Tag Archive: money

Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

Read More »

Read More »

Sound money: A Biblical perspective – Part I

In today’s world, it is obvious that the competition of ideas is under serious threat and with it, the much-needed discussions on how to deal with certain topics or try to understand the world we live in. That is particularly worrying, especially when one considers that the western world went through the process of Enlightenment roughly 200 years ago. In the words of Immanuel Kant:

Read More »

Read More »

Sometimes Bad News Is Just Right

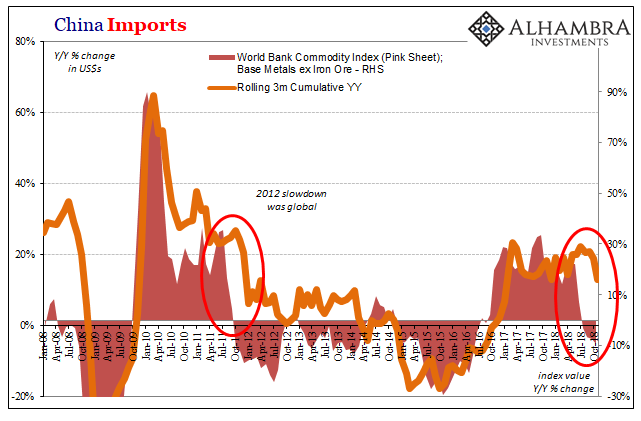

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019).

Read More »

Read More »

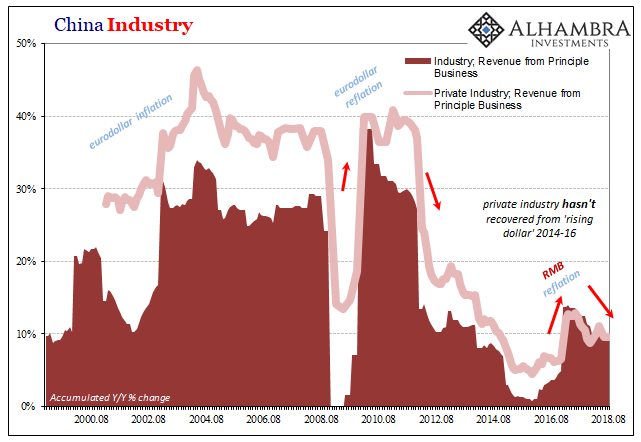

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

Brent’s Back In A Big Way, Still ‘Something’ Missing

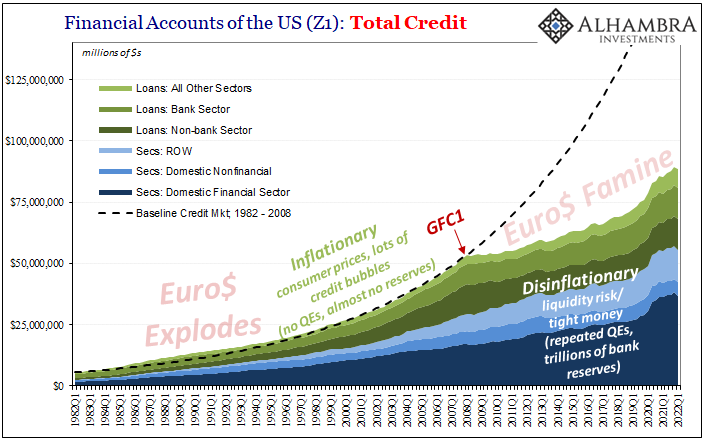

The concept of bank reserves grew from the desire to avoid the periodic bank runs that plagued Western financial systems. As noted in detail starting here, the question had always been how much cash in a vault was enough? Governments around the world decided to impose a minimum requirement, both as a matter of sanctioned safety and also to reassure the public about a particular bank’s status.

Read More »

Read More »

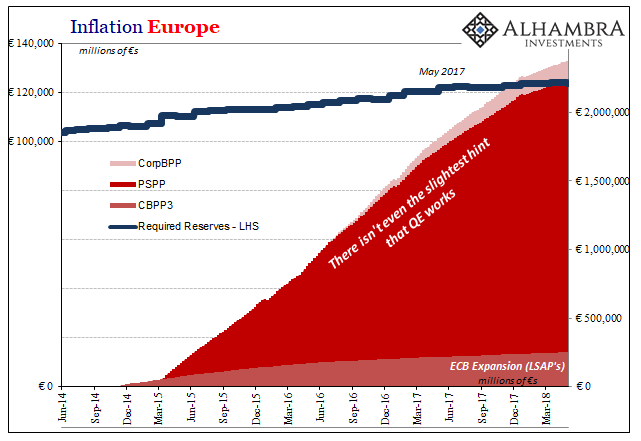

What Really Happened In Europe

The primary example of globally synchronized growth has been Europe. Nowhere has more hope been attached to shifting fortunes. The Continent, buoyed by the persistence of central bankers like Mario Draghi, has not just accelerated it is actually booming. Or so they say.

Read More »

Read More »

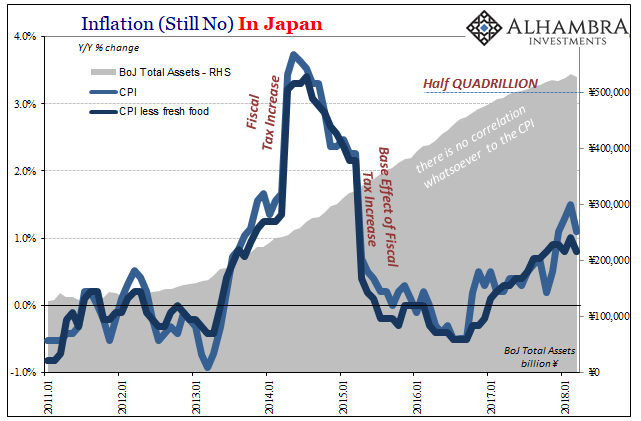

Transitory’s Japanese Cousin

Thomas Hoenig was President of the Federal Reserve’s Kansas City branch for two decades. He left that post in 2011 to become Vice Chairman of the FDIC. Before that, Mr. Hoenig as a voting member of the FOMC in 2010 cast the lone dissenting vote in each of the eight policy meetings that year (meaning he was against QE2, too). This makes him, apparently, the hawk of all hawks.

Read More »

Read More »

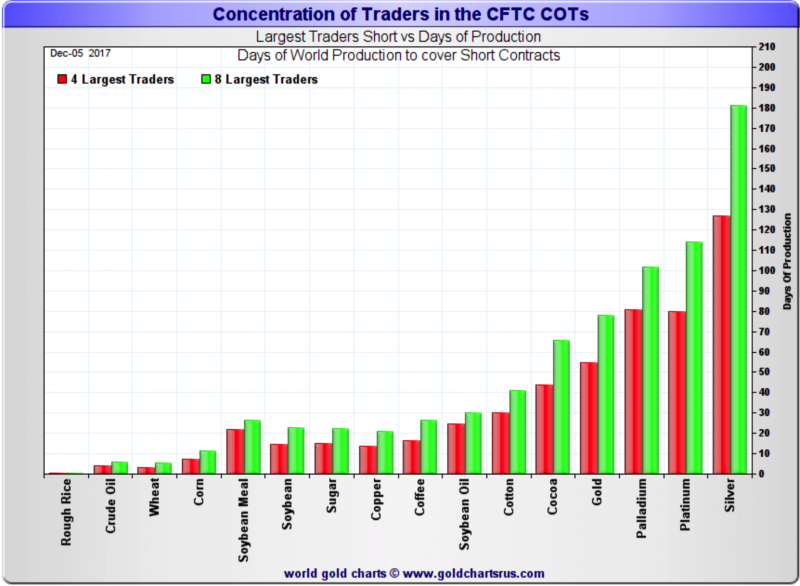

Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here on the BullionStar website.

Read More »

Read More »

The Historical Warnings of Money

It’s interesting, to me anyway, that an image of the Roman goddess Juno remains to this day on the logo of the Bank of England. There are many stories about her role as it relates to money, but what cannot be denied is that the very word itself came to us from her temple. The Latin moneta was derived from the word monere, a verb meaning to warn. Moneta was Juno’s surname.

Read More »

Read More »

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

In Unprecedented Intervention, Swiss Central Bank Bails Out Firm That Prints Swiss Banknotes

In the most ironic story of the day, the company that makes the paper that Swiss banknotes are printed on was just bailed out by the money-printing, stock-purchasing, plunge-protecting, savior-of-global equities…Swiss National Bank. While The SNB has a long and checkered history of buying shares in companies… as we have detailed numerous times.

Read More »

Read More »

Bubble Watch: Warning Signs That The Everything Bubble Will Burst in 2018

I believe 2018 will be the year inflation arrives. The reason, as I’ve noted throughout mid-2017, is that multiple Central Banks, particularly the European Central Bank (ECB), Bank of Japan (BoJ) and Swiss National Bank (SNB) have maintained emergency levels of QE and money printing, despite the fact that globally the economy is performing relatively well.

Read More »

Read More »

A Gold Guy’s View Of Crypto, Bitcoin, And Blockchain

Bitcoin was on my radar far back as 2011, but for years, I didn’t think much of it. It was a curiosity. Nothing more. Sort of like the virtual money you use in World of Warcraft or something. In 2015, looking deeper, I slowly (not the sharpest tool in the shed) arrived at that “aha” inflection point that most advocates of honest money arrive at. I realized that a distributed public ledger has the power to change, well, everything.

Read More »

Read More »

Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm.

Read More »

Read More »

The Latte Index: Using The Impartial Bean To Value Currencies

Like any other market, there are many opinions on what a currency ought to be worth relative to others. With certain currencies, that spectrum of opinions is fairly narrow. As an example, for the world’s most traded currency – the U.S. dollar – the majority of opinions currently fall in a range from the dollar being 2% to 11% overvalued, according to organizations such as the Council of Foreign Relations, the Bank of International Settlements, the...

Read More »

Read More »