Tag Archive: newsletter

Was Finanz-YouTuber euch nie erzählen (ICH TUE ES JETZT)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Was Finanz-YouTuber euch nie erzählen (ICH TUE ES)

Von aussen sieht als Zuschauer, das Leben eines YouTubers immer perfekt aus. Ich möchte dir, die Wahrheit sagen und zeigen, dass nicht immer alles Gold ist was glänzt. Transparent möchte ich über meine aktuellen Hürden und Challenges sprechen und mit dir meine Gedanken...

Read More »

Read More »

WIE SCHLIMM WIRD ES NOCH?

Alles Rot, Insolvenzen, Gerüchte... Wie geht es diese Woche weiter? Was erwarte ich? Pump? Oder geht es noch weiter runter?

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH cryptofit zu machen!

#JulianHosp #Bitcoin #Blockchain

? Kein Video mehr verpassen? ABONNIERE meinen Kanal: https://www.youtube.com/channel/UCseNUrq7mUUWqTspr4QJ9eg?sub_confirmation=1 UND klicke die GLOCKE ? -...

Read More »

Read More »

The Dollar Posts Corrective Upticks, while the Market Digests China’s Initiatives

Overview: China’s new initiatives to support the property sector helped lift the Hang Seng. And while the China’s CSI 300 edged higher both the Shanghai and Shenzhen composites fell. Most Asia Pacific markets fell, while Europe’s Stoxx 600 is posting a small gain.

Read More »

Read More »

What You Need To Do With Your GOLD & SILVER Now! – Alasdair Macleod | GOLD Price Prediction

What You Need To Do With Your GOLD & SILVER Now! - Alasdair Macleod | GOLD Price Prediction

#AlasdairMacleod#Silver #silverprice #silverstacking #fed #financedaily #silverprice #silversqueeze

______________

Video content: Mike Larson, silver, Restart, reset, the big reset, banks USA, savings banks USA, economy USA, finance USA, money USA, capital USA, stocks USA, stock exchange USA, real estate USA, politics USA, media USA, gold, gold...

Read More »

Read More »

Joe Biden and the “Transformational” Presidency

Much is made of the failure of Republicans to make predicted gains in the recent midterm elections, but, as Ryan McMaken has pointed out, Congress plays a much-diminished role in national governance to the point that even had the so-called Red Wave actually occurred, it is doubtful that much would have changed regarding Joe Biden’s presidency.

Read More »

Read More »

Can Increases in the Supply of Gold Lead to Boom-Bust Cycles?

According to the Austrian business cycle theory, the boom-bust cycle emerges in response to a deviation in the market interest rate from the natural interest rate, or the equilibrium interest rate. As a rule, it is held, the tampering with market interest rates by the central bank sets the boom-bust cycle in motion.

Read More »

Read More »

EZB-Ratsmitglied Holzmann: Fiskalpolitik im Euroraum gibt mehr Geld aus als nötig

Der Kampf der EZB gegen die Rekordinflation wird zum Teil von einer Haushaltspolitik konterkariert, die zu viel Geld ausgibt, um die steigenden Lebenshaltungskosten abzufedern, sagte Ratsmitglied Robert Holzmann.

Read More »

Read More »

Weiterhin Stärke für unseren Leitindex – “DAX Long oder Short?” mit Marcus Klebe – 14.11.22

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbrokers.com/de...

Read More »

Read More »

Swiss health office and pharma firm at odds over flu spray

The Swiss health authorities and the manufacturer AstraZeneca are at loggerheads over a nasal spray to vaccinate children and adolescents against influenza.

Read More »

Read More »

Weekly Market Pulse: Good News, Bad News

One thing I can tell you for certain about last week’s big rally on Thursday and Friday: there were a lot of people who desperately wanted a good excuse to buy stocks. And buy they did after a better-than-expected CPI report Thursday morning, pushing the S&P 500 up nearly 6% on the week with all of that coming on Thursday and Friday.

Read More »

Read More »

