Tag Archive: newsletter

USDJPY Technical Analysis

Here's a quick technical analysis on the USDJPY pair with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Dr. Markus Krall – Die kriminelle Wahrheit zur Rufmordkampagne

Kriminelle Behördenmitarbeiter und politische Deckung. Wie Deutschland sich von seinen Grundprinzipien entfernt

Geldsicherheit GARANTIERT - Online-Training: https://www.thorstenwittmann.de/yt-geldsicherheit-garantiert/

Atlas Initiative: https://atlas-initiative.de/

Du möchtest Dr. Krall mit den erheblichen Anwaltskosten unterstützen? Hier sind die Angaben zum Spendenkonto: https://twitter.com/Markus_Krall/status/1695808932759900399

Wie...

Read More »

Read More »

MEINE LETZTEN WORTE AN SIE | Das Ende?

Es ist Zeit Ihnen etwas mitzuteilen...

_

Abonnieren Sie den Kanal von meinem Sohn - Disruptors Spotlight: https://www.youtube.com/channel/UC9EB0P0RjXjI4Pd-4HoeiYA

Das erste Video: ?si=BR32gLU51RPyB7B4

_

? Von Dr. Markus Elsässer

3.? "Die sechs entscheidenden Lektionen des Lebens" - *https://amzn.to/3V6SbsO

2.? "Dieses Buch ist bares Geld wert" *https://amzn.to/3wr2Vq5

Als Hörbuch *https://amzn.to/3xnT6rW

1.? "Des klugen...

Read More »

Read More »

Beyond Crisis: The Ratchet Effect and the Erosion of Liberty

After governments create crises, they use those crises to seize new powers. After the crisis subsides, governments give up some, but not all, of their new authority, which we call the ratchet effect.

Original Article: "Beyond Crisis: The Ratchet Effect and the Erosion of Liberty"

Read More »

Read More »

¿Qué Debe Hacer AHORA El Partido Popular?

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Ethnic Prejudice and Wealth Gaps: Does the First Lead to the Second?

California's decision to grant reparations to black Americans has galvanized activists across the globe. Activists think that doing so will remedy the black-white wealth gap. Ensuring that blacks are on par with whites, however, is a strange goal, since East Asians outperform whites on several metrics, including education. Rather than contrasting blacks with whites, political activists should investigate why blacks have lagged behind relative to...

Read More »

Read More »

9/11 and the Triumph of the Uniparty

On this episode of Radio Rothbard, Ryan McMaken and Tho Bishop look at the domestic costs of 9/11 and its continuing impact on Americans. The two discuss articles they wrote this week about how the events sowed the seeds of the current regime, how it reversed the trajectory of rising government skepticism in the 90s, and the need for accountability still to this day.

Recommended Reading

"Three Reasons Why Military Recruitment Is in...

Read More »

Read More »

The EURUSD is lower and so are the EURGBP and the EURJPY. What are the technicals saying?

The EURUSD is lower after the ECB rate decision. What about some of the other cross-currency pairs including the EURGBP and EURJPY. In this video, I take a technical look at those currency pairs.

Read More »

Read More »

So schützt du dich vor den Tricks der Bitcoin-Anbieter | Podcast Highlight #bitcoin #shorts

Bitcoin kaufen: So schützt du dich vor den Tricks der Krypto-Anbieter!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=701&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Trader vs. Investor / Praxisbeispiel CHINA

Was sind die großen Unterschiede zwischen einem Trader und einem Investor? Warum ist es wichtig, diese beiden Handelsstile zu trennen? Diese Fragen beantworte ich dir im heutigen Video am Beispiel von chinesischen Aktien.

Trage dich ein zum kostenfreien Webinar am 19.09.2023:

https://jensrabe.de/WebinarSep23

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q3Termin23

ALLE Bücher von Jens Rabe:...

Read More »

Read More »

Schreibt uns mal privat? Nein, bloß nicht! Vorsicht vor “Finanztip”-Scammern

In der letzten Zeit eskaliert die Situation mit Bots und Scammern auf unseren Kanälen. Deshalb seid bitte vorsichtig! Wir bei Finanztip geben keine "geheimen" Tipps über Messenger. Wenn Ihr solche Fälle entdeckt: bitte meldet sie. Danke ?

Unsere Depotempfehlungen ► https://www.finanztip.de/wertpapierdepot/

Unsere ETF-Empfehlungen ► https://www.finanztip.de/indexfonds-etf/

? Jetzt Finanztip Unterstützer werden:...

