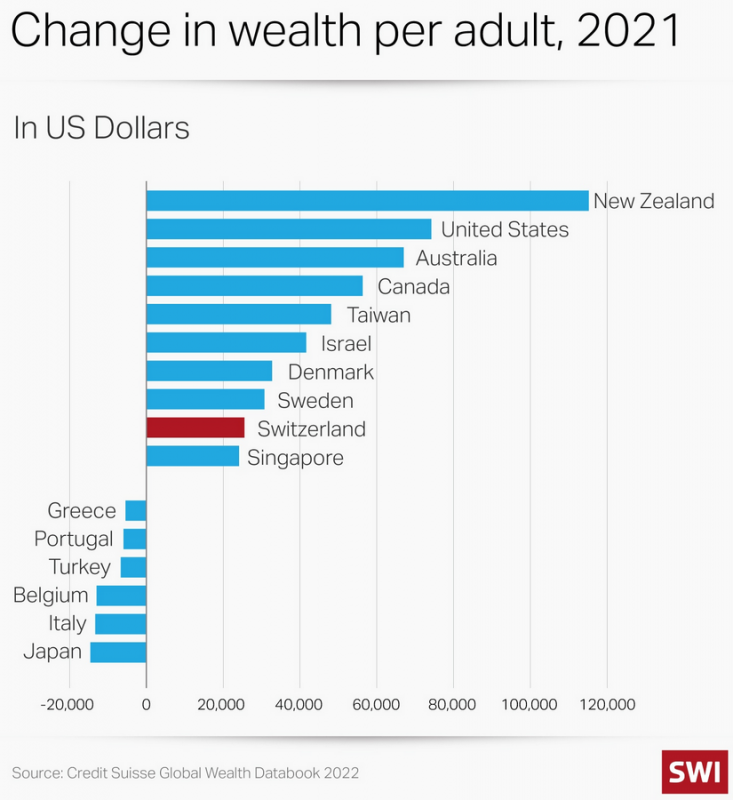

Wealthy echelons thrive amid economic volatility

The world’s richest people saw their wealth expand last year as stock markets and real estate gained in value, according to Swiss bank Credit Suisse.

Read More »

Read More »

Does Capitalism Itself Create Economic Instability or Is Central Banking the Culprit?

Instability in financial markets has brought back the ideas of post-Keynesian school of economics (PK) economist Hyman Minsky. Minsky held that the capitalist economy inherently is unstable, culminating in severe economic crisis, accumulation of debt being the key mechanism pushing the economy toward a crisis.

Read More »

Read More »

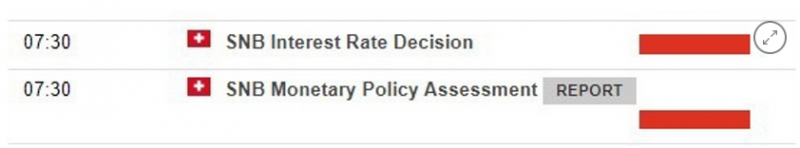

Swiss National Bank meet this week – Goldman Sachs says “We are bullish on the CHF”

Goldman Sachs maintains a bullish bias on CHF going into this week's SNB policy meeting.

Read More »

Read More »

Central Bankers Are Gaslighting Us about the “Strong Dollar”

On February 8, the Japanese yen fell to a 24-year low against the dollar, dropping to 143 yen per dollar. Not much has changed since then with the yen hovering between 142 and 144 per dollar. In September of 2021, one only needed 109 yen to buy a dollar.

Read More »

Read More »

Hans-Werner Sinn: EZB muss dringend reagieren, tut es aber nicht

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3OXwFTQ

HANS-WERNER SINN ONLINE

▶︎ Hans-Werner Sinns Webseite: https://www.hanswernersinn.de/

▶︎ Hans-Werner Sinns Bücher auf Amazon: http://bit.ly/Hans-Werner-Sinn-auf-Amazon

#hanswernersinn #finanznews #inflation #finanzmarkt #zentralbank #euro #fiatgeld

Hans-Werner Sinn: EZB muss dringend reagieren, tut es aber nicht...

Read More »

Read More »

It will be Enough, even if Too Much

Business travel commitments

keep me from updating the blog until the weekend, but I wanted to share a

few thoughts post-Fed. First, the Fed was more

hawkish, and the median dot sees 125 bp increase in the target rate in

Q4. The hawkish thrust was also evident in projecting that the target

rate will remain higher for longer. Even in 2025 sees the target rate

above the longer-term (neutral) level. Second, the market still

does not fully accept...

Read More »

Read More »

As the FOMC dust settles, what are the technical driving the currencies vs the USD

The FOMC raised rates by 75 basis points and also sent the market a warning that they see even higher rates than the market expects.

The price action saw the dollar move higher initially , but then down as comments in the presser showed less hawkishness from the Fed chair.

However, as the dust settled, the more hawkish overtures restarted and the dollar moved higher.

What next?

In the vidoe, Greg Michalowski looks at ALL the major...

Read More »

Read More »

Eilmeldung: FED will dass der Markt weiter fällt!

Kostenloses Live-Webinar: Wann endet der Bärenmarkt & wie kannst du davon profitieren?

22.09.2022 um 19 Uhr

Trage dich hier zum kostenfreien Webinar ein: https://jensrabe.de/EilmeldungFEDwebinar

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:

https://jensrabe.de/EilmeldungFED

Schaut auf dem neuen Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

Newsletter

https://jensrabe.de/newsletter-yt...

Read More »

Read More »

Principles 5 Year Anniversary

It’s been a surprising and delightful 5 years since I put out my book #Principles, and the highlight has been interacting with so many of you. #journal #raydalio

Read More »

Read More »

MAX OTTE SPRICHT KLARTEXT! UNSERE WELT AM ENDE!

Wirtschaft und Politik aktuell - DIE WAHRHEIT - GELD | WIRTSCHAFT | FINANZEN

? HIER ZUM DEPOT GESAMTSIEGER ➔ https://bit.ly/2VSscrq

? BITCOINS KOSTENFREI KAUFEN AUF ETORO ➔ https://bit.ly/36U1W6o

---------------------------

Wichtige Schlagwörter

#wirtschaft #finanzen #community #geldanlage #demokonto #demodepot #demobroker #forexbroker #forexhandel #wirtschaftaktuell #wirtschaft #wirtschaftsnachrichten #finanzstrategie #prognosen #nachrichten...

Read More »

Read More »

Alasdair Macleod – An Asian Bretton Woods? Where Does that Leave America?

Alasdair Macleod thinks Putin is assembling a new gold-backed, multi-currency system combining plans for a new Asian trade currency with his new Moscow World Standard for gold.

Read More »

Read More »