Asymmetries, Distortions and Denial

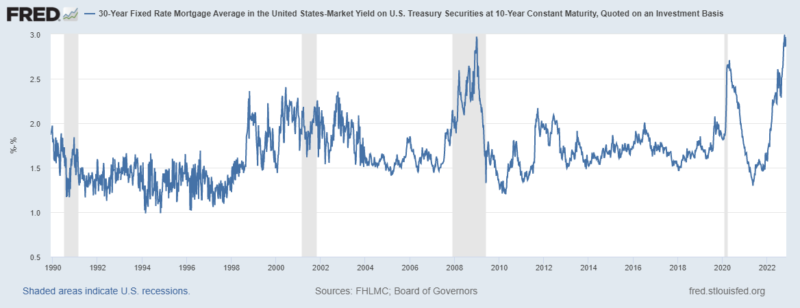

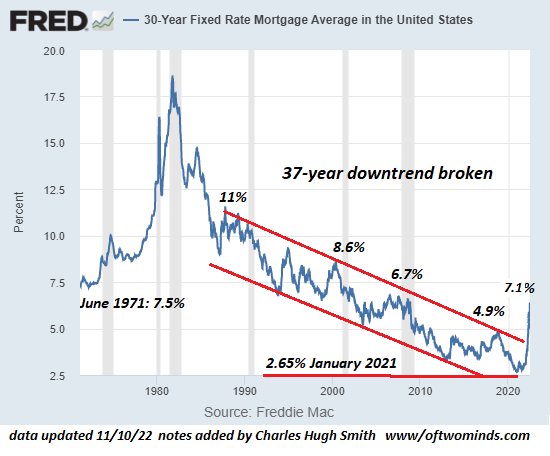

When bubbles pop, it's natural selection at its most unforgiving: "adapt or die," and those who ignore or discount consequential asymmetries will have a very difficult time navigating the triage. After years of relative stability, it seems asymmetries, distortions and denial are playing out in unexpectedly destabilizing ways.

Read More »

Read More »

FTX lacked in their risk focus & the rest is history.That and a CPI miss led to a USD rout

The weekend forex technical report too.

RISK

Or lack thereof, led to the demise of the FTX currency exchange last week. That story led to sharply lower digital currencies, including a 92% decline in the FTX token FTT.

From an economic perspective, the US CPI proved to be the binary release that many thought it would be. The subsequent wave sent the USD sharply lower, the stocks soaring and yields lower in the US (the USD is driving the global...

Read More »

Read More »

Was will Elon Musk mit Twitter erreichen?

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Dow Jones technical analysis till the end of 2022

Dow Jones futures is looking bullish till the end of year 2022, and probably heading to 35000. Visit ForexLive.com for additional technical analyses.

Read More »

Read More »

Wolfgang Grupp: “STOPPT die Waffenlieferungen und verhandelt!”

Heute wird mein Format "Marc spricht mit.." besonders spannend! Mit dem bekannten TRIGEMA-Chef Wolfgang Grupp bespreche ich, ob er für seine offene Meinung schon diffamiert wurde, was seine Gedanken zur momentanen Sanktionspolitik sind, wie sein Unternehmen mit der aktuellen Krise umgeht und wann auch er die Koffer packen würde, da sich der Industriestandort Deutschland nicht mehr rentiert. Viel Spaß!

Website Trigema:...

Read More »

Read More »

Drei Bücher, die vom Markt genommen wurden | Vorgestellt durch Max Otte

Max Otte stellt in diesem Video drei Bücher vor, die in Deutschland vom Markt genommen wurden und im Buchhandel nicht mehr erhältlich sind. Warum will man nicht, dass diese Bücher in Deutschland gelesen werden? Natürlich geht es um die Inhalte! Max Otte stellt zunächst das Buch "Die einzige Weltmacht" von Zbigniew Brzezinski vor, das bereits vor 25 Jahren erschienen ist und in dessen Inhaltsverzeichnis die Ukraine 20mal vorkommt. Des...

Read More »

Read More »

„Cancel-Culture“ in Universitäten und Hochschulen | Prof. Dr. Max Otte mit Robert Stein

Wir alle erleben Cancel-Culture täglich in unseren Jobs. Als verbeamteter Professor auf Lebenszeit für internationale Wirtschaft in Worms, wollte ich mich nicht länger den Zwängen der Hochschule aussetzten und habe somit entschieden alles an den Nagel zu hängen. Für mich ist die Hochschule ein Ort, an dem man sich frei entfalten und denken kann. Mittlerweile darf man immer weniger sagen, man wird mehr überwacht. Die ganze Hochschullandschaft hat...

Read More »

Read More »

Roomtour: Minimalistisch leben auf 100qm – ist das noch Minimalismus?

Originalvideo: _Hg

Depot eröffnen & loslegen:

⭐ Scalable Capital: *https://minimalfrugal.com/scalable

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect:...

Read More »

Read More »

Something Big Is About To Happen With Gold & Silver Being Drained – Alasdair Macleod

Something Big Is About To Happen With Gold & Silver Being Drained - Alasdair Macleod

You can reach the full transcript from our blog: theeconomictruth24.blogspot.com/

Twitter: twitter.com/economictruth24

----------------------------------------------------------------------------------------------------------------------------------------

Most of the work in these videos was created by The Economic Truth and used as a topic representation....

Read More »

Read More »