Tag Archive: newsletter

The Unintended (Awful) Consequences of ETF Investing

(1/26/23) What happened to the Market selloff? If the Fed goes "dovish" next week, the subsequent rally will be ON, and you'll have only one chance to catch it. The challenges of stock-picking in 2023 because of passive indexing. The conundrum of market volatility and the VIX "Fear Gauge;" the Zero-DTE activity surge is not measured in the VIX. The danger in next week's Fed Meeting: What Powell says afterwards. Rate hikes are...

Read More »

Read More »

European Shadow Unemployment Is a Real Problem

The latest jobs report in the United States shows strengths and weaknesses. Total nonfarm payroll employment increased by 223,000 in December, and the unemployment rate fell to 3.5 percent. However, the United States job market continues to show negative real wage growth, the employment-to-population ratio is 60.1 percent, and the force participation rate is 62.3 percent.

Read More »

Read More »

Live-Trading mit Rüdiger Born Analyse, Trading-Ideen & Daytrading 31.01.23

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter.

Erleben Sie einen der bekanntesten Daytrader Deutschlands bei der Arbeit: Screening der Märkte, Chartanalyse, Trademanagement und vieles mehr. Dabei anschaulich und in einfacher Sprache auch für Anfänger gut verständlich und nachvollziehbar.

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/Taegliche-Marktanalysen

???...

Read More »

Read More »

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

2,3% Zinshammer bei Scalable Capital! Gibt es einen Haken?

2,3% Zinshammer bei Scalable Capital! Gibt es einen Haken?

? 2,3% Zinsen bei Depoteröffnung für ETFs & Aktien ► http://link.aktienmitkopf.de/Depot *

Seit heute bietet Scalable Capital den Kunden satte 2,3% Zinsen auf das Geld auf ihrem Verrechnungskonto an. Aber was genau steckt hinter dieser Aktion? Hat das Ganze einen Haken? Und was muss man als Bestandskunde machen, um von dieser Aktion zu profitieren? All das und mehr, erfahrt ihr im...

Read More »

Read More »

Company takeovers and mergers on the rise in Switzerland

Despite the volatile situation on financial markets and the war in Ukraine, the number of mergers and acquisitions (M&As) reached a record high in Switzerland in 2022.

Read More »

Read More »

An eye opening forecast for the stock market in 2023 aided by volume profile analysis @ForexLive.com

Learn about the powerful technique of Volume Profile and how it can give you insight into the market's future direction. See how @Forexlive expert Itai Levitan uses it to predict the stock market by identifying key levels of support and resistance. Understand how volume activity at different price levels can indicate market sentiment and potential price movements.

Don't miss out on this valuable information and visit ForexLive.com for more...

Read More »

Read More »

Davon träumen ALLE (und es ruiniert sie!) ️ #shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #44

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #45

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Aktien der Kantonalbanken: Des Rätsels Lösung

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Yes, the Minimum Wage Harms the Economy

The 2021 Nobel Prize in Economic Sciences was awarded to David Card, Joshua Angrist, and Guido Imbens. David Card received the award for his paper (coauthored with Alan Krueger) “Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania.”

Read More »

Read More »

Nasdaq technical analysis for 26 Jan 2023

The market reaction to Tesla's earnings release will be closely watched today. See how Nasdaq futures respond and if the uptrend is sustained. Learn about key resistance zones and what it means for bulls and bears.

Stay informed with expert analysis on ForexLive.com

Read More »

Read More »

Der Weg nach oben wird wieder freier – “DAX Long oder Short?” mit Marcus Klebe – 26.01.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

Was Martin Luther King a Russian Red?

Today, federal officials stumble over themselves to show how much they revere Martin Luther King. They’ve even created a federal holiday to honor him. Not so back when King was alive, however. During that time, U.S. officials were convinced that King was a Red, and they were also convinced that the Reds, especially the Russian Reds, were coming to get us.

Read More »

Read More »

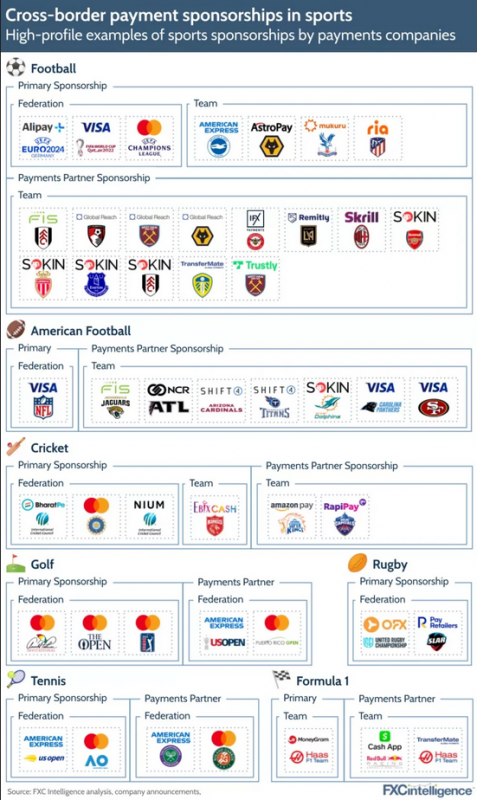

Payment, Fintech Companies Embrace Sports Sponsorships

Sports sponsorship deals from financial services and fintech companies alike have increased significantly over the past three years on the back of rising competition in the industry and amid hopes for increased brand awareness and exposure.

Read More »

Read More »

Time has run out and there’s no escaping what’s next.

Government officials and politicians, even stock market "analysts", these are the last people you want to depend on for useful macro analysis. What is dependable has been unmistakable if you haven't been distracted.

Read More »

Read More »

Saving Your Retirement – Robert Kiyosaki, Peter Grandich

The baby boomer generation is the second largest generation in American history with over 72 million individuals. And they’re all getting ready to retire. The problem is…they have no money. Even worse, generations following the baby boomer generation are worse off. Today’s guest gives his outlook for retirement savings in 2023.

Peter Grandich, author of “Confessions of a Former Wall Street Whiz Kid” says, “I never thought I’d see 33 trillion in...

Read More »

Read More »