Tag Archive: Markets

Moscow Rules (for ‘dollars’)

In Ian Fleming’s 1959 spy novel Goldfinger, he makes mention of the Moscow Rules. These were rules-of-thumb for clandestine agents working during the Cold War in the Soviet capital, a notoriously difficult assignment. Among the quips included in the catalog were, “everyone is potentially under opposition control” and “do not harass the opposition.” Fleming’s book added another, “Once is an accident. Twice is coincidence. Three times is an enemy...

Read More »

Read More »

Deja Vu

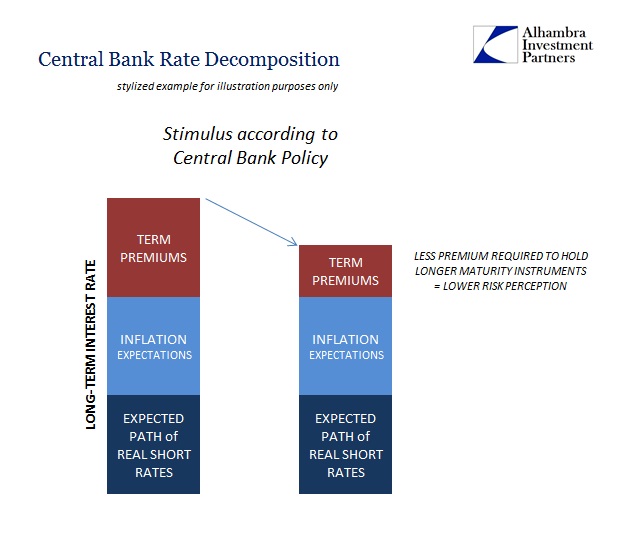

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to...

Read More »

Read More »

Currency Risk That Isn’t About Exchange Values (Eurodollar University)

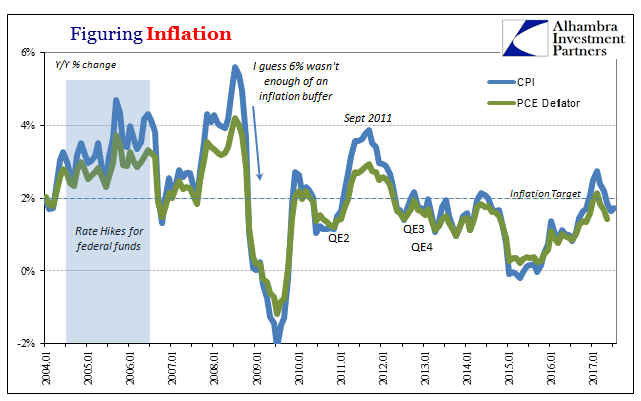

This week the Bureau of Economic Analysis will release updated estimates for Q2 GDP as well as Personal Consumption Expenditures (PCE) and Personal Incomes for July. Accompanying those latter two accounts is the currently preferred inflation standard for the US economy. The PCE Deflator finally hit 2% and in two consecutive months, after revisions, earlier this year.

Read More »

Read More »

