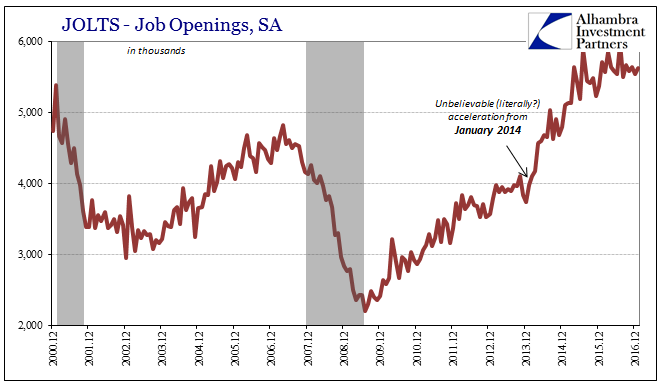

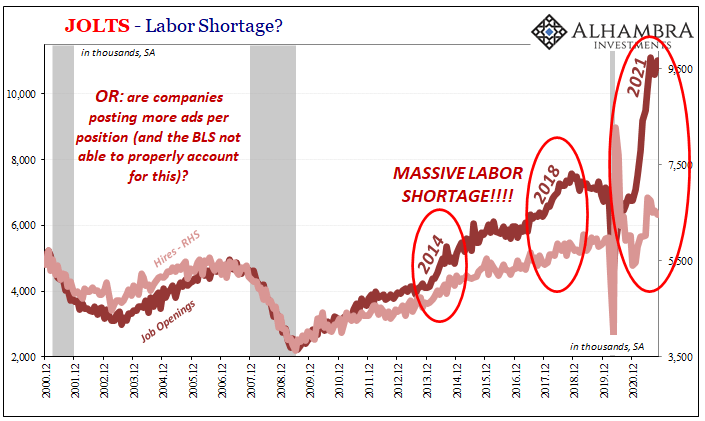

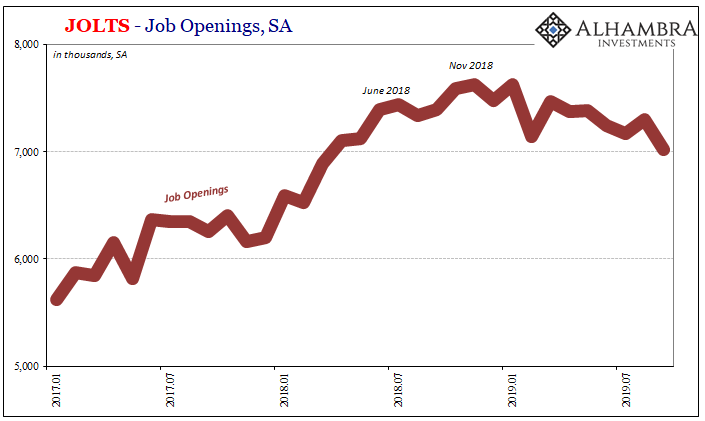

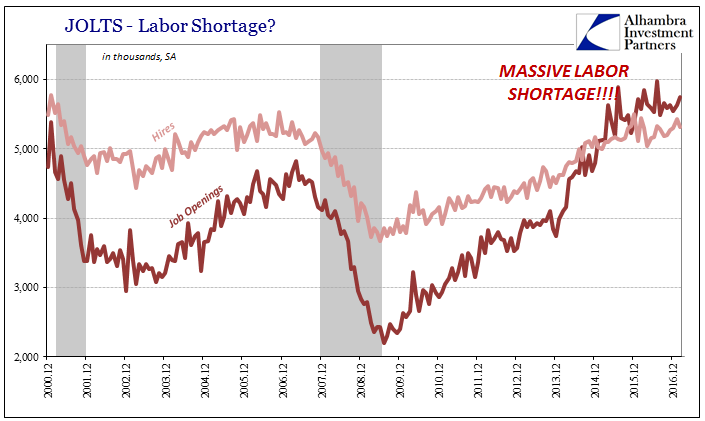

Perhaps the most encouraging data produced by the BLS has been within its JOLTS figures, those of Job Openings. It is one data series that policymakers watch closely and one which they purportedly value more than most. While the unemployment and participation rates can be caught up in structural labor issues (heroin and retirees), Job Openings are related to the demand for labor rather than the complications on the labor supply side.

