Tag Archive: newsletter

Rothbard: Understanding the History of Banking from an Austrian Perspective

A History of Money and Banking in the United States:

The Colonial Era to World War II

by Murray N. Rothbard

Edited with an Introduction by Joseph T. Salerno

(Auburn, Alabama: Ludwig von Mises Institute, 2002; 510 pages)

A History of Money and Banking in the United States comprises a collection of essays written by Murray N. Rothbard and compiled and edited by Joseph T. Salerno. It is the most comprehensive and enlightening treatise on the history...

Read More »

Read More »

Wirtschaft: ALLES bricht gerade ein!

Alles bricht ein! Baugewerbe, Einzelhandel, Industrie! Und Manche danken Habeck sogar dafür!

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

3 Aktien ab 5.000 € Einzahlung aufs Handelskonto mit Code: aktienmitkopf5

7 Aktien ab 20.000 € Einzahlung aufs Handelskonto mit Code: aktienmitkopf20

10 Aktien ab 50.000 € Einzahlung aufs Handelskonto mit Code: aktienmitkopf50

??5 Euro Startbonus bei...

Read More »

Read More »

Dirk Müller: Barzahlung ist ein “Akt der Freiheitsförderung”

? ????????.???: ????? ? ????? ?ü? ?€ ?????? ►► https://bit.ly/Cashkurs_1

????? ??? ??? ????? ?????-?????? ??? ???? ?ü???? ????:

https://go.cashkurs.com/DM231107

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 07.11.2023 auf Cashkurs.com.)

? Gratis-Newsletter inkl. täglichem DAX-Update ►►► https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Bildrechte: Cashkurs.com /...

Read More »

Read More »

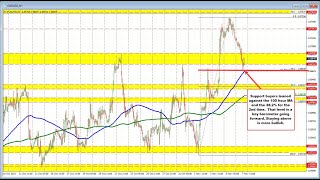

USDCAD rebounds higher and retraces 50% of the move down from last week’s high. What next?

The 50% of the move down comes in at 1.37634. The 100 hour MA is close support now at 1.3740.

Read More »

Read More »

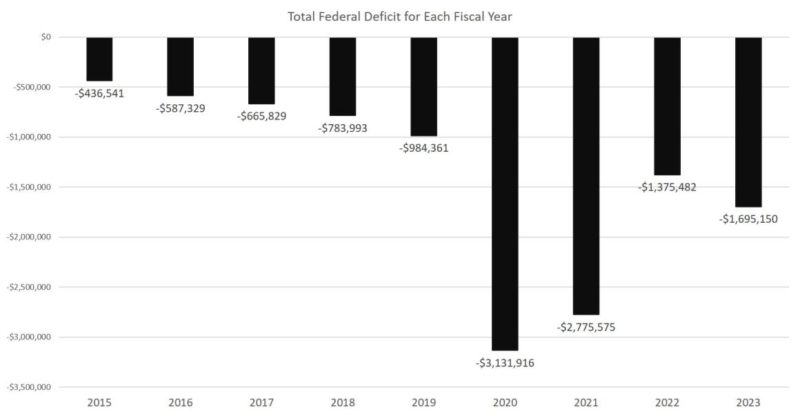

There’s No Easy Way Out of This Debt Spiral

We're about six weeks into fiscal year 2024, but if this year looks anything like last year, we can assume the federal government will continue to pile up debt at astonishing rates.

According to the September Monthly Treasury report, the US government accumulated an additional 1.7 trillion dollars in debt for the 2023 fiscal year, which ended October 31. That' up by $319 billion, or 23 percent, from the 2022 fiscal year. As recently as June,...

Read More »

Read More »

Gerd Kommer ETF wettet gegen Tech #gerdkommer #shorts

Gerd Kommer ETF wettet gegen Tech ?

? Gerd Kommer bietet einen neuen ETF an, der gegen Tech-Aktien wettet. Der ETF ist extrem breit diversifiziert, ca. 5.000 Aktien werden abgebildet und keine Aktie hat mehr als 1% Gewichtung. #gerdkommer #techaktien

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre...

Read More »

Read More »

Israel Isn’t the Brilliant Friend of Freedom the Beltway Claims It to Be

It certainly wasn’t the only time calling a perceived ally of DC a democracy became a tradition with India. While India could have been the first non-European “ally” to receive such treatment since the heydays of the Cold War, the immense support India currently enjoys despite a litany of human rights violations will never outclass the kind of prowess Tel Aviv has from the grassroots and political elite in the Beltway. Between the dying enthusiasm...

Read More »

Read More »

Besser als Buy and Hold? Echtgeld-Depot / Die Abrechnung

Nach meinem Video 'Totale Transparenz' vom 27.07.2023, präsentiere ich nun das erste Update zur Performance der beiden Depots. Ist der Aufwand im Vergleich zu einem Buy-and-Hold-Ansatz gerechtfertigt? Erfahre mehr in meinem Video.

Hier zum kostenlosen Webinar JETZT anmelden:

https://jensrabe.de/WebinarOkt23

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q4Termin23

Tägliche Updates ab sofort auf...

Read More »

Read More »

Mondlandung vor 50 Jahren – Apollo 11 Flugdetails mit Transfer-Ellipsen (2019)

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

1969 landeten Armstrong und Aldrin von der #Apollo11 Crew mit dem Lander auf dem Mond. In diesem Video erkläre ich, wie die Raumschiffe aufgebaut waren und welche Bahnen sie zu #Mondlandung genommen haben. Interessant sind die verschiedenen Treibstoffe, die...

Read More »

Read More »

EURUSD bounces off the 38.2% retracement and 100 hour MA support for 2nd time today

The dip buyers against the 38.2% were joined by the 100-hour moving average near the 1.0664 level. Traders leaned against that level as risk can be defined and limited. That could be you too. Were you there?

Read More »

Read More »

DAFÜR brauchst du eine Hausverwaltung! #shorts

? https://gratis-workshop.com/yts ? Jetzt Gratis Workshop-Platz sichern!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell den...

Read More »

Read More »

What’s behind the Autoworker’s Strike? – Mike Mauceli, Mark Mills

In this episode, Mark Mills joins Mike Mauceli in a thorough breakdown of how the Green New Deal affects the Autoworkers Strike, in turn affecting the consumer. Find out what it means for investors, the American Auto Industry, and ultimately the future of the entire world.

-----

Please read carefully.

This is not financial advice. You may be asking, “What does that mean?”

Let me explain…

Do not just do what I, my team, or my guest say. That...

Read More »

Read More »

Kickstart your FX trading for November 7 with technical look at EURUSD, USDJPY and GBPUSD

What is moving the markets from a technical perspective in the 3 major currency pairs on November 7, 2023.

Read More »

Read More »

90% machen diesen Fehler beim investieren

Zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Fighting the Surveillance State Begins with the Individual

Fed up with the state's surveillance regime? There are ways to use available technology to frustrate government efforts to spy on you.

Original Article: The Parasitic Rich Men North of Richmond

Read More »

Read More »

Is This the End of the Bond Bear Market?

(11/7/23) How did WeWork go from $47-B to Bankruptcy? Beware the days' 'narrative of the moment' in interest rates, AI. Market performance ahead, pre- and post-Thanksgiving. Is the Bond Bear market dead or just hibernating? Are bon yields doing the Fed's dirty work now? WeWork is a symptom. Yields are a function of debt and economic growth = Bond Math. Don't be distracted by the media. Why the Fed wants higher rates; the risk of recession in 2024:...

Read More »

Read More »