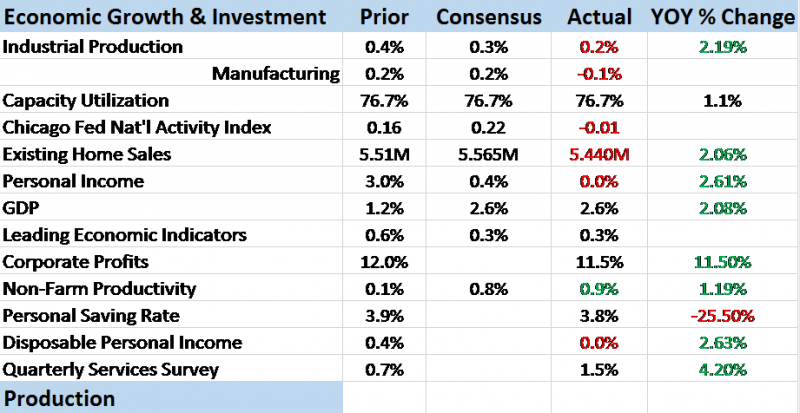

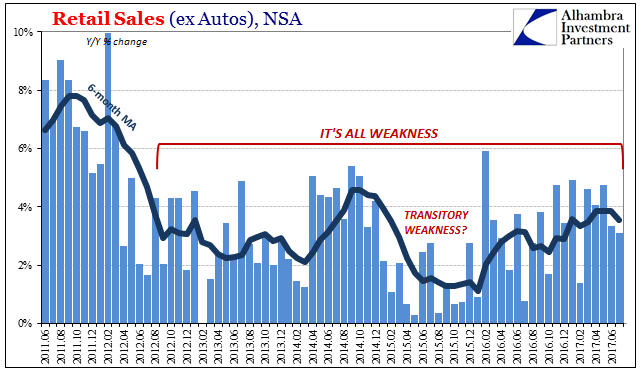

Bi-Weekly Economic Review: Don’t Underestimate Gridlock

The economic reports released since the last update were slightly more upbeat than the previous period. The economic surprises have largely been on the positive side but there were some major disappointments as well. The economy has been doing this for several years now, one part of the economy waxing while another wanes and the overall trajectory not much changed. Indeed, the broad Chicago Fed National Activity index probably says it all, coming...

Read More »

Read More »

More Noise Than Signal

A number of people have forwarded this Bloomberg article – Wall Street Banks Warn Downturn Is Coming – to me over the last couple of days. That fact alone is probably a good argument to ignore it but I can’t help but read articles like this if for no other reason than to know what the crowd is thinking.

Read More »

Read More »

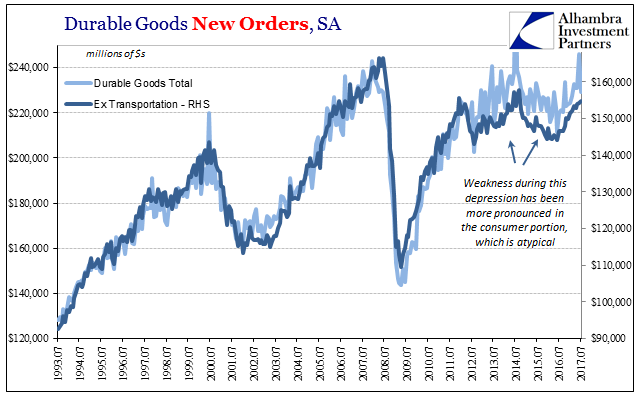

United States Durable Goods In July; Rinse, Repeat

The Census Bureau reported today updated estimates for Durable Goods in July 2017. Quite frankly, nothing has changed so minimal commentary is all that is required. The aircraft anomaly from last month faded, leaving total new orders of $229.2 billion (seasonally-adjusted). That is less than in May before the Boeing surge, and less even than estimated order volume in March 2017.

Read More »

Read More »