Read More »

Tag Archive: jolts

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

3 days ago -

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

29 days ago -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: increased by 5.2 billion francs compared to the previous week

3 days ago -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

2-18-26 How To Manage Capital In A Rotation-Driven Market

2-18-26 How To Manage Capital In A Rotation-Driven Market -

Wer lenkt unsere Zukunft? Mehr dazu jetzt im neuen Video auf meinem Kanal!

Wer lenkt unsere Zukunft? Mehr dazu jetzt im neuen Video auf meinem Kanal! -

The Nasdaq & S&P indices are having a solid day. What are the technicals telling traders?

The Nasdaq & S&P indices are having a solid day. What are the technicals telling traders? -

Is This Eisenhower Dollar REALLY Silver? (Ping Test)

Is This Eisenhower Dollar REALLY Silver? (Ping Test) -

The Paper Problem

The Paper Problem -

USDCHF Technicals: The USDCHF is showing modest bullish buying. Awaits the shove.

USDCHF Technicals: The USDCHF is showing modest bullish buying. Awaits the shove. -

The USD is mixed to start the US trading session. A technical look at the EUR, JPY and GBP

The USD is mixed to start the US trading session. A technical look at the EUR, JPY and GBP -

2-18-26 Q&A Wednesday: Markets, Money, and Your Questions

2-18-26 Q&A Wednesday: Markets, Money, and Your Questions -

US Dollar is Mostly Firmer, amid Weak Conviction

US Dollar is Mostly Firmer, amid Weak Conviction -

Finland’s president: Europe can defend itself without America | The Economist

Finland’s president: Europe can defend itself without America | The Economist

More from this category

How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper

How Many More Americans Might Have Quit Their Jobs Than The Huge Number Already Estimated, And What Might This Mean For FOMC Taper7 Jan 2022

A Global JOLT(s) In July

A Global JOLT(s) In July9 Dec 2021

Weekly Market Pulse: Happy Anniversary!

Weekly Market Pulse: Happy Anniversary!16 Aug 2021

Weekly Market Pulse: Is It Time To Panic Yet?

Weekly Market Pulse: Is It Time To Panic Yet?12 Jul 2021

JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?

JOLTS Revisions: Much Better Reopening, But Why Didn’t It Last?12 Mar 2021

Inflation Hysteria #2 (WTI)

Inflation Hysteria #2 (WTI)12 Dec 2020

A Second JOLTS

A Second JOLTS11 Aug 2020

Very Rough Shape, And That’s With The Payroll Data We Have Now

Very Rough Shape, And That’s With The Payroll Data We Have Now15 Jan 2020

Consistent Trade War Inconsistency Hides The Consistent Trend

Consistent Trade War Inconsistency Hides The Consistent Trend5 Dec 2019

From Friends to Nemeses: JO and Jay

From Friends to Nemeses: JO and Jay8 Nov 2019

Monthly Macro Monitor: Doom & Gloom, Good Grief

Monthly Macro Monitor: Doom & Gloom, Good Grief12 Oct 2019

From JOLTS Series Shift To Series of Rate Cuts

From JOLTS Series Shift To Series of Rate Cuts10 Oct 2019

Another ‘Highest In Ten Years’