Read More »

Read More »

4 Gründe warum Du Immos brauchst! ? #shorts

?Jetzt gratis teilnehmen! ?? https://wohnung-gewinnen.com/ytc

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell den Beinamen...

Read More »

Read More »

AUDUSD trades the short term retracement levels today. What next?

The 38.2% holds support in the AUDUSD today at 0.64198. The 61.8% holds resistance at 0.64587. The levels of support and resistance are defined. In between sits the 50% at 0.64392,

Read More »

Read More »

How to Start a Business with NO Money: Part 1 – Alexandra Gonzalez

When starting a business, the biggest excuse for people not doing it is because they “don’t have any money.”

Plenty of successful businesses were born out of little-to-no start-up capital. LinkedIn, Shopify, Shutterstock, and Craigslist are just a few examples of companies that started with little to no money.

Listen as Host Alexandra Gonzalez-Ganoza shares the mindset, tools, and tips to start a business with little to no money.

Blog: 12...

Read More »

Read More »

What will it take to control AI? With Yuval Noah Harari and Mustafa Suleyman

The Economist brought together Yuval Noah Harari and Mustafa Suleyman to grapple with the biggest technological revolution of our times. They debate the impact of AI on our immediate futures, how the technology can be controlled and whether it could ever have agency.

00:00 - Harari and Suleyman discuss the future of AI

00:51 - What will the world look like in 2028?

03:35 - Is AI comparable to an alien invasion?

06:22 - The importance of...

Read More »

Read More »

12 oz Libertad Sterling Silver Statue #investment #preciousmetals #silverstacker

12 oz Libertad Sterling Silver Statue - A Stunning Sterling Silver Statue of Mexico's National Symbol This stunning sterling silver statue is a beautiful depiction of Mexico's national symbol, the Libertad. The statue is 12 ounces of pure silver and is beautifully crafted. It is a perfect way to celebrate Mexico's culture and history. Order Online Today! ⬇️ https://www.moneymetals.com/libertad-sterling-silver-statue-12-troy-ozs-925-pure/641

?...

Read More »

Read More »

Weitsicht oder Fehler – Podcast mit Dr. Ulrich Kaffarnik (Marketing-Anzeige)

Nur wenige Tage vor der #Notenbanksitzung im September steht weiterhin die Frage im Raum, ob die #Fed mit dem richtigen Fingerspitzengefühl agiert.

Bisher monierten viele Marktbeobachter drei Fehler der Notenbanker:

▶ Erstens die zu ausufernde monetäre Stimulation während und nach Corona.

▶ Zweitens die Einschätzung der Inflation als temporär.

▶ Und drittens: Die zu harte Bekämpfung eben dieser durch eine scharfe geldpolitische Bremsung.

Ob...

Read More »

Read More »

The White House, the Fed, and the Economy: Mises Circle in Fort Myers, FL

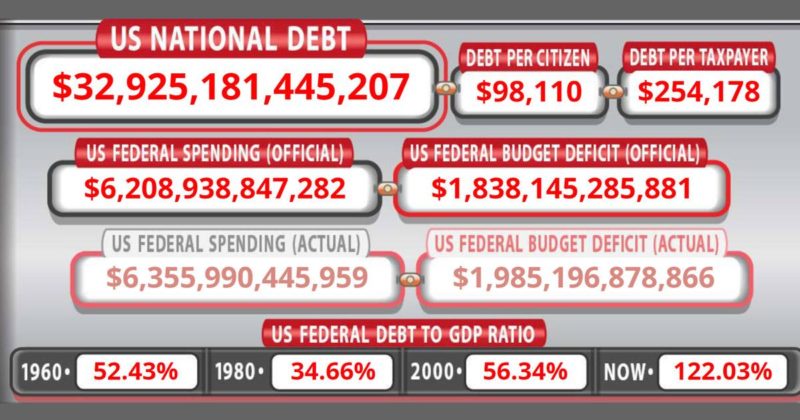

Every day, Americans feel the political capture of the economy. Inflation, taxes, and regulatory costs hit our paychecks and savings. The regulatory capture of medical industries; food and energy production; and the various instruments of Big Tech empowers the regime with new tools to promote their latest ideological cause. The ever-growing burden of government debt has become a crisis without any political will to address it.

This November, the...

Read More »

Read More »

Saving Marxism from the Labor Theory of Value: It Is Still Bad Theory

While Graham Priest seems to have "rescued" Marxism from the labor theory of value, he cannot rescue Marxism itself.

Original Article: "Saving Marxism from the Labor Theory of Value: It Is Still Bad Theory"

Read More »

Read More »