Questions

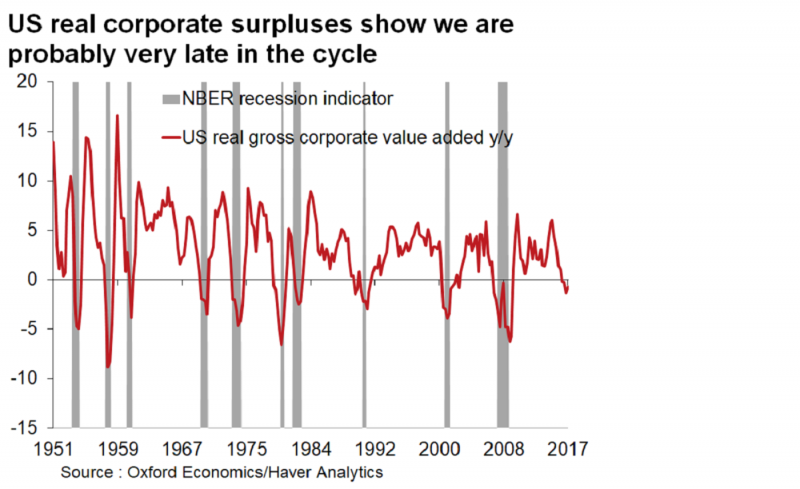

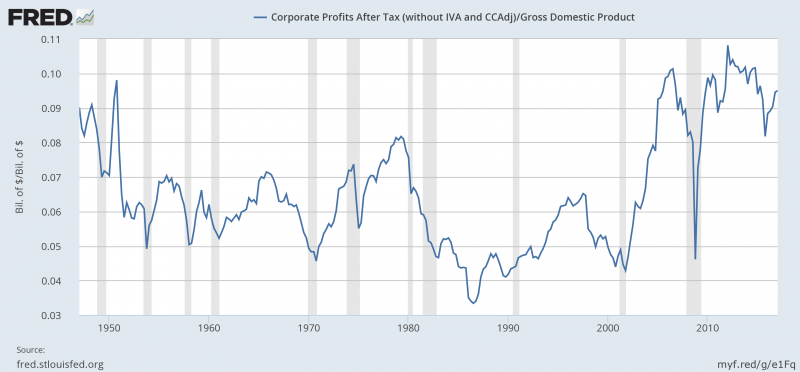

Why are profit margins persistently high? With decent earnings this quarter, corporate profits as a % of GDP will approach (maybe exceed) 10% again. That is abnormally high compared to the period 1960 to 2000. Margins actually started to rise in the mid-80s but really accelerated after 2000 and outside of the 2008 crisis have remained high. Why?

Read More »

Read More »

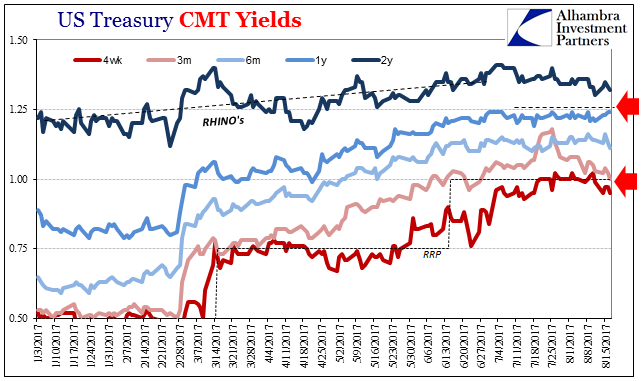

United States: The Fed Tries To Tighten By Rates, But The System Instead Tightens By Repo

The Fed voted for the first federal funds increase in almost a decade on December 15, 2015. It was the official end of ZIRP, and though taking so many additional years to happen, to many it marked the start of recovery. The yield on the 2-year Treasury Note was 98 bps that day.

Read More »

Read More »

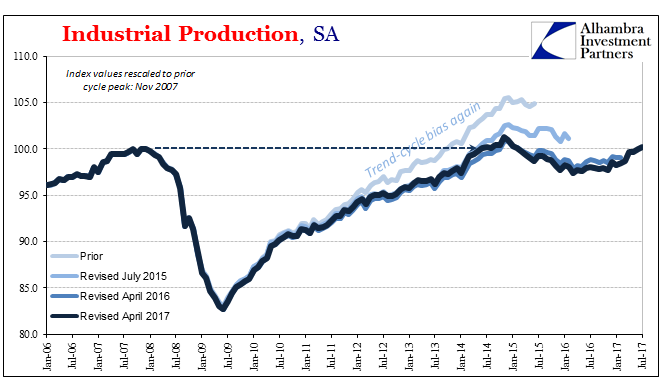

United States: Lack Of Industrial Momentum Is (For Now) Big Auto Problems

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction.