Another ‘Highest In Ten Years’1 Nov 2018

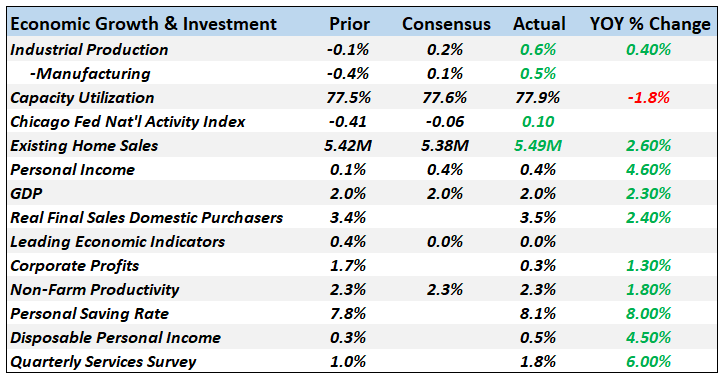

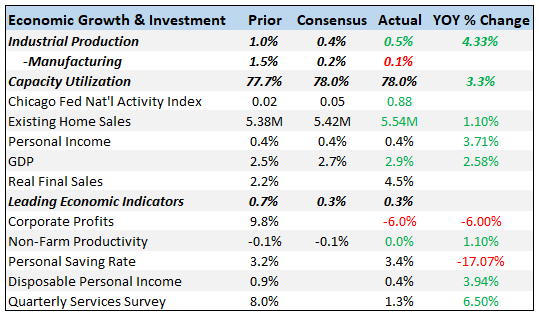

Bi-Weekly Economic Review

Bi-Weekly Economic Review22 Jun 2018

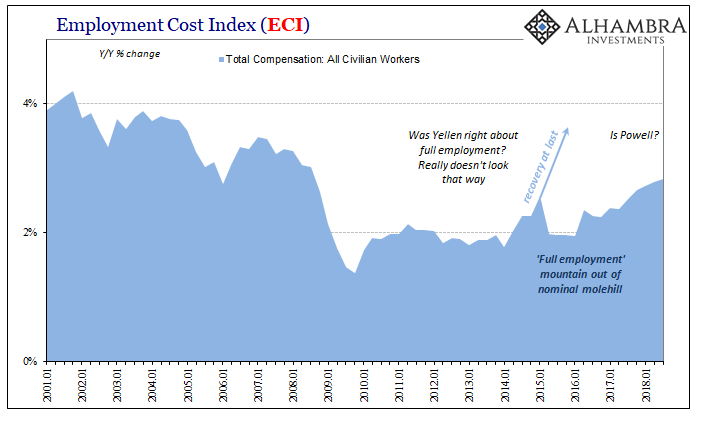

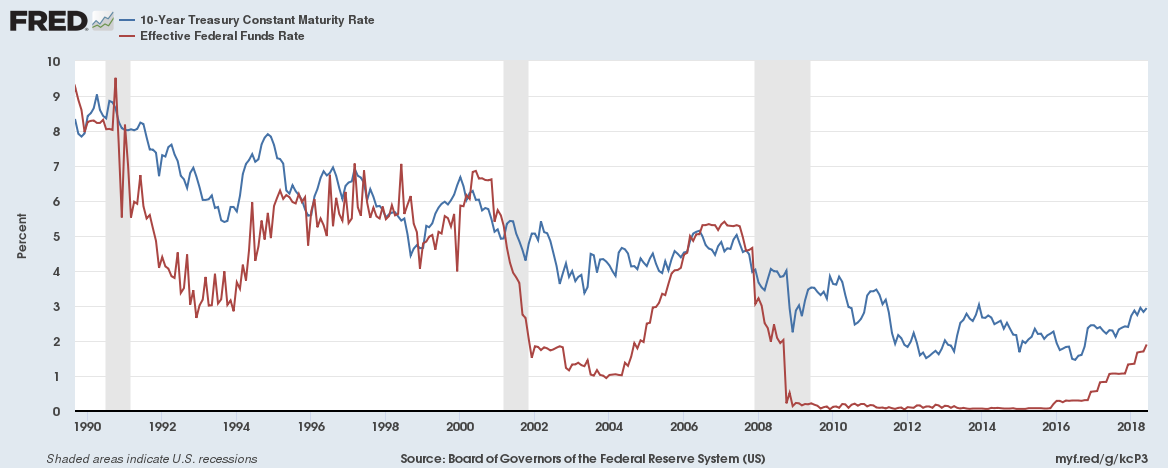

Bi-Weekly Economic Review: Interest Rates Make Their Move

Bi-Weekly Economic Review: Interest Rates Make Their Move27 Apr 2018

Bi-Weekly Economic Review: Embrace The Uncertainty

Bi-Weekly Economic Review: Embrace The Uncertainty28 Mar 2018

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew

Bi-Weekly Economic Review: A Weak Dollar Stirs A Toxic Stew16 Jan 2018

The JOLTS of Drugs

The JOLTS of Drugs17 Sep 2017

Forced Finally To A Binary Labor Interpretation

Forced Finally To A Binary Labor Interpretation13 Jun 2017

Defining Labor Economics

Defining Labor Economics2 May 2017