Tag Archive: Labor costs

And the Dollar Bounces Back, While BOE is in Focus

Overview: The Federal Reserve announced tapering and, like the Reserve Bank of Australia earlier in the week, did not validate expectations for an aggressive rate hike. Now the focus is on the Bank of England, where several officials seemed to goad the market into lifting short-term rates. The S&P 500 and NASDAQ rallied to new record highs yesterday and helped raise global shares today. Among the large markets in the Asia Pacific region,...

Read More »

Read More »

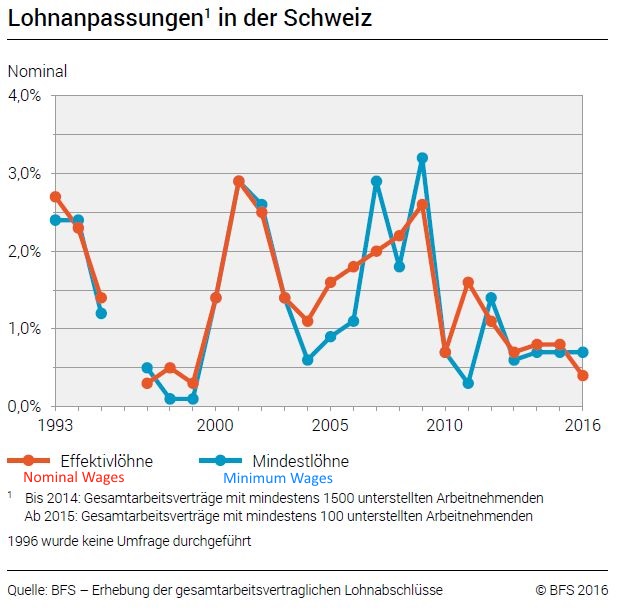

Swiss nominal and minimum wages increase by 0.4% and 0.7% respectively

The social partners signing the collective labour agreements (CLA) have agreed a nominal rise in real wages estimated at 0.4% for 2016, of which 0.2% is to be awarded collectively and 0.2% at individual level. Minimum wages were increased by 0.7%. The graph shows nominal wages since 1993.

Read More »

Read More »

The “Sell in May, Come Back in October” Effect and the 19 Fortune-Tellers of the FOMC

The U.S. economy regularly improves between October and April, this year additionally fueled by "unlimited" quantitative easing, weaker gas prices and higher competitiveness thanks to a stronger Chinese yuan and weaker Asian economies. Update 2013: The Case-Shiller index continued to climb in April 2013; it became clear that this year the "Sell in May" …

Read More »

Read More »

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

Roubini and Deutsche Bank’s Sanjeev Sanyal: Still Waiting for the Chinese Consumer

Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

Read More »

Read More »

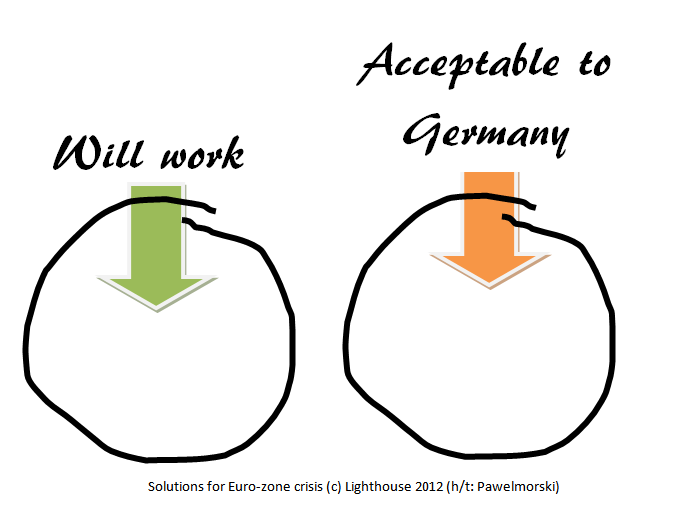

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

4 Different Solutions for the Euro Crisis: Can it Be the Northern Euro? A Discussion

The discussion about the future of the Euro: Among a Post-Keynesian, a European Etatist, an Austrian economist and an advocate of a Northern Euro on the French website www.atlantico.fr. The French paper is asking: “Sommet européen : créer un euro du Nord est-il le seul moyen de sauver l’Europe de l’austérité ?” Is the creation of …

Read More »

Read More »

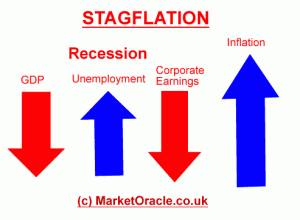

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

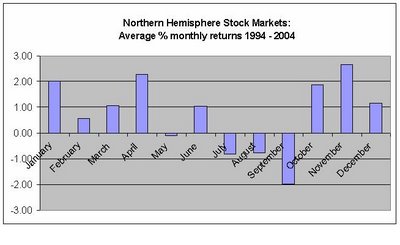

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

Why the Euro Crisis may last another 15 years

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

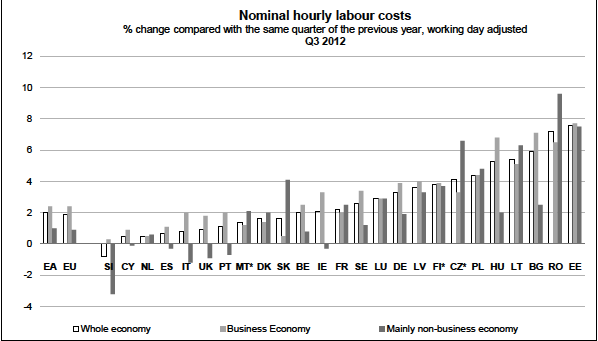

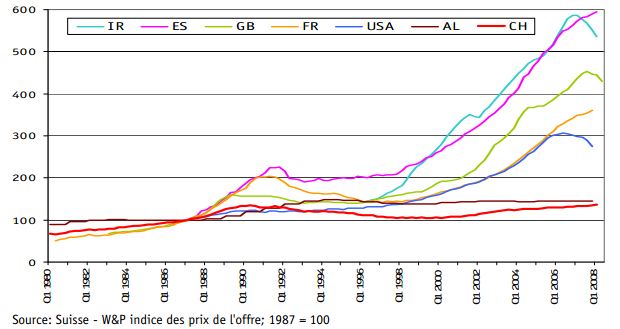

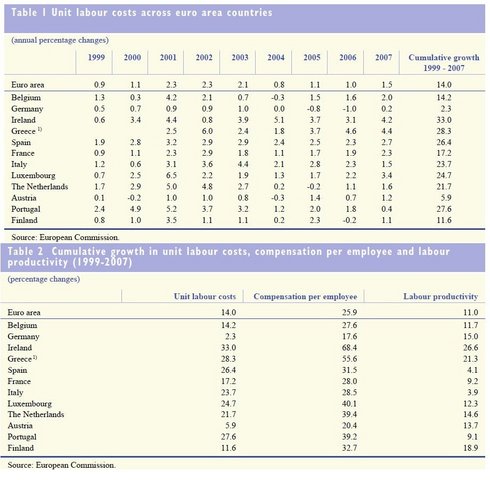

Jürgen Stark’s resignation and the ECB 2005 warning about labor cost divergence in the Euro-zone

The Wirtschaftswoche reports about the real reasons of ECB Chief economist Jürgen Stark’s resignation. The reasons are rather political, namely a protest against European governments:

Read More »

Read More »