Read More »

Read More »

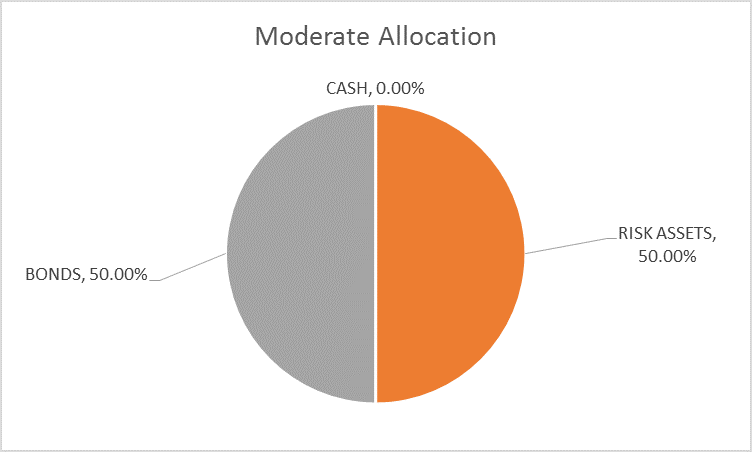

Global Asset Allocation Update: No Upside To Credit

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand.

Read More »

Read More »

United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general.

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »

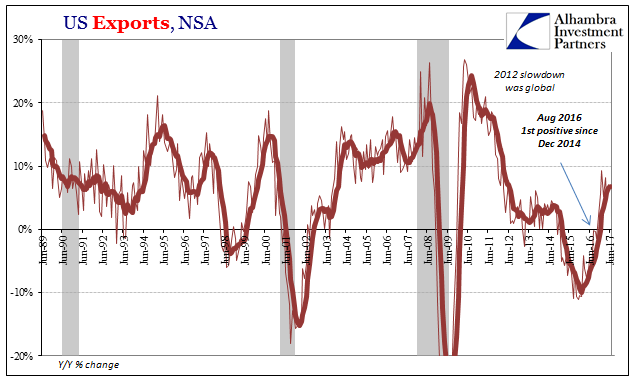

U.S. Export/Import: Losing Economic Trade

The oil effect continued to recede in late spring for more than just WTI prices or inflation rates. US trade on both sides, inbound and outbound, while still positive has stalled since the winter.

Read More »

Read More »

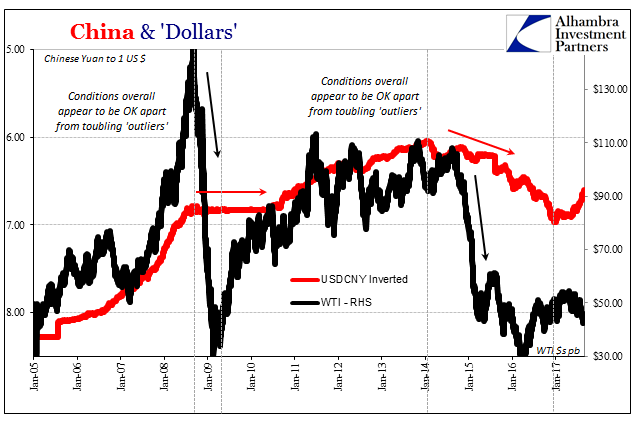

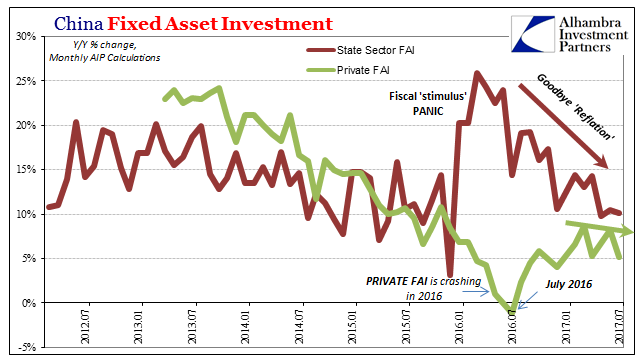

China: Losing Economic ‘Reflation’

If “reflation” was born last year in Japan, and I think it was, it was surely given its most tangible dimensions in China. The idea that the Bank of Japan was going to do something magnificent was perhaps always a longshot, but enough given the times for people to hope (sentiment) they might try (helicopter). The Chinese, however, have been relatively more pragmatic. Authorities began 2016 with an actual rather than imagined “stimulus” injection...

Read More »

Read More »

Oil Prices, CPI: Why Not Zero?

