Hyperventilating Minds “What has been will be again, what has been done will be done again; there is nothing new under the sun,” explained Solomon in Ecclesiastes, nearly 3,000 years ago. Perhaps the advent of negative yielding debt would have been cause for Solomon to reconsider his axiom. We can only speculate on what his motive would be.

Read More »

Tag Archive: monetization of debt

“It’s Prohibited By Law” – A Problem Emerges For Japan’s “Helicopter Money” Plans

Over the past four days, risk assets have been on a tear, led by the collapsing Yen and soaring Nikkei, as the market has digested daily news that - as we predicted last week - Bernanke has been urging Japan to become the first developed country to unleash the monetary helicopter, in which the central banks directly funds government fiscal spending, most recently with an overnight report that Bernanke has pushed Abe and Kuroda to sell perpetual...

Read More »

Read More »

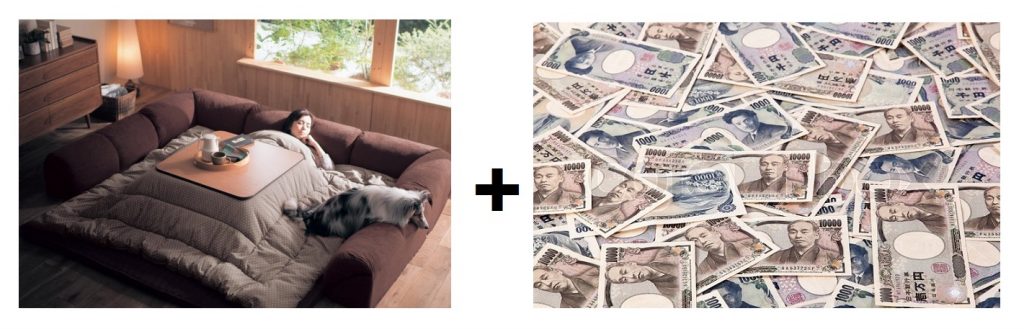

Turning Stones Into Bread – The Japanese Miracle

Stuffing the Futon Our friend Ramsey Su just asked what Haruhiko Kuroda and Shinzo Abe are going to do now in light of the strong yen (aside from perhaps doing the honorable thing). Isn’t it time to just “wipe out some debt with the stroke of a pen...

Read More »

Read More »

The Pitfalls of Currency Manipulation – A History of Interventionist Failure

The G-20 and Policy Coordination Readers may recall that the last G20 pow-wow (see “The Gasbag Gabfest” for details) featured an uncharacteristic lack of grandiose announcements, a fact we welcomed with great relief. The previously announced “900 p...

Read More »

Read More »

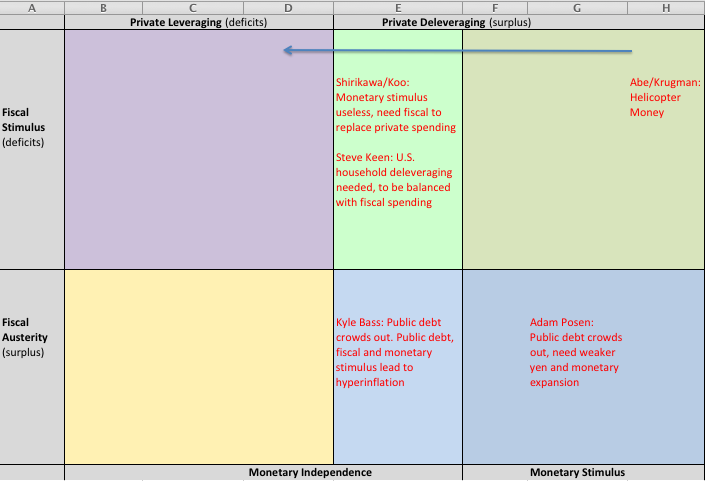

Opinions of Leading Economists on Japan and the Unholy Alliance of Kyle Bass and Shinzo Abe

We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass.

Read More »

Read More »

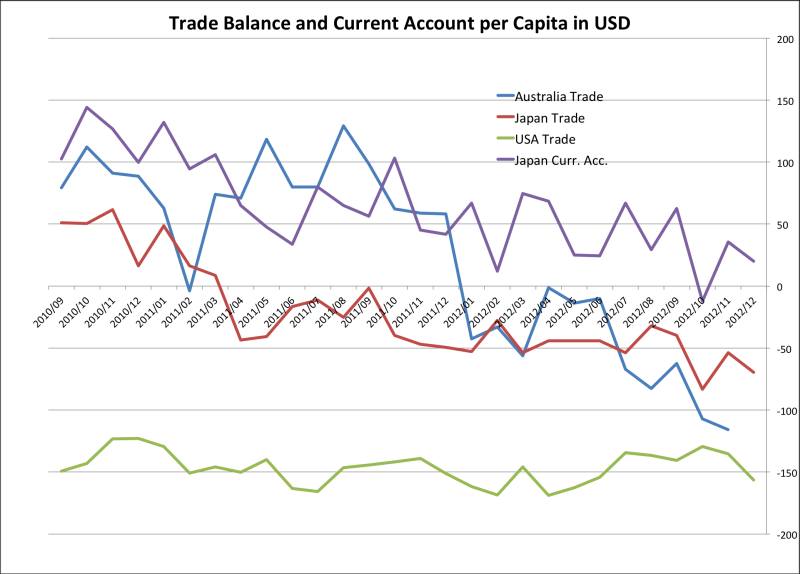

Japanese Currency Debasement, Part 1: Current Account and Japanese Bond Bears

In our first part on Japans currency debasement, we look on three aspects, government bond yields, current account balances and potential hyper-inflation which causes yields to rise strongly.

Read More »

Read More »

Did Austrian Economists Get the Recovery Wrong?

Austrians got the recovery after the financial crisis wrong. Monetary expansion did not lead to hyperinflation and a collapse of central banks. Their mistake was that the Austrian principle of "too cheap money leads to wrong investments", is currently not valid. Due to high risk aversion after the financial crisis, firms do only only best projects. Austrian economists were right before the crisis, but after the crisis Keynesians and Germans with...

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »