Tag Archive: Money Supply

Testing The Supply Chain Inflation Hypothesis The Real Money Way

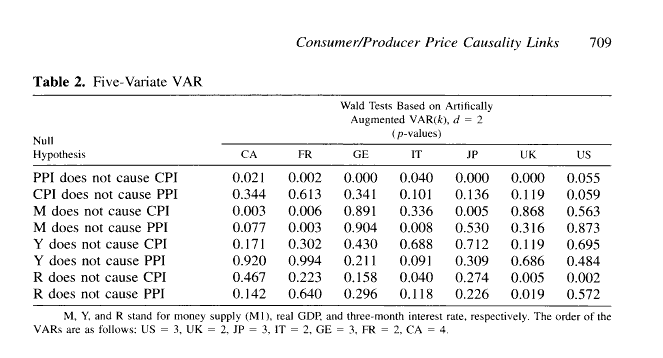

Basic intuition says this is a no-brainer. Producer prices rise, businesses then pass along these higher input costs to their customers in the form of consumer price “inflation” so as to preserve profits. This is the supply chain hypothesis. Statistically, we’d therefore expect the PPI to lead the CPI.And this was expected for much of Economics’ history, taken for granted as one of those self-evident truths (kind of like the Inflation Fairy). After...

Read More »

Read More »

The Great Eurodollar Famine: The Pendulum of Money Creation Combined With Intermediation

It was one of those signals which mattered more than the seemingly trivial details surrounding the affair. The name MF Global doesn’t mean very much these days, but for a time in late 2011 it came to represent outright fear. Some were even declaring it the next “Lehman.”

Read More »

Read More »

The Two Big Anniversaries of August: The Lost Decade (plus) Of The ‘Fiat’ Half Century

As my esteemed podcast co-host Emil Kalinowski has already mentioned (recurrently), we have, this year, two major anniversaries during these dog days of summer circled on our calendar. Today is, obviously, August 9 and for anyone the slightest familiar with the eurodollar story, that date is seared into their consciousness for as long as it will take to rebuild from the ashes created by the monetary fire lit that day. It has been, sadly, fourteen...

Read More »

Read More »

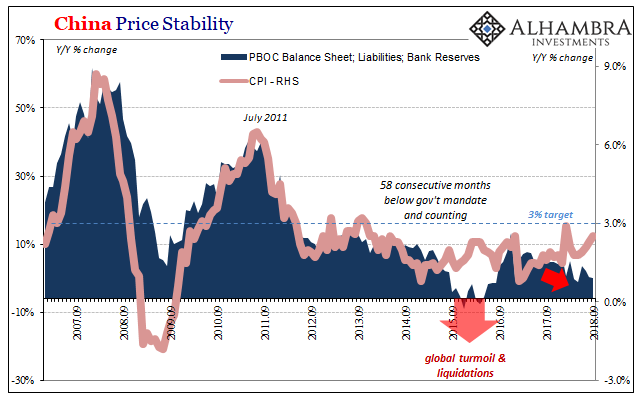

Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm.

Read More »

Read More »

The Great Reset, Report 8 July 2018

Before it collapsed, the city of Rome had a population greater than 1,000,000 people. That was an extraordinary accomplishment in the ancient world, made possible by many innovative technologies and the organization of the greatest civilization that the world had ever seen. Such an incredible urban population depended on capital accumulated over centuries. But the Roman Empire squandered this capital, until it was no longer sufficient to sustain...

Read More »

Read More »

US: Reflation Check

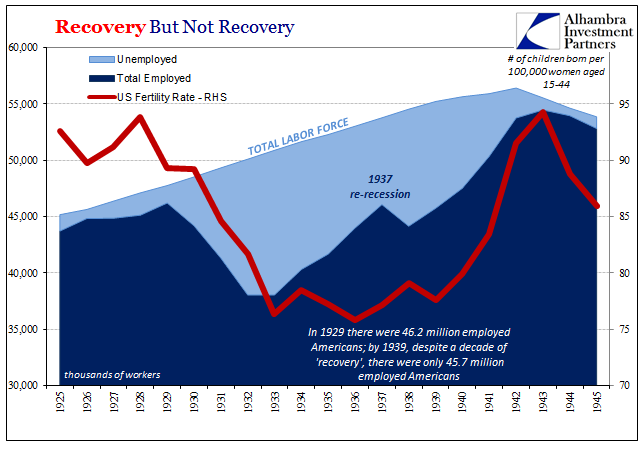

There is a difference between reflation and recovery. The terms are similar and relate to the same things, but in many ways the latter requires first the former. To get to recovery, the economy must reflate if in contraction it was beaten down in money as well as cyclical forces. In the Great Crash of 1929 and after, reflation was required because of the wholesale devastation of the money supply.

Read More »

Read More »

The Two Parts of Bubbles

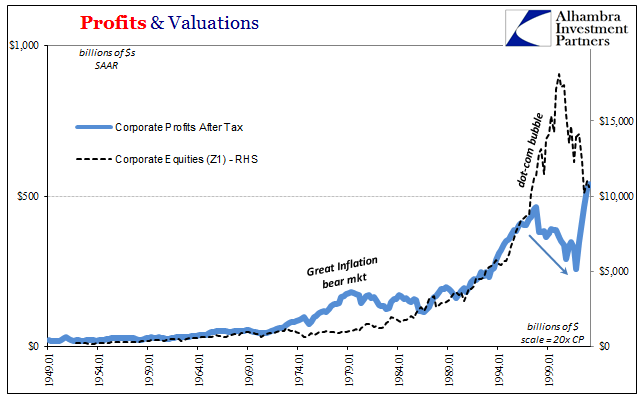

What makes a stock bubble is really two parts. Most people might think those two parts are money and mania, but actually money supply plays no direct role. Perceptions about money do, even if mistaken as to what really takes place monetarily from time to time. In fact, for a bubble that would make sense; people are betting in stocks on one monetary view that isn’t real, and therefore prices don’t match what’s really going on.

Read More »

Read More »

Currency Risk That Isn’t About Exchange Values (Eurodollar University)

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

Read More »

Read More »

Inflation Is Not About Consumer Prices

I suspect President Trump has been told that markets don’t like radical changes. If there is one thing that any elected official is afraid of, it’s the internet flooded with reports of grave financial instability. We need only go back a year to find otherwise confident authorities suddenly reassessing their whole outlook.

Read More »

Read More »

Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

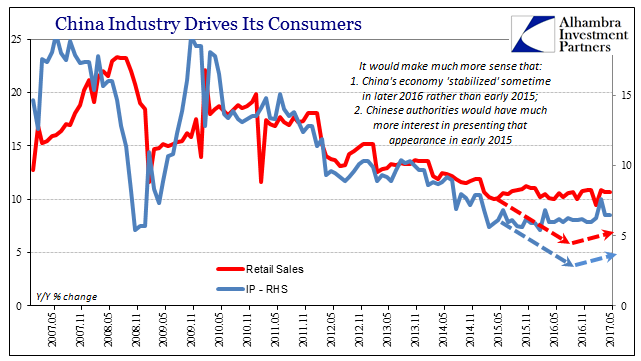

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level.

Read More »

Read More »

US Federal Funds, Bond Market and WSJ Economic Survey: The Hidden State of Money

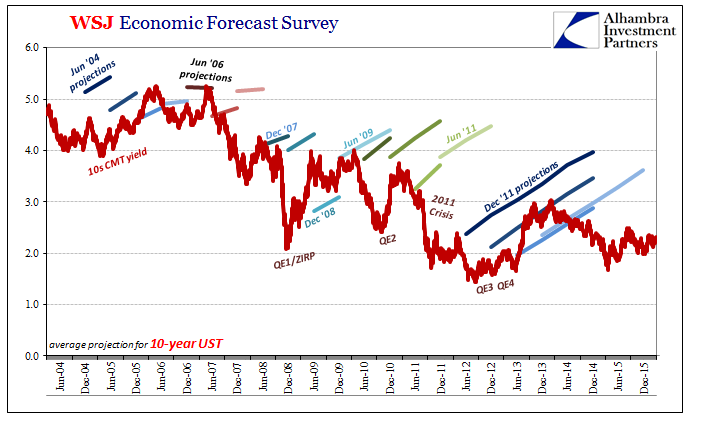

Correctly interpreting the bond market is more than just how and when to invest your money in UST’s. Not that it isn’t useful in such a money management capacity, but interest rates starting at the risk-free tell us a lot about what is wholly unseen. There is simply no way to directly observe inside an economy what is taking place at all levels and in all transactions. We try to estimate as best we can in the aggregate, but the real economy works...

Read More »

Read More »