In the early throes of economic devastation in 1931, Sweden found itself particularly vulnerable to any number of destabilizing factors. The global economy had been hit by depression, and the Great Contraction was bearing down on the Swedish monetary system. The krona had always been linked to the British pound, so that when the Bank of England removed gold convertibility (left the gold standard) from its notes on September 19 that year the Swedish...

Read More »

Read More »

Real GDP: The Staggering Costs

How do we measure what has been lost over the last ten years? There is no single way to calculate it, let alone a correct solution. There are so many sides to an economy that choosing one risks overstating that facet at the expense of another. It’s somewhat of an impossible task already given the staggering dimensions.

Read More »

Read More »

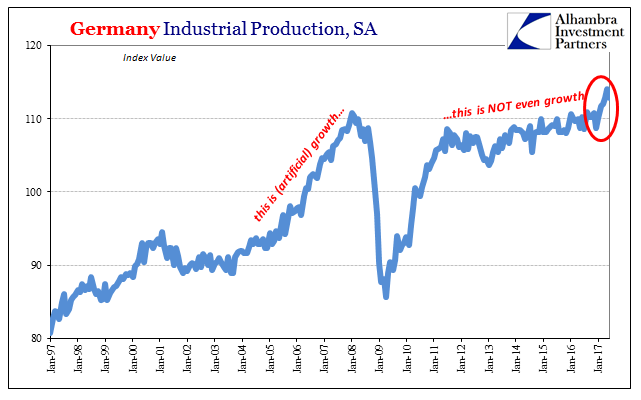

Industrial Production: Irreführende Statistiken

Germany’s Federal Statistical Office (DeStatis) reported today disappointing figures for Industrial Production. The seasonally-adjusted series fell in June 2017 month-over-month for the first time this year, last declining in December 2016. The index had been on a tear, rising nearly 5% in the first five months of this year.

Read More »

Read More »

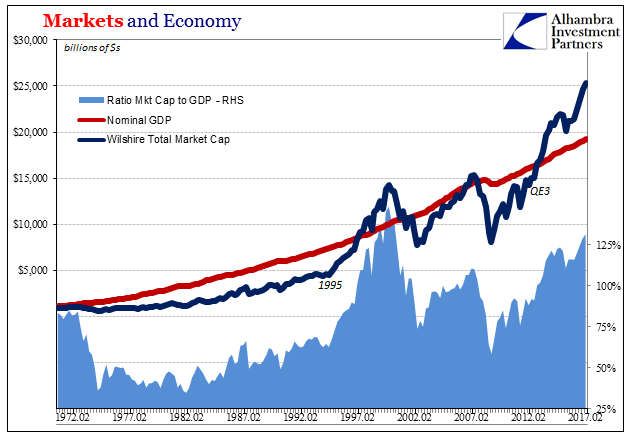

SNB Balance Sheet, Markets and Economy: As Good As It Gets?

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004.

Read More »

Read More »

Oil Prices: The Center Of The Inflation Debate

The mainstream media is about to be presented with another (small) gift. In its quest to discredit populism, the condition of inflation has become paramount for largely the right reasons (accidents do happen). In the context of the macro economy of 2017, inflation isn’t really about consumer prices except as a broad gauge of hidden monetary conditions.

Read More »

Read More »

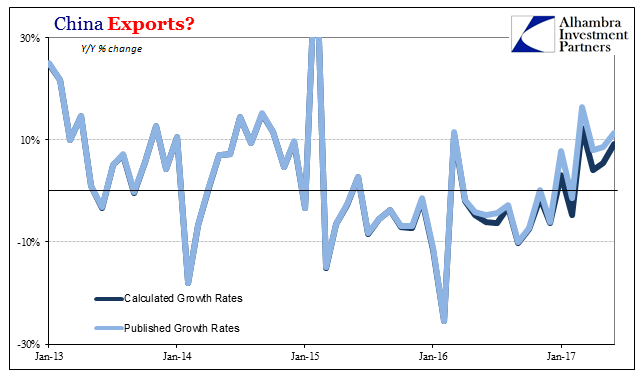

China Exports, China Imports: Textbook

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »