Tag Archive: negative interest

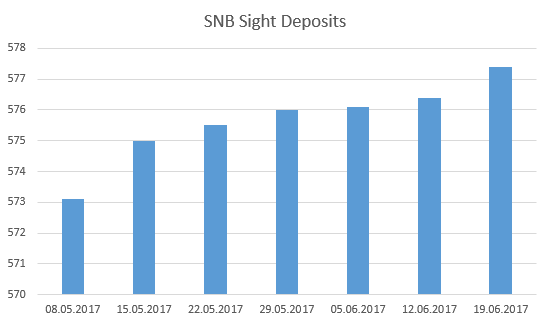

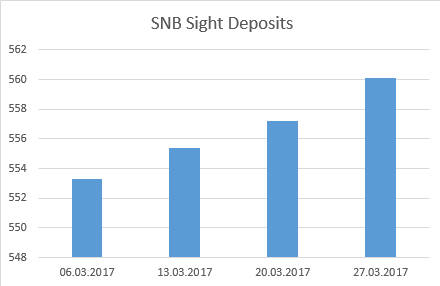

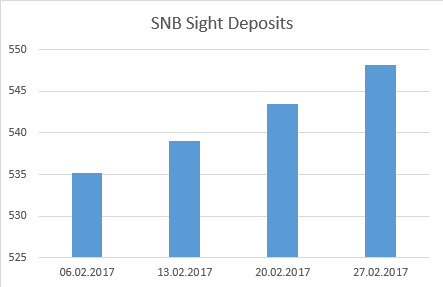

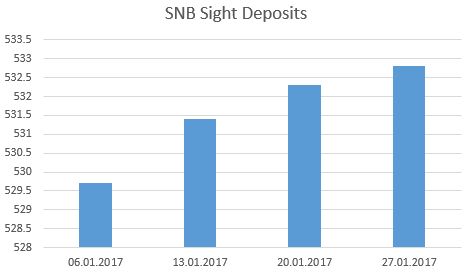

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

The sight deposits at the SNB increased by 5.2 billion francs compared to the previous week.

Read More »

Read More »

Weekly SNB Interventions Update: Slight Rise after Weeks of Near-Zero Interventions

The pro-European politician Macron has won the French elections. His success moved the EUR/CHF up to 1.0980, mostly caused by FX speculators. But "serious" investors (not FX speculators) did not follow the political event, but focus on monetary policy. A ECB rate hike is very, very far, see why....

Read More »

Read More »

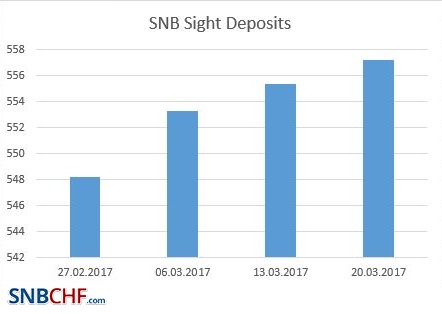

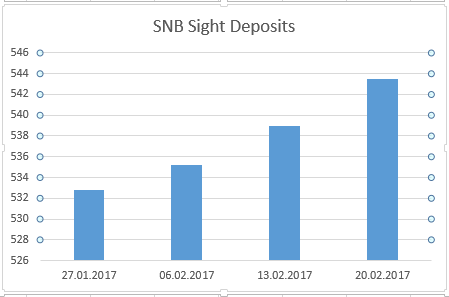

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 1.6 bn CHF at EUR/CHF 1.07 - 1.0750. This is less than previously.

Read More »

Read More »

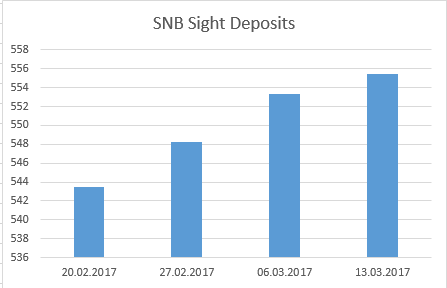

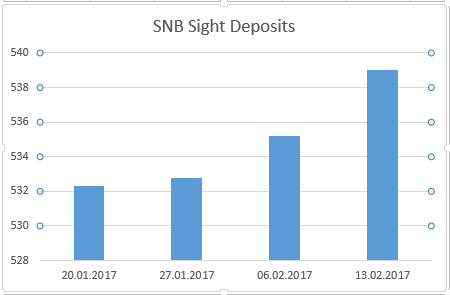

Weekly Sight Deposits and Speculative Positions: SNB interventions are rising again

The SNB intervenes for 2.9 bn CHF at EUR/CHF 1.07. For us, clearly too much and too risky; she will not maintain this pace over a longer term. Hence the EUR/CHF is prone to fall again.

Read More »

Read More »

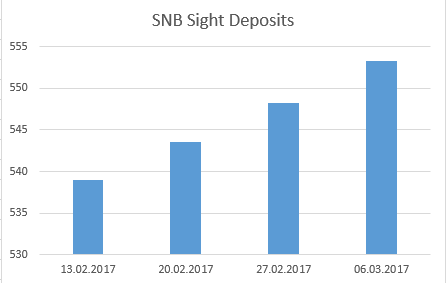

Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

The EUR/CHF suddenly appreciated with the ECB meeting, when Draghi seemed less dovish than before. The rate rose from the previous 1.0650 to over 1.0750. With the SNB meeting, the EUR/CHF receded again. SNB interventions, are currently at 2 bn. per week compared to 5 bn. before Draghi.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: EUR/CHF suddenly higher after ECB

The SNB intervened less than before. Investors might have changed their positions after a less dovish ECB.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Each week an intervention record.

