Tag Archive: newsletter

How Religious Freedom in America Was Founded on Privatization and Decentralization

The drive to religious freedom in America was carried out overwhelmingly in the state legislatures—and the federal First Amendment had almost nothing to do with it.

Read More »

Read More »

Today’s Events from a Big Cycle Perspective

The pandemic and AI didn’t just disrupt the U.S. economy — they accelerated long-term forces that were already in motion. They’ve reshaped how work is done, who wins, and who falls behind.

Understanding these shifts is essential if you want to navigate what’s coming next.

You can watch the full conversation here: -uGWS1GH8?si=-MxpNAYZv4JWhkN0

Read More »

Read More »

Forex technical view: FX majors set up ahead of US jobs, retail sales, and PMI data

As North America opens, EURUSD, USDJPY, and GBPUSD show key technical signals with nonfarm payrolls, retail sales, and flash PMIs in focus

Read More »

Read More »

12-16-25 Year-End Checklist for Young Investors

As the year comes to a close, young investors have a unique opportunity to make small moves that can compound into meaningful long-term results. In this episode, we walk through a practical, end-of-year checklist designed for early-career investors who want to stay organized, tax-aware, and financially disciplined.

Lance Roberts & Jonathan Penn cover how to confirm you’re capturing all available employer benefits, including 401(k) or 403(b)...

Read More »

Read More »

Mein wichtigster Investitionsgrundsatz

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Warum??? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #nato

Endlich finanziell Frei sein? Sichere dir JETZT deinen Platz im kostenlosen Workshop:

👉 https://www.oliverklemm.com/workshop/

Kostenfreies Video-Training (Durch Trading in 2025 absichern)

👉 http://oliverklemmtrading.com/training

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen

👉 http://oliverklemmtrading.com/bewerbung

►►Mein Zweitkanal (Trading Content): https://www.youtube.com/@oliverklemmtrading/

►Folge Oli auf...

Read More »

Read More »

President Trump’s “Mission Accomplished” Moment

Unless President Trump reverses course, the “Lower Prices Bigger Paychecks” banner that hung behind him at his “affordability” speech this month will be remembered as being to economic policy what President George W. Bush’s “Mission Accomplished” banner was to foreign policy.

Read More »

Read More »

An Economic Contagion

When there is a cascade of failing businesses at one time, it is easy to think of it as an economic contagion that is a by-product of capitalism. Yet, a cluster of business errors can be laid firmly at the feet of government.

Read More »

Read More »

LA LÓGICA DE COMPRAR DÓLARES ES ABRUMADORA

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

Obama’s PowerPoint Death Parade Led to Trump’s Venezuelan Killings

President Trump and Hegseth are cashing a blank check for carnage that was written years earlier by President Barack Obama.

Read More »

Read More »

November’s Weak Jobs Report Pushes the Fed Toward More Monetary Stimulus

If employment reports continue to show growing economic stagnation, calls for more monetary inflation and government spending will only grow.

Read More »

Read More »

J.P. Morgan Launches Tokenised Money Market Fund on Ethereum

J.P. Morgan Asset Management has launched its first tokenised money market fund, My OnChain Net Yield Fund (MONY), on the public Ethereum blockchain.

The fund is powered by Kinexys Digital Assets, the firm’s multi-chain asset tokenisation solution.

MONY is a 506(c) private placement fund offering qualified investors the ability to earn US dollar yields by subscribing via Morgan Money, J.P. Morgan’s trading and analytics platform for liquidity...

Read More »

Read More »

US Fed Cuts – Das musst du jetzt tun!

Wenn die US Zentral Bank (Federal Reserve) cuttet, heißt das: Zinsen fallen.

Und oft passiert das nicht allein, sondern begleitet von massiven Staatsanleihekäufen.

Was bedeutet das für dich:

1️⃣ Inflation schießt rauf.

Dein Geld wird schneller entwertet, als du „Inflation“ sagen kannst.

Wer jetzt Cash rumliegen lässt, verliert. Punkt.

2️⃣ Kapital wird wieder billig.

Und dann? Aktien, Krypto und Immobilien schießen nach oben.

Der Zugang zu Geld...

Read More »

Read More »

Property Rights: The Root Cause of the Palestinian-Israeli Conflict

Saifedean Ammous: "Property rights in Palestine have been replaced by a government agency that owns the majority of land, constantly steals more, never sells, and only leases land to one racial group."

Read More »

Read More »

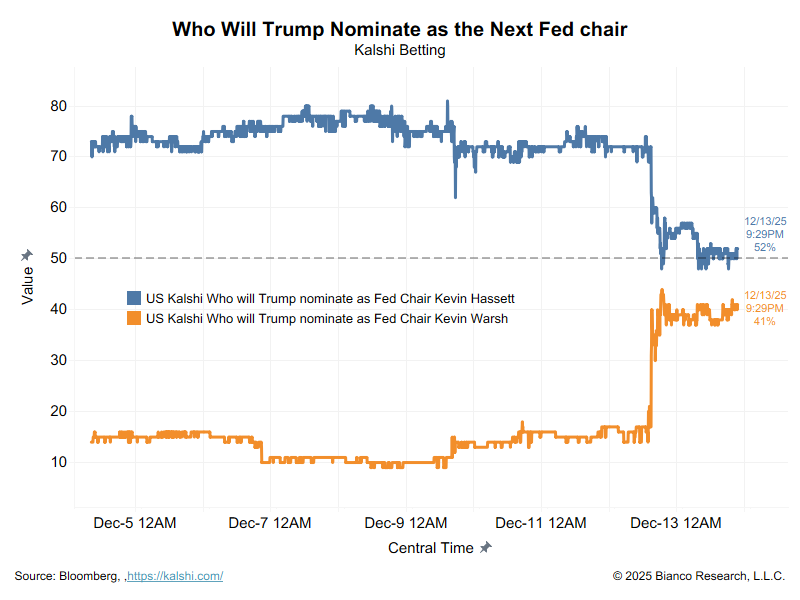

Warsh Is In The Race: Fed Chair Odds In Flux

Over the last few weeks, it seemed all but a done deal that Kevin Hassett would replace Jerome Powell as the next Fed Chair. That changed this past weekend as President Trump added Kevin Warsh alongside Hassett as his top Fed contenders. It's likely that there are a couple of factors leading Trump to add … Continue reading »

Read More »

Read More »

Why is endangered shark ending up on Swiss plates?

New regulations have restricted the import of shark meat but it still finds its way on to Swiss plates due to mislabelling, poor identification skills and the clandestine trade. Sopa de cação is a Portuguese delicacy believed to originate in the Alentejo region. It is a rich garlic and coriander broth thickened with flour and …

Read More »

Read More »

Staat versagt beim Schutz | Assimilation ist vorbei | Emirate vs. Südafrika (Morning News #521)

👉 Hier anmelden zum Workshop am 19.12.2025 um 18.00

👉 https://www.oliverklemm.com/workshop/

Kostenfreies Video-Training (Durch Trading in 2025 absichern)

👉 http://oliverklemmtrading.com/training

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen

👉 http://oliverklemmtrading.com/bewerbung

►►Mein Zweitkanal (Trading Content): @oliverklemmtrading

►Folge Oli auf Instagram: http://bit.ly/TOInst

►Abonniere Oli auf YouTube:...

Read More »

Read More »