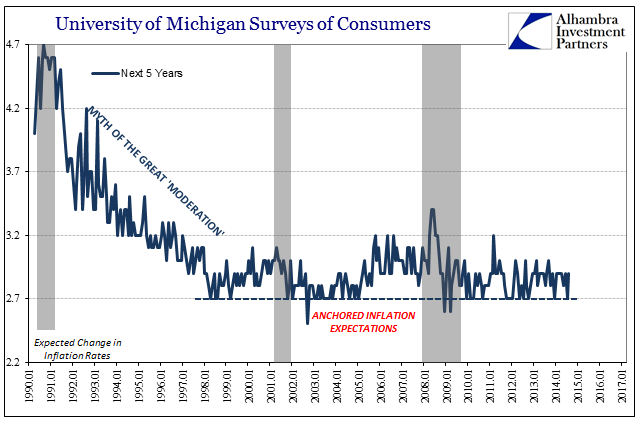

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

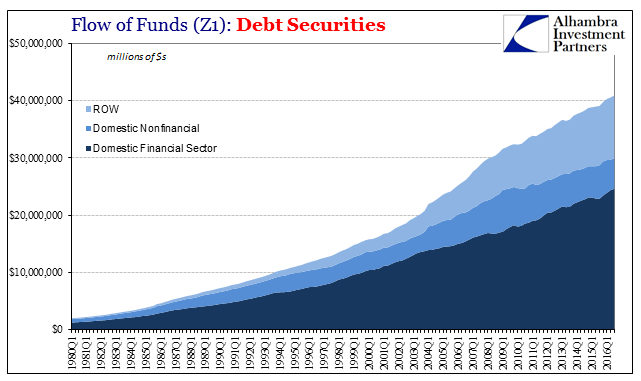

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

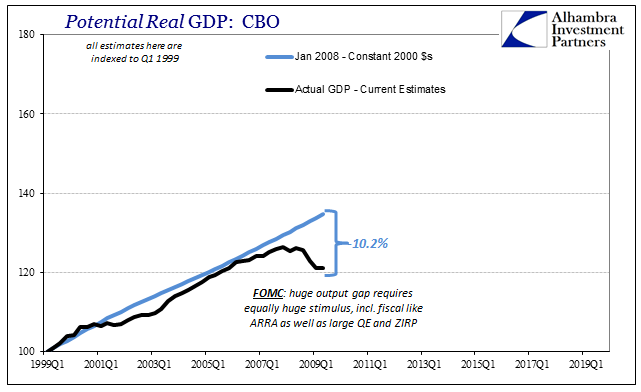

Their Gap Is Closed, Ours Still Needs To Be

There are actually two parts to examining the orthodox treatment of the output gap. The first is the review, looking backward to trace how we got to this state. The second is looking forward trying to figure what it means to be here. One final rearward assessment is required so as to frame how we view what comes next. As I suggested earlier this week, the so-called output gap started at the trough of the Great “Recession” at around 10% of the CBO’s...

Read More »

Read More »

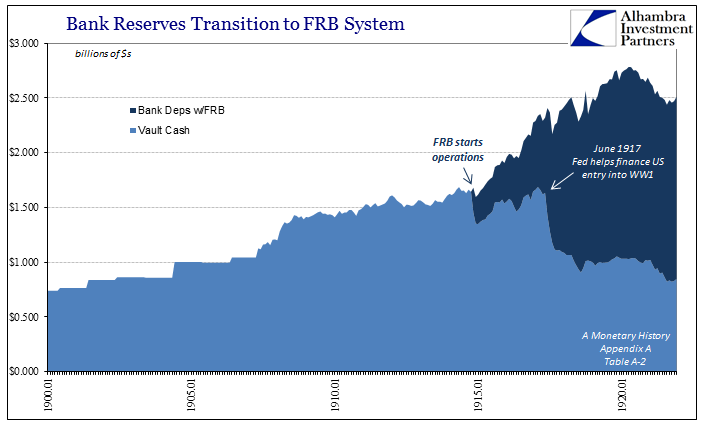

A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

“This Is Total Chaos” – Venezuela Shuts Colombia Border To Stop “Mafia” Currency Smuggling

As if things were not already chaotic enough in the socialist utopia of Venezuela, following President Nicolas Maduro's decision to follow Indian PM Modi's playbook and announce that the nation's largest denomination bill (100-Bolivars - worth around 3c) will be pulled from circulation in 72 hours, he has tonight closed the border to Colombia to crackdown on currency smuggling by so-called "mafias".

Read More »

Read More »

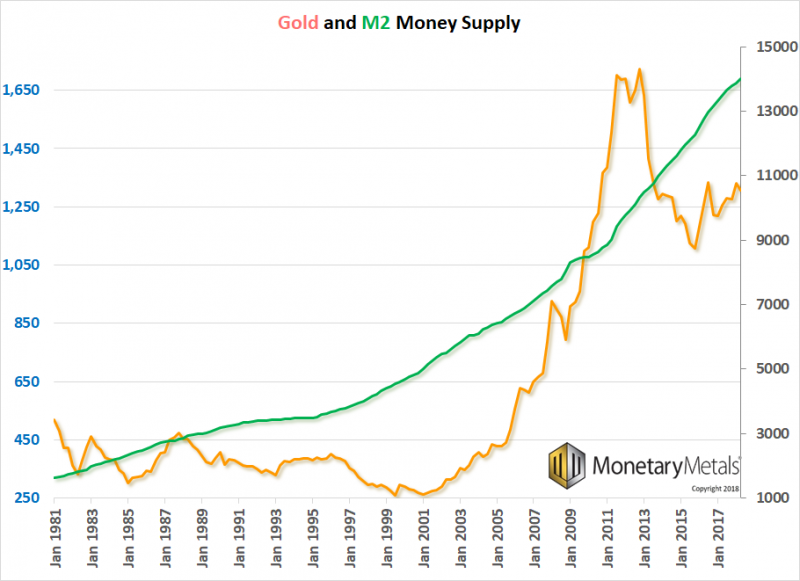

Gold, the Tried-and-True Inflation Hedge for What’s Coming!

2021-01-28

by Stephen Flood

2021-01-28

Read More »