Once again a massive SNB intervention and a post Trump election record: 5,1 billion, at far too expensive FX rates: EUR rate of 1.0648 and USD/CHF over parity.

Read More »

Read More »

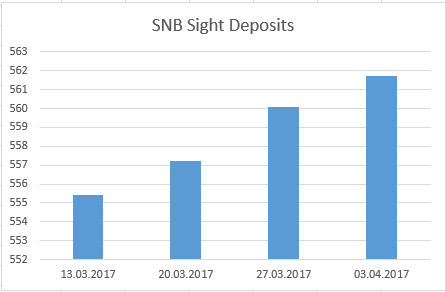

Each Week the Same: Another SNB Intervention Record

Once again: another record in SNB intervention record for the period after Trump's election: an increase of 4.7 billion CHF in sight deposits. The trend for EUR/CHF versus parity getting confirmed.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Once again a new SNB intervention record

Once again a massive SNB intervention and a post Trump election record: 4.5 billion CHF at a EUR rate of 1.0648.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Another Post-Trump SNB Intervention Record

A big Swiss bank bets on EUR/CHF 1.10 as soon as the ECB ends their bond buying program. But one should realize that private investors will need to buy the EUR at 1.10, but the SNB is not willing to do so any more. Hence we must see SNB interventions of zero, before EUR/CHF goes to 1.10.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Strong Swiss Trade Balance: SNB allows EUR/CHF to 1.0680

With the strong Swiss trade balance, the SNB let EUR/CHF fall to 1.0680. SNB intervenes for 0.5 bn CHF. Speculators are net short CHF with 13.6K contracts against USD, nearly unchanged.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: Weaker dollar let SNB accumulates losses

EUR/CHF is slightly above the “in-official minimum band”. The weaker dollar leads to bigger SNB losses in January. SNB intervenes for 0.9 bn at higher EUR/CHF rate. Speculators are net short CHF with 13.7K contracts against USD.

Read More »

Read More »

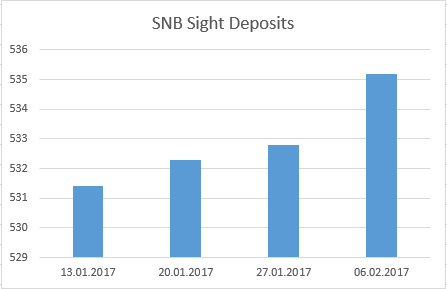

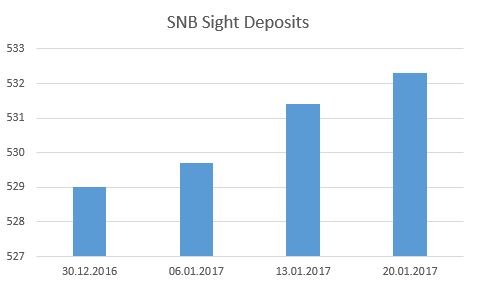

Weekly Sight Deposits and Speculative Positions: Stronger SNB interventions at more expensive EUR

EUR/CHF slightly above the “in-official minimum band” of 1.0680 – 1.07. SNB intervenes for 1.7 bn at higher EUR/CHF rate. Speculators are net short CHF with 14K contracts against USD.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

EUR/CHF at the "in-official minimum band" of 1.0680 to 1.07. SNB intervenes for 0.7 bn CHF to keep the euro slightly over 1.07. Speculators are net short CHF with 13K contracts against USD, 3K more than last week. This is still far from the post financial crisis record of 26 K contracts. Moreover the net short GBP are increasing again.

Read More »

Read More »

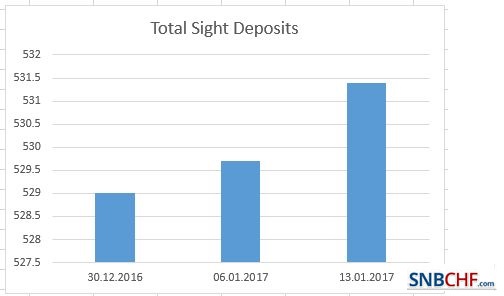

Weekly Sight Deposits and Speculative Positions: SNB Intervenes, Speculators Short CHF again

Last week's data: FX: EUR/CHF was between 1.07 and 1.0750. SNB sight deposits: SNB intervenes for 0.7 bn. CHF at the EUR/CHF 1.07 level. CHF Speculative Positions Speculators went net short CHF with 10K contracts, this is still far from the 26.K contracts record.

Read More »

Read More »

Weekly Sight Deposits and Speculative Positions: SNB intervenes, while Speculators go Long CHF

The Fed has hiked rates and with this fait accomplis speculators sold the news. They closed their short CHF and opened new CHF longs. The SNB, however, intervened again for 0.5 billion CHF.

Read More